Berkshire Hills Reports Operating Results; Dividend Increased; Annual Meeting Announced

PR Newswire

PITTSFIELD, Mass., Jan. 25, 2018

PITTSFIELD, Mass., Jan. 25, 2018 /PRNewswire/ -- Berkshire Hills Bancorp, Inc. (NYSE: BHLB) reported that fourth quarter pre-tax income grew by 82% to $19.5 million in 2017 compared to $10.7 million in the prior year. This improvement was due to business development and the benefit of mergers, including Worcester-based Commerce Bancshares Corp. which was acquired on October 13, 2017. Net income after-tax was impacted by an $18 million non-core charge to income tax expense resulting from federal tax reform enacted near year-end. This reform is expected to benefit future earnings due to a lower statutory federal tax rate beginning in 2018. Net income after-tax totaled $55 million in 2017 compared to $59 million in 2016.

The tax charge noted above reduced fourth quarter earnings per share by $0.40 and resulted in a fourth quarter net loss of $0.06 per share in 2017, compared to a profit of $0.32 per share in 2016. Fourth quarter core earnings per share improved by 4% to $0.58 in 2017, from $0.56 in 2016. The measure of core earnings excludes the above tax charge and also excludes other net non-core charges primarily related to merger costs. These costs in the fourth quarter of 2017 were mostly related to the Commerce acquisition, which increased assets by $1.8 billion, or 19%, to $11.6 billion at year-end.

FOURTH QUARTER FINANCIAL HIGHLIGHTS (comparisons are to prior quarter unless otherwise stated):

- 15% increase in net quarterly revenue to a record $116 million

- 19% increase in total loans; 6% annualized organic increase excluding Commerce

- 29% increase in total deposits, 4% organic increase excluding Commerce

- 3.50% net interest margin; increased from 3.36%

- 57.4% efficiency ratio

- 0.21% non-performing assets/assets

- 0.17% net loan charge-offs/average loans

CEO Michael Daly stated, "During a very busy quarter, our market teams delivered solid business results in our franchise. We finished the year with double digit annualized organic growth in commercial and industrial loans, which were up 70% for the year including acquired balances. Our SBA team was very busy throughout the year, moving up to 17th spot nationally in the annual SBA 7A loan count rankings as of September 30. Organic deposit growth measured 4% during the quarter, including seasonally high year-end commercial balances. The net interest margin improved to 3.50% including the benefit of increased purchased loan accretion relating to the Commerce acquisition. Including this benefit, the efficiency ratio improved to 57.4%."

"With the completion of the Commerce acquisition, we added nearly $2 billion in assets. Including the First Choice merger in December 2016, we have grown our assets by more than 30% and have crossed the $10 billion regulatory threshold to become the third largest regional bank based in New England. The Commerce merger was also the catalyst for the move of our corporate headquarters to Boston, positioning us as the largest regional banking company located there. We recruited new leadership for our Greater Boston region, and are looking forward to further opportunities to expand in this market."

Mr. Daly concluded, "We're optimistic about the economic prospects in our regions. We expect that the recent federal tax reform will lower our future statutory tax rate, leaving us more capital to provide credit support for the growth of the businesses and communities that we serve. Due to the tax reform, we also recently announced new investment initiatives in our team and in our communities, including a higher minimum wage, employee bonuses, expansion of our AMEBU training programs, and a contribution to our Foundation to fund future community support. As we've done in recent years, we are announcing a penny increase in our quarterly dividend reflecting our improved profitability in 2017 and our positive future outlook."

DIVIDEND INCREASED

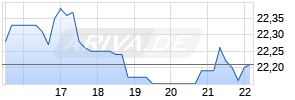

The Board of Directors voted to increase the quarterly cash dividend by $0.01, or 5%, to $0.22 per common share to shareholders of record at the close of business on February 15, 2018, payable on March 1, 2018. The dividend equates to a 2.3% annualized yield based on the $38.09 average closing price of Berkshire Hills Bancorp common stock during the fourth quarter. Effective on the same dates, the Board also increased the quarterly cash dividend on preferred stock to $0.44 per share for preferred stock issued in conjunction with the Commerce acquisition.

ANNUAL MEETING ANNOUNCED

The Board of Directors voted that the Annual Meeting of Shareholders will be held on May 17, 2018 at the Crowne Plaza Hotel, One West Street, Pittsfield, Massachusetts at 10:00 a.m., local time. The date of March 22, 2018 was established as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Annual Meeting.

FINANCIAL CONDITION

Total assets increased by $1.8 billion to $11.6 billion during the fourth quarter of 2017, due to the Commerce acquisition. Total loans increased by $1.4 billion to $8.3 billion, including $1.2 billion added with Commerce, net of a $104 million fair value discount. Goodwill and intangible assets increased by $137 million due primarily to the Commerce loan discounts. Commercial loans increased to 61% of total loans with the Commerce addition. Excluding the acquired balances, organic loan growth was 6% annualized in the fourth quarter, including a 10% contribution from C&I loans and a 15% contribution from residential mortgages. For the year, organic loan growth was 8%, including balanced growth among the commercial, mortgage, and consumer categories. At year-end, delinquent and non-accruing loans measured 0.83% of total loans including the Commerce addition, and quarterly annualized net loan charge-offs measured 0.17% of average loans.

Total deposits increased by $2.0 billion to $8.7 billion, including $1.7 billion added with Commerce. Organic deposit growth of $247 million included a $224 million seasonal increase in commercial payroll deposits. Organic deposit growth was 6% for the year. The ratio of loans/deposits decreased to 95% at year-end due to the addition of the Commerce balances.

Total shareholders' equity increased during the fourth quarter by $212 million, or 16%, to $1.5 billion. This included the $229 million in stock issued for the Commerce acquisition, including $188 million of common stock and $41 million of non-voting convertible preferred stock. For the year, book value per common share increased by 5% to $32.14, and tangible book value per common share, a non-GAAP financial measure, also increased by 5% to $19.83.

RESULTS OF OPERATIONS

Most measures of revenue and expense increased over the prior quarter due to the addition of the Commerce operations after October 13, 2017. These measures increased year-over-year due to Commerce as well as the full period benefit of integrated First Choice operations. Per share earnings included the impact of shares issued as merger consideration and in the May 2017 stock offering. Non-core charges in 2017 were mostly merger-related, including First Choice and Commerce. Non-core activity during the year also included a charge on the termination of hedges and restructuring and other expense, as well as the write-down of the net deferred tax asset as a result of federal tax reform.

The Company recorded a loss of $3 million in the most recent quarter, including the $18 million tax expense and $11 million in net other after-tax non-core charges primarily related to the Commerce acquisition. Core income increased to a record quarterly amount of $26 million in the most recent quarter, increasing by 12% over the prior quarter. Measured as a percent of assets, GAAP results were a loss of 0.10%, whereas core return on assets measured 0.94%. The Company's goal is to generate future improvement in this measure, with the benefit of merger efficiencies and tax changes offsetting the higher regulatory costs related to crossing the $10 billion asset regulatory threshold.

Quarterly net revenue increased to a record $116 million in the most recent quarter, including Commerce operations for most of the quarter. Revenue increased by $15 million, or 15%, compared to the prior quarter, primarily due to Commerce. Berkshire's fourth quarter net interest margin improved to 3.50% including higher purchased loan accretion and other increases in earning asset yields. Purchased loan accretion contributed 0.21% to the net interest margin in the most recent quarter, compared to 0.14% in the prior quarter, when the margin was 3.36%. Total fee income decreased 2% due to seasonal factors.

Total non-interest expense increased by $24 million to $90 million in the fourth quarter, compared to the prior quarter. This included a $17 million increase in non-core expense, including $14 million related to the Commerce acquisition and $3 million accrued for tax reform related investments in employees and community contributions. Additional merger-related expenses are planned in 2018 as integration activities are completed. Core non-interest expense increased by $7 million to $71 million including the new Commerce operations. The Company plans to benefit from additional efficiencies related to cost saves following the completion of the Commerce integration in 2018, including the systems conversion planned for March 2018. Berkshire had full time equivalent staff totaling 1,992 at year-end 2017, including the Commerce positions which were reported at 226 as of September 30, 2017. Berkshire reported 1,788 full time equivalent staff as of that date.

Fourth quarter income tax expense included the $18 million one-time net charge for the write-down of the net deferred tax assets at year-end. The charge was primarily due to the unamortized balance related to fair value discounts recorded on prior acquisitions (including Commerce), as well as the accumulated excess of loan loss provisions over charge-offs. The Company expects that the effect of the federal tax reform will be to lower its future income tax expense compared to what it would have been under the previous tax rules. The income tax rate on core income was 32% for the fourth quarter and 29% for the full year 2017. The Company recorded $0.01 per share in net benefit from its tax credit investments in each quarter in 2017, which was net of amortization charges included in non-interest income.

INVESTOR CONFERENCE CALL

Berkshire will conduct a conference call/webcast at 10:00 a.m. eastern time on Friday, January 26, 2018 to discuss the results for the quarter and provide guidance about expected future results. Participants are encouraged to pre-register for the conference call using the following link: http://dpregister.com/10115690. Callers who pre-register will be given dial-in instructions and a unique PIN to gain immediate access to the call. Participants may pre-register at any time prior to the call, and will immediately receive simple instructions via email. Investors may reach the registration link and access the webcast by logging in through the investor section of the Company's website at http://ir.berkshirebank.com. Persons may also participate at the above time by dialing 1-844-792-3726 and asking the Operator to join the Berkshire Hills Bancorp (BHLB) earnings call. A telephone replay of the call will be available through Friday, February 2, 2018 by dialing 877-344-7529 and entering access number 10115690. The webcast will be available on Berkshire's website for an extended period of time.

BACKGROUND

Berkshire Hills Bancorp is the parent of Berkshire Bank - America's Most Exciting Bank®. The Company has approximately $11.6 billion in assets and 113 full service branches in Massachusetts, New York, Connecticut, Vermont, New Jersey, and Pennsylvania providing personal and business banking, insurance, and wealth management services. The Company also offers mortgages and specialized commercial lending services in targeted national markets.

FORWARD LOOKING STATEMENTS

This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire's most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC's website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements.

NON-GAAP FINANCIAL MEASURES

This document contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles ("GAAP"). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition. They are not a substitute for GAAP measures; they should be read and used in conjunction with the Company's GAAP financial information. A reconciliation of non-GAAP financial measures to GAAP measures is included on pages F-9 and F-10 in the accompanying financial tables. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders.

The Company utilizes the non-GAAP measure of core earnings in evaluating operating trends, including components for core revenue and expense. These measures exclude items which the Company does not view as related to its normalized operations. These items primarily include securities gains/losses, merger costs, and restructuring costs. Charges related to merger and acquisition activity consist primarily of severance/benefit related expenses, contract termination costs, systems conversion costs, variable compensation expenses, and professional fees. These charges are related to the following business combinations: First Choice Bank, 44 Business Capital, financial planning assets, and Commerce. Restructuring costs generally consist of costs and losses associated with the disposition of assets and liabilities and lease terminations, including costs related to branch sales. Additionally, the Company recorded charges for hedge terminations in the first quarter of 2017 and legal settlement costs during the year.

Non-core adjustments are presented net of an adjustment for income tax expense. This adjustment is determined as the difference between the GAAP tax rate and the effective tax rate applicable to core income. In the fourth quarter of 2017, the Company recorded an $18 million one-time non-core charge to income tax expense representing the partial write-down of its net deferred tax assets as a consequence of federal tax reform that was enacted near year-end. In conjunction with this tax reform, the Company also announced plans for certain expenditures totaling $3.4 million representing investments in employee bonuses and charitable giving; these charges were included in other non-core expense during the quarter.

The efficiency ratio is adjusted for non-core revenue and expense items and for tax preference items. The Company also calculates measures related to tangible equity, which adjust equity (and assets where applicable) to exclude intangible assets due to the importance of these measures to the investment community. Of note, following systems upgrades, non-material revisions were made in the first quarter of 2017 to the calculations of the net interest margin and efficiency ratio and prior period measures were revised to include these changes.

CONTACTS

Investor Relations Contact

Allison O'Rourke; Executive Vice President, Investor Relations Officer; 413-236-3149

Media Contact

Elizabeth Mach; Senior Vice President, Marketing Officer; 413-445-8390

| TABLE INDEX |

CONSOLIDATED UNAUDITED FINANCIAL SCHEDULES |

| F-1 | Selected Financial Highlights |

| F-2 | Balance Sheets |

| F-3 | Loan and Deposit Analysis |

| F-4 | Statements of Operations |

| F-5 | Statements of Operations (Five Quarter Trend) |

| F-6 | Average Yields and Costs |

| F-7 | Average Balances |

| F-8 | Asset Quality Analysis |

| F-9 | Reconciliation of Non-GAAP Financial Measures (Five Quarter Trend) and Supplementary Data |

| F-10 | Reconciliation of Non-GAAP Financial Measures (Year-to-Date) and Supplementary Data |

| BERKSHIRE HILLS BANCORP, INC. | ||||||||||||

| SELECTED FINANCIAL HIGHLIGHTS - UNAUDITED - (F-1) | ||||||||||||

| | | | At or for the Quarters Ended (2) | |||||||||

| | | | Dec. 31, | | Sept. 30, | | June 30, | | March 31, | | Dec. 31, | |

| | | | 2017 (3) | | 2017 | | 2017 | | 2017 | | 2016 (4) | |

| | | | | | | | | | | | | |

| PER SHARE DATA | | | | | | | | | | | ||

| | Net earnings, diluted | $ (0.06) | | $ 0.57 | | $ 0.53 | | $ 0.44 | | $ 0.32 | | |

| | Core earnings, diluted (1) | 0.58 | | 0.59 | | 0.58 | | 0.55 | | 0.56 | | |

| | Total book value per common share | 32.14 | | 31.78 | | 31.37 | | 30.77 | | 30.65 | | |

| | Tangible book value per common share (1) | 19.83 | | 21.38 | | 20.96 | | 18.97 | | 18.81 Werbung Mehr Nachrichten zur Berkshire Hills Bancorp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||