SS&C Technologies Releases Q4 and Full Year 2022 Earnings Results

PR Newswire

WINDSOR, Conn., Feb. 7, 2023

Q4 2022 GAAP revenue $1,338.3 million, up 3.4%, Fully Diluted GAAP Earnings Per Share $0.81, down 13.8%

Adjusted revenue $1,339.1 million, up 3.3%, Adjusted Diluted Earnings Per Share $1.16, down 9.4%

WINDSOR, Conn., Feb. 7, 2023 /PRNewswire/ -- SS&C Technologies Holdings, Inc. (NASDAQ: SSNC), a global provider of investment, financial and healthcare software-enabled services and software, today announced its financial results for the fourth quarter and full year ended December 31, 2022.

| | Three Months Ended December 31, | | Twelve Months Ended December 31, | | ||||||||||||

| (in millions, except per share data): ARIVA.DE Börsen-GeflüsterWerbung Weiter aufwärts?

Morgan Stanley

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: ME4TKJ,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

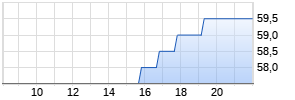

Kurse

| 2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||

| GAAP Results | | | | | | | ||||||||||

| Revenue | $1,338.3 | $1,294.2 | 3.4 % | $5,283.0 | $5,051.0 | 4.6 % | ||||||||||

| Operating income | 301.3 | 320.2 | (5.9) % | 1,142.9 | 1,242.3 | (8.0) % | ||||||||||

| Operating income margin | 22.5 % | 24.7 % | -220 bp | 21.6 % | 24.6 % | -300 bp | ||||||||||

| Diluted earnings per share attributable to SS&C | $0.81 | $0.94 | (13.8) % | $2.48 | $2.99 | (17.1) % | ||||||||||

| Adjusted Non-GAAP Results (defined in Notes 1 - 4 below) | | | | |||||||||||||

| Adjusted revenue | $1,339.1 | $1,296.2 | 3.3 % | $5,287.3 | $5,058.9 | 4.5 % | ||||||||||

| Adjusted operating income attributable to SS&C | 502.1 | 507.5 | (1.1) % | 1,942.3 | 2,003.2 | (3.0) % | ||||||||||

| Adjusted operating income margin | 37.5 % | 39.2 % | -170 bp | 36.7 % | 39.6 % | -290 bp | ||||||||||

| Adjusted diluted earnings per share attributable to SS&C | $1.16 | $1.28 | (9.4) % | $4.65 | $5.02 | (7.4) % | ||||||||||

Fourth Quarter and Full Year 2022 Highlights:

- SS&C generated net cash from operating activities of $369.7 million for the three months ended December 31, 2022, and $1,134.3 million for the twelve months ended December 31, 2022.

- Q4 2022 we bought back 1.8 million shares for $90.7 million, at an average price of $50.14 per share.

- We paid down $166.2 million in debt in Q4 2022, bringing our net leverage ratio to 3.40 times consolidated EBITDA attributable to SS&C.

- SS&C reported GAAP net income attributable to SS&C of $207.5 million and adjusted consolidated EBITDA attributable to SS&C of $518.6 million for Q4 2022.

- GAAP net income margin for Q4 2022 was 15.5%. Adjusted consolidated EBITDA margin for Q4 2022 was 38.7%, a 70 basis point increase from Q3 2022.

- Completed the acquisition of Complete Financial Ops, Inc., expanding our fund administration capabilities in servicing venture capital and family office funds.

"SS&C finished out 2022 in line with our expectations," says Bill Stone, Chairman and Chief Executive Officer. "We announced several large renewals and new client wins, including two major lift outs, which we think will be a revenue driver over the next several years. We continue to deploy Blue Prism digital workers across our organization. 180 digital workers have been implemented as of year end 2022, with initial successes in our GIDS and fund services businesses. We look forward to the productivity and efficiency increases as we accelerate Blue Prism's deployment across our organization."

Operating Cash Flow

SS&C generated net cash from operating activities of $1,134.3 million for the twelve months ended December 31, 2022, compared to $1,429.0 million for the same period in 2021, a 20.6% decrease. SS&C ended the fourth quarter with $440.1 million in cash and cash equivalents and $7,132.3 million in gross debt. SS&C's net debt balance as defined in our credit agreement, which excludes cash and cash equivalents of $134.1 million held at DomaniRx, LLC was $6,826.3 million as of December 31, 2022. SS&C's consolidated net leverage ratio as defined in our credit agreement stood at 3.40 times consolidated EBITDA attributable to SS&C as of December 31, 2022. SS&C's net secured leverage ratio stood at 2.40 times consolidated EBITDA attributable to SS&C as of December 31, 2022.

Guidance

| | | Q1 2023 | | FY 2023 |

| Adjusted Revenue ($M) | | $1,332.0 – $1,372.0 | | $5,455.0 – $5,655.0 |

| Adjusted Net Income attributable to SS&C ($M) | | $282.0 – $299.0 | | $1,190.0 – $1,285.0 |

| Adjusted Diluted Earnings per Share attributable to SS&C | | $1.10 – $1.16 | | $4.67 – $4.97 |

| Cash from Operating Activities ($M) | | – | | $1,275.0 – $1,375.0 |

| Capital Expenditures (% of revenue) | | – | | 3.8% – 4.0% |

| Diluted Shares (M) | | 256.0 – 257.0 | | 255.0 – 258.5 |

| Effective Income Tax Rate (%) Werbung Mehr Nachrichten zur SS+C Technologies Holdings Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |