BERKSHIRE HILLS REPORTS IMPROVED FIRST QUARTER RESULTS

PR Newswire

BOSTON, April 20, 2022

BOSTON, April 20, 2022 /PRNewswire/ -- Berkshire Hills Bancorp, Inc. (NYSE: BHLB) today reported that first quarter earnings per share (EPS) increased year-over-year by 62% to $0.42 in 2022 from $0.26 in 2021. The non-GAAP measure of adjusted EPS increased by 37% to $0.43 from $0.32. Earnings benefited from loan growth in 2022 together with a release of the allowance for credit losses, reflecting improved loan performance expectations. Compared to the fourth quarter of 2021, first quarter EPS was unchanged at $0.42 and adjusted EPS increased by 4% to $0.43 from $0.42.

- 62% year-over-year increase in EPS

- 6% increase in total loans quarter-over-quarter

- 2.61% net interest margin, stable over the last five quarters

- $4 million benefit to the credit loss provision due to a release of the credit loss allowance

- 0.26% non-performing assets/assets – fifth sequential quarterly improvement

- 6% reduction in period-end shares outstanding year-over-year reflecting stock buybacks

CEO Nitin Mhatre stated, "Our strong growth in loan balances was driven by a significant increase in new loan originations that benefited from higher productivity of our existing bankers, recruitment of experienced frontline bankers and new partnership channels in the second half of 2021. Our credit metrics remained strong and our earnings benefited from a release of the credit loss allowance, which continues to provide comparatively strong coverage of the loan portfolio."

"We remain well positioned to benefit from the expected rising rate environment. During the first quarter, Berkshire announced the approval of a new program to repurchase approximately $140 million in common shares and correspondingly total outstanding shares decreased by 2% during the quarter."

Mr. Mhatre concluded, "Berkshire Bank recently announced an expanded partnership with fintech Narmi to create a best-in-class digital banking experience for consumers and small businesses. We continue to promote employees from within the organization and bring on board knowledgeable bankers to deepen long-term relationships with our customers. I'm also pleased that our collective efforts to support our customers and communities continue to gain recognition as we were recently named by Newsweek as one of America's Most Trustworthy Companies and placed among the top 10 banks nationally. Our team has gotten off to a strong start in 2022 as we execute on our BEST plan in pursuit of our vision to be a high-performing, leading socially responsible community bank in New England and beyond."

RESULTS OF OPERATIONS

Earnings: First quarter GAAP earnings per share totaled $0.42, unchanged from the prior quarter and increased year-over-year by 62% from $0.26. The non-GAAP measure of adjusted EPS totaled $0.43, increasing quarter-over-quarter by 4% from $0.42 and year-over-year by 37% from $0.32 per share. First quarter adjustments to earnings consisted primarily of branch restructuring expenses in 2021 and unrealized equity securities losses in 2022. Year-over-year earnings improvement also resulted from a benefit in 2022 to the provision for credit losses on loans and as well as from share repurchases. The first quarter 2022 return on tangible common equity measured 7.3% and the non-GAAP measure of adjusted return on tangible common equity measured 7.5%.

Revenue: Net interest income was essentially unchanged quarter-over quarter. Loan growth was weighted towards the end of the quarter, with full benefit expected beginning in the second quarter. Net interest income decreased by 8% year-over-year due primarily to lower loan balances during the year 2021. The Company's net interest income is modeled to be positively sensitive to the market forecast scenario of rising interest rates.

Non-interest income excluding securities losses increased 5% quarter-over-quarter including seasonal components. It decreased 18% year-over-year primarily due to the sale of insurance and branch operations in the third quarter of 2021, and PPP loan referral fees recorded in the first quarter of 2021.

Provision for Credit Losses on Loans: Berkshire recorded a $4 million benefit to the first quarter 2022 provision, compared to a $3 million benefit in the linked quarter and a $6.5 million charge in the first quarter of 2021. The $4 million benefit resulted from a $7 million release of the credit loss allowance net of $3 million in net loan charge-offs. The Company also utilizes the non-GAAP financial measure of Pre-tax Pre-Provision Net Revenue ("PPNR") to evaluate the results of operations before the impact of the provision and tax expense. PPNR measured $21 million in the most recent quarter, and $22 million on a non-GAAP adjusted basis.

Expense: First quarter 2022 non-interest expense was down 1% quarter-over quarter and down 12% year-over-year including the impact of operations sold in 2021. Full time equivalent staff totaled 1,333 positions at period-end, compared to 1,319 positions at the start of the year. The effective tax rate was 20% in the most recent quarter, which was unchanged from the tax rate for the year 2021.

BALANCE SHEET (references are to period-end balances unless otherwise stated)

Summary: Total assets increased quarter-over-quarter by $0.5 billion, or 5%, to $12.1 billion reflecting loan growth. Total shareholders' equity decreased quarter-over-quarter by $89 million, or 7%, due primarily to a $75 million reduction in accumulated other comprehensive income reflecting lower bond valuations as a result of the increase in interest rates during the quarter. We anticipate that the Company's strong capital and liquidity will position it for future targeted loan growth and capital distributions which are integral elements of its BEST strategic plan.

Loans: Total loans increased quarter-over-quarter by $441 million, or 6% to $7.27 billion at March 31, 2022. The largest increases were in commercial real estate, asset based lending, and residential mortgages. The Company has expanded its commercial and business banking teams and is developing new sourcing channels for residential mortgages and consumer loans in its markets to support planned loan growth in 2022. Loans were down 5% year-over-year due to the impact of refinancings and targeted runoff.

Asset Quality: Asset quality metrics remained favorable and improving in the most recent quarter. Non-accruing loans decreased by 16%, measuring 0.41% of period-end total loans. Annualized net loan charge-offs measured 0.15% of average loans, down from 0.29% for the year 2021. Accruing delinquent loans declined to a near five quarter low of 0.28% of total loans. The allowance for credit losses on loans decreased quarter-over-quarter by $7 million to $99 million, measuring 1.37% of total loans, which was a decrease from 1.55% at the start of the year.

Deposits and Borrowings: Period-end total deposits increased by 6% quarter-over-quarter and 4% year-over-year. These increases were concentrated in payroll deposits, which fluctuate daily. Shifts in balances between the NOW and money market categories also relate to payroll deposits. Total average deposits increased 1% both compared to the linked quarter and compared to the first quarter of 2021. The Company has been reducing higher cost time deposits, including brokered deposits, which declined by 7% quarter-over-quarter and 28% year-over-year based on average balances. Total average non-maturity deposits increased by 3% quarter-over-quarter and 10% year-over-year. The first quarter total cost of deposits decreased to 0.17%, compared to 0.19% in the linked quarter and 0.36% in the prior year.

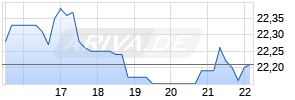

Equity: Shareholders' equity decreased by 7% quarter-over-quarter and year-over-year. This reflected the impact of share repurchases and a $75 million reduction in the most recent quarter reflecting the lower fair value of the bond portfolio as a result of higher interest rates. The ratio of equity/assets decreased quarter-over- quarter to 9.0% from 10.2%. At quarter-end, book value per share was $22.89 and the non-GAAP measure of tangible book value per share was $22.30. These values decreased quarter-over-quarter, but were not significantly changed year-over-year.

ESG & CORPORATE RESPONSIBILITY UPDATE

Berkshire Bank is committed to purpose-driven, community-centered banking that enhances value for all stakeholders as it pursues its vision of being a high-performing, leading socially responsible community bank in New England and beyond. Learn more about the steps Berkshire is taking at berkshirebank.com/csr and in its most recent Corporate Responsibility Report.

Key developments in the quarter include:

- Corporate Responsibility Report - Earlier this month, the Company released its 2021 Corporate Responsibility Report, Empowering Community Comebacks. The report highlights Berkshire's performance on environmental, social, and governance matters along with its progress on its BEST Community Comeback. Detailed on the pages of the report are examples of how the simple decision of where you bank can have an outsized impact in your community.

- Standing with Ukraine: Berkshire took several actions along with its employees and customers in response to the ongoing humanitarian crisis in Ukraine including making a $50,000 contribution, through its Foundation, to the Ukrainian Federation of America. In addition, Berkshire is refunding outgoing wire transfer fees to individuals who are sending money to family and non-profit organizations in Ukraine; matching employee contributions to non-profits working to aid in relief efforts; and activating a virtual supply drive to provide critical supplies to organizations working to assist in Ukraine and neighboring countries.

- Awards & Recognition: The Company was named to Newsweek's list of America's Most Trusted Companies 2022 and ranked #9 for banks. Earlier in the quarter Berkshire was also listed in Bloomberg's Gender Equality Index and named a Best Place to Work for LGBTQ+ Equality by the Human Rights Campaign. Finally, Berkshire received a 2022 Communitas Award for Leadership in Corporate Responsibility for its BEST Community Comeback program recognizing its early progress on the multi-year commitment.

- Current ESG Performance: The Company moved into the top 22% of leading ESG indexes in the U.S. for its Environmental, Social and Governance (ESG) ratings. As of March 31, 2022 the Company received ratings of: MSCI ESG- BBB; ISS ESG Quality Score - Environment: 3, Social: 1, Governance: 3; and Bloomberg ESG Disclosure- 47.81. The Company is also rated by Sustainalytics.

INVESTOR CONFERENCE CALL AND INVESTOR PRESENTATION

Berkshire will conduct a conference call/webcast at 10:00 a.m. eastern time on Wednesday, April 20, 2022 to discuss results for the quarter and provide guidance about expected future results. The Company will also place an investor presentation at its website at ir.berkshirebank.com with additional financial information and other information about the quarter.

Participants are encouraged to pre-register for the conference call using the following link:

https://www.incommglobalevents.com/registration/q4inc/10475/berkshire-hills-bancorp-q1-earnings-release-conference-call/.

Callers who pre-register will be given dial-in instructions and a unique PIN to gain immediate access to the call. Participants may pre-register at any time prior to the call and will immediately receive simple instructions via email. Additionally, participants may reach the registration link and access the webcast by logging in through the investor relations section of Berkshire's website at ir.berkshirebank.com. Those parties who do not have Internet access or are otherwise unable to pre-register for this event, may still participate at the above time by dialing 844-200-6205 and using participant access code: 647451. Participants are requested to dial-in a few minutes before the scheduled start of the call. A telephone replay of the call will be available for one week by dialing 866-813-9403 and using access code: 478827. The webcast will be available on Berkshire's website for an extended period of time.

ABOUT BERKSHIRE HILLS BANCORP

Berkshire Hills Bancorp is the parent of Berkshire Bank, which is transforming what it means to bank its neighbors socially, humanly, and digitally to empower the financial potential of people, families, and businesses in its communities as it pursues its vision of being a leading socially responsible omni-channel community bank in New England and beyond. Berkshire Bank provides business and consumer banking, mortgage, wealth management, and investment services. Headquartered in Boston, Berkshire has approximately $12.1 billion in assets and operates 105 branch offices in New England and New York, and is a member of the Bloomberg Gender-Equality Index. To learn more, call 800-773-5601 or follow us on Facebook, Twitter, Instagram, and LinkedIn.

FORWARD-LOOKING STATEMENTS

This document contains "forward-looking statements" within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. You can identify these statements from the use of the words "may," "will," "should," "could," "would," "plan," "potential," "estimate," "project," "believe," "intend," "anticipate," "expect," "target" and similar expressions. There are many factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire's most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC's website at www.sec.gov. You should not place undue reliance on forward-looking statements, which reflect our expectations only as of the date of this document. Berkshire does not undertake any obligation to update forward-looking statements.

NON-GAAP FINANCIAL MEASURES

This document contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles ("GAAP"). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition. They are not a substitute for GAAP measures; they should be read and used in conjunction with the Company's GAAP financial information. A reconciliation of non-GAAP financial measures to GAAP measures is included on page F-9 in the accompanying financial tables. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders.

The Company utilizes the non-GAAP measure of adjusted earnings in evaluating operating trends, including components for adjusted revenue and expense. These measures exclude items which the Company does not view as related to its normalized operations. These items primarily include securities gains/losses, other gains/losses, merger costs, restructuring costs, goodwill impairment, and discontinued operations. In 2021, the Company recorded a third quarter net gain of $52 million on the sale of the Company's insurance subsidiary and the Mid-Atlantic branch operations. Expense adjustments in the first quarter 2021 were primarily related to branch consolidations. Third quarter 2021 adjustments included Federal Home Loan Bank borrowings prepayment costs. They also included other restructuring charges for efficiency initiatives in operations areas including write-downs on real estate moved to held for sale and severance related to staff reductions. The fourth quarter 2021 revenue adjustment was primarily related to trailing revenue on a previously reported sale, and the expense adjustment was due primarily to branch restructuring costs. The revenue adjustment in the first quarter of 2022 was due to an unrealized loss in equity mutual funds.

The Company utilizes Adjusted Pre-Provision Net Revenue ("Adjusted PPNR") which measures adjusted income before credit loss provision and tax expense. PPNR is used by the investment community due to the volatility and variability across banks related to credit loss provision expense under the Current Expected Credit Loss accounting standard. The Company also calculates Adjusted PPNR/assets in order to utilize the PPNR measure in assessing its comparative operating profitability.

Non-GAAP adjustments are presented net of an adjustment for income tax expense. This adjustment is determined as the difference between the GAAP tax rate and the effective tax rate applicable to adjusted income. The efficiency ratio is adjusted for adjusted revenue and expense items and for tax preference items. The Company also calculates measures related to tangible equity, which adjust equity (and assets where applicable) to exclude intangible assets due to the importance of these measures to the investment community.

CONTACTS

Investor Relations Contacts

Kevin Conn, SVP, Investor Relations & Corporate Development

Email: KAConn@berkshirebank.com

Tel: (617) 641-9206

David Gonci, Capital Markets Director

Email: dgonci@berkshirebank.com

Tel: (413) 281-1973

Media Contact:

Gary Levante, SVP, Corporate Responsibility & Communications

Email: glevante@berkshirebank.com

Tel: (413) 447-1737

| TABLE | CONSOLIDATED UNAUDITED FINANCIAL SCHEDULES |

| F-1 | Selected Financial Highlights |

| F-2 | Balance Sheets |

| F-3 | Loan and Deposit Analysis |

| F-4 | Statements of Income |

| F-5 | Statements of Income (Five Quarter Trend) |

| F-6 | Average Balances and Average Yields and Costs |

| F-7 | Asset Quality Analysis |

| F-8 | Asset Quality Analysis (continued) |

| F-9 | Reconciliation of Non-GAAP Financial Measures |

| BERKSHIRE HILLS BANCORP, INC. | |||||||||||||

| SELECTED FINANCIAL HIGHLIGHTS - UNAUDITED - (F-1) | |||||||||||||

| | | | | | |||||||||

| | | | | March 31, | | June 30, | | Sept. 30, | | Dec. 31, | | March 31, | |

| | | | | 2021 | | 2021 | | 2021 | | 2021 | | 2022 | |

| | | | | | | | | | | | | | |

| | NOMINAL AND PER SHARE DATA | | | | | | | | | | | ||

| | | Net earnings per common share, diluted | $ 0.26 | | $ 0.43 | | $ 1.31 | | $ 0.42 | | $ 0.42 | | |

| | | Adjusted earnings per common share, diluted (2) | 0.32 | | 0.44 | | 0.53 | | 0.42 | | 0.43 | | |

| | | Net income, (thousands) | 13,031 | | 21,636 | | 63,749 | | 20,248 | | 20,196 | | |

| | | Adjusted net income,(thousands)(2) | 16,015 | | 22,104 | | 25,695 | | 20,172 Werbung Mehr Nachrichten zur Berkshire Hills Bancorp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||