Orvana Reports Q2 2018 Financial Results; El Valle Achieves Highest Gold Production Since 2014

PR Newswire

TORONTO, May 9, 2018

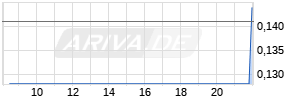

TSX:ORV

Second Quarter of Fiscal 2018 Highlights:

- Consolidated quarterly gold production of 24,788 ounces, copper production of 2.6 million pounds;

- El Valle oxide production sustained at 34% of mill ore feed, achieving highest gold ounce production since 2014;

- Consolidated COC and AISC of $1,055 and $1,309, respectively;

- EBITDA of $4.5 million.

- El Valle transition to higher gold grade oxide mining continues, targeting a 50% oxide-skarn plant throughput ratio;

- Don Mario transitioned mining activities successfully to Cerro Felix gold deposit.

TORONTO, May 9, 2018 /PRNewswire/ -- Orvana Minerals Corp. (TSX:ORV) (the "Company" or "Orvana") announced today financial and operational results for the second quarter ("Q2 2018"). The Company is also providing financial and operational updates for its El Valle and Carlés Mines (collectively, "El Valle") operations in northern Spain and its Don Mario Mine Complex ("Don Mario") in Bolivia.

The unaudited condensed interim consolidated financial statements for Q2 2018 and Management's Discussion and Analysis related thereto are available on SEDAR and on the Company's website at www.orvana.com.

Q2 2018 Highlights

- El Valle – Delivery of higher gold production due to 25% gold grade improvement:

- The progress made to increase the proportion of oxides production delivered to the mill was sustained, averaging 34% over the second quarter of fiscal 2018. This allowed for a 25% gold grade improvement during the same period to 3.36 g/t and quarterly production of 15,139 gold ounces, the highest level since 2014.

- A number of geological and geotechnical process changes in the mine, metallurgical process changes to improve recovery of in-process gold and maintenance investments are expected to allow El Valle to progress towards a targeted 50% oxides processing blend.

- Don Mario – Production from Cerro Felix gold deposit commences:

- Production at Don Mario successfully transitioned from the depleted LMZ to the open-pit Cerro Felix gold deposit during the second quarter of fiscal 2018. Gold recoveries from the Don Mario CIL circuit rose to 91.3%, positively impacted by the absence of copper in the ore processed from Cerro Felix.

- Gold production results were impacted by lower grades due to ore dilution caused by stripping activities during the ramp up of Cerro Felix. Gold grades are expected to recover in the second half of fiscal 2018.

Juan Gavidia, Interim CEO stated, "At El Valle, we are proud of the results of our ramp-up of higher gold grade oxide production, as we have reached our highest gold quarterly production levels since 2014. Similarly, at Don Mario, we achieved a smooth transition to production from our Cerro Felix gold deposit. We have reviewed our production and cost guidance based on our first half results, and believe we will achieve guidance on both fronts."

Strategy and Outlook

The Company continues to pursue its objectives of optimizing production, lowering unitary cash costs, maximizing fee cash flow, extending the life-of-mine of its operations and growing its operations to deliver shareholder value.

El Valle

At El Valle, the primary objective in fiscal 2018 continues to be replacing mined skarn tonnes with higher gold grade oxides in order to bring the proportion of oxide ore processed in the plant up to a target of 50%, thereby substantially increasing ore grades delivered to the mill and increasing gold ounce production. Through additional geological and geotechnical work, the Company also expects to significantly increase the reliability of the mine plan by minimizing the proportion of inferred material in its mine planning and taking additional measures to address grade variability. Infrastructure and fleet maintenance investments to improve productivity and efficiency will continue to be made through fiscal 2018 as planned.

Don Mario

At Don Mario, the Company continues to produce consistent results from its re-commissioned CIL circuit, with a recovery rate averaging above 90% during the second quarter of fiscal 2018. Don Mario continues to pursue realization of a number of known opportunities for mine life extension, including processing existing mineral stockpiles, pursuing mining of the Company's Las Tojas deposit and reprocessing gold bearing tailings. With regards to exploration activities on the Las Tojas property, the Company expects to release full exploration results by the end of fiscal 2018.

FY 2018 Production and Cost Guidance

| | | | | | |

| | | YTD 2018 | | FY 2018 | |

| El Valle Production | | | | | |

| | Gold (oz) | | 25,923 | | 65,000 – 72,000 |

| | Copper (million lbs) | | 2.3 | | 4.1 – 4.5 |

| Don Mario Production | | | | | |

| | Gold (oz) | | 22,037 | | 45,000 – 48,000 |

| | Copper (million lbs) | | 3.1 | | 2.0 – 2.3 |

| Total Production | | | | | |

| | Gold (oz) | | 47,960 | | 110,000 – 120,000 |

| | Copper (million lbs) | | 5.4 | | 6.1 – 6.8 |

| Total capital expenditures | | $11,669 | | $24,000 – $27,000 | |

| Cash operating costs (by-product) ($/oz) gold (1) | | $1,029 | | $950 – $1,050 | |

| All-in sustaining costs (by-product) ($/oz) gold (1) | | $1,283 | | $1,150 – $1,250 | |

| (1) | FY 2018 guidance assumptions for COC and AISC include by-product commodity prices of $2.75 per pound of copper and an average Euro to US Dollar exchange of 1.20. |

Selected Operational and Financial Information

| | | | | | | |

| | Q2 2018 | Q1 2018 | Q2 2017 | YTD 2018 | YTD 2017 | |

| Operating Performance | | | | | | |

| Gold | | | | | | |

| | Production (oz) | 24,788 | 23,172 | 20,513 | 47,960 | 36,212 |

| | Sales (oz) | 25,489 | 21,995 | 20,773 | 47,484 | 34,710 |

| | Average realized price / oz | $1,304 | $1,280 | $1,238 | $1,293 | $1,247 |

| Copper | | | | | | |

| | Production ('000 lbs) | 2,609 | 2,759 | 2,867 | 5,368 | 6,455 |

| | Sales ('000 lbs) | 2,531 | 2,700 | 3,032 | 5,231 | 6,592 |

| | Average realized price / lb | $2.80 | $2.82 | $2.50 | $2.81 | $2.40 |

| Financial Performance (in 000's, except per share amounts) | | | | |||

| Revenue | $36,930 | $34,170 | $31,714 Werbung Mehr Nachrichten zur Orvana Minerals Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||