Crescent Point Announces 2023 Results & Reserves

PR Newswire

CALGARY, AB, Feb. 29, 2024

CALGARY, AB, Feb. 29, 2024 /PRNewswire/ - Crescent Point Energy Corp. ("Crescent Point" or the "Company") (TSX: CPG) (NYSE: CPG) is pleased to announce its operating and financial results for the year ended December 31, 2023.

KEY HIGHLIGHTS

- Transformed portfolio, increasing premium inventory to over 20 years and enhancing excess cash flow profile.

- Replaced over 900 percent of 2023 production on a 2P reserves basis including strategic A&D, or 150 percent organically.

- Generated $980 million of excess cash flow in 2023, with capital expenditures and production in-line with guidance.

- Returned approximately $600 million, or 60 percent of excess cash flow, to shareholders in 2023.

- Increasing quarterly base dividend by 15 percent to $0.115 per share, or $0.46 per share annually.

- Generated a strong FD&A recycle ratio of 2.5 times in 2023, including change in FDC, based on 2P reserves.

- Excess cash flow of $830 million expected in 2024 at US$75 WTI, with 60 percent returned to shareholders.

- Five-year plan expected to generate strong per share growth and cumulative excess cash flow of $4.7 billion at US$70 WTI.

"This past year was pivotal in our company's history as we successfully transformed our portfolio," said Craig Bryksa, President and CEO of Crescent Point. "Through this execution, we have materially enhanced the long-term sustainability of our business, including by increasing our premium drilling inventory to over 20 years and enhancing our excess cash flow profile on a per share basis. Our strategic priorities going forward are operational execution, balance sheet strength and increasing return of capital to shareholders."

FINANCIAL HIGHLIGHTS

- Adjusted funds flow totaled over $2.3 billion for the year ended December 31, 2023, or $4.27 per share diluted, driven by a strong operating netback of $43.71 per boe. In fourth quarter, adjusted funds flow totaled $574.5 million, or $1.03 per share diluted.

- For the year ended December 31, 2023, development capital expenditures, which included drilling and development, facilities and seismic costs, totaled $1.14 billion, within the Company's annual guidance range of $1.05 billion to $1.15 billion.

- The Company's net debt as at December 31, 2023 was approximately $3.7 billion. Throughout 2023, Crescent Point executed on its portfolio strategy which included material additions in the Alberta Montney along with non-core asset dispositions. During fourth quarter 2023, Crescent Point entered into agreements to dispose of its Swan Hills and Turner Valley assets in Alberta, which have closed or are expected to close in first quarter 2024.

- For the year ended December 31, 2023, Crescent Point reported net income from continuing operations of $799.4 million, or $1.46 per share diluted. The Company's total net income for 2023, including discontinued operations, was $570.3 million, or $1.04 per share diluted, which included net non-cash charges of $106.7 million related to the disposition of its U.S. assets.

- The Company has hedged approximately 45 percent of its oil and liquids production and over 30 percent of its natural gas production in 2024, net of royalty interest. The Company has also diversified its pricing exposure for natural gas, with the majority of its production through 2025 receiving a combination of fixed prices and pricing related to major U.S. markets.

RETURN OF CAPITAL HIGHLIGHTS

- The Company's total return of capital to shareholders in 2023, including the base dividend, was $599.5 million, or approximately 60 percent of its annual excess cash flow.

- During fourth quarter, Crescent Point prioritized share buybacks within its return of capital framework, repurchasing 8.4 million shares for $83.8 million. The Company repurchased a total of 34.6 million shares for $349.9 million in 2023, representing over six percent of its public float at the start of the year. Crescent Point intends to file with the Toronto Stock Exchange ("TSX") a notice of intention to renew its normal course issuer bid ("NCIB"), which is due to expire on March 8, 2024.

- Crescent Point's Board of Directors has approved and declared a first quarter 2024 base dividend of $0.115 per share, an increase of 15 percent from the prior level. The base dividend is payable on April 1, 2024 to shareholders of record on March 15, 2024. This base dividend increase equates to an annualized base dividend of $0.46 per share.

| Adjusted funds flow, adjusted funds flow per share diluted, excess cash flow, recycle ratio, total return of capital and net debt are specified financial measures - refer to the Specified Financial Measures section in this press release for further information. All financial figures are approximate and in Canadian dollars unless otherwise noted. This press release contains forward-looking information and references to specified financial measures. Significant related assumptions and risk factors, and reconciliations are described under the Specified Financial Measures, Forward-Looking Statements and Reserves and Drilling Data sections of this press release, respectively. Further information breaking down the production information contained in this press release by product type can be found in the "Product Type Production Information" section of this press release. |

OPERATIONAL HIGHLIGHTS

- Achieved annual average production of 159,411 boe/d in 2023, within the Company's annual production guidance range of 156,000 to 161,000 boe/d, notwithstanding the downtime associated with the Alberta wildfires earlier in the year. Crescent Point's average production in fourth quarter 2023 was 162,269 boe/d.

- In the Kaybob Duvernay, the Company delivered consistent results throughout 2023, demonstrating the strength of its operational execution. Crescent Point brought on stream over 20 wells during the year through four multi-well pads. These pads generated average peak 30-day rates ranging from 1,000 boe/d to 1,550 boe/d (75% to 85% liquids) per well within the Volatile Oil window and 1,425 boe/d (60% liquids) per well in the Liquids-Rich window. During fourth quarter, Crescent Point added a second rig in the Kaybob Duvernay to accelerate the development of its high-return inventory.

- Crescent Point has also continued to achieve strong operational momentum in the Alberta Montney since its initial entry into the play in second quarter 2023. The Company brought on stream over 25 wells during the remainder of the year through nine multi-well pads. These pads generated average peak 30-day rates ranging from 1,200 boe/d to 2,000 boe/d (70% to 85% liquids) per well in Gold Creek West, 1,000 boe/d to 1,350 boe/d (45% to 75% liquids) per well in Gold Creek and 775 boe/d (85% liquids) per well in Karr East.

- Crescent Point's open hole multi-lateral ("OHML") well development program in southeast Saskatchewan included nine eight-leg wells during 2023. The Company's most recent OHML well achieved a peak-30 day rate of over 300 bbl/d (100% light oil), further highlighting the strong drilling economics of this program. Crescent Point also continued to advance its decline mitigation initiatives in 2023, including by successfully converting approximately 100 producing wells to water injection wells. These initiatives support the Company's low base decline rate of approximately 15 percent in its Saskatchewan assets, further enhancing its strong excess cash flow generation from these assets.

- In 2023, Crescent Point achieved the best safety scores in the Company's history, demonstrating its ongoing commitment to safe operations.

- During 2023, Crescent Point continued to demonstrate its commitment to strong environmental, social and governance ("ESG") practices as it progresses toward each of its environmental targets, including reducing its Scope 1 and 2 emissions intensity, surface freshwater use and inactive well inventory. The Company remains on track to meet or exceed each of these environmental targets. Crescent Point has significantly improved its environmental profile, reducing both its Scope 1 emissions intensity and asset retirement liabilities by approximately 60 percent since beginning its portfolio transformation.

RESERVES HIGHLIGHTS

"Our 2023 reserves highlight the benefits of our strategic portfolio transformation and our technical team's strong ongoing operational execution," said Bryksa. "We organically replaced 150 percent of our 2023 annual production on a proved plus probable basis, primarily driven by drilling and development activity in the Kaybob Duvernay. In 2024, we see opportunities to further enhance shareholder value by realizing potential cost efficiencies and productivity enhancements. At year-end 2023, over 70 percent of our premium locations in the Alberta Montney and approximately 60 percent in the Kaybob Duvernay remain unbooked, allowing for future reserves growth."

- The Company's reserves at year-end 2023 increased across all categories driven by organic additions and strategic acquisitions, net of non-core dispositions. Proved plus Probable ("2P") reserves totaled 1,201.3 million boe ("MMboe"), Proved ("1P") reserves totaled 768.3 MMboe and Proved Developed Producing ("PDP") reserves totaled 381.1 MMboe.

- The Company's 2P reserve life index ("RLI") is approximately 16 years based on mid-point of 2024 annual average production guidance.

- Crescent Point achieved net reserve additions of 88.7 MMboe on a 2P basis, excluding acquisitions and dispositions ("A&D"), replacing approximately 150 percent of its 2023 annual production. These reserve additions primarily originated from the Company's Kaybob Duvernay asset, which contributed reserve adds at an attractive finding and development ("F&D") cost, including change in future development capital ("FDC"), of approximately $13.50 per boe. These Kaybob Duvernay reserve additions resulted in a strong recycle ratio of over 3.0 times.

- Reserve additions within Crescent Point's Alberta Montney asset are captured under the Company's acquired reserves, given the timing of its initial entry into the play in second quarter 2023. Including strategic acquisitions, net of dispositions, Crescent Point added 457.7 MMboe of 2P reserves. This addition contributed to the significant increase in 2P reserves in 2023 of approximately 70 percent and replaced over 900 percent of the Company's 2023 annual production.

- Crescent Point generated 2P finding, development and acquisition ("FD&A") cost, including change in FDC, of $17.70 per boe, producing a recycle ratio of 2.5 times based on an operating netback of $43.71 per boe in 2023.

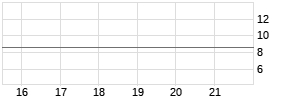

- Crescent Point's 2P net asset value ("NAV") was $22.45 per share at year-end 2023, based on independent engineering pricing. On a PDP and 1P basis, the Company's NAV was $7.63 and $14.07 per share, respectively. The independent engineering price forecast assumes an average WTI price of approximately US$76.35/bbl and AECO price of approximately $3.60/Mcf in the first five years. The Company's NAV at year-end 2023 does not include unbooked locations, primarily in the Kaybob Duvernay and Alberta Montney, allowing for future reserves additions.

Additional information on the Company's 2023 reserves is provided in its Annual Information Form ("AIF") for the year-ended December 31, 2023.

OUTLOOK

Crescent Point's strategic priorities remain focused on operational execution, balance sheet strength and increasing return of capital to shareholders.

The Company's previously released 2024 annual average production guidance of 198,000 to 206,000 boe/d and development capital expenditures budget of $1.4 billion to $1.5 billion remain unchanged. This budget remains disciplined and flexible, with a continued focus on allocating capital to the highest-return assets. Approximately 45 percent of Crescent Point's 2024 budget is allocated to the Alberta Montney, 35 percent to Kaybob Duvernay and 20 percent to Saskatchewan. The Company's 2024 capital budget, including its base dividend, remains fully funded at approximately US$55/bbl WTI.

Within its operations, Crescent Point continues to target additional efficiencies and improved productivity by further enhancing drilling and completions optimization, including optimizing wells drilled per section on its recently acquired Alberta Montney assets and drilling longer lateral wells in the Kaybob Duvernay. In Saskatchewan, the Company continues to build on its operational momentum through the advancement of its OHML drilling and decline mitigation programs.

Crescent Point's 2024 budget is expected to generate significant excess cash flow of approximately $830 million at average commodity prices of approximately US$75/bbl WTI and $2.30/Mcf AECO for the full year. The Company's funds flow sensitivity is approximately $30 million for every US$1/bbl change in WTI and $20 million for every $0.25/Mcf change in AECO for the remainder of the year.

Crescent Point plans to continue allocating 60 percent of its excess cash flow to shareholders through the base dividend and share repurchases, with the remaining 40 percent directed toward the balance sheet. The Company's leverage ratio, or net debt to adjusted funds flow, is expected to be approximately 1.2 times by year-end 2024, based on average commodity prices of approximately US$75/bbl WTI and $2.30/Mcf AECO for the full year.

The Company plans to increase the percentage of excess cash flow it returns to shareholders over time as it further strengthens its balance sheet. Crescent Point's strategy is focused on delivering meaningful and sustainable total returns through a combination of return of capital, per-share growth and balance sheet strength.

INVESTOR DAY

Crescent Point will host an Investor Day on March 20, 2024 to discus its corporate strategy, operational results and long-term development plan.

For more details, please refer to the press release dated February 15, 2024.

CONFERENCE CALL DETAILS

Crescent Point management will host a conference call on Thursday, February 29, 2024 at 10:00 a.m. MT (12:00 p.m. ET) to discuss the Company's results and outlook. A slide deck will accompany the conference call and can be found on Crescent Point's website.

Participants can listen to this event online via webcast. To join the call without operator assistance, participants may register online by entering their phone number to receive an instant automated call back. Alternatively, the conference call can be accessed with operated assistance by dialing 1‑888‑390‑0605. Participants will be able to take part in a question and answer session following management's opening remarks through both the webcast dashboard and the conference line.

The webcast will be archived for replay and can be accessed online at Crescent Point's conference calls and webcasts page. The replay will be available shortly after the completion of the call.

Shareholders and investors can also find the Company's most recent investor presentation on Crescent Point's website.

| Net debt to adjusted funds flow is a specified financial measure - refer to the Specified Financial Measures section in this press release for further information. |

2024 GUIDANCE

The Company's guidance for 2024 is as follows:

| Total Annual Average Production (boe/d) (1) | 198,000 - 206,000 |

| | |

| Capital Expenditures | |

| Development capital expenditures ($ millions) | $1,400 - $1,500 |

| Capitalized administration ($ millions) | $40 |

| Total ($ million) (2) | $1,440 - $1,540 |

| | |

| Other Information for 2024 Guidance | |

| Reclamation activities ($ millions) (3) | $40 |

| Capital lease payments ($ millions) | $20 |

| Annual operating expenses ($/boe) | $12.75 - $13.75 |

| Royalties | 10.00% - 11.00% |

| 1) | Total annual average production (boe/d) is comprised of approximately 65% Oil, Condensate & NGLs and 35% Natural Gas |

| 2) | Land expenditures and net property acquisitions and dispositions are not included. Development capital expenditures spend is allocated on an approximate basis as follows: 90% drilling & development and 10% facilities & seismic |

| 3) | Reflects Crescent Point's portion of its expected total budget |

RETURN OF CAPITAL OUTLOOK

| Base Dividend | |

| Current quarterly base dividend per share | $0.115 |

| Total Return of Capital | |

| % of excess cash flow (1) | 60 % |

| 1) Total return of capital is based on a framework that targets to return to shareholders 60% of excess cash flow on an annual basis |

The Company's audited consolidated financial statements and management's discussion and analysis for the year ended December 31, 2023, will be available on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedarplus.com, on EDGAR at www.sec.gov/edgar.shtml and on Crescent Point's website at www.crescentpointenergy.com.

Summary of Reserves

The Company's reserves were independently evaluated by McDaniel & Associates Consultants Ltd. ("McDaniel") as at December 31, 2023. The reserves evaluation and reporting was conducted in accordance with the definitions, standards and procedures contained in the COGEH and National Instrument 51-101 Standards for Disclosure of Oil and Gas Activities ("NI 51-101").

As at December 31, 2023 (1) (2) (3) (4)

| | Tight Oil (Mbbls) | Light and Medium Oil (Mbbls) | Heavy Oil (Mbbls) | Natural Gas Liquids (Mbbls) | ||||

| Reserves Category | Gross | Net | Gross | Net | Gross | Net | Gross | Net |

| Proved Developed Producing | 131,979 | 118,448 | 37,020 | 33,181 | 17,173 | 14,417 | 82,447 | 69,988 |

| Proved Developed Non-Producing | 587 | 539 | 252 | 244 | 2,260 | 2,089 | 149 Werbung Mehr Nachrichten zur Crescent Point Energy Corp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |