DGAP-News: Aroundtown Property Holdings Plc. / Key word(s): Half Year Results/Real Estate Aroundtown Property Holdings Plc.'s H1 2016 results: increasing operational profits and value creation 29.08.2016 / 06:53 The issuer is solely responsible for the content of this announcement.

---------------------------------------------------------------------------

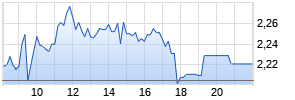

CORPORATE NEWS THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF APPLICABLE LAWS OR REGULATIONS AROUNDTOWN'S H1 2016 RESULTS: INCREASING OPERATIONAL PROFITS AND VALUE CREATION - Rental and operating income at EUR110 million, up 138% YOY - EBITDA amounted to EUR610 million, increasing from EUR536 million in H1 2015. - Adjusted EBITDA increased to EUR113 million, up 85% YOY - Net profit amounted to EUR 510 million, (EUR505 million H1 2015) - EPS (basic) is EUR0.6 (EUR0.83 H1 2015) EPS fully diluted is EUR0.46 (EUR0.73 H1 2015). - FFO I at EUR71 million, up 77% YOY - FFO I per share increased to EUR0.11, up by 40% YOY - EPRA NAV amounts to EUR3.9 billion in June 2016, from EUR3 billion in Dec 2015 - Low leverage: LTV 40%. After conversion of "in-the-money" convertible bond LTV is down to 32%. High Interest Cover Ratio maintained at 4.6x - Board of Directors updated the financial policy and set the LTV limit at 45%, down from 50% - Equity ratio at 52%, up to 59% including the conversion of "in the money" convertible bond - Robust capital structure and conservative financial policy, along with EUR227 million cash and liquid assets and additional EUR500 million straight bond issuance in July 2016, providing significant firepower for additional acquisitions 29 August 2016. Remarkable operational performance rising from internal and external portfolio growth boosting top and bottom line The outstanding portfolio growth and ongoing operational improvements resulted in 138% growth in the top line to EUR110 million rental and operating income in the first six months of 2016. Accordingly, and following successfully repositioning of the portfolio, the Adjusted EBITDA increased to EUR113 million and the FFO to EUR71 million. Due to successful repositioning measures performed, and acquisitions of high quality properties the vacancy of the commercial portfolio decreased to 7.4% of the rentable area as of August 2016. AT presents accretive FFO growth with FFO per share increase of 40% to EUR11.2 cent. Along the increased operational profitability, AT recorded EUR410 million revaluation profits rising from property value creation which together with the operational profit resulted in EUR510 million profit for the first six months of 2016. AT has continued the external portfolio growth momentum after the reporting period and as of August 2016 the Group's portfolio generates a monthly annualized adjusted EBITDA of EUR264 and an annualized FFO I of EUR171 million (EUR0.25 per share). AT has constructed the operational platform to cater for further internal and external growth and to extract additional potential from the current portfolio. Solid equity, low financial leverage alongside high liquidity level, enable Aroundtown to further pursue attractive opportunities and create accretive growth. Board of Directors updated the financial policy and set the LTV limit at 45%, down from 50%. EPRA NAV for the 30th of June 2016 amounted to EUR3.9 billion, increasing by 28% since year-end 2015, due to the profit over the period and the successful EUR270 million equity capital increase in April 2016. Additionally in April 2016, AT continued its fruitful capital market activities by issuing EUR600 million straight bonds, Series D, bearing a 1.5% coupon rate. In June 2016 Standard & Poor's increased AT's credit rating to BBB, following the favorable financial structure, and acknowledging AT's good scale and diversification and material operational improvement in occupancy. In July 2016 AT issued Series E, EUR500 million 8-year straight bond bearing a 1.5% coupon, decreasing the total cost of debt to 2%. The full H1 2016 interim financial report is available on the Company's website: http://www.aroundtownholdings.com/downloads.html About the Company Aroundtown Property Holdings Plc (trading symbol: AT1 on Frankfurt Stock Exchange/Xetra; ALATP on Euronext) is a specialist real estate company focused on value-add income generating properties primarily in the German real estate markets. Aroundtown Property Holdings Plc (ISIN: CY0105562116) is a public limited liability company incorporated in 2004 under the laws of Cyprus, having its registered office at Artemidos & Nikou Dimitriou, 54 B, 6027, Larnaca, Cyprus (registered number HE148223). Contact: Timothy Wright T: +357-2420-1312 E: info@aroundtownholdings.com www.aroundtownholdings.com Disclaimer: THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES. THE SECURITIES MENTIONED IN THIS ANNOUNCEMENT HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT. THERE WILL BE NO PUBLIC OFFERING OF THE SECURITIES IN THE UNITED STATES. THIS ANNOUNCEMENT IS DIRECTED AT AND IS ONLY BEING DISTRIBUTED IN THE UNITED KINGDOM TO (I) PERSONS WHO HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS FALLING WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (THE "ORDER"), (II) HIGH NET WORTH ENTITIES, AND OTHER PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED FALLING WITHIN ARTICLE 49 OF THE ORDER, AND (III) PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS "RELEVANT PERSONS"). THIS COMMUNICATION MUST NOT BE READ, ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. IN MEMBER STATES OF THE EUROPEAN ECONOMIC AREA ("EEA"), THIS ANNOUNCEMENT AND ANY OFFER IF MADE SUBSEQUENTLY IS DIRECTED ONLY AT PERSONS WHO ARE "QUALIFIED INVESTORS" WITHIN THE MEANING OF ARTICLE 2(1)(E) OF DIRECTIVE 2003/71/EC, AS AMENDED (THE "PROSPECTUS DIRECTIVE") ("QUALIFIED INVESTORS"). ANY PERSON IN THE EEA WHO ACQUIRES THE SECURITIES IN ANY OFFER (AN "INVESTOR") OR TO WHOM ANY OFFER OF THE SECURITIES IS MADE WILL BE DEEMED TO HAVE REPRESENTED AND AGREED THAT IT IS A QUALIFIED INVESTOR. ANY INVESTOR WILL ALSO BE DEEMED TO HAVE REPRESENTED AND AGREED THAT ANY SECURITIES ACQUIRED BY IT IN THE OFFER HAVE NOT BEEN ACQUIRED ON BEHALF OF PERSONS IN THE EEA OTHER THAN QUALIFIED INVESTORS, NOR HAVE THE SECURITIES BEEN ACQUIRED WITH A VIEW TO THEIR OFFER OR RESALE IN THE EEA TO PERSONS WHERE THIS WOULD RESULT IN A REQUIREMENT FOR PUBLICATION BY THE COMPANY OR ANY OF THE JOINT BOOKRUNNERS OF A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE. THIS ANNOUNCEMENT MAY CONTAIN PROJECTIONS OR ESTIMATES RELATING TO PLANS AND OBJECTIVES RELATING TO OUR FUTURE OPERATIONS, PRODUCTS, OR SERVICES, FUTURE FINANCIAL RESULTS, OR ASSUMPTIONS UNDERLYING OR RELATING TO ANY SUCH STATEMENTS, EACH OF WHICH CONSTITUTES A FORWARD-LOOKING STATEMENT SUBJECT TO RISKS AND UNCERTAINTIES, MANY OF WHICH ARE BEYOND THE CONTROL OF AROUNDTOWN PROPERTY HOLDINGS PLC. ACTUAL RESULTS COULD DIFFER MATERIALLY, DEPENDING ON A NUMBER OF FACTORS.

---------------------------------------------------------------------------

29.08.2016 Dissemination of a Corporate News, transmitted by DGAP - a service of EQS Group AG. The issuer is solely responsible for the content of this announcement. The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.dgap.de

---------------------------------------------------------------------------

Language: English Company: Aroundtown Property Holdings Plc. Faros, Shop 2, Spyros Thalassines Alkyonides 7560 Larnaca Cyprus Internet: www.aroundtownholdings.com ISIN: XS1151498737 WKN: A1ZTVA Listed: Regulated Unofficial Market in Berlin, Stuttgart; Open Market in Frankfurt ; Paris End of News DGAP News Service

---------------------------------------------------------------------------

496423 29.08.2016

---------------------------------------------------------------------------

CORPORATE NEWS THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF APPLICABLE LAWS OR REGULATIONS AROUNDTOWN'S H1 2016 RESULTS: INCREASING OPERATIONAL PROFITS AND VALUE CREATION - Rental and operating income at EUR110 million, up 138% YOY - EBITDA amounted to EUR610 million, increasing from EUR536 million in H1 2015. - Adjusted EBITDA increased to EUR113 million, up 85% YOY - Net profit amounted to EUR 510 million, (EUR505 million H1 2015) - EPS (basic) is EUR0.6 (EUR0.83 H1 2015) EPS fully diluted is EUR0.46 (EUR0.73 H1 2015). - FFO I at EUR71 million, up 77% YOY - FFO I per share increased to EUR0.11, up by 40% YOY - EPRA NAV amounts to EUR3.9 billion in June 2016, from EUR3 billion in Dec 2015 - Low leverage: LTV 40%. After conversion of "in-the-money" convertible bond LTV is down to 32%. High Interest Cover Ratio maintained at 4.6x - Board of Directors updated the financial policy and set the LTV limit at 45%, down from 50% - Equity ratio at 52%, up to 59% including the conversion of "in the money" convertible bond - Robust capital structure and conservative financial policy, along with EUR227 million cash and liquid assets and additional EUR500 million straight bond issuance in July 2016, providing significant firepower for additional acquisitions 29 August 2016. Remarkable operational performance rising from internal and external portfolio growth boosting top and bottom line The outstanding portfolio growth and ongoing operational improvements resulted in 138% growth in the top line to EUR110 million rental and operating income in the first six months of 2016. Accordingly, and following successfully repositioning of the portfolio, the Adjusted EBITDA increased to EUR113 million and the FFO to EUR71 million. Due to successful repositioning measures performed, and acquisitions of high quality properties the vacancy of the commercial portfolio decreased to 7.4% of the rentable area as of August 2016. AT presents accretive FFO growth with FFO per share increase of 40% to EUR11.2 cent. Along the increased operational profitability, AT recorded EUR410 million revaluation profits rising from property value creation which together with the operational profit resulted in EUR510 million profit for the first six months of 2016. AT has continued the external portfolio growth momentum after the reporting period and as of August 2016 the Group's portfolio generates a monthly annualized adjusted EBITDA of EUR264 and an annualized FFO I of EUR171 million (EUR0.25 per share). AT has constructed the operational platform to cater for further internal and external growth and to extract additional potential from the current portfolio. Solid equity, low financial leverage alongside high liquidity level, enable Aroundtown to further pursue attractive opportunities and create accretive growth. Board of Directors updated the financial policy and set the LTV limit at 45%, down from 50%. EPRA NAV for the 30th of June 2016 amounted to EUR3.9 billion, increasing by 28% since year-end 2015, due to the profit over the period and the successful EUR270 million equity capital increase in April 2016. Additionally in April 2016, AT continued its fruitful capital market activities by issuing EUR600 million straight bonds, Series D, bearing a 1.5% coupon rate. In June 2016 Standard & Poor's increased AT's credit rating to BBB, following the favorable financial structure, and acknowledging AT's good scale and diversification and material operational improvement in occupancy. In July 2016 AT issued Series E, EUR500 million 8-year straight bond bearing a 1.5% coupon, decreasing the total cost of debt to 2%. The full H1 2016 interim financial report is available on the Company's website: http://www.aroundtownholdings.com/downloads.html About the Company Aroundtown Property Holdings Plc (trading symbol: AT1 on Frankfurt Stock Exchange/Xetra; ALATP on Euronext) is a specialist real estate company focused on value-add income generating properties primarily in the German real estate markets. Aroundtown Property Holdings Plc (ISIN: CY0105562116) is a public limited liability company incorporated in 2004 under the laws of Cyprus, having its registered office at Artemidos & Nikou Dimitriou, 54 B, 6027, Larnaca, Cyprus (registered number HE148223). Contact: Timothy Wright T: +357-2420-1312 E: info@aroundtownholdings.com www.aroundtownholdings.com Disclaimer: THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES. THE SECURITIES MENTIONED IN THIS ANNOUNCEMENT HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT. THERE WILL BE NO PUBLIC OFFERING OF THE SECURITIES IN THE UNITED STATES. THIS ANNOUNCEMENT IS DIRECTED AT AND IS ONLY BEING DISTRIBUTED IN THE UNITED KINGDOM TO (I) PERSONS WHO HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS FALLING WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (THE "ORDER"), (II) HIGH NET WORTH ENTITIES, AND OTHER PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED FALLING WITHIN ARTICLE 49 OF THE ORDER, AND (III) PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS "RELEVANT PERSONS"). THIS COMMUNICATION MUST NOT BE READ, ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. IN MEMBER STATES OF THE EUROPEAN ECONOMIC AREA ("EEA"), THIS ANNOUNCEMENT AND ANY OFFER IF MADE SUBSEQUENTLY IS DIRECTED ONLY AT PERSONS WHO ARE "QUALIFIED INVESTORS" WITHIN THE MEANING OF ARTICLE 2(1)(E) OF DIRECTIVE 2003/71/EC, AS AMENDED (THE "PROSPECTUS DIRECTIVE") ("QUALIFIED INVESTORS"). ANY PERSON IN THE EEA WHO ACQUIRES THE SECURITIES IN ANY OFFER (AN "INVESTOR") OR TO WHOM ANY OFFER OF THE SECURITIES IS MADE WILL BE DEEMED TO HAVE REPRESENTED AND AGREED THAT IT IS A QUALIFIED INVESTOR. ANY INVESTOR WILL ALSO BE DEEMED TO HAVE REPRESENTED AND AGREED THAT ANY SECURITIES ACQUIRED BY IT IN THE OFFER HAVE NOT BEEN ACQUIRED ON BEHALF OF PERSONS IN THE EEA OTHER THAN QUALIFIED INVESTORS, NOR HAVE THE SECURITIES BEEN ACQUIRED WITH A VIEW TO THEIR OFFER OR RESALE IN THE EEA TO PERSONS WHERE THIS WOULD RESULT IN A REQUIREMENT FOR PUBLICATION BY THE COMPANY OR ANY OF THE JOINT BOOKRUNNERS OF A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE. THIS ANNOUNCEMENT MAY CONTAIN PROJECTIONS OR ESTIMATES RELATING TO PLANS AND OBJECTIVES RELATING TO OUR FUTURE OPERATIONS, PRODUCTS, OR SERVICES, FUTURE FINANCIAL RESULTS, OR ASSUMPTIONS UNDERLYING OR RELATING TO ANY SUCH STATEMENTS, EACH OF WHICH CONSTITUTES A FORWARD-LOOKING STATEMENT SUBJECT TO RISKS AND UNCERTAINTIES, MANY OF WHICH ARE BEYOND THE CONTROL OF AROUNDTOWN PROPERTY HOLDINGS PLC. ACTUAL RESULTS COULD DIFFER MATERIALLY, DEPENDING ON A NUMBER OF FACTORS.

---------------------------------------------------------------------------

29.08.2016 Dissemination of a Corporate News, transmitted by DGAP - a service of EQS Group AG. The issuer is solely responsible for the content of this announcement. The DGAP Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.dgap.de

---------------------------------------------------------------------------

Language: English Company: Aroundtown Property Holdings Plc. Faros, Shop 2, Spyros Thalassines Alkyonides 7560 Larnaca Cyprus Internet: www.aroundtownholdings.com ISIN: XS1151498737 WKN: A1ZTVA Listed: Regulated Unofficial Market in Berlin, Stuttgart; Open Market in Frankfurt ; Paris End of News DGAP News Service

---------------------------------------------------------------------------

496423 29.08.2016