30.1.08

Time: 09:51pm

Rev Shark Blog

The Good News is SoldWe have been pointing out over the past few days that

the recent run-up in the major indices on decreasing volume had set up the ideal conditions for a sell-the-news reaction to Wednesday’s Fed interest rate decision. Market participants have been fully expecting a 50 basis point cut, and even though the initial response once those expectations were met was positive, a severe reversal a little less than an hour before the close sent the market careening lower into the close.

Although the action was relatively tame as we headed towards the open, sentiment was somewhat negative following another huge subprime-related write down, this time from Swiss banking giant UBS, and a poor earnings report from Yahoo. The futures did move a bit higher on the heels of a much better than expected ADP employment numbers, but that boost was to be short lived following

a very disappointing reading on fourth quarter GDP. While estimates were for a real growth rate of 1.2%, well off the 3.7% reading in the third quarter, the actual number was an attention-grabbing 0.6%. Be that as it may, all eyes remained squarely on the Fed, and after a slightly soft open, the major indices spent the time between the opening bell and 2:15pm EST trading in a very narrow range just underneath the flat-line. However, as we said yesterday, since few expect the market to fall apart before Fed events, there are usually a few pockets of action, and today it was in biotechs and semiconductors.

Meanwhile, there seemed to be more than the usual level of uncertainty regarding this Fed meeting; not about the size of the cut, but more about how the market would react. We’ve mentioned that the perception seems to be that the Fed has lost credibility over the past several months after failing to respond to conditions that were obviously deteriorating and then delivering what came across as a panicked intermeeting cut on the heels of the “rogue trader” scandal [SG, A.L.] last week.

Thus, since the Fed is seen as being behind the curve, many were fully expecting a negative reaction to their decision, regardless of the size. Still, others brought attention that the old adage “don’t fight the Fed,” because even though the market might not have a lot of confidence that Chairman Bernanke and his crew know what they’re doing, the money that they pump into the system has to go somewhere.

The net result was that the market was more or less at a standstill, but once the news was out, the fireworks began. While neither the size of the cut nor the language contained within the accompanying policy statement was all that surprising, the averages spiked higher immediately following the release. Although it’s impossible to tell if that initial pop was driven by real buying or by shorts, who were hoping for a smaller cut, covering their bets, the move began to gain steam, and before long, the averages were sporting gains of just around 1%.

However, that rally ended just as quickly as it began in one of the nastier reversals we’ve seen in quite some time. Certainly, news that Fitch has downgraded the credit rating of bond insurer FGIC around 3:15pm EST likely helped exacerbate the selling, but today’s reversal looked more like a classic “sell-the-news” reaction than anything else.

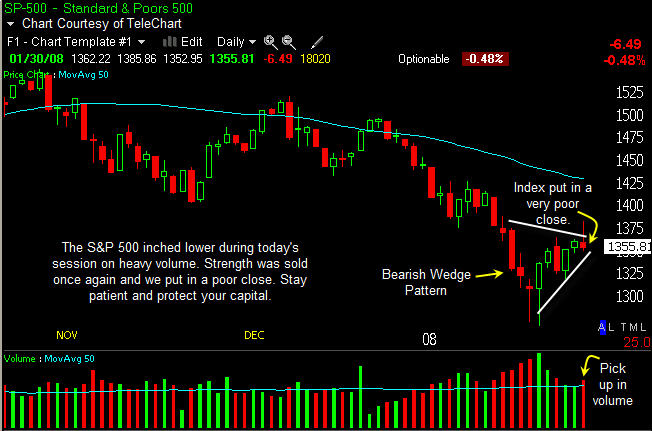

Regardless of the reason behind the late-day reversal, one thing for certain is that it has created a very ominous technical pattern in the major indices, which we point out in the charts below. We’ve been cautioning against putting too much faith in the counter-trend bounce that began last week, and while that rebound may yet have legs, the lack of a test of recent lows does not justify the risk of building longer-term positions before there is confirmation in the charts.

Let’s go to the charts.

The Nasdaq moved lower during today’s trade on increasing volume. The index opened lower, but had a bid out of the gate. We saw lackluster action through the morning session. The average heated up as the Fed cut interest rates by 50bp during the afternoon trade, but the index closed horribly. Strength was sold once again and the action was very poor. The Nasdaq is below its 50dma and is in a downtrend.

The S&P 500 edged lower during Wednesday’s trade on heavy volume. The index opened weak and drifted into afternoon session, but it exploded higher on the Fed cut. The bulls were unable to keep the positive action up in the final hour, and we put in a miserable close. It was a wild day of action and it was very difficult to trade. The charts remain in poor shape and capital protection continues to be our focus.

The Russell 2000 sank lower during today’s trade and put in a horrid close. Small-Caps continue to act poor and saw more rough action today. Many names saw ugly reversals in afternoon trade, and the group remains difficult to trade.

Quelle: www.sharkinvesting.com

SP-500-Chart: Der "bearish wedge" hat bislang seine Versprechungen gehalten. Mehr als ein "false break" nach oben war nach der Fed-Zinssenkung nicht drin. (Verkleinert auf 85%)