Silvercrest Asset Management Group Inc. Reports Q4 and Year-end 2017 Results

PR Newswire

NEW YORK, March 9, 2018

NEW YORK, March 9, 2018 /PRNewswire/ -- Silvercrest Asset Management Group Inc. (NASDAQ: SAMG) (the "Company" or "Silvercrest") today reported the results of its operations for the quarter and year ended December 31, 2017.

Business Update

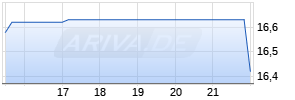

Silvercrest achieved record revenues and assets under management to conclude the fourth quarter and full year 2017. Our total assets under management increased by $0.7 billion during the fourth quarter, driven by capital markets performance and net new client organic growth. Silvercrest concluded 2017 with discretionary assets under management of $16.0 billion, representing a year-over-year increase of 16% and a new high. Silvercrest's total assets under management stood at $21.3 billion as of year end.

Silvercrest's results have been driven by continued execution of our disciplined growth strategy, and the fourth quarter of 2017 represented the firm's ninth straight quarter of net organic growth. Silvercrest has delivered 18 quarters of positive or breakeven asset flows, with 15 of those quarters being positive.

Silvercrest has maintained its adjusted EBITDA margins while investing in the business on behalf of clients and future growth. We continue to invest in Silvercrest's next generation of high-quality talent and have funded new growth initiatives, including our previously announced OCIO business.

Silvercrest's proprietary value equity strategies continued their strong long-term performance in 2017. Each of the firm's six primary equity strategies have outperformed their relevant benchmarks for nearly all measured periods, as well as since inception. Silvercrest's performance supports continued opportunity in the institutional marketplace and presents a compelling and competitive offering to high net worth clients and prospects.

Silvercrest continues to evaluate selective and prudent acquisitions to complement our organic growth, capabilities and professional talent, including the potential to expand in new geographies.

All of us at Silvercrest are grateful for the long-term support of our clients and shareholders.

Fourth Quarter 2017 Highlights

- Total Assets Under Management ("AUM") of $21.3 billion, inclusive of discretionary AUM of $16.0 billion and non-discretionary AUM of $5.3 billion at December 31, 2017.

- Revenue of $24.5 million.

- U.S. Generally Accepted Accounting Principles ("GAAP") consolidated net income and net (loss) attributable to Silvercrest of $1.9 million and ($80) thousand, respectively. Included in the net loss attributable to Silvercrest is a $7.3 million write off of deferred tax assets reported as income tax expense and a $5.3 million reduction to our tax receivable agreement reported in other income as a result of the reduction in the federal corporate tax rate.

- Basic and diluted net loss per share of $(0.01).

- Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA")1 of $7.6 million.

- Adjusted net income1 of $3.6 million.

- Adjusted basic and diluted earnings per share1, 2 of $0.27 and $0.26, respectively.

The table below presents a comparison of certain GAAP and non-GAAP ("adjusted") financial measures and AUM.

| | | For the Three Months | | | For the Year Ended | | ||||||||||

| (in thousands except per share amounts or as indicated) | | 2017 | | | 2016 | | | 2017 | | | 2016 | | ||||

| Revenue | | $ | 24,471 | | | $ | 21,192 | | | $ | 91,358 | | | $ | 80,262 | |

| Income before other income (expense), net | | $ | 5,152 | | | $ | 3,326 | | | $ | 20,369 | | | $ | 14,636 | |

| Net income | | $ | 1,917 | | | $ | 2,487 | | | $ | 12,531 | | | $ | 9,982 | |

| Net (loss) income attributable to Silvercrest | | $ | (80) | | | $ | 1,286 | | | $ | 5,337 | | | $ | 5,015 | |

| Net (loss) income per basic and diluted share | | $ | (0.01) | | | $ | 0.15 | | | $ | 0.66 | | | $ | 0.62 | |

| Adjusted EBITDA1 | | $ | 7,597 | | | $ | 5,889 | | | $ | 27,887 | | | $ | 22,453 | |

| Adjusted EBITDA margin1 | | | 31.0 | % | | | 27.8 | % | | | 30.5 | % | | | 28.0 | % |

| Adjusted net income1 | | $ | 3,620 | | | $ | 2,632 | | | $ | 13,064 | | | $ | 9,836 | |

| Adjusted basic earnings per share1, 2 | | $ | 0.27 | | | $ | 0.20 | | | $ | 0.99 | | | $ | 0.76 Werbung Mehr Nachrichten zur Silvercrest Asset Management Group Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |