NEW YORK COMMUNITY BANCORP, INC. ANNOUNCES NEW EMPLOYMENT INDUCEMENT AWARDS

PR Newswire

HICKSVILLE, N.Y., April 26, 2024

HICKSVILLE, N.Y., April 26, 2024 /PRNewswire/ -- New York Community Bancorp, Inc. (NYSE: NYCB) (the "Company") today announced that it has approved employment inducement awards to three individuals who have recently become executives of the Company.

In connection with the appointments of (i) Craig Gifford as Senior Executive Vice President and Chief Financial Officer of the Company, (ii) Scott Shepherd as Senior Executive Vice President and Head of Commercial Real Estate Lending of the Company, and (iii) Bao Nguyen as Senior Executive Vice President, General Counsel, and Chief of Staff of the Company, the Board of Directors of the Company approved employment inducement awards for Mr. Gifford, Mr. Shepherd, and Mr. Nguyen as a material inducement to such individuals entering into offers of employment with the Company in reliance on the employment inducement award exception to New York Stock Exchange Listing Rule 303A.08.

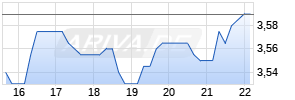

Each of Mr. Gifford, Mr. Shepherd, and Mr. Nguyen was granted a one-time stock option grant to acquire 3,000,000 shares of the Company's common stock. Each stock option has an exercise price of $3.07, which is equal to the closing price of the Company's common stock on the date of the grants, and will vest in 3 equal annual installments on the first, second, and third anniversary of the grant date, with any applicable taxes payable by way of a net settlement.

The employment inducement awards are being made outside of the New York Community Bancorp, Inc. 2020 Omnibus Incentive Plan (the "Plan") and the Company's shareholder-approved equity compensation plan, but will generally be subject to the same terms and conditions as apply to awards granted under the Plan.

About New York Community Bancorp, Inc.

New York Community Bancorp, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered in Hicksville, New York. At December 31, 2023, the Company had $113.9 billion of assets, $85.8 billion of loans, deposits of $81.4 billion, and total stockholders' equity of $8.4 billion.

Flagstar Bank, N.A. operates 420 branches, including strong footholds in the Northeast and Midwest and exposure to high growth markets in the Southeast and West Coast. Flagstar Mortgage operates nationally through a wholesale network of approximately 3,000 third-party mortgage originators. In addition, the Bank has 134 private banking teams located in over ten cities in the metropolitan New York City region and on the West Coast, which serve the needs of high-net worth individuals and their businesses.

New York Community Bancorp, Inc. has market-leading positions in several national businesses, including multi-family lending, mortgage origination and servicing, and warehouse lending. Flagstar Mortgage is the seventh largest bank originator of residential mortgages for the 12-months ending December 31, 2023, while we are the industry's fifth largest sub-servicer of mortgage loans nationwide, servicing 1.4 million accounts with $382 billion in unpaid principal balances. Additionally, the Company is the second largest mortgage warehouse lender nationally based on total commitments.

Cautionary Note Regarding Forward-Looking Statements

The foregoing disclosures may include forward‐looking statements within the meaning of the federal securities laws by the Company pertaining to such matters as our goals, intentions, and expectations regarding equity award grants, including the terms thereof; revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, the purchase and assumption of certain assets and liabilities of Signature Bridge Bank beginning March 20, 2023 (the "Signature Transaction"), and our transition to a $100 billion plus bank.

Forward‐looking statements are typically identified by such words as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "should," and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results.

Our forward‐looking statements are subject to the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends at currently expected rates; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures or disruptions in or breaches of the Company's operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and the Signature Transaction; the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management's attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company's merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K/A for the year ended December 31, 2023, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this Amendment, during investor presentations, or in our other SEC filings, which are accessible on our website and at the SEC's website, www.sec.gov.

Investor Contact:

Salvatore J. DiMartino

(516) 683-4286

Media Contact:

Steven Bodakowski

(248) 312-5872

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-york-community-bancorp-inc-announces-new-employment-inducement-awards-302128970.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-york-community-bancorp-inc-announces-new-employment-inducement-awards-302128970.html

SOURCE New York Community Bancorp, Inc.

Mehr Nachrichten zur New York Community Bancorp Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.