PREIT Enters into Agreement to Exchange $465 Million of Cash and Operating Partnership Units for the Redeveloped Springfield Town Center

PR Newswire

PHILADELPHIA, March 3, 2014

PHILADELPHIA, March 3, 2014 /PRNewswire/ -- PREIT (NYSE: PEI) today announced that it has entered into an agreement with Vornado Realty Trust (NYSE: VNO) to acquire Springfield Town Center in Springfield, VA.

Key terms of the transaction:

- Total consideration is $465 million.

- The transaction is expected to be funded using $125 million in PREIT Common and Preferred Operating Partnership Units with the balance expected to be paid in cash, including paying off debt to affiliates of Vornado, to be assumed at closing. Under certain circumstances, additional Units could be payable in lieu of cash.

- As a result of this transaction, Vornado will be a passive investor in PREIT and will be subject to an equity ownership limit of 9.9% and a standstill agreement.

- Vornado will complete the ongoing renovation of Springfield Town Center's non-anchor space.

- PREIT and Vornado will jointly lease the property, effective immediately, and through closing.

- Closing will occur two weeks following completion of the redevelopment and the achievement of 75% occupancy of non-anchor space and the opening of Dick's Sporting Goods and Regal Cinema or March 31, 2015, whichever is earlier.

- Vornado will be entitled to additional consideration equal to 50% of the value over the initial consideration calculated three years after closing, when the project is expected to be stabilized, utilizing a 5.5% capitalization rate.

- PREIT also becomes entitled to develop land surrounding the mall in accordance with existing zoning, which permits the construction of an additional 3 million square feet of retail, residential, office and hotel space.

The 1.35 million square foot mall, comprised of 642,000 square feet of anchor space and 703,000 square feet of non-anchor space, is currently undergoing redevelopment with a grand re-opening scheduled for October 17, 2014. The non-anchor space at the property is currently 30% leased, including the following notable retailers: Michael Kors, H&M, Chico's, Pandora, Francesca's Collection, Maggiano's Little Italy, Yard House Restaurant, Wood Ranch BBQ, LA Fitness, Regal Cinema, Dick's Sporting Goods and the Mid-Atlantic region's only Topshop. Additionally, over 175,000 square feet of leases are currently being negotiated. The mall is anchored by Macy's, Target and JCPenney, all of whom remain operational while the mall is closed for construction.

Springfield, VA is located in Fairfax County, one of the wealthiest and highest income counties in the U.S. The mall is located at the intersection of I-95, I-395 and the Capital Beltway with average daily traffic exceeding 500,000 cars. The property will join PREIT's Premier malls group, strengthen the Company's presence in the Mid-Atlantic region and provide greater access to the dynamic, strong and growing Washington D.C. metro market.

When commenting on the transaction, Joseph Coradino, CEO of PREIT said, "This off-market transaction is transformative for PREIT in our evolution into a quality mall owner with a strong presence in major markets. The opportunity to acquire a property of this caliber is rare and, in light of having achieved balance sheet and operational stability and divested several of our lower quality malls, we are well positioned to leverage PREIT's value creation capabilities to realize this asset's potential."

BofA Merrill Lynch and Wachtell, Lipton, Rosen & Katz acted in advisory roles to PREIT on this transaction.

Management has scheduled a conference call to discuss this transaction for 12:30 p.m. Eastern Time on Monday, March 3, 2014. To listen to the call, please dial (877) 870-4263 (domestic) or (412) 317-0790 (international) and provide conference number 10042194. Investors can also access the call in a "listen only" mode via the internet by using the following link: http://www.videonewswire.com/event.asp?id=98346. A replay of the call will be available for two weeks following the call at (877) 344-7529 (domestic) and (412) 317-0088 (international), using conference number: 10042194. A detailed Form 8-K has been filed with the Securities and Exchange Commission and a presentation has also been posted to the Company's website, preit.com.

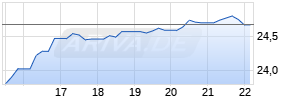

ARIVA.DE Börsen-Geflüster

Kurse

|

|

About Pennsylvania Real Estate Investment Trust

PREIT is a real estate investment trust specializing in the ownership and management of differentiated retail shopping malls designed to fit the dynamic communities they serve. Founded in 1960 as Pennsylvania Real Estate Investment Trust, the Company now operates properties in 12 states in the eastern half of the United States with concentration in the Mid-Atlantic region and Greater Philadelphia. The Company's current portfolio is comprised of 35 shopping malls, five community and power centers, and three development sites totaling 43 properties and 30.4 million square feet of space. PREIT is headquartered in Philadelphia, Pennsylvania, and is publicly traded on the NYSE under the symbol PEI. Information about the Company can be found at preit.com or on Twitter or LinkedIn.

Forward Looking Statements

This press release contains certain "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations, beliefs, projections, future plans, strategies, anticipated events, trends and other matters that are not historical facts. These forward-looking statements reflect our current views about future events, achievements or results and are subject to risks, uncertainties and changes in circumstances that might cause future events, achievements or results to differ materially from those expressed or implied by the forward-looking statements. In particular, the transaction is subject to certain conditions to closing (including completion of the construction) which may not be satisfied, the transaction may fail to close for other reasons, and after closing we may be unable to realize the anticipated benefits of the transaction. In addition, our business might be materially and adversely affected by uncertainties affecting real estate businesses generally as well as the following, among other factors: our substantial debt, stated value of preferred shares and our high leverage ratio; constraining leverage, interest and tangible net worth covenants under our 2013 Revolving Facility and 2014 Term Loans; potential losses on impairment of certain long-lived assets, such as real estate, or of intangible assets, such as goodwill; potential losses on impairment of assets that we might be required to record in connection with any dispositions of assets; changes to our corporate management team and any resulting modifications to our business strategies; our ability to refinance our existing indebtedness when it matures, on favorable terms or at all; our ability to raise capital, including through the issuance of equity or equity-related securities if market conditions are favorable, through joint ventures or other partnerships, through sales of properties or interests in properties, or through other actions; our ability to identify and execute on suitable acquisition opportunities and to integrate acquired properties into our portfolio; our short- and long-term liquidity position; current economic conditions and their effect on employment, consumer confidence and spending and the corresponding effects on tenant business performance, prospects, solvency and leasing decisions and on our cash flows, and the value and potential impairment of our properties; general economic, financial and political conditions, including credit market conditions, changes in interest rates or unemployment; changes in the retail industry, including consolidation and store closings, particularly among anchor tenants; the effects of online shopping and other uses of technology on our retail tenants; our inability to sell properties that we seek to dispose of or our ability to obtain estimated sale prices; our ability to maintain and increase property occupancy, sales and rental rates, in light of the relatively high number of leases that have expired or are expiring in the next two years; increases in operating costs that cannot be passed on to tenants; risks relating to development and redevelopment activities; concentration of our properties in the Mid-Atlantic region; changes in local market conditions, such as the supply of or demand for retail space, or other competitive factors; potential dilution from any capital raising transactions; possible environmental liabilities; our ability to obtain insurance at a reasonable cost; and existence of complex regulations, including those relating to our status as a REIT, and the adverse consequences if we were to fail to qualify as a REIT. Additional factors that might cause future events, achievements or results to differ materially from those expressed or implied by our forward-looking statements include those discussed in our most recent Annual Report on Form 10-K and in any subsequent Quarterly Report on Form 10-Q in the section entitled "Item 1A. Risk Factors." We do not intend to update or revise any forward-looking statements to reflect new information, future events or otherwise.

Contact:

Robert McCadden

EVP & CFO

(215) 875-0735

Heather Crowell

VP, Corporate Communications and Investor Relations

(215) 875-0735

Logo - http://photos.prnewswire.com/prnh/20130905/MM75091LOGO

SOURCE PREIT

Mehr Nachrichten zur Vornado REIT Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.