Aufrufe: 28

Aufrufe: 28

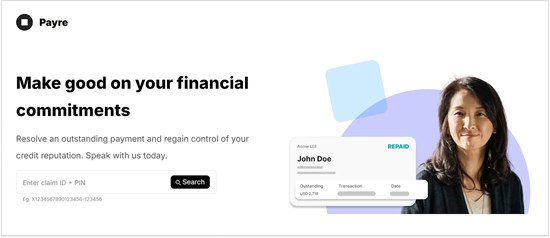

Payre: Solving Late Payments Woes by Making Legal Debt Recovery Platform Accessible to All

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8530/276800_3344d896544bb81b_001full.jpg

Payre (https://www.payre.co), today announced its use of AI to transform how creditors recover late payments worldwide. The platform addresses a critical market gap: millions in outstanding payments remain uncollected because the sums are too small to justify the cost of traditional recovery methods. According to Forbes, 51% of businesses pay their suppliers late (https://www.forbes.com/sites/sap/2025/04/29/the-global-impact-of-late-payments-and-what-you-can-do-about-it/).

Consider these scenarios: A financial institution with a borrower who went silent on a $1,500 loan. A corporate service provider owed $5,000 in unpaid invoices across a dozen clients. A startup with a customer 90 days overdue on a $59 invoice. Traditionally, pursuing these claims isn't economically viable-the cost of recovery could end up exceeding the original amount owed. Payre changes that equation.

"I've seen countless small business owners and freelancers write off thousands in unpaid billings because chasing a $500 invoice through a collection agency costs $300-without certainty of success," said Shawn H., Partner at Payre. "We've built a system that makes professional recovery economically viable-whether you're owed $50 or $50,000. No upfront costs. No guessing. Just results." The platform has partnered with an international law firm to aid creditors with legal action across different countries and jurisdictions.

Unlike traditional collection agencies, Payre pairs technology with professional oversight. Every claim is handled by a practicing accountant or lawyer, ensuring claims are legitimate, properly documented, and strategically pursued. Users pay nothing upfront-Payre's model aligns incentives with successful recovery.

Comprehensive Recovery Workflow

Payre combines streamlined technology with expert guidance across the entire recovery lifecycle:

AI-Powered Submissions: Upload documents with Google (Alphabet A Aktie) AI-the platform extracts key information automatically.

Instant Letters of Demand: Generate lawyer letters in minutes, not weeks.

Legal Representation Requests: Connect with legal counsel when escalation is needed.

Permanent Pursuit: Maintain systematic pressure on debtors through persistent, compliant contact.

Credit Reporting: Penalize debtor creditworthiness by reporting the bad credit.

Factoring Marketplace: Convert claims into cash by selling to interested 3rd parties.

Case Management: Monitor debtor communications and commitments in one centralized system.

Transparent Pricing: Success fee is a flat rate at 10% of every dollar (Dollarkurs) repaid.

"We operate like a traditional accounts receivable firm-v claims, drafting professional correspondence, escalating strategically-but with AI handling of internal processes," Shawn H. said. "This allows our partners to focus on making professional judgment calls while automation handles scale.

Creditors can submit their claims by creating an account at https://www.payre.co/enter.

About Payre

Payre (https://www.payre.co) is the trading name of Pay Atlas LLC, a platform that empowers creditors to recover late payments. Serving freelancers, small businesses, large enterprises, and individuals managing credit risk, Payre can recover a claim anywhere in the world. By combining AI-enabled workflows for qualified accountants and lawyers, Payre makes late payment recovery economically viable for claims of any size. The platform operates on a success-fee model, earning a fee only when the debtor has made repayment-aligning Payre's interests with creditor recovery outcomes.

Media Details

Lyro Goodsmith

Partner at Payre

lyro.goodsmith@payre.co

https://www.payre.co

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276800

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.