US Economy Faces Big Test Next Month: Meredith Whitney

MEREDITH WHITNEY, ECONOMY, HOUSING, RECESSION, WAL-MART, EMPLOYMENT, REAL ESTATE

CNBC.com

| 15 Sep 2009 | 10:21 AM ET

The economy remains weak and will face a big test next month when the government starts winding down its massive support programs, banking analyst Meredith Whitney told CNBC.

Despite avoiding a worst-case scenario, the economy continues to languish under weak job growth and home sales, Whitney said in a live interview.

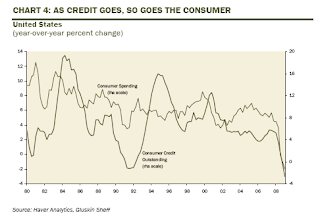

"There's not a lot of new job creation going on on Main Street—and the liquidity to the consumer and small business is still contracting," she said. "And it's very difficult to get the engine moving without a lot of government support within that. So when you slowly wean government supports, that's going to be the test that I think everyone's going to be watching starting in October."

The Federal Reserve will wind down its aggressive buying of Treasurys next month. At the same time, President Obama and Treasury Secretary Timothy Geithner have said recently that the government is looking more broadly at getting out of the bailout programs used to prop up the financial system after its 2008 collapse.

Though economists generally believe the US is pulling out of a recession, unemployment remains high and most economic indicators are still showing only modest improvement.

As the economy retools, there are few areas that show any promise of generating big new jobs numbers, Whitney said. A potential complication is a leaning from the White House towards trade protectionism, most recently expressed in a trade dispute with China over tire imports.

"Where do the jobs come from?" she said. "Surely if this country becomes massively protectionist we'll build up manufacturing capability. Is that necessarily a good thing? No. There's not a lot of free capital for small business innovation—small business, period—and that's half the workforce."

In real estate, she said sales numbers have been boosted by foreclosures and other distressed sales, but high-end home sales continue to languish.

"The high-dollar units have not sold. So people are still shopping at Wal-Mart . People will go after value," Whitney said. "Home ownership is still less attractive to the average consumer."

Werbung

Werbung