BB&T reports record second quarter earnings; Performance driven by record quarterly revenues

PR Newswire

WINSTON-SALEM, N.C., July 20, 2017

WINSTON-SALEM, N.C., July 20, 2017 /PRNewswire/ -- BB&T Corporation (NYSE: BBT) today reported earnings for the second quarter of 2017. Net income available to common shareholders was a record $631 million, up 16.6 percent from the second quarter of 2016. Earnings per diluted common share were $0.77 for the second quarter of 2017. Excluding pre-tax merger-related and restructuring charges of $10 million ($6 million after tax), net income available to common shareholders was $637 million, or $0.78 per diluted share.

Net income available to common shareholders was $378 million ($0.46 per diluted share) for the first quarter of 2017 and $541 million ($0.66 per diluted share) for the second quarter of 2016.

"We are pleased to report record earnings and revenues for the second quarter," said Chairman and Chief Executive Officer Kelly S. King. "Taxable-equivalent revenues were a record $2.9 billion, up 3.9 percent compared to the second quarter of 2016," King said. "Net interest income was up $18 million and noninterest income was up $90 million from last year. In addition, revenues were up an annualized 10.7 percent, from the first quarter of 2017.

"Our credit quality improved further in the second quarter, as we had declines in non-performing assets, net charge-offs, performing TDRs and loans 90 days or more past due."

"We are also pleased to receive the Federal Reserve's non-objection to our capital plan that includes a quarterly dividend of $0.33 per share, an increase of ten percent, and up to $1.88 billion in share repurchases," King said. "This will allow us to continue to provide one of the strongest dividend payouts among all large banks."

Second Quarter 2017 Performance Highlights

- Taxable-equivalent revenues were $2.9 billion for the second quarter, up $75 million from the first quarter of 2017

- Net interest income on a taxable-equivalent basis was up $26 million

- Net interest margin was 3.47 percent, up one basis point; driven by rate increases

- Noninterest income was up $49 million due to higher insurance revenues, investment banking and brokerage fees and commissions and bankcard fees and merchant discounts

- Fee income ratio was 42.7 percent, compared to 42.1 percent for the prior quarter

- Noninterest expense was $1.7 billion, down $360 million compared to the first quarter of 2017

- Decrease includes $392 million loss on debt extinguishment recorded in the prior quarter

- Personnel expense increased $31 million

- Merger-related and restructuring charges decreased $26 million

- GAAP efficiency ratio was 61.0 percent, compared to 75.6 percent for the prior quarter

- Adjusted efficiency ratio was 58.6 percent, compared to 58.0 percent for the prior quarter

- Average loans and leases held for investment were $143.1 billion compared to $142.0 billion for the first quarter of 2017

- Average commercial and industrial loans increased $781 million, or 6.1 percent annualized

- Average other lending subsidiaries loans increased $717 million, or 19.3 percent annualized

- Average total CRE increased $323 million, or 7.0 percent annualized

- Average sales finance loans decreased $446 million, or 16.4 percent annualized

- Average residential mortgage loans decreased $309 million, or 4.2 percent annualized

- Average deposits were $160.3 billion compared to $161.4 billion for the first quarter of 2017

- Average noninterest-bearing deposits increased $1.5 billion, or 11.6 percent annualized

- Deposit mix remained strong, with average noninterest-bearing deposits representing 32.8 percent of total deposits, compared to 31.7 percent in the prior quarter

- Average interest-bearing deposits decreased $2.6 billion and costs were 0.30 percent, up four basis points compared to the prior quarter

- Asset quality continues to improve

- Nonperforming loans were 0.43 percent of loans held for investment, down $111 million

- Loans 90 days or more past due and still accruing were 0.34 percent of loans held for investment, compared to 0.38 percent in the prior quarter

- Loans 30-89 days past due and still accruing were 0.61 percent of loans held for investment, compared to 0.56 percent in the prior quarter

- The allowance for loan loss coverage ratio was 2.43 times nonperforming loans held for investment, versus 2.05 times in the prior quarter

- The allowance for loan and lease losses was 1.03 percent of loans held for investment, slightly down from the prior quarter

- Capital levels remained strong across the board

- Common equity tier 1 to risk-weighted assets was 10.3 percent, or 10.2 percent on a fully phased-in basis

- Tier 1 risk-based capital was 12.1 percent

- Total capital was 14.1 percent

- Leverage capital was 10.1 percent

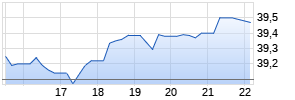

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Truist Financial | ||

|

ME5BA5

| Ask: 0,77 | Hebel: 4,71 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

| EARNINGS HIGHLIGHTS | | | | | | | | | | | ||||||||||

| (dollars in millions, except per share data) | | | | | | | | Change 2Q17 vs. | ||||||||||||

| | | 2Q17 | | 1Q17 | | 2Q16 | | 1Q17 | | 2Q16 | ||||||||||

| Net income available to common shareholders | | $ | 631 | | | $ | 378 | | | $ | 541 | | | $ | 253 | | | $ | 90 | |

| Diluted earnings per common share | | 0.77 | | | 0.46 | | | 0.66 | | | 0.31 | | | 0.11 | | |||||

| | | | | | | | | | | | ||||||||||

| Net interest income - taxable equivalent | | $ | 1,675 | | | $ | 1,649 | | | $ | 1,657 | | | $ | 26 | | | $ | 18 | |

| Noninterest income | | 1,220 | | | 1,171 | | | 1,130 | | | 49 | | | 90 | | |||||

| Total taxable-equivalent revenue | | $ | 2,895 | | | $ | 2,820 | | | $ | 2,787 | | | $ | 75 | | | $ | 108 | |

| Less taxable-equivalent adjustment | | 40 | | | 40 | | | 40 | | | | | | |||||||

| Total revenue | | $ | 2,855 | | | $ | 2,780 | | | $ | 2,747 | | | | | | ||||

| | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 1.22 | % | | | 0.79 | % | | | 1.06 | % | | | 0.43 | % | | | 0.16 | % |

| Return on average risk-weighted assets | | | 1.53 | | | | 0.98 | | | | 1.38 | | | | 0.55 | | | | 0.15 | |

| Return on average common shareholders' equity | | | 9.30 | | | | 5.72 | | | | 8.21 | | | | 3.58 | | | | 1.09 | |

| Return on average tangible common shareholders' equity (1) | | | 15.60 | | | | 9.98 | | | | 14.33 Werbung Mehr Nachrichten zur Truist Financial Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||