Digital Realty Reports First Quarter 2017 Results

PR Newswire

SAN FRANCISCO, April 27, 2017

SAN FRANCISCO, April 27, 2017 /PRNewswire/ -- Digital Realty (NYSE: DLR), a leading global provider of data center, colocation and interconnection solutions, announced today financial results for the first quarter of 2017. All per-share results are presented on a fully-diluted share and unit basis.

Highlights

- Reported net income available to common stockholders of $0.41 per share in 1Q17, compared to $0.27 per share in 1Q16

- Reported FFO per share of $1.50 in 1Q17, compared to $1.39 in 1Q16

- Reported core FFO per share of $1.52 in 1Q17, compared to $1.42 in 1Q16

- Signed total bookings during 1Q17 expected to generate $50 million of annualized GAAP rental revenue, including a $9 million contribution from interconnection

- Raised 2017 core FFO per share outlook from $5.90 - $6.10 to $5.95 - $6.10 and "constant-currency" core FFO per share outlook from $5.95 - $6.25 to $6.00 - $6.25

Financial Results

Digital Realty reported first-quarter 2017 revenues of $551 million, a 5% decrease from the previous quarter, which included a $29 million non-cash gain on a lease termination. Compared to the same quarter last year, revenues increased 9%.

The company delivered first-quarter 2017 net income of $85 million, and net income available to common stockholders of $66 million, or $0.41 per diluted share, compared to $0.49 per diluted share in the previous quarter, and $0.27 per diluted share in the same quarter last year.

Digital Realty generated first-quarter 2017 adjusted EBITDA of $323 million, a 4% increase from the previous quarter and a 10% increase over the same quarter last year.

The company reported first-quarter 2017 funds from operations ("FFO") on a fully diluted basis of $244 million, or $1.50 per share, compared to $1.58 per share in the previous quarter and $1.39 per share in same quarter last year.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Digital Realty Trust | ||

|

ME3AFH

| Ask: 1,83 | Hebel: 4,10 |

| mit moderatem Hebel |

Zum Produkt

| |

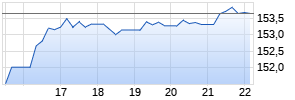

Kurse

|

Excluding certain items that do not represent core expenses or revenue streams, Digital Realty delivered first-quarter 2017 core FFO of $1.52 per share, a 6% increase from $1.43 per share in the previous quarter, and a 7% increase from $1.42 per share in the same quarter last year.

Leasing Activity

"We achieved healthy volume in each of our global regions and across product types during the first quarter," said Chief Executive Officer A. William Stein. "We signed total bookings representing $50 million of annualized GAAP rental revenue, including a $9 million contribution from interconnection. We are encouraged by the favorable intermediate-term outlook, given healthy market fundamentals, a supportive macro environment and secular demand tailwinds."

The weighted-average lag between leases signed during the first quarter of 2017 and the contractual commencement date was three months.

In addition to new leases signed, Digital Realty also signed renewal leases representing $46 million of annualized GAAP rental revenue during the quarter. Rental rates on renewal leases signed during the first quarter of 2017 rolled up 3.1% on a cash basis and up 4.5% on a GAAP basis.

New leases signed during the first quarter of 2017 by region and product type are summarized as follows:

| | | Annualized GAAP | | | | | | | | | | |||||

| | | Base Rent | | | | GAAP Base Rent | | | | | GAAP Base Rent | |||||

| North America | | (in thousands) | | Square Feet | | per Square Foot | | Megawatts | | per Kilowatt | ||||||

| Turn-Key Flex | | $16,015 | | | 102,360 | | | $156 | | | 9 | | | | $147 | |

| Colocation | | 9,494 | | | 34,204 | | | 278 | | | 3 | | | | 302 | |

| Non-Technical | | 301 | | | 7,792 | | | 39 | | | — | | | | — | |

| Total | | $25,810 | | | 144,356 | | | $179 | | | 12 | | | | $181 | |

| | | | | | | | | | | | | |||||

| Europe (1) | | | | | | | | | | | | |||||

| Turn-Key Flex | | $6,990 | | | 48,350 | | | $145 | | | 5 | | | | $110 | |

| Colocation | | 1,353 | | | 4,352 | | | 311 | | | 0 | | | | 232 | |

| Non-Technical | | 38 | | | 593 | | | 64 | | | — | | | | — | |

| Total | | $8,381 | | | 53,295 | | | $157 | | | 6 | | | | $120 | |

| | | | | | | | | | | | | |||||

| Asia Pacific (1) | | | | | | | | | | | | |||||

| Turn-Key Flex | | $7,467 | | | 34,352 | | | $217 | | | 4 | | | | $173 | |

| Non-Technical | | 91 | | | 1,076 | | | 84 | | | — | | | | — | |

| Total | | $7,558 | | | 35,428 | | | $213 | | | 4 | | | | $173 | |

| | | | | | | | | | | | | |||||

| Interconnection | | $8,629 | | | N/A | | | N/A | | | N/A | | | | N/A | |

| | | | | | | | | | | | | |||||

| Grand Total Werbung Mehr Nachrichten zur Digital Realty Trust Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | ||||||||||||||||