Pulmatrix Reports Q1 2019 Results

PR Newswire

LEXINGTON, Mass., May 15, 2019

LEXINGTON, Mass., May 15, 2019 /PRNewswire/ -- Pulmatrix, Inc. (NASDAQ: PULM) today reports its first quarter results.

"We reached a major milestone in the first quarter with the FDA providing approval to begin our planned Pulmazole Phase 2 clinical trial. With the closing of our recent financing in April and receipt of the upfront payment from Cipla related to the Definitive Agreement for the co-development and commercialization of Pulmazole, we currently have a cash balance of approximately $37 million which fully funds Pulmatrix beyond the completion of the Phase 2 trial that will begin this quarter," said Robert W. Clarke, Ph.D., chief executive officer of Pulmatrix.

Financials

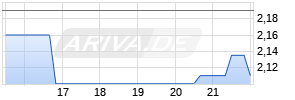

As of March 31, 2019, Pulmatrix had $2.1 million in cash, compared to $2.6 million as of December 31, 2018. In April 2019, Pulmatrix completed a financing that resulted in $16.6 million total gross proceeds and executed a Definitive Agreement with Cipla for the co-development and commercialization of Pulmazole. In early May 2019, Pulmatrix received a $22 million upfront payment from Cipla. Following the completion of planned Phase 2 clinical trial, both parties will equally share costs related to the future development and commercialization of Pulmazole and will equally share worldwide free cash flow from future sales of Pulmazole.

Pulmatrix generated no revenue in the first quarter of 2019, compared to $0.2 million of revenues in the first quarter of 2018. The revenue for the first quarter of 2018 resulted from the Cystic Fibrosis Foundation Therapeutics award related to our Pulmazole program.

Research and development expenses for the first quarter of 2019 were $2.2 million, compared to $3.2 million for the same period last year. The increase was primarily due to decreases in clinical development costs and external service costs on the PUR1800 project. General and administrative expenses for both the first quarter of 2019 and the first quarter of 2018 were $2.0 million.

Net loss was $5.2 million for both the first quarter of 2019 and the first quarter of 2018.

About Pulmatrix

Pulmatrix is a clinical stage biopharmaceutical company developing innovative inhaled therapies to address serious pulmonary disease using its patented iSPERSE™ technology. The Company's proprietary product pipeline is focused on advancing treatments for serious lung diseases, including Pulmazole, an inhaled anti-fungal for patients with allergic bronchopulmonary aspergillosis ("ABPA"), and PUR1800, a narrow spectrum kinase inhibitor for patients with obstructive lung diseases including asthma and chronic obstructive pulmonary disease ("COPD"). Pulmatrix's product candidates are based on iSPERSE™, its proprietary engineered dry powder delivery platform, which seeks to improve therapeutic delivery to the lungs by maximizing local concentrations and reducing systemic side effects to improve patient outcomes.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release that are forward-looking and not statements of historical fact are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements of historical fact, and may be identified by words such as "anticipates," "assumes," "believes," "can," "could," "estimates," "expects," "forecasts," "guides," "intends," "is confident that", "may," "plans," "seeks," "projects," "targets," and "would," and their opposites and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are based on the beliefs of management as well as assumptions made by and information currently available to management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors, including, but not limited to, delays in planned clinical trials; the ability to establish that potential products are efficacious or safe in preclinical or clinical trials; the ability to establish or maintain collaborations on the development of therapeutic candidates; the ability to obtain appropriate or necessary governmental approvals to market potential products; the ability to obtain future funding for developmental products and working capital and to obtain such funding on commercially reasonable terms; the Company's ability to manufacture product candidates on a commercial scale or in collaborations with third parties; changes in the size and nature of competitors; the ability to retain key executives and scientists; and the ability to secure and enforce legal rights related to the Company's products, including patent protection. A discussion of these and other factors, including risks and uncertainties with respect to the Company, is set forth in the Company's filings with the SEC, including its annual report on Form 10-K filed with the Securities and Exchange Commission on February 19, 2019, as may be supplemented or amended by the Company's Quarterly Reports on Form 10-Q. The Company disclaims any intention or obligation to revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Financial Tables to Follow

| CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share data) | | |||

| | | |||

| | At March 31, | | At December 31, | |

| | (unaudited) | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash | $ 2,146 | | $ 2,563 | |

| Prepaid expenses and other current assets | 1,236 | | 717 | |

| | | | | |

| Total current assets | 3,382 | | 3,280 | |

| Property and equipment, net | 354 | | 394 | |

| Long-term restricted cash | 204 | | 204 | |

| Goodwill | 10,051 | | 10,845 | |

| | | | | |

| Total assets | $ 13,991 | | $ 14,723 | |

| | | | | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | $ 1,611 | | $ 1,183 | |

| Accrued expenses | 2,184 | | 1,696 | |

| | | | | |

| Total current liabilities | 3,795 | | 2,879 | |

| | | | | |

| Stockholders' equity: | | | | |

| Common stock, $0.0001 par value — 200,000,000 shares authorized; | 1 | | - | |

| Additional paid-in capital | 209,916 | | 206,409 | |

| Accumulated deficit | (199,721) | | (194,565) | |

| | | | | |

| Total stockholders' equity | 10,196 | | 11,844 | |

| | | | | |

| Total liabilities, redeemable convertible preferred stock and stockholders' equity | $ 13,991 | | $ 14,723 | |

| | | | | |

| CONDENSED CONSOLIDATED RESULTS OF OPERATIONS (unaudited) (in thousands, except share and per share data) | |||

| | | ||

| | For the Three Months Ended | ||

| | 2019 | | 2018 |

| Revenues | $ — | | $ 153 |

| | | | |

| Operating expenses | | | |

| Research and development | 2,176 | | 3,221 |

| General and administrative | 1,987 | | 2,046 |

| Impairment of goodwill | 794 | | — |

| | | | |

| Total operating expenses | 4,957 | | 5,267 |

| | | | |

| Loss from operations | (4,957) | | (5,114) |

| Interest expense Werbung Mehr Nachrichten zur Pulmatrix Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||