Walter Investment Management Corp. Announces Second Quarter 2016 Highlights And Financial Results

PR Newswire

TAMPA, Fla., Aug. 9, 2016

TAMPA, Fla., Aug. 9, 2016 /PRNewswire/ -- Walter Investment Management Corp. (NYSE: WAC) ("Walter Investment" or the "Company") today announced operational highlights and financial results for the quarter ended June 30, 2016.

Second Quarter 2016 Operational Highlights and Recent Developments

- Capital efficiency

- Entered into a series of agreements with a subsidiary of New Residential Investment Corp (NYSE: NRZ) for the sale of mortgage servicing rights for approximately $231 million, which Ditech will sub-service, and a forward flow arrangement for originated MSR

- Increased cash and cash equivalents by $118.5 MN during the quarter

- Completed MSR sales of $8.5 billion UPB, retaining servicing on $4.1 billion UPB with shared recapture economics

- Improved liquidity by approximately $60 million as a result of advance initiatives

- Process efficiency

- Actions already completed this year expected to result in approximately $75 million of annual savings

- Actions taken during the current quarter include workforce reduction, exit of 5 regional servicing locations, consolidation of IT staff into centers of excellence, and redesign of certain servicing operational groups

- Engaged workforce and new leadership

- New executive chairman and interim CEO effective June 30, 2016

- Industry veteran hired as permanent CEO expected to begin Q4 2016

Second Quarter 2016 Financial Results

GAAP net loss for the quarter ended June 30, 2016 was $232.4 million, or ($6.49) per share, as compared to a GAAP net loss of $38.1 million, or ($1.01) per share for the quarter ended June 30, 2015. The 2016 net loss includes goodwill impairment charges of $133.6 million after tax, or ($3.73) per share(1), and non-cash charges of $82.7 million after tax, or ($2.31) per share(1), resulting from fair value changes due to changes in valuation inputs and other assumptions. Adjusted EBITDA ("AEBITDA") for the current quarter was $98.8 million and Adjusted Earnings was $2.4 million after tax, or $0.07 per share(1).

The goodwill impairment charges incurred in the current quarter relate to the Servicing and ARM reporting units within the Servicing segment and were primarily the result of elevated discount rates applied to lower re-forecasted cash flows.

"While second quarter performance showed improvement in some areas as compared to the prior quarter, our results continue to fall short of expectations, driven by both external factors such as the declining interest rate environment as well as internal operational inefficiencies," said George M. Awad, Walter Investment's Executive Chairman of the Board and Interim Chief Executive Officer. "We remain resolute on achieving sustainable growth, delivering consistent profitability and maximizing our capital allocation. Our strategy to achieve these goals is founded on three pillars: capital efficiency, process efficiency and an engaged workforce and new leadership.

For capital efficiency, we have entered into a strategic capital arrangement that bolsters our transition to a more fee-for-service business model, including sales of mortgage servicing rights, origination flow purchases and expansion of sub-servicing opportunities. We are also pursuing additional opportunities to establish flow arrangements with other entities. Furthermore, we are evaluating strategic options for the Reverse Mortgage business and continuing to focus on de-leveraging opportunities, including debt reduction as well as aggressive efforts to reduce advances.

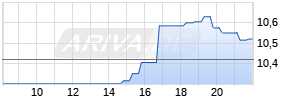

ARIVA.DE Börsen-Geflüster

Kurse

|

|

Process efficiencies have been a key focus of the Company, as we announced a company-wide process re-engineering initiative earlier this year that includes a comprehensive review of our cost structure and operations. We have already taken actions this year in conjunction with our transformation efforts that will result in approximately $75 million of annual savings, including further site consolidation, operational realignment, a more focused collections strategy and the redesign of certain operational procedures. Additionally, we are targeting at least $75 million of incremental annual savings through identified actions to be completed by the end of 2017. Technology enhancement and automation are key drivers of achieving our process efficiencies.

Lastly, our success isn't possible without an engaged and unified workforce. Building off of our brand consolidation from 2015, we are extending our solidarity as a unified company by forming a single culture across the organization based on newly launched values. Additionally, I am delighted to announce that Anthony Renzi will be joining Walter as Chief Executive Officer, and is expected to be on board in the fourth quarter. Mr. Renzi brings with him over 30 years of experience in the mortgage industry and will be an integral part of leading Walter through its transformation.

I am excited to be leading the Company through this transformative period as we continue to strive to become our customers' lifelong partner in homeownership. By executing on our strategy, we are positioning ourselves to deliver future earnings growth and drive value for our stakeholders," concluded Awad.

Second Quarter 2016 Financial and Operating Overview

Total revenue for the second quarter of 2016 was $187.5 million, a decrease of $225.0 million as compared to the prior year quarter, primarily due to $192.0 million lower net servicing revenue and fees, including $188.6 million higher fair value losses on mortgage servicing rights driven by a higher assumed conditional prepayment rate resulting from declining interest rates and forward projections of interest rate curves. Additionally, the current quarter reflects $19.2 million lower net gains on sales of loans primarily due to a lower volume of locked loans in the current quarter as compared to the prior year quarter, $8.1 million lower other revenues driven by lower fair value gains relating to charged-off loans, and $6.3 million lower interest income on loans primarily due to the sale of the residual interests in seven of the Residual Trusts in the prior year quarter.

Total expenses for the second quarter of 2016 were $565.7 million, 32% higher as compared to the prior year quarter, reflecting a $158.9 million higher goodwill impairment charge as compared to the charge taken in the prior year quarter. Operating expenses for the period declined $15.3 million as compared to the prior year period with $9.5 million lower salaries and benefits largely from fewer employees as compared to the prior year quarter and $6.3 million lower general and administrative expenses.

Segment Results

Results for the Company's segments are presented below.

Servicing

Ditech is nationally ranked as a top 10 servicer by UPB, servicing approximately 2.1 million accounts, with a UPB of approximately $248.6 billion as of June 30, 2016. During the three months ended June 30, 2016, the Company completed MSR sales of $8.5 billion UPB, retaining sub-servicing and shared recapture economics on approximately $4.1 billion. During the three months ended June 30, 2016, the Company experienced a net disappearance rate of 15.6%, essentially flat as compared to the prior year quarter.

The Servicing segment reported $356.0 million of pre-tax loss for the second quarter of 2016 as compared to pre-tax income of $82.3 million in the prior year quarter. During the current quarter, the segment generated revenue of $72.8 million, a $201.4 million decline as compared to the second quarter of 2015, reflecting $188.6 million higher fair value losses on our mortgage servicing rights and $6.3 million lower interest income on loans due to the April 2015 sale of the residual interests in seven of the Residual Trusts.

Expense for the Servicing segment was $428.4 million, an increase of $239.4 million as compared to the prior year quarter, primarily due to $215.4 million goodwill impairment charges in the current quarter driven by a elevated discount rates applied to lower re-forecasted cash flows. Operating expenses were $26.9 million higher as compared to the prior year quarter, resulting primarily from additional costs to support efficiency and technology-related initiatives including our servicing platform conversion, lower salaries and benefits expense and higher legal accruals for loss contingencies and other legal expenses. Current quarter expenses also included $10.7 million of depreciation and amortization costs.

The segment generated AEBITDA of $64.7 million and Adjusted Loss of $0.8 million, a decline of $32.8 million and $37.2 million, respectively, as compared to the prior year quarter, primarily due to lower revenues driven by a declines incentive and performance fees and interest income.

Originations

Ditech is nationally ranked as a top 20 originator by UPB, generating total pull-through adjusted locked volume for the second quarter of $5.3 billion. Because we increased our return hurdles for acquired MSR and faced increased market competition in 2016, our pull-though adjusted locked volumes declined approximately $1.0 billion in the second quarter of 2016 as compared to the prior year quarter. Funded loans in the current quarter totaled $4.8 billion, a decrease of 34% from the prior year quarter, with approximately 33% of that volume in the consumer lending channel and approximately 67% generated by the correspondent channel. The combined direct margin for the current quarter was 87 bps, a decrease of 13 bps from the prior year quarter, consisting of a weighted average of 195 bps direct margin in the consumer lending channel and 42 bps direct margin in the correspondent channel. The Originations business delivered a recapture rate of 18% for the current quarter.

The Originations segment reported $45.6 million of pre-tax income for the three months ended June 30, 2016, an increase of $12.7 million over the prior year quarter. The segment generated revenue of $110.2 million in the second quarter of 2016, a decline of $18.5 million as compared to the prior year quarter primarily due to a $15.2 million decrease in net gains on sales of loans. The decrease in net gains on sales of loans was driven by a lower volume of locked loans during the current quarter as compared to the prior year quarter resulting from increased market competition, an increase in our return hurdles for servicing acquired through our correspondent channel and lower HARP volumes, as well as a slight market shift from refinancing to purchase money volume. Expenses for the Originations segment of $64.6 million, which include $7.7 million of interest expense and $2.2 million of depreciation and amortization, declined 33% compared to the prior year quarter, driven by $14.9 million lower salaries and benefits largely due to the closure of the Retail channel and volume declines and $14.6 million lower general and administrative expenses primarily driven by a reduction of $10.1 million related to a change in estimate of the liability associated with our originations representations and warranty reserve in the current quarter.

The segment generated Adjusted Earnings of $48.4 million and AEBITDA of $43.5 million for the second quarter of 2016, an increase of $13.2 million and $4.0 million, respectively as compared to the prior year quarter, driven primarily by lower expenses largely due to the closure of the Retail channel.

Reverse Mortgage

The Reverse Mortgage business grew its serviced portfolio 6% as compared to the prior year quarter to $20.5 billion of UPB at June 30, 2016. During the second quarter, the business securitized $188 million of HECM loans.

The Reverse Mortgage segment reported $26.9 million of pre-tax loss in the current quarter, an improvement of $64.0 million as compared to the prior year quarter. The segment generated revenue of $16.1 million for the quarter, a decrease of $4.0 million as compared to the prior year quarter driven by lower net servicing revenue and fees of $4.9 million reflecting a decrease in incentive and performance fees related to the management of real estate owned. Current quarter revenues included $7.7 million net fair value gains on reverse loans and related HMBS obligations, $7.0 million in net servicing revenue and fees and $1.5 million of other revenues. Total expenses for the second quarter of $43.1 million were 61% lower as compared to the prior year period, reflecting the absence of a goodwill impairment charge, lower levels of curtailment expense and a decrease in salaries and benefits.

The segment reported an Adjusted Loss of $9.1 million and AEBITDA of ($8.0) million for the second quarter of 2016 as compared to Adjusted Earnings of $2.5 million and AEBITDA of $3.7 million in the second quarter of 2015, reflecting lower securitization volumes and a reduction in net servicing revenue and fees, partially offset by a decrease in salaries and benefits.

Other Non-Reportable Segment

The Other Non-Reportable segment reported $42.2 million of pre-tax loss for the second quarter of 2016, slightly below pre-tax loss of $39.3 million in the prior year quarter. The segment reported nominal revenue in both the current and prior year quarters. Total expenses of $41.3 million in the current quarter decreased slightly as compared to the prior year quarter, and included $35.9 million of interest expense related to corporate debt.

The Other non-reportable segment had an Adjusted Loss of $34.6 million and AEBITDA of ($1.5) million for the second quarter of 2016 as compared to an Adjusted Loss of $34.8 million and AEBITDA of ($0.4) million in the second quarter of 2015.

About Anthony Renzi

Anthony Renzi most recently served as the Chief Operating Officer, Managing Director and Head of Operations for Citi's North America Retail Bank, Commercial Bank and CitiMortgage (2012 - 2016). In that capacity he provided executive operations leadership for customer contact centers, core banking and mortgage operations, branch operations support, investor reporting / servicing accounting, default operations and servicing technology. With over 30 years of experience in mortgage banking, he is an accomplished executive with demonstrated success creating and leading top national financial services organizations, including serving as the Executive Vice President of the Single Family Business, Operations and Technology at Freddie MAC (2010 - 2012) and the Chief Operating Officer of GMAC Residential Capital and President of GMAC Mortgage LLC (2001 - 2010). Mr. Renzi earned a Bachelor's Degree in Business Administration from Holy Family University in Philadelphia and an MBA from Philadelphia University.

About Walter Investment Management Corp.

Walter Investment Management Corp. is a diversified mortgage banking firm focused primarily on the servicing and origination of residential loans, including reverse loans. Based in Tampa, Fla., the Company has approximately 5,600 employees and services a diverse loan portfolio. For more information about Walter Investment Management Corp., please visit the Company's website at www.walterinvestment.com. The information on our website is not a part of this release.

Conference Call Webcast

Members of the Company's leadership team will discuss Walter Investment's second quarter results and other general business matters during a conference call and live webcast to be held on Tuesday, August 9, 2016, at 9 a.m. Eastern Time. To listen to the event live or in an archive, and to access presentation slides (which include supplemental information) which will be available for at least 30 days, visit the Company's website at www.walterinvestment.com.

This press release and the accompanying reconciliations include non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the reconciliations as well as "Non-GAAP Financial Measures" at the end of this press release.

Disclaimer and Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not historical fact are forward-looking statements. Certain of these forward-looking statements can be identified by the use of words such as "believes," "anticipates," "expects," "intends," "plans," "projects," "estimates," "assumes," "may," "should," "will," "targets," or other similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors, and our actual results, performance or achievements could differ materially from future results, performance or achievements expressed in these forward-looking statements. These forward-looking statements are based on our current beliefs, intentions and expectations. These statements are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements include, but are not limited to, those factors, risks and uncertainties described below and in more detail under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2016 and June 30, 2016 and in our other filings with the SEC.

In particular (but not by way of limitation), the following important factors, risks and uncertainties could affect our future results, performance and achievements and could cause actual results, performance and achievements to differ materially from those expressed in the forward-looking statements:

- our ability to operate our business in compliance with existing and future rules and regulations affecting our business, including those relating to the origination and servicing of residential loans, the management of third-party assets and the insurance industry (including lender-placed insurance), and changes to, and/or more stringent enforcement of, such rules and regulations;

- increased scrutiny and potential enforcement actions by federal and state authorities;

- the substantial resources (including senior management time and attention) we devote to, and the significant compliance costs we incur in connection with, regulatory compliance and regulatory examinations and inquiries, and any consumer redress, fines, penalties or similar payments we make in connection with resolving such matters;

- uncertainties relating to interest curtailment obligations and any related financial and litigation exposure (including exposure relating to false claims);

- potential costs and uncertainties, including the effect on future revenues, associated with and arising from litigation, regulatory investigations and other legal proceedings;

- our dependence on U.S. government-sponsored entities (especially Fannie Mae) and agencies and their residential loan programs and our ability to maintain relationships with, and remain qualified to participate in programs sponsored by, such entities, our ability to satisfy various existing or future GSE, agency and other capital, net worth, liquidity and other financial requirements applicable to our business, and our ability to remain qualified as a GSE approved seller, servicer or component servicer, including the ability to continue to comply with the GSEs' respective residential loan and selling and servicing guides;

- uncertainties relating to the status and future role of GSEs, and the effects of any changes to the origination and/or servicing requirements of the GSEs or various regulatory authorities or the servicing compensation structure for mortgage servicers pursuant to programs of GSEs or various regulatory authorities;

- our ability to maintain our loan servicing, loan origination, insurance agency or collection agency licenses, or any other licenses necessary to operate our businesses, or changes to, or our ability to comply with, our licensing requirements;

- our ability to comply with the terms of the stipulated order resolving allegations arising from an FTC and CFPB investigation of Ditech Financial;

- operational risks inherent in the mortgage servicing and mortgage originations businesses, including reputational risk;

- risks related to our substantial levels of indebtedness, including our ability to comply with covenants contained in our debt agreements, generate sufficient cash to service such indebtedness and refinance such indebtedness on favorable terms, as well as our ability to incur substantially more debt;

- our ability to renew advance financing facilities or warehouse facilities and maintain adequate borrowing capacity under such facilities;

- our ability to maintain or grow our servicing business and our residential loan originations business;

- our ability to achieve our strategic initiatives, particularly our ability to: execute and complete balance sheet management activities; complete the sale of our insurance business; make arrangements with potential counterparties; complete sales of assets to, and enter into other arrangements with, third parties; increase the mix of our fee-for-service business; reduce our debt; enhance efficiencies and streamline processes; and develop new business, including acquisitions of MSRs or entering into new subservicing arrangements;

- changes in prepayment rates and delinquency rates on the loans we service or sub-service;

- the ability of our clients and credit owners to transfer or otherwise terminate our servicing or sub-servicing rights;

- a downgrade of, or other adverse change relating to, our servicer ratings or credit ratings;

- our ability to collect reimbursements for servicing advances and earn and timely receive incentive payments and ancillary fees on our servicing portfolio;

- our ability to collect indemnification payments and enforce repurchase obligations relating to mortgage loans we purchase from our correspondent clients and our ability to collect in a timely manner indemnification payments relating to servicing rights we purchase from prior servicers;

- local, regional, national and global economic trends and developments in general, and local, regional and national real estate and residential mortgage market trends in particular, including the volume and pricing of home sales and uncertainty regarding the levels of mortgage originations and prepayments;

- uncertainty as to the volume of originations activity we will benefit from prior to, and following, the expiration of HARP, which is scheduled to occur on December 31, 2016, including uncertainty as to the number of "in-the-money" accounts we may be able to refinance;

- risks associated with the origination, securitization and servicing of reverse mortgages, including changes to reverse mortgage programs operated by FHA, HUD or Ginnie Mae, our ability to accurately estimate interest curtailment liabilities, continued demand for HECM loans and other reverse mortgages, our ability to fund HECM repurchase obligations, our ability to fund principal additions on our HECM loans, and our ability to securitize our HECM loans and tails;

- our ability to realize all anticipated benefits of past, pending or potential future acquisitions or joint venture investments;

- the effects of competition on our existing and potential future business, including the impact of competitors with greater financial resources and broader scopes of operation;

- changes in interest rates and the effectiveness of any hedge we may employ against such changes;

- risks and potential costs associated with technology and cybersecurity, including: the risks of technology failures and of cyber-attacks against us or our vendors; our ability to adequately respond to actual or alleged cyber-attacks; and our ability to implement adequate internal security measures and protect confidential borrower information;

- risks and potential costs associated with the implementation of new technology such as MSP, the use of new vendors or the transfer of our servers or other infrastructure to new data center facilities;

- our ability to comply with evolving and complex accounting rules, many of which involve significant judgment and assumptions;

- uncertainties regarding impairment charges relating to our goodwill or other intangible assets;

- our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures;

- our ability to manage conflicts of interest relating to our investment in WCO and maintain our relationship with WCO; and

- risks related to our relationship with Walter Energy and uncertainties arising from or relating to its bankruptcy filings, including potential liability for any taxes, interest and/or penalties owed by the Walter Energy consolidated group for the full or partial tax years during which certain of the Company's former subsidiaries were a part of such consolidated group and certain other tax risks allocated to us in connection with our spin-off from Walter Energy.

All of the above factors, risks and uncertainties are difficult to predict, contain uncertainties that may materially affect actual results and may be beyond our control. New factors, risks and uncertainties emerge from time to time, and it is not possible for our management to predict all such factors, risks and uncertainties.

Although we believe that the assumptions underlying the forward-looking statements (including those relating to our outlook) contained herein are reasonable, any of the assumptions could be inaccurate, and therefore any of these statements included herein may prove to be inaccurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. We make no commitment to revise or update any forward-looking statements in order to reflect events or circumstances after the date any such statement is made, except as otherwise required under the federal securities laws. If we were in any particular instance to update or correct a forward-looking statement, investors and others should not conclude that we would make additional updates or corrections thereafter except as otherwise required under the federal securities laws.

Amounts or metrics that relate to future earnings projections are forward-looking and subject to significant business, economic, regulatory and competitive uncertainties, many of which are beyond the control of us and our management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. Nothing in this press release should be regarded as a representation by any person that any target will be achieved and we undertake no duty to update any target. Please refer to the disclosures in this press release, in our Annual Report on Form 10-K for the year ended December 31, 2015, our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2016 and June 30, 2016 and our other filings with the SEC for important information regarding forward-looking statements and the use and limitations of non-GAAP financial measures.

In addition, this press release may contain statements of opinion or belief concerning market conditions and similar matters. In certain instances, those opinions and beliefs could be based upon general observations by members of our management, anecdotal evidence and/or our experience in the conduct of our business, without specific investigation or statistical analyses. Therefore, while such statements reflect our view of the industries and markets in which we are involved, they should not be viewed as reflecting verifiable views and such views may not be shared by all who are involved in those industries or markets.

|

Walter Investment Management Corp. and Subsidiaries Consolidated Statements of Comprehensive Income (Loss) (in thousands)

| ||||||||||||||||

| | | | | | ||||||||||||

| | | For the Three Months | | For the Six Months | ||||||||||||

| | | 2016 | | 2015 | | 2016 | | 2015 | ||||||||

| REVENUES | | | | | | | | | ||||||||

| Net servicing revenue and fees | | $ | 31,936 | | | $ | 223,915 | | | $ | (73,826) | | | $ | 314,802 | |

| Net gains on sales of loans | | 100,176 | | | 119,399 | | | 184,653 | | | 244,626 | | ||||

| Interest income on loans | | 11,849 | | | 18,186 | | | 24,020 | | | 50,127 | | ||||

| Net fair value gains on reverse loans and related HMBS obligations | | 7,650 | | | 6,815 | | | 42,858 | | | 37,589 | | ||||

| Insurance revenue | | 11,277 | | | 11,429 | | | 21,644 | | | 25,560 | | ||||

| Other revenues | | 24,585 | | | 32,689 | | | 54,895 | | | 50,586 | | ||||

| Total revenues | | 187,473 | | | 412,433 | | | 254,244 | | | 723,290 | | ||||

| | | | | | | | | | ||||||||

| EXPENSES | | | | | | | | | ||||||||

| Salaries and benefits | | 133,681 Werbung Mehr Nachrichten zur Walter Investment Management Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||||||||