Union Pacific Reports Fourth Quarter and Full Year 2020 Results

PR Newswire

OMAHA, Neb., Jan. 21, 2021

OMAHA, Neb., Jan. 21, 2021 /PRNewswire/ -- Union Pacific Corporation (NYSE: UNP) today reported 2020 fourth quarter net income of $1.4 billion, or $2.05 per diluted share. These results include a previously announced $278 million pre-tax, non-cash impairment charge. Excluding the effects of that charge, adjusted fourth quarter net income was $1.6 billion, or $2.36 per diluted share. This compares to $1.4 billion, or $2.02 per diluted share, in the fourth quarter 2019.

"These outstanding results demonstrate the true potential of our franchise as we leveraged all three profitability drivers simultaneously – volume growth, productivity, and pricing – to produce record fourth quarter results," said Lance Fritz, Union Pacific chairman, president, and chief executive officer. "The women and men of Union Pacific persevered throughout the pandemic to provide our customers with a safe, reliable, and consistent service product."

Fourth Quarter Summary

Operating revenue of $5.1 billion was down 1% in fourth quarter 2020 compared to fourth quarter 2019. Fourth quarter business volumes, as measured by total revenue carloads, increased 3% compared to 2019. Premium volumes increased compared to 2019, while bulk was flat and industrial declined. In addition:

- Quarterly freight revenue declined 1% compared to fourth quarter 2019, as volume growth and core pricing gains were more than offset by decreased fuel surcharge revenue and a less favorable business mix.

- Union Pacific's 61.0% reported operating ratio when adjusted for the impairment charge is an all-time quarterly record of 55.6%, 410 basis points lower than fourth quarter 2019. Lower fuel prices positively impacted the operating ratio by 90 basis points.

- Quarterly freight car velocity was 223 daily miles per car, a 1% improvement compared to fourth quarter 2019.

- Quarterly locomotive productivity was 142 gross ton-miles per horsepower day, a 13% improvement compared to fourth quarter 2019.

- Quarterly workforce productivity was 1,032 car miles per employee, an 18% improvement compared to fourth quarter 2019.

- Average maximum train length was 9,154 feet, a 12% increase compared to fourth quarter 2019.

- The Company repurchased 3.8 million shares in fourth quarter 2020 at an aggregate cost of $749 million.

Summary of Fourth Quarter Freight Revenues

- Bulk up 1%

- Industrial down 7%

- Premium up 5%

2020 Full Year Summary

For the full year 2020, Union Pacific reported net income of $5.3 billion or $7.88 per diluted share. Excluding the effects of the $278 million pre-tax, non-cash impairment charge, adjusted full year net income was $5.6 billion, or $8.19 per diluted share. This compares to $5.9 billion, or $8.38 per diluted share, in 2019.

Operating revenue totaled $19.5 billion compared to $21.7 billion in 2019. Operating income totaled $7.8 billion, which decreased compared to 2019. In addition:

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Union Pacific Corp. | ||

|

UM1YZY

| Ask: 3,04 | Hebel: 18,38 |

| mit starkem Hebel |

Zum Produkt

| |

|

UM1LM1

| Ask: 6,00 | Hebel: 4,99 |

| mit moderatem Hebel |

Zum Produkt

| |

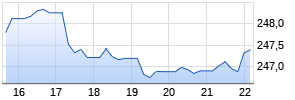

Kurse

|

- Freight revenue totaled $18.3 billion, a 10% decrease compared to 2019. Carloadings were down 7% versus 2019, as all three business teams – bulk, industrial, and premium – declined due to the economic conditions brought on by the COVID-19 pandemic.

- Union Pacific's full year 59.9% reported operating ratio when adjusted for the impairment charge is a best ever 58.5%, 210 basis points lower than 2019. Lower fuel prices positively impacted the operating ratio by 130 basis points.

- Union Pacific's reportable personal injury rate of 0.90 incidents per 200,000 employee hours was flat compared to full year 2019. The Company's FRA reportable rail equipment incident rate of 3.54 per million train miles improved 17% compared to full year 2019.

- Through continued implementation of precision scheduled railroading principles, Union Pacific made year-over-year improvements in its key operating performance indicators:

- Freight car velocity – 6% improvement

- Average terminal dwell – 8% improvement

- Locomotive productivity – 14% improvement

- Workforce productivity – 11% improvement

- Train length – 14% improvement

- Intermodal car trip plan compliance – 6 pt. improvement

- Manifest/Autos car trip plan compliance – 6 pt. improvement

- Fuel consumption rate, measured in gallons of fuel per thousand gross ton miles, improved 2% in 2020 compared to 2019.

- Union Pacific's capital program in 2020 totaled $2.8 billion.

- Union Pacific repurchased 22 million shares in 2020 at an aggregate cost of $3.7 billion.

2021 Outlook

"While the economic outlook for 2021 remains uncertain, we will build off our solid 2020 performance to produce continued strong productivity through operational excellence. We expect our enhanced service product will support both solid core pricing gains while also increasing our share of the freight transportation market," Fritz said. "Our confidence in our ability to drive value for all of our stakeholders has never been greater."

Fourth Quarter 2020 Earnings Conference Call

Union Pacific will webcast its fourth quarter 2020 earnings release presentation live at www.up.com/investor and via teleconference on Thursday, January 21, 2021, at 8:45 a.m. Eastern Time. Participants may join the conference call by dialing 877-407-8293 (or for international participants, 201-689-8349).

ABOUT UNION PACIFIC

Union Pacific (NYSE: UNP) delivers the goods families and businesses use every day with safe, reliable and efficient service. Operating in 23 western states, the company connects its customers and communities to the global economy. Trains are the most environmentally responsible way to move freight, helping Union Pacific protect future generations. More information about Union Pacific is available at www.up.com.

Supplemental financial information is attached.

This news release and related materials contain statements about the Company's future that are not statements of historical fact, including specifically the statements regarding the Company's expectations with respect to economic conditions and demand levels, its ability to improve network performance, its results of operations, and potential impacts of the COVID-19 pandemic. These statements are, or will be, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements also generally include, without limitation, information or statements regarding: projections, predictions, expectations, estimates or forecasts as to the Company's and its subsidiaries' business, financial, and operational results, and future economic performance; and management's beliefs, expectations, goals, and objectives and other similar expressions concerning matters that are not historical facts.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times that, or by which, such performance or results will be achieved. Forward-looking information, including expectations regarding operational and financial improvements and the Company's future performance or results are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statement. Important factors, including risk factors, could affect the Company's and its subsidiaries' future results and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements. Information regarding risk factors and other cautionary information are available in the Company's Annual Report on Form 10-K for 2019, which was filed with the SEC on February 7, 2020, and the Company's Quarterly Report on Form 10-Q, which was filed with the SEC on July 23, 2020. The Company updates information regarding risk factors if circumstances require such updates in its periodic reports on Form 10-Q and its subsequent Annual Reports on Form 10-K (or such other reports that may be filed with the SEC).

Forward-looking statements speak only as of, and are based only upon information available on, the date the statements were made. The Company assumes no obligation to update forward-looking information to reflect actual results, changes in assumptions, or changes in other factors affecting forward-looking information. If the Company does update one or more forward-looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking statements. References to our website are provided for convenience and, therefore, information on or available through the website is not, and should not be deemed to be, incorporated by reference herein.

| UNION PACIFIC CORPORATION AND SUBSIDIARY COMPANIES | |||||||||||||

| Condensed Consolidated Statements of Income (unaudited) | |||||||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Millions, Except Per Share Amounts and Percentages, | 4th Quarter | | Full Year | ||||||||||

| For the Periods Ended December 31, | 2020 | 2019 | % | | | 2020 | 2019 | % | | ||||

| Operating Revenues | | | | | | | | | | | | | |

| Freight revenues | $ | 4,803 | $ | 4,851 | (1) | % | | $ | 18,251 | $ | 20,243 | (10) | % |

| Other | | 338 | | 361 | (6) | | | | 1,282 | | 1,465 | (12) | |

| Total operating revenues | | 5,141 | | 5,212 | (1) | | | | 19,533 | | 21,708 | (10) | |

| Operating Expenses | | | | | | | | | | | | | |

| Compensation and benefits | | 1,021 | | 1,049 | (3) | | | | 3,993 | | 4,533 | (12) | |

| Depreciation | | 557 | | 559 | - | | | | 2,210 | | 2,216 | - | |

| Purchased services and materials | | 492 | | 531 | (7) | | | | 1,962 | | 2,254 | (13) | |

| Fuel | | 332 | | 512 | (35) | | | | 1,314 | | 2,107 | (38) | |

| Equipment and other rents | | 220 | | 230 | (4) | | | | 875 | | 984 | (11) | |

| Other | | 513 | | 231 | U | | | | 1,345 | | 1,060 | 27 | |

| Total operating expenses Werbung Mehr Nachrichten zur Union Pacific Corp. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||||