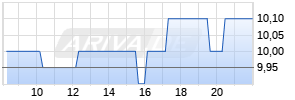

Permian Basin Royalty Trust Announces July Cash Distribution

PR Newswire

DALLAS, July 19, 2019

DALLAS, July 19, 2019 /PRNewswire/ -- Simmons Bank, as Trustee of the Permian Basin Royalty Trust (NYSE: PBT) ("Permian") today declared a cash distribution to the holders of its units of beneficial interest of $0.044227 per unit, payable on August 14, 2019, to unit holders of record on July 31, 2019.

This month's distribution increased from the previous month due primarily to an increase of both oil and gas production. This reflects the production month of May. Pricing for both oil and gas declined on the Waddell Ranch. Capital Expenditures declined to reflect less activity due to the completion of drilling of the additional wells on the Waddell Ranch Properties for the previous month's accounting. Lease Operating Expenses (LOE) for the Waddell Ranch properties decreased this month to reflect the resulting additional work being performed last month. The Texas Royalty Properties saw a decline in the production of oil and gas, primarily due to the timing of receipt of payment of certain revenue due to some changes in lease operators. This was in addition to a decrease in pricing for oil and gas production for the Texas Royalty Properties.

WADDELL RANCH

Production for the underlying properties at the Waddell Ranch was 56,347 barrels of oil and 273,061 Mcf of gas. The production for the Trust's allocated portion of the Waddell Ranch was 17,653 barrels of oil and 85,921 Mcf of gas. The average price for oil was $56.65 per bbl and for gas was $1.89 per Mcf. This would primarily reflect production and pricing for the month of May for oil and the month of April for gas. These allocated volumes were significantly impacted by the pricing of both oil and gas.

This production and pricing for the Underlying Properties resulted in revenues for the Waddell Ranch Properties of $3,708,151. Deducted from these would be the Lease Operating Expense (LOE) of $1,760,573, taxes of $264,306 and Capital Expenditures (CAPEX) of $203,881 totaling $2,228,760 resulting in a Net Profit of $1,479,391 for the month of June. With the Trust's Net Profit Interest (NPI) of 75% of the underlying properties, this would result in a net contribution by the Waddell Ranch Properties of $1,109,543 to this month's distribution.

ConocoPhillips has advised the Trust of the 2019 budget for the Waddell Ranch reflecting 2 new drill wells into the Wolfcamp formation at an estimated $2.5 million, gross, ($1.2 million net to the Trust), including $1.7 million, gross, ($.8 million net to the trust), of 2018 carryover budget, anticipated to be completed in early 2019. Also, base well work of $1.6 million, gross, ($0.7 million net to the trust) and facilities work of $4.2 million, gross, ($1.8 million net to the Trust) bringing a total of $6.6 million, gross, ($2.97 million to the trust) of drilling and projects for 2019. There are no recompletions planned for the year of 2019.

| | Underlying Properties | Net to Trust Sales | | | ||

| | Volumes | Volumes | Average | Price | ||

| | Oil (bbls) | Gas (Mcf) | Oil (bbls) | Gas (Mcf) | Oil (per bbl) | Gas (per Mcf) |

| Current Month | | | | | | |

| Waddell Ranch | 56,347 | 273,061 | 17,653 | 85,921* | $56.65 | $1.89** |

| Texas Royalties | 19,438 | 16,458 | 16,571 | 14,049* | $58.12 | $4.65** |

| | | | | | | |

| Prior Month | | | | | | |

| Waddell Ranch | 51,588 | 266,216 | 13,515 | 70,218* | $62.05 | $2.09** |

| Texas Royalties | 20,794 | 23,871 | 17,963 | 20,613* | $58.35 | $6.60** |

| |

| *These volumes are the net to the trust, after allocation of expenses to Trust's net profit interest, including any prior period adjustments. |

| **This pricing includes sales of gas liquid products. |

TEXAS ROYALTY PROPERTIES

Production for the underlying properties at the Texas Royalties was 19,438 barrels of oil and 16,458 Mcf of gas. The production for the Trust's allocated portion of the Texas Royalties was 16,571 barrels of oil and 14,049 of gas. The average price for oil was $58.12 per bbl and for gas was $4.65 per Mcf. This would primarily reflect production and pricing for the month of May for oil and the month of April for gas. These allocated volumes were impacted by the pricing of both oil and gas.

This production and pricing for the underlying properties resulted in revenues for the Texas Royalties of $1,206,222. Deducted from these were taxes of $156,107 resulting in a Net Profit of $1,050,115 for the month of June. With the Trust's Net Profit Interest (NPI) of 95% of the Underlying Properties, this would result in net contribution by the Texas Royalties of $997,609 to this month's distribution.

General and Administrative Expenses deducted for the month were $48,113 resulting in a distribution of $2,061,392 to 46,608,796 units outstanding, or $0.044227 per unit.

The worldwide market conditions continue to affect the pricing for domestic production. It is difficult to predict what effect these conditions will have on future distributions.

Permian's cash distribution history, current and prior year financial reports, including a summary of reserves as of 1/1/2019, tax information booklets, and a link to filings made with the Securities and Exchange Commission, all can be found on its website at http://www.pbt-permian.com/.

![]() View original content:http://www.prnewswire.com/news-releases/permian-basin-royalty-trust-announces-july-cash-distribution-300887801.html

View original content:http://www.prnewswire.com/news-releases/permian-basin-royalty-trust-announces-july-cash-distribution-300887801.html

SOURCE Permian Basin Royalty Trust

Mehr Nachrichten zur Permian Basin Royalty Trust Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.