Aon Reports Second Quarter 2017 Results

PR Newswire

LONDON, Aug. 4, 2017

LONDON, Aug. 4, 2017 /PRNewswire/ --

Second Quarter Key Metrics From Continuing Operations

- Reported revenue increased 4% to $2.4 billion, with organic revenue growth of 3%

- Operating margin was (5.0)%, and operating margin, adjusted for certain items, increased 110 basis points to 22.4%

- EPS was $(0.20), and EPS, adjusted for certain items, increased 13% to $1.45

- For the first six months of 2017, cash flow from operations was $436 million, and free cash flow was $354 million

Second Quarter Highlights

- Repurchased 8 million Class A Ordinary Shares for approximately $1 billion

- Closed the sale of the Benefits Administration and HR Business Process Outsourcing (BPO) platform for cash consideration of $4.3 billion, subject to customary adjustments, and additional consideration of up to $500 million

- Announced a 9% increase to the quarterly cash dividend

Aon plc (NYSE: AON) today reported results for the three months ended June 30, 2017.

Net income attributable to Aon shareholders was $769 million, or $2.93 per share, compared to $300 million or $1.11 per share, in the prior year period. Net income per share attributable to Aon shareholders, adjusted for certain items, increased 2% to $1.53, compared to $1.50 in the prior year period. Net income (loss) from continuing operations was $(43) million, or $(0.20) per share, compared to $273 million, or $0.98 per share, in the prior year period. Net income per share from continuing operations, adjusted for certain items, increased 13% to $1.45, compared to $1.28 in the prior year period. Certain items that impacted second quarter results and comparisons with the prior year period are detailed in the "Reconciliation of Non-GAAP Measures - Operating Income from Continuing Operations and Diluted Earnings per Share" on page 11 of this press release.

"Our second quarter results reflect growth across all major lines of revenue, solid operating performance with 110 basis points of adjusted operating margin improvement and 13% earnings per share growth, highlighted by the repurchase of $1 billion of stock in the quarter," said Greg Case, President and Chief Executive Officer. "During the quarter, we took significant steps to strengthen our industry-leading global professional services platform, including the completed divestiture of our outsourcing businesses and initial investments in our Aon United single operating model. Combined with strong free cash flow generation and capital proceeds from the transaction, we believe we are on track to exceed $7.97 adjusted earnings per share in 2018 and deliver double-digit free cash flow growth over the long-term."

SECOND QUARTER 2017 FINANCIAL SUMMARY

The second quarter financial results discussed herein represent performance from continuing operations unless otherwise noted.

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Aon Plc. | ||

|

MB1BUK

| Ask: 4,04 | Hebel: 7,42 |

| mit moderatem Hebel |

Zum Produkt

| |

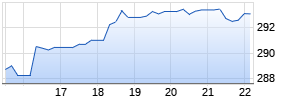

Kurse

|

Total revenue in the second quarter increased 4% to $2.4 billion, compared to the prior year period driven primarily by 3% organic revenue growth and a 3% increase related to acquisitions, net of divestitures, partially offset by a 2% unfavorable impact from foreign currency translation.

Total operating expenses in the second quarter increased 31% to $2.5 billion compared to the prior year period due primarily to a $380 million non-cash impairment charge to the associated indefinite lived tradenames associated with the sale of the Benefits Administration and HR Business Process Outsourcing (BPO) platform, $155 million of restructuring costs, a $62 million increase in operating expenses related to acquisitions, net of divestitures, $35 million of accelerated amortization related to tradenames, $34 million of costs related to regulatory and compliance matters, and an $8 million increase in intangible asset amortization from previous acquisitions, partially offset by $62 million of expense related to certain non-cash pension settlements in the prior year period, a $50 million favorable impact from foreign currency translation and $44 million of savings related to restructuring and other operational improvement initiatives.

Restructuring expenses were $155 million in the second quarter, primarily driven by workforce reductions. The Company expects to invest $900 million in total cash over a three-year period, and incur $50 million of non-cash charges, in driving one operating model across the firm. This includes an estimated investment of $700 million of cash restructuring charges and $200 million of capital expenditures. To date, the Company has incurred 40% of the total estimated restructuring charges. An analysis of restructuring and related costs by type is detailed on page 15 of this press release.

Restructuring savings in the second quarter related to restructuring and other operational improvement initiatives are estimated at $44 million before reinvestment. Before any potential reinvestment of savings, restructuring and other operational improvement initiatives are expected to deliver run-rate savings of $400 million annually in 2019. To date, the Company has achieved 14% of the total estimated annualized savings.

Foreign currency exchange rates in the second quarter had a $0.05 per share, or $15 million, favorable impact on U.S. GAAP net income, and a $0.02 per share, or $7 million, pretax favorable impact on adjusted net income if the Company were to translate prior year quarter results at current quarter foreign exchange rates.

Effective tax rate used in the U.S. GAAP financial statements in the second quarter was 76.9%, compared to the prior year quarter of 13.6%. After adjusting to exclude the applicable tax impact associated with estimated restructuring expenses, accelerated tradename amortization, impairment charges, regulatory and compliance provisions, and non-cash pension settlement charges anticipated in Q4 2017, the adjusted effective tax rate for the second quarter of 2017 was 15.6% compared to 14.9% in the prior year quarter, due primarily to a net favorable impact of certain discrete items recognized in both periods. These adjustments are discussed in "Reconciliation of Non-GAAP Measures - Operating Income from Continuing Operations and Diluted Earnings per Share" on page 11 of this press release.

Weighted average diluted shares outstanding decreased to 262.4 million in the second quarter compared to 269.8 million in the prior year quarter. The Company repurchased 8 million Class A Ordinary Shares for approximately $1 billion in the quarter. As of June 30, 2017, the Company had $6.7 billion of remaining authorization under its share repurchase program.

SECOND QUARTER 2017 CASH FLOW SUMMARY

Cash flow from operations for the first six months of 2017 decreased 22%, or $121 million, to $436 million compared to the prior year period, primarily reflecting $94 million of cash restructuring charges and $44 million of transaction related costs, partially offset by operational improvement.

Free cash flow, defined as cash flow from operations less capital expenditures, decreased 28%, or $135 million, to $354 million for the first six months of 2017 compared to the prior year period, reflecting a decline in cash flow from operations and a $14 million increase in capital expenditures, including investments in our operating model. A reconciliation of free cash flow to cash flow from operations can be found in "Reconciliation of Non-GAAP Measures - Organic Revenue and Free Cash Flow" on page 10 of this press release.

SECOND QUARTER 2017 REVENUE REVIEW

The second quarter revenue reviews provided below include supplemental information related to organic revenue, which is a non-GAAP measure that is described in detail in "Reconciliation of Non-GAAP Measures - Organic Revenue and Free Cash Flow" on page 10 of this press release.

| | | Three Months Ended | | | | | | | | | | | ||||

| (millions) | | June 30, | | June 30, | | % | | Less: | | Less: Fiduciary | | Less: | | Organic | ||

| Revenue | | | | | | | | | | | | | | | | |

| Commercial Risk Solutions | | $ | 1,042 | | $ | 990 | | 5% | | (1)% | | —% | | 4% | | 2% |

| Reinsurance Solutions | | 344 | | 332 | | 4 | | (1) | | — | | (1) | | 6 | ||

| Retirement Solutions | | 389 | | 405 | | (4) | | (4) | | — | | (1) | | 1 | ||

| Health Solutions | | 312 | | 281 | | 11 | | (1) | | — | | 7 | | 5 | ||

| Data & Analytic Services | | 285 | | 275 | | 4 | | (1) | | — | | 1 | | 4 | ||

| Elimination | | (4) | | (1) | | N/A | | N/A | | N/A | | N/A | | N/A | ||

| Total revenue | | $ | 2,368 | | $ | 2,282 | | 4% | | (2)% | | —% | | 3% | | 3% |

Total organic revenue increased 3% compared to the prior year period, reflecting growth across every major revenue line and highlighted by strong growth in Reinsurance Solutions and Health Solutions.

Commercial Risk Solutions organic revenue increased 2% compared to the prior year period driven by strong growth across the Pacific region, in both Australia and New Zealand, and solid growth in the U.S. and Canada, partially offset by a modest decline in Latin America and Asia.

Reinsurance Solutions organic revenue increased 6% compared to the prior year period driven by strong growth in capital markets, as well as growth in facultative placements and net new business generation in treaty, partially offset by a modest unfavorable market impact globally.

Retirement Solutions organic revenue increased 1% compared to the prior year period driven by continued growth in investment consulting, primarily for delegated investment management, partially offset by a decline in our talent practice.

Health Solutions organic revenue increased 5% compared to the prior year period driven by solid growth globally in health & benefits brokerage, highlighted by strong growth in the U.S., Asia, and EMEA.

Data & Analytic Services organic revenue increased 4% compared to the prior year period driven by strong growth across Affinity, with particular strength in the U.S.

SECOND QUARTER EXPENSE REVIEW

| | | Three Months Ended | | | | |||||||

| (millions) | | June 30, | June 30, Werbung Mehr Nachrichten zur Aon Plc. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | |||||||||