Original-Research: KPS AG - von GBC AG

Einstufung von GBC AG zu KPS AG

Unternehmen: KPS AG ISIN: DE000A1A6V48

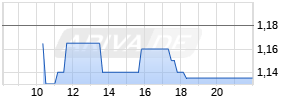

Anlass der Studie: Research Update Empfehlung: BUY Kursziel: 13.20 EUR Kursziel auf Sicht von: 31.12.2019 Letzte Ratingänderung: - Analyst: Matthias Greiffenberger, Cosmin Filker

Internationalisation strategy pays off. Another major customer was acquired in Scandinavia. Margin improvements in sight.

The first half of the 2018/19 financial year developed very well for KPS AG and was generally in line with our expectations. Revenue increased by 3.3% to €91.28 million (previous year: €88.39 million) despite a larger software deal in the Products and Licences segment which significantly increased revenue in the previous year. The margin did not increase to a proportional extent since this mainly involved the resale of software. According to the management, revenue growth was around 13% when adjusted for this effect.

The acquisition of additional transformation projects from existing and new customers was one reason behind the revenue growth. Among other things, a new major customer was acquired in the Scandinavian region. KPS’ presence in Denmark is likely to have been an important factor in attracting this customer. In 2016, Danish consulting firm Saphira Consulting (today: KPS Consulting A/S) was acquired in this way, which, as part of the KPS Group, should benefit from the company’s size and international direction, making it more attractive for large orders. According to the management, an identical phenomenon has also occurred when recruiting personnel. As a result, it is now easier for acquired companies to recruit qualified personnel because large international companies are generally perceived as being more attractive employers.

At the same time, the company is considerably broadening its customer base. While around 80% of revenue was generated by approx. 15 customers two years ago, the customer base for 80% of the revenue has now risen to 35. This has significantly reduced cluster risk. In parallel to this, the distribution of revenue has also been considerably internationalised. Additionally, the considerable expertise was gradually transferred from the logistics and commerce areas to other sectors in order to expand the range of customers.

The EBITDA increased by 41.3% to €13.23 million (previous year: €9.37 million). The disproportionate improvement in earnings led to a rise in the EBITDA margin to 14.5% (previous year: 10.6%), with the first six months of 2017/18 being adversely affected by the initial costs of numerous consulting projects in particular. As a result, the company is again approaching the traditionally high EBITDA margin of over 15%. The result could have been even better, however provisions were made for earn-out payments for the acquired subsidiaries. The very good development of the subsidiaries could lead to higher performance-related earn-out payments to the former owners.

Furthermore, the cost optimisation strategy is still being implemented successfully within human resources. As a result, employees will undertake an increasing amount of tasks and will gradually decrease their reliance on external services. Material costs therefore fell by 15% to €32.24 million (previous year: €38.00 million), which also resulted from a €5.6 million fall in software acquisitions.

At the same time, more employees were hired so that the project’s growing needs could be met. Personnel expenses increased by 9.4% to €33.76 million (previous year: €30.85 million). The regional focus is on Spain in particular, as personnel costs are lower here on average. In addition, the subsidiaries benefit from the KPS acquisition because companies which are under the stewardship of KPS, which is established internationally, are perceived as more attractive and it is therefore easier for them to attract employees. Overall, 16 more employees were hired in Spain, with a further seven added in England. Consequently, the strategy currently seems to have been implemented very successfully and we therefore expect continued margin improvements in the future.

On the basis of revenue and profit for the first six months of 2018/19, we confirm our forecast. For the current financial year 2018/19, we expect revenue of €179.97 million, with revenue of €188.97 million for 2019/20. Our forecast remains in the limits of the €170.0-€180.0 million revenue guidance and of the €22.0-€27.0 million EBIDTA guidance.

Due to a major customer experiencing a drop in revenue, the company expects moderate growth for the current financial year, below that of the double-digit growth momentum of previous years. In our view, the company should return to a more dynamic growth path in the medium term. However, we expect that the major customer’s effect on revenue will still be evident in 2019/20.

We regard the internationalisation strategy and the improvements in how the acquired companies address customers in particular as growth drivers in the medium- and long-term. More large-scale projects in Scandinavia or an even greater number of projects in Great Britain could be acquired in this way using Envoy Digital. At present, management does not expect the potential Brexit to negatively impact the company’s development. Even in the case of a hard Brexit, digital transformation projects should feel little or no effect.

Overall, the company has positioned itself well internationally by means of the acquisitions and we expect a significantly higher growth momentum to once again become apparent in the long term.

In line with the increase in revenue, we expect a disproportionate improvement in earnings. For the current financial year, we expect an EBITDA of €26.47 million, within the guidance of €22.0 million to €27.0 million. Based on the half-year figures (first half-year 2018/19 EBITDA: €13.23 million), we confirm our forecasts are at the upper end of the guidance. For the subsequent year 2019/20, we expect a further disproportionate increase to €28.76 million. This would equate to a margin improvement from 14.7% (2018/19) to 15.2% (2019/20).

The diminishing effect of the major customer’s declining revenue is another reason for the margin improvement. This impacted financial year 2017/18 in particular, with gradually lessened effects for 2018/19 and 2019/20.

In our view, the company should once again achieve historically high profitability and reach an EBITDA margin of at least 15% in the medium term. The reasons for this include the switch from using external services to using the company’s own employees, plus the increased use of employees from countries with a low wage level.

Furthermore, we should be able to tap into further margin potential by increasing internal digitisation. The company also relies in part on the industrialisation of the consulting approach. In this way, the design centre in Dortmund could help to develop important standard solutions that could be distributed in scalable form.

Consequently, we expect a gradual margin improvement on the whole and we view the company as being very well positioned in an attractive market.

We confirm our forecast and continue to assign it the buy rating with a stock price target of €13.20 per share.

Die vollständige Analyse können Sie hier downloaden: http://www.more-ir.de/d/18245.pdf

Kontakt für Rückfragen Jörg Grunwald Vorstand GBC AG Halderstraße 27 86150 Augsburg 0821 / 241133 0 research@gbc-ag.de ++++++++++++++++ Offenlegung möglicher Interessenskonflikte nach § 85 WpHG und Art. 20 MAR. Beim oben analysierten Unternehmen ist folgender möglicher Interessenkonflikt gegeben: (5a,6a,7,11); Einen Katalog möglicher Interessenkonflikte finden Sie unter: http://www.gbc-ag.de/de/Offenlegung.htm +++++++++++++++ Date and time of completion of this research: 04/06/2019 (15:00) Date and time of first distribution: 05/06/2019 (09:00) Target price valid until: max. 31/12/2019

-------------------übermittelt durch die EQS Group AG.-------------------

Für den Inhalt der Mitteilung bzw. Research ist alleine der Herausgeber bzw. Ersteller der Studie verantwortlich. Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte.