Axon 2023 Revenue Grows 31% to $1.56 Billion

PR Newswire

SCOTTSDALE, Ariz., Feb. 27, 2024

SCOTTSDALE, Ariz., Feb. 27, 2024 /PRNewswire/ --

- Axon Cloud and Services revenue grows 52% to $561 million

- Annual recurring revenue grows 47% to $697 million

- Annual net income of $174 million supports Adjusted EBITDA of $329 million

- Company projects Full Year 2024 revenue of $1.88 billion to $1.94 billion, representing 20% to 24% annual growth

Fellow shareholders,

Axon is delighted to deliver another year of record company performance, fueled by product innovation, partnership with our customers and strong industry trends. Demand for our mission-driven product ecosystem continued to grow in the fourth quarter of 2023, and we recorded our fifth consecutive year of 25% or greater revenue growth, growing 31% year over year. We achieved this growth with a full year net income margin of 11% and Adjusted EBITDA margin of 21%.

Our core measure of success as a company is progress on our mission to protect life. Our mission aligns our people, our customers and our communities. Together, we focus on solving problems with modern technology, pioneering new ways of thinking and taking new approaches to complex social dynamics, driving toward our moonshot goal to cut gun-related deaths between police and the public in half by 2033. In this first year after announcing our moonshot, we introduced new technology, new modern training capabilities and new sources of improved data and analytics. We've laid the groundwork for the next nine years, and we are just getting started.

Our mission and products have resonated with our customers and afford us a growing pipeline across our business. In 2024, Axon expects to deliver annual revenue in a range of $1.88 billion to $1.94 billion, and Adjusted EBITDA of $410 million to $430 million, reflecting more than 20% annual growth and continued Adjusted EBITDA margin expansion from the prior year. We are propelling our growth through innovation and diversification while realizing efficiencies and leverage on our business as it scales. We are humbled to enter a new year with robust expectations for each of our product categories and customer verticals. In this letter, we recap a historic 2023 for our company and provide an update on the opportunities we see ahead, our roadmap and our progress.

2023 Key Takeaways

Commitment to being a Force for Good

Axon's mission is embodied in our moonshot goal to cut gun-related deaths between police and the public by 50% over 10 years. 2023 was the first year in our moonshot journey, and we progressed significant advancements to help us achieve this goal, including introducing technology, new ways of training, and optimized data collection and reporting with the Axon Public Safety Gun Fatality Database. We also published our Force For Good report in November, a bi-annual update on our progress in the areas of Corporate Social Responsibility. In addition, we summarize 5 Giant Leaps we made over the last year, here.

Weiter aufwärts?

| Kurzfristig positionieren in Axon Enterprise Inc | ||

|

ME9B03

| Ask: 10,74 | Hebel: 4,44 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Strong financial results

Axon delivered annual revenue of $1.56 billion and net income of $174 million in 2023. This represents 31% annual revenue growth and an 11.1% net income margin, supporting Adjusted EBITDA of $329 million (21.1% margin). We are delivering profitable growth at scale and improvement in our operating expenses as a percentage of revenue was primarily driven by leverage on sales, general and administrative ("SG&A") expenses. Axon continues to grow our research and development ("R&D") footprint to invest in several multi-year growth opportunities, and our R&D expenses grew roughly in-line with revenue. 2023 revenue and Adjusted EBITDA margin exceeded our expectations and reflect record performance for our company.

Product innovation

We power our business through relentless product innovation. In 2023, years of investments materialized in two major new product launches — TASER 10 and Axon Body 4 — and a number of advancements in our ecosystem, including groundbreaking real-time communications features such as two-way voice communications and WatchMe, as well as an expanded virtual reality ("VR") training suite including all-new bespoke TASER VR controllers alongside expanded training content and more. We also reached key adoption milestones, including new deployments bringing us to over 100 agencies live on one or more modules of Axon Records.

New customer vertical expansion

Axon has diversified beyond U.S. state and local law enforcement. In 2023, we achieved significant growth in emerging customer verticals, including U.S. federal, international, justice, corrections and enterprise. A few examples of our progress include the successful deployment of Axon Records with the U.S. Department of Veterans Affairs, two of our largest TASER 10 orders coming from international and corrections customers, and our partnership with the Government of Scotland to power its digital evidence management system across courts, lawyers, government and police. We also have several trials kicking off with our newly launched product for enterprise, including Fairview Health, where they are trialing Body Workforce with nurses as part of their commitment to patient and staff safety.

Strategic investments to further enhance our ecosystem and expand our TAM

Axon's investment and partner strategy is geared to accelerate our product roadmap and enhance our ecosystem while building our talent base in product categories accretive to our long-term growth. In 2023, we acquired Sky-Hero and earlier this month we announced our acquisition of Fusus. Sky-Hero is an example of an acquisition supporting Axon in building next-generation technology in public safety that will leverage enhanced robotic security capabilities to improve situational awareness, power more effective means of response and protect life. With Fusus, Axon advances mission control, the future of real-time operations for public safety, enabling customers to aggregate live video, data and sensor feeds from virtually any source. Even without updating our core total addressable market ("TAM"), which we updated last year and update on a bi-annual basis, these acquisitions expand Axon's TAM from $50 billion to more than $63 billion.

Select Highlights

Product Traction & Ecosystem Expansion

Axon has set out to build the technology ecosystem for public safety — to enable our customers to protect life, capture truth and accelerate justice. We invest incrementally each year to consistently develop and deliver new game-changing technology while simultaneously enhancing our existing products. When our products resonate with our customers, we see strong demand and a growing opportunity set of expanding relationships, measurable through new product traction and increasing adoption of the expanding Axon software ecosystem surrounding those new products. This affords us the opportunity to further invest in new technology categories and applications, both through our continued investment in R&D and through strategic investment, fueling our future product innovation, expansion and growth.

Product highlights from this past year are examples of this strategy at work:

Our two most successful product launches together in a single year

The successful launch and ramp of TASER 10 and Axon Body 4 in the same year is evidence of what our team is able to accomplish.

After over five years of development, our latest TASER device features new game changing technology, including individually targeted probes, the ability to deploy up to 10 probes, and a longer range of up to 45 feet, along with a host of other features and upgrades that make this latest generation TASER product the best yet. These are major steps toward where we see the future of this critical technology, and together they are generating unprecedented demand from our customers.

At the same time, our operational advancements are measurable in our execution in launching the product. In 2023, we shipped over 50,000 units of TASER 10 and the new product was our top selling TASER device in the fourth quarter.

"TASER 10 is now our fastest growing TASER product in history." — Rick Smith, Axon Founder and CEO

Following the launch of TASER 10 in January 2023, we introduced Axon Body 4 in April 2023, which has quickly become our fastest selling body camera product to date. Axon Body 4 includes a host of advancements from prior generation body cameras, including expanded communications abilities, more points of view, upgraded camera features and more streamlined operations. We shipped more than 100,000 units of Axon Body 4 in the second half of 2023, only months after introducing this next generation body camera product to market.

"As Sheriff of Bernalillo County, I've witnessed firsthand the profound impact that the new TASER 10 audible and visual warning alert system has had on our law enforcement efforts. The innovative design, featuring a bright pulsing light paired with a loud alert sound, has significantly enhanced our deputies' ability to gain compliance from initially non-compliant suspects without the need to deploy cartridges. This technology is not just about maintaining safety; it's about escalating our approach to de-escalation. We've observed that this generation, in particular, responds strongly to the visual and audible cues of the TASER 10 warning alert. It captures their attention and conveys a clear message that they need to reconsider their actions. This tool has been invaluable in our mission to protect and serve, offering a powerful alternative that benefits both our deputies and our team and the results in the field speak volumes to the effectiveness of this approach. The TASER 10 is a testament to the evolution of law enforcement tools towards safer, more effective outcomes." — Sheriff Josh Allen, Bernalillo County (NM) Sheriff's Office

Software innovation supporting multiple vectors of growth

We describe our software products as belonging to three major categories: 1) digital evidence management, 2) real-time operations and 3) productivity software. Within our software portfolio, we deliver right-sized and custom subscription plans that can be configured to meet the needs of any customer, and we support customers in their journeys to build world-class public safety organizations. Most often, our customers initially adopt cloud digital evidence management licenses included with our standard product subscription plans for Axon Body, Axon Fleet, TASER, interview rooms and Officer Safety PlanS.

Over time, we see customers opting to upgrade to additional product features and categories — this includes adding premium digital evidence management features, such as Axon Performance, Auto-Tagging and Redaction Assistant, as well as our real-time operations, live-streaming and two-way voice communications capabilities with Axon Respond and productivity software with Axon Standards and Axon Records. Our net revenue retention of 122% in the fourth quarter of 2023 reflects our success in selling new premium features to our existing customers.

"Best of all, as the agency continues to leverage [Axon] Respond, everyone in the agency can have a voice in maximizing the technology — officers, for example, can proactively request assistance from supervisors at complicated scenes. This is why supervisors at Las Cruces have been transparent about when and how it's being used. The more [patrol officers] know about it, they get creative and [think of] ways to use it I'm not even aware of...and then they let me know and it makes everyone better" — Officer Benavidez, Las Cruces (NM) Police Department

Strategic acquisition of Fusus accelerates and further unleashes Axon real-time operations

In addition to our R&D, Axon also leverages partnerships to deliver on our product vision. We take a technology first strategic approach to reviewing potential partners and believe it benefits our customers when we can provide them more of an ecosystem opportunity. Sometimes we also see the opportunity to make minority investments in select partners to further align our goals on delivering strategic outcomes to customers. Fusus was one of those partners where we saw strong alignment between our products, we invested in them as a company, and now we're thrilled to have acquired them to more fully support our ecosystem vision for real-time operations.

An immediate benefit from this acquisition is empowering customers to securely access existing CCTV and other camera feeds from key sources like local businesses in the community — with appropriate permissions — to see events unfolding in real-time with greater context and clarity. This open platform improves crucial real-time situational awareness for our customers, while directly facilitating collaborative community partnerships.

Over time, real-time crime centers powered by Axon and Fusus will safely and securely connect to an increasingly wide range of data sources beyond Axon devices, including fixed, body-worn, in-car, and automated license plate recognition ("ALPR") cameras; gunshot detection sensors, social media feeds and various other sensors and systems — again, with appropriate permissions. By aggregating all of this information into a single pane of glass, real-time crime centers can further improve situational awareness, reduce response times and support proactive crime prevention efforts by leveraging up-to-minute information and analytics. We enable information to be quickly and easily shared between collaborating agencies, ensuring accelerated justice for all involved, another point of expansion into additional emerging product areas for our company. We believe Fusus adds approximately $13 billion to our TAM opportunity, bringing our total real-time operations TAM to $16 billion, which we discuss in more detail later in this letter.

Real-time operations is an example of Axon's product innovation driving category creation. Axon introduced live-streaming through a body camera to the market with Axon Body 3 and further advanced on our vision with direct two-way voice communications with Axon Body 4. We believe the integration of Fusus into this product category will be accretive to our long-term growth, and we saw early signs of success leading into this strategic acquisition.

Laying the groundwork for a new phase of product innovation with Sky-Hero and Axon Air

Axon Air is our product category that powers applications for robotic security, which we believe holds significant promise in achieving our moonshot goal, and as a driver of future growth. We think utilizing robotic systems in tactical high-risk situations to create more distance and time, two critical factors that can drastically change outcomes for the better, will become a mission-critical tool leveraged in the future of public safety operations. Ultimately, we aim to enable customers to reduce the number of times where humans are forced to face high-risk, potentially life-altering situations.

Axon Air also supports use cases for drones to increase situational awareness, providing an additional point of view for an evolving incident or enabling better visibility into surveying and disaster search efforts. In crime scene investigations, Axon Air powered drones can be leveraged to uncover otherwise undiscoverable evidence to support resolution. Finally, drone as a first responder ("DFR") is a growing application where the utilization of drone technology can reduce emergency response times and act as a force multiplier.

We have leveraged our internal talent, as well as strategic partnerships and our Sky-Hero acquisition, in this emerging product category. Along with our partners, we are able to drive robotic security applications and ensure secure operating conditions for this future technology through highly advanced software and systems. We estimate Sky-Hero's current products expand our TAM for Axon Air by more than $400 million to $4.5 billion.

"It didn't take long for us to realize the value of drones. Now we use them for everything. After the traffic division, detectives started using drones for crime scene documentation. Then SWAT started using them. And now, every patrol crew has a drone and pilot. We tell our people if there's a situation where you think a drone would be useful, just try it out to see." — Chad Karlewicz, Commander of Special Operations, Renton (WA) Police Department

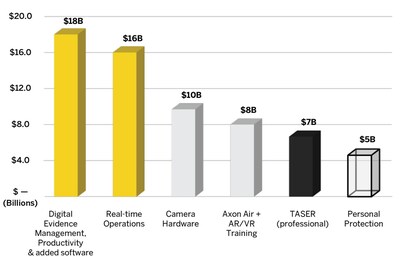

Updating TAM for our Expanding Ecosystem

In the beginning of 2023, we updated our TAM analysis to reflect the opportunities we see ahead in each of our product categories, with a breakdown into the primary product drivers, including digital evidence management, real-time operations and productivity software, camera hardware, Axon Air, AR/VR training, TASER professional and personal protection. Our findings resulted in a TAM of approximately $50 billion, which we will update in full again at the beginning of 2025.

However, we have updated our TAM with respect to the acquisitions of Sky-Hero and Fusus. In total, these additions to our ecosystem expand Axon's TAM to $63 billion in 2024.

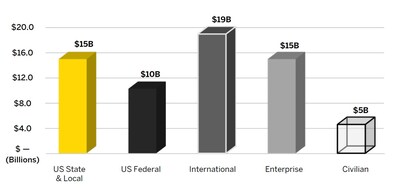

Our efforts to build the technology ecosystem for public safety go beyond our product strategy. We are also diversifying our business by growing our presence with new types of customer profiles, or users, and by adding to our core customer base. This materializes through Axon selling into additional categories of funding sources beyond U.S. state and local governments, including the U.S. federal government, international governments, enterprises and civilians. Simultaneously, the types of customers, or verticals, who find value in our product offerings expand beyond law enforcement to include attorneys, fire and emergency medical services ("EMS") personnel, corrections and the U.S. military.

As we recap our progress over the last year, we are providing a breakdown of our 2023 TAM by funding source to highlight an additional view into our opportunities. Collectively, customer funding sources outside U.S. state and local governments account for the majority of the TAM we pursue today.

- $15 billion in U.S. state and local governments, including more than 900,000 law enforcement personnel between sworn and civilian roles and more than 400,000 vehicles. In addition, we estimate approximately 30% of our U.S. state and local customer TAM comprises adjacent public safety customer verticals outside of law enforcement, including justice, with over 700,000 legal professionals involved in criminal justice between attorneys and paralegals; corrections, with approximately 500,000 corrections, probation, and child services officers; fire, with approximately 1 million career and volunteer firefighters; and EMS, with over 250,000 paramedics. We estimate that our acquisitions of Fusus and Sky-Hero added nearly $3 billion to our U.S. state and local government TAM.

- $10 billion in U.S. federal government, with more than 2 million potential users and over 300,000 vehicles across various branches of the U.S. federal government, including the U.S. Department of Defense, U.S. Department of Justice, U.S. Department of Homeland Security, U.S. Department of Veterans Affairs and U.S. Department of State, to name a few.

- $19 billion in international governments, where a single-country opportunity presents a 200,000 or larger potential user base and, together, the potential user base of international law enforcement and adjacencies totals to approximately 10x the user base of U.S. state and local law enforcement. We estimate that our acquisitions of Fusus and Sky-Hero added over $3 billion to our international government TAM.

- $15 billion in enterprise, comprising more than 20 million potential users in the United States, including retail associates, technicians, transportation and warehouse employees, and private security professionals, among others. Our recent acquisition of Fusus nearly doubled our enterprise opportunity, adding $7 billion to this TAM, with Fusus technology helping unlock our opportunity to access fixed video and CCTV feeds within our ecosystem.

- $5 billion in civilian personal protection.

Our TAM estimates are based on publicly available data on user counts, our estimate of in-scope users for our products over the next three years, by product and user category, and our estimated potential value of applicable products. We reference the most up to date data published by national governments, surveys and studies and proprietary information in the production of our TAM estimates. The product and vertical level TAMs shown have been rounded to the nearest whole number and will not arrive at our total TAM of $63 billion when added together due to rounding.

Growing Customer Verticals

Each year, we provide updates on our progress and activity in select customer verticals where we have directed our investment. Last quarter, we discussed our progress in U.S. federal and international, two areas that have become driving forces of our growth beyond the growth we see with our U.S. state and local law enforcement customers. As we recap our year, we are providing an additional update on corrections, a fast-growing adjacent public safety vertical, and enterprise, where our new product introductions open further applications for our technology in the private sector, including private security, retail and healthcare.

The future of technology and corrections

One area where we have identified the opportunity to enable safe means of de-escalation while improving transparency is in the corrections vertical — which, as we described above, increases our potential domestic user base by approximately 50% relative to U.S. state and local law enforcement.

We introduced TASER devices to corrections customers to provide a means to safely de-escalate conflict without violence, particularly useful in a correctional environment, and have found strong new customer fit for this product. In fact, our second largest TASER 10 order has come from a corrections customer in the United States. Further, conversations during our recent participation at the annual conference of the Florida Council on Crime and Delinquency validated our strategy to drive body camera adoption in this emerging customer vertical for Axon. Body cameras were discussed as an accountability and transparency tool to keep corrections facilities safe, and our growing pipeline with this customer vertical supports our investment here. Corrections was our top growing adjacent customer vertical in 2023.

"Body-worn cameras have deterred use of force in our facility" — Correctional Officer, Hardee (FL) Correctional Institution

Introducing Axon Body Workforce for enterprise

In January, we announced our first ever dedicated enterprise vertical product, Axon Body Workforce. This new generation of body cameras is designed for frontline workers in retail stores and healthcare facilities and adapts the same life-saving technology trusted by our public safety customers. Axon has identified applications in retail, healthcare and other areas within enterprise where body cameras are a tool to promote personal safety for employees at work. In addition to deterring and de-escalating incidents with the presence of a camera, Axon Body Workforce integrates Axon's real-time capabilities and digital evidence management workflows, allowing for quicker and more effective interventions and making it easier to act on captured footage. We have kicked off several customer trials with this newly launched product for enterprise.

The enterprise vertical also includes applications in private security, which more closely mirror public safety professional use cases. Private security use of Axon technology facilitates collaboration between local public safety professionals and governments, creating efficiencies and improving transparency. Examples of current customer applications include private security professionals in stadiums, theme parks and other secured public spaces. Within our potential enterprise user base, the U.S. Bureau of Labor Statistics reports there are approximately 1 million private security professionals employed in the United States, today.

"Public safety is about just that — people feeling and being safe in public, including while at work." — Rick Smith, Axon Founder and CEO.

Q4 2023 Summary Results

- Quarterly revenue of $432 million exceeded our expectations and grew 28.6% year over year driven by strong demand across product categories. Axon Cloud software was the primary driver, with increasing adoption of our premium add-on features, a growing base of software licenses associated with Axon Fleet systems and expansion into new customers supporting growth in our now largest product category. Ramping shipments of TASER 10 and Axon Body 4 also supported our growth as demand for both new products continues to build.

- Total company gross margin of 61.1% declined 10 basis points year over year, primarily driven by lower TASER gross margin, partially offset by a higher Sensors gross margin and increased mix to Axon Cloud and Services.

- Operating profit of $43 million increased 89.9% year over year driven by higher revenue and operating leverage. Operating expenses of $221 million included $33 million in stock-based compensation expenses. Operating expenses as a percent of revenue improved to 51.2% as compared to 54.5% in the Q4 2022.

- SG&A expense of $137 million, 31.7% of revenue, included $15 million in stock-based compensation expenses.

- R&D expense of $84 million, 19.4% of revenue, included $18 million in stock-based compensation expenses.

- Net income of $57 million (13.3% net income margin, compared to 8.7% in Q4 2022), or $0.75 per diluted share, supported non-GAAP net income of $85 million (19.8% margin), or $1.12 per diluted share.

- Adjusted EBITDA of $91 million reflected an Adjusted EBITDA margin of 21.1%. Adjusted EBITDA margin expanded from 19.6% in Q4 2022 driven by operating leverage.

- Both Non-GAAP net income and Adjusted EBITDA exclude stock-based compensation expenses and net gains or losses related to our strategic investment portfolio.

- Operating cash flow of $140 million in the quarter supported Free Cash Flow of $116 million and Adjusted Free Cash Flow of $121 million.

- As of December 31, 2023, Axon had $1.2 billion in cash, cash equivalents and investments, and outstanding convertible notes in principal amount of $690 million, for a net cash position of $553 million, up $121 million sequentially.

Financial commentary by segment

| Software & Sensors | ||||||||||||||||||

| | ||||||||||||||||||

| | | THREE MONTHS ENDED | | | CHANGE | | ||||||||||||

| | | 31 DEC 2023 | | 30 SEP 2023 | | 31 DEC 2022 | | QoQ | | YoY | ||||||||

| | | (in thousands) | | | | | | | | |||||||||

| Axon Cloud and Services revenue(1) | | $ | 163,632 | | | $ | 147,963 | | | $ | 113,538 | | | 10.6 | % | | 44.1 | % |

| Axon Cloud gross margin | | | 74.6 | % | | | 72.4 | % | | | 75.5 | % | | 220 | bp | | (90) | bp |

| | | | | | | | | | | | | | | | | | | |

| Sensors and Other revenue | | $ | 107,167 | | | $ | 103,068 | | | $ | 85,867 | | | 4.0 | % | | 24.8 | % |

| Sensors and Other gross margin | | | 46.3 | % | | | 45.2 | % | | | 41.5 | % | | 110 | bp Werbung Mehr Nachrichten zur Axon Enterprise Inc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | |||