Albemarle reports third quarter 2016 results and raises full year guidance

PR Newswire

CHARLOTTE, N.C., Nov. 7, 2016

CHARLOTTE, N.C., Nov. 7, 2016 /PRNewswire/ --

Third quarter 2016 highlights:

- Third quarter earnings were $128.2 million, or $1.13 per diluted share, an increase of 96% over the prior year

- Adjusted net income from continuing operations was $102.7 million, or $0.91 per diluted share, an increase of 20% over the prior year

- Third quarter adjusted EBITDA was $188.3 million, an increase of 10% over the prior year, excluding the impact of divestitures

- Year-to-date cash from operations was $452.4 million, an increase of 43% over the prior year

- Signed definitive agreement to acquire the lithium hydroxide and lithium carbonate conversion assets of Jiangxi Jiangli New Materials Science and Technology Co. Ltd.

| | Three Months Ended | | Nine Months Ended | ||||||||||||||||||||||

| | September 30, ARIVA.DE Börsen-GeflüsterWerbung Weiter aufwärts?

Morgan Stanley

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: ME0L7Q,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

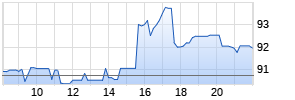

Kurse

| | September 30, | ||||||||||||||||||||||

| In thousands, except per share amounts | 2016 | | 2015 | | 2016 | | 2015 | ||||||||||||||||||

| Net sales | $ | 654,010 | | | $ | 693,216 | | | $ | 1,980,548 | | | $ | 2,103,819 | | ||||||||||

| Adjusted EBITDA | $ | 188,329 | | | $ | 180,681 | | | $ | 570,833 | | | $ | 581,519 | | ||||||||||

| Net income from continuing operations | $ | 114,512 | | | $ | 59,842 | | | $ | 428,334 | | | $ | 158,313 | | ||||||||||

| Net income attributable to Albemarle Corporation | $ | 128,220 | | | $ | 65,392 | | | $ | 41,585 | | | $ | 160,654 | | ||||||||||

| Diluted earnings per share from continuing operations | $ | 0.93 | | | $ | 0.48 | | | $ | 3.53 | | | $ | 1.27 | | ||||||||||

| Diluted earnings per share attributable to Albemarle Corporation | $ | 1.13 | | | $ | 0.58 | | | $ | 0.37 | | | $ | 1.44 | | ||||||||||

| Non-operating pension and OPEB items(a) | — | | | (0.01) | | | — | | | (0.02) | | ||||||||||||||

| Non-recurring and other unusual items(b) | (0.02) | | | 0.29 | | | (0.75) | | | 1.30 | | ||||||||||||||

| Discontinued operations(c) | (0.20) | | | (0.10) | | | 3.16 | | | (0.17) | | ||||||||||||||

| Adjusted diluted earnings per share from continuing operations(d) | $ | 0.91 | | | $ | 0.76 | | | $ | 2.78 | | | $ | 2.55 | | ||||||||||

| | |||||||||||||||||||||||||

| See accompanying notes (a) through (d) to the condensed consolidated financial information and non-GAAP reconciliations. | |||||||||||||||||||||||||

Albemarle Corporation (NYSE: ALB) reported net income from continuing operations for the third quarter 2016 of $114.5 million, or $0.93 per diluted share (after income attributable to noncontrolling interests), compared to $59.8 million, or $0.48 per diluted share in the third quarter 2015. The Company reported third quarter 2016 net income attributable to Albemarle Corporation of $128.2 million, or $1.13 per diluted share, compared to net income attributable to Albemarle Corporation of $65.4 million, or $0.58 per diluted share, for third quarter 2015. Third quarter 2016 adjusted net income from continuing operations was $102.7 million, or $0.91 per diluted share, compared to $85.5 million, or $0.76 per diluted share, for third quarter 2015 (see notes to the condensed consolidated financial information). The Company reported net sales of $654.0 million in third quarter 2016, down from net sales of $693.2 million in the third quarter of 2015, driven by the divestitures of the metal sulfides and minerals-based flame retardants and specialty chemicals businesses of $73.3 million, partially offset by the impact of higher sales volumes, as well as favorable price and mix impacts in certain businesses and favorable currency exchange impacts.

Net income from continuing operations for the nine months ended September 30, 2016 was $428.3 million, or $3.53 per diluted share (after income attributable to noncontrolling interests), compared to $158.3 million, or $1.27 per diluted share, for the nine months ended September 30, 2015. Including a non-recurring, non-cash tax net charge of $411.3 million related to our decision to sell our Chemetall Surface Treatment business, partially offset by gains on sales of businesses of $122.3 million (see notes to the condensed consolidated financial information), the Company reported net income attributable to Albemarle Corporation of $41.6 million, or $0.37 per diluted share, for the nine months ended September 30, 2016, compared to net income attributable to Albemarle Corporation of $160.7 million, or $1.44 per diluted share for the nine months ended September 30, 2015. Adjusted net income from continuing operations for the nine months ended September 30, 2016 was $315.0 million, or $2.78 per diluted share, compared to $284.1 million, or $2.55 per diluted share, for the same period 2015 (see notes to the condensed consolidated financial information). Net sales for the nine months ended September 30, 2016 were $1.98 billion, down from net sales of $2.10 billion, driven primarily by the divestitures of the metal sulfides and minerals-based flame retardants and specialty chemicals businesses of $194.4 million, partially offset by the impact of higher sales volumes, as well as favorable price and mix impacts in certain businesses and favorable currency exchange impacts.

"In the third quarter, we continued our strong growth trend as adjusted EBITDA grew by 10% compared to third quarter of 2015, excluding the impact of divestitures. Adjusted EBITDA growth of 32% in Lithium and 19% in Refining Solutions set the pace," said Luke Kissam, Albemarle's president and CEO. "We also took steps to accelerate our strategy and strengthen our lithium franchise by entering into an agreement to acquire the spodumene conversion assets of Jiangxi Jiangli New Materials Science and Technology Company and entering into an agreement with Bolland Minera, S.A. that gives us exclusive exploration and acquisition rights to what could prove to be the largest lithium resource in Argentina."

On June 17, 2016, the Company entered into a definitive agreement to sell the Chemetall Surface Treatment business to BASF SE for proceeds of approximately $3.2 billion, subject to adjustment with respect to certain pension liabilities, cash, working capital and indebtedness. The sale is subject to regulatory approvals and other customary closing conditions, and is expected to close in the fourth quarter of 2016. In the second quarter of 2016, the Company determined that the business qualified for discontinued operations treatment, and as such began accounting for its assets and liabilities as held for sale. The financial results of the disposal group have been presented as discontinued operations in the consolidated statements of income and excluded from segment results for all periods presented.

On January 12, 2015, we completed the acquisition of Rockwood Holdings, Inc. ("Rockwood"). The results of Rockwood from January 1, 2015 to January 12, 2015 ("stub period") are excluded from the year-to-date 2015 financial results presented herein. Excluded net sales and adjusted EBITDA for the stub period were $13.6 million and $1.1 million, respectively.

Mehr Nachrichten zur Albemarle Corp Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.