Over $400 Million Raised by U.S. Life Sciences Companies Through At-the-Market (ATM) Offerings in 2012, Reports Brinson Patrick

PR Newswire

NEW YORK, April 8, 2013

NEW YORK, April 8, 2013 /PRNewswire/ -- Brinson Patrick Securities Corporation, a boutique investment bank specializing in at-the-market (ATM) offerings, reported today that life sciences companies in the U.S. raised roughly $404 million through ATMs in 2012, compared to $227 million in 2011, a 78 percent year-over-year increase.

In the fourth quarter of 2012, life sciences companies raised $128 million through ATMs, compared to $101 million in the third quarter, a 27 percent increase. This ATM activity included the following companies: StemCells Inc. (NASDAQ: STEM), Newark, Calif.; Sarepta Therapeutics Inc. (NASDAQ: SRPT), Cambridge, Mass.; Sunesis Pharmaceuticals Inc. (NASDAQ: SNSS), San Francisco, Calif.; Acadia Pharmaceuticals Inc. (NASDAQ: ACAD), San Diego, Calif.

"The continued uptrend in ATM adoption and usage by life sciences companies is evident in these numbers," says Todd Wyche, CEO of Brinson Patrick. "As we have predicted, an increasing number of life sciences companies continue to add ATMs to their financing toolkits to lower their cost of capital and avoid unnecessary dilution."

An ATM provides an efficient means of raising equity capital over time by enabling a publicly traded company to tap into the existing secondary market for its shares on an as-needed basis. With an ATM, an exchange-listed company incrementally sells newly issued shares into the trading market through a designated broker-dealer at prevailing market prices, rather than via a traditional underwritten offering of a fixed number of shares at a fixed price all at once.

About Brinson Patrick Securities Corporation

Brinson Patrick Securities Corporation is a boutique investment bank that employs its DOCS® (Dynamic Offering of Common Stock) at-the-market (ATM) financing facility to raise the capital for clients as they need it. The DOCS® ATM is a low-profile equity offering appropriate for publicly traded companies across multiple industries and market capitalizations. It has been successfully utilized by companies in the energy, life sciences, technology, real estate, financial services and hospitality industries with market capitalizations that range from $50 million to over $1 billion.

For more information about ATMs and the firm, visit http://www.brinsonpatrick.com. To access Todd Wyche's biography and a Brinson Patrick fact sheet click here.

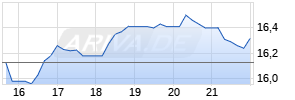

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

Brinson Patrick is a FINRA member broker-dealer.

SOURCE Brinson Patrick Securities Corporation

Mehr Nachrichten zur Microbot Medical Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.