Top-News

Donnerstag,

26.02.2015 07:00

von

GlobeNewswire

| Aufrufe: 343

SOLVAY GROUP 4TH QUARTER & FULL YEAR 2014 FINANCIAL REPORT

Schriftzug "News" (Symbolbild).

pixabay.com

Press release | CEO comments on results | Toolkit Investors & Analysts |

| Q4 highlights - Strong Results

· Group net sales at € 10,213 m, up 5% yoy, with volumes 3.6%, forex (1.4)%, scope 2.4% and stable prices 0.5% · REBITDA at € 1,783 m, up 11% yoy driven by volume growth (organic and external), pricing power and excellence initiatives; margins widened to 17.5% of net sales, up 90 basis points compared to last year · Adjusted EBIT at € 761 m, up 3.7% yoy; Adjusted Result from continuing operations at € 333 m, up 6.7% yoy · IFRS Net income Solvay share at € 80 m versus € 270 m in 2013. · Adjusted Net Income Solvay Share at € 156 m versus € 378 m in 2013. 2014 contained material exceptional elements largely linked to the Group's active portfolio management (c.f. Details in page 14). · Free Cash Flow generation at € 656 m +35% yoy; net debt decreased € 363 m from 2013 year-end · DIVIDEND increase proposed: € 3.40 gross per share, up 6.3% compared to last year Quote of the CEO Solvay posted solid results throughout the year, benefiting from its ongoing transformation, its upgraded portfolio and operational delivery. We progressed in reshaping our business profile towards a high-end solutions provider. Robust demand for our innovative products and solutions boosted our growth engines. Excellence measures delivered on all fronts, compensating for a higher cost base and securing our pricing power. Overall, Solvay posted double-digit operating profit growth in 2014, expanded margins in all of its businesses and generated a strong free cash flow. Outlook Solvay is confident to sustain recent momentum. The levers of the transformation continue to be deployed and Solvay is currently well-positioned to meet its 2016 ambitions. FORENOTE The U.S.-based Eco Services business has been disposed as of December 1st, 2014 and has been reported under Assets Held for Sale and Discontinued Operations as from the third quarter of 2014. For comparative purposes, 2013 and 2014 Income and Cash Flow Statements data have been restated for Eco Services' business discontinuation as well as for the updated reallocation of shared functions costs from the Corporate & Business Services segment into the Global Business Units. 2013 and 2014 Financial Statements reflect the Group's application of IFRS 11. Furthermore, Solvay presents Adjusted Income Statement performance indicators that exclude non-cash Purchase Price Allocation (PPA) accounting impacts related to the Rhodia acquisition. | ||

| ||

This announcement is distributed by NASDAQ OMX Corporate Solutions on behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Solvay S.A. via Globenewswire

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Solvay S.A. via Globenewswire

HUG#1897241

ARIVA.DE Börsen-Geflüster

Werbung

Weiter aufwärts?

| Kurzfristig positionieren in Solvay | ||

|

ME5APH

| Ask: 1,21 | Hebel: 4,23 |

| mit moderatem Hebel |

Zum Produkt

| |

Morgan Stanley

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: ME5APH,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

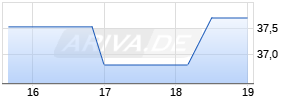

Kurse

|

Werbung

Mehr Nachrichten zur Solvay Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

-1

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.