Power Corporation Reports First Quarter 2021 Financial Results

Canada NewsWire

MONTRÉAL, May 13, 2021

| Readers are referred to the sections "Non-IFRS Financial Measures and Presentation" and "Forward-Looking Statements" at the end of this release. All figures are expressed in Canadian dollars unless otherwise noted. |

MONTRÉAL, May 13, 2021 /CNW Telbec/ - Power Corporation of Canada (Power Corporation or the Corporation) (TSX: POW) today reported earnings results for the three months ended March 31, 2021.

Power Corporation

Consolidated results for the period ended March 31, 2021

HIGHLIGHTS

- The Corporation's net asset value (NAV) per share [1] was $45.94 at March 31, 2021, compared with $41.27 at December 31, 2020, an increase of 11.3%.

- The Corporation reported net earnings per share of $0.82 for the first quarter of 2021, compared to net earnings per share of $0.36 for the first quarter of 2020. Adjusted net earnings per share[1] was $1.16, compared to $0.62 per share in 2020.

- Great-West Lifeco Inc.'s (Lifeco) assets under administration were $2.1 trillion at March 31, 2021, an increase of 5% from December 31, 2020.

- IGM Financial Inc. (IGM) reported record assets under management and advisement of $248.5 billion, up 3.6% in the quarter.

- IGM's net earnings at March 31, 2021 were $202.2 million or $0.85 per share, compared with $160.9 million or $0.68 per share in the first quarter of 2020. This represents a 25.0% increase in earnings per share and is the highest first quarter result in IGM's history.

- Groupe Bruxelles Lambert's (GBL) NAV was €21.1 billion at March 31, 2021, compared with €20.5 billion at December 31, 2020, an increase of 2.9%.

- Wealthsimple Financial Corp. (Wealthsimple) announced a $750 million financing round on May 3, 2021, which values the Power group's investment at $2.6 billion compared to invested capital of $315 million. The Power group will receive proceeds of $500 million from a secondary offering and will retain an interest of $2.1 billion in Wealthsimple.

- Sagard Credit Partners II completed an additional closing in April 2021, increasing the fund size to US$909 million.

- Launch of third fintech fund, Portage Ventures III LP, with an initial closing of US$148 million.

- Power Sustainable Capital Inc. (Power Sustainable) launched the Power Sustainable Energy Infrastructure Partnership, a $1 billion investment platform dedicated to the North American renewable energy sector, in January 2021.

- Lion began trading on the Toronto Stock Exchange (TSX: LEV) and the New York Stock Exchange (NYSE: LEV) on May 7, 2021. Lion's market capitalization on May 12, 2021 was US$2.8 billion, which values the Corporation's investment at $1.2 billion.

| | |

| [1] | NAV, NAV per share and adjusted net earnings per share are non-IFRS financial measures. See the Non-IFRS Financial Measures and Presentation section later in this news release. |

Net Asset Value

Net asset value per share represents management's estimate of the fair value of participating shareholders' equity of the Corporation. Net asset value is the fair value of the assets of the combined Power Financial Corporation (Power Financial) and Power Corporation non-consolidated balance sheet less their net debt and preferred shares. Refer to the detailed Net Asset Value section later in this news release for a reconciliation to the non-consolidated combined balance sheet.

The Corporation's net asset value per share was $45.94 at March 31, 2021, compared with $41.27 at December 31, 2020, representing an increase of 11.3%.

| | (in millions of dollars, except per share amounts) | March 31, 2021 | December 31, 2020 | Variation % |

| Publicly | Lifeco | 20,741 | 18,825 | 10 |

| IGM | 5,666 | 5,105 | 11 | |

| GBL | 2,907 | 2,870 | 1 | |

| | | 29,314 | 26,800 | 9 |

| | | | | |

| Alternative | Sagard Holdings [1] | 1,958 | 1,298 | 51 |

| Power Sustainable [1] | 1,581 | 1,872 | (16) | |

| | 3,539 | 3,170 | 12 | |

| | | | | |

| Other | China AMC [2] | 690 | 715 | (3) |

| Standalone businesses [3] | 1,369 | 1,351 | 1 | |

| Other assets and investments | 618 | 548 | 13 | |

| Cash and cash equivalents | 1,315 | 1,226 | 7 | |

| | Gross asset value | 36,845 | 33,810 | 9 |

| | Liabilities and preferred shares | (5,758) | (5,859) | 2 |

| | Net asset value | 31,087 | 27,951 | 11 |

| | Shares outstanding (millions) | 676.7 | 677.2 | |

| | Net asset value per share | 45.94 | 41.27 | 11 |

| | |

| [1] | Includes the management companies of the investment funds at their carrying value. |

| [2] | China Asset Management Co., Ltd. (China AMC). |

| [3] | Includes Lion, Lumenpulse Group Inc. (Lumenpulse), Peak Achievement Athletics Inc. (Peak) and GP Strategies. |

Power Corporation's Ownership in Publicly Traded Operating Companies

| | | Shares held [1] | Share price | ||

| | Ownership [1] | March 31, 2021 | December 31, 2020 | ||

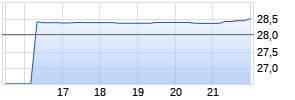

| Lifeco | 66.8 | 620.3 | $33.44 | $30.35 | |

| IGM | 62.1 | 147.9 | $38.30 Werbung Mehr Nachrichten zur Power Corporation Of Canada Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||