Original-Research: FinLab AG - von GBC AG

Einstufung von GBC AG zu FinLab AG

Unternehmen: FinLab AG ISIN: DE0001218063

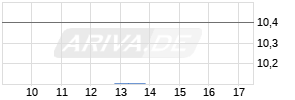

Anlass der Studie: Researchstudie (Anno) Empfehlung: BUY Kursziel: 28,87 Euro Kursziel auf Sicht von: 31.12.2019 Letzte Ratingänderung: Analyst: Cosmin Filker; Matthias Greiffenberger

High profit contributions impacted by fintech investments, decrease in NAV at HELIAD, relevant hidden reserves in place

Over the course of financial year 2018, FinLab AG successfully maintained its positive news flow regarding its portfolio companies. Most noteworthy is the development of the 'flagship investment' Deposit Solutions GmbH, for which a round of financing was carried out in 2018 on the basis of a business valuation of USD 500 million. In September 2015, when FinLab AG initially invested, the Company was valued at just over EUR 20 million, meaning that the valuation of this investment has risen by a factor of more than 20. As part of the new financing round, FinLab AG realised gains and reduced its shareholding from 12% to 7.7% through sales of shares. This generated an inflow of liquidity of EUR 10.14 million and profits (less reduction in book value) of EUR 3.80 million.

The other portfolio companies also developed further, with corresponding positive effects on the financial result of FinLab AG. nextmarkets GmbH was approved as a securities trading bank, AUTHADA GmbH was certified by the German Federal Office for Information Security (BSI), Vaultoro Ltd. introduced its second product, 'Bar9', FastBill GmbH reported a new partnership and the new FinLab fund made its first investment, EOS.IO (FinLab EOS VC Europe I). As a result, the financial result of FinLab AG, which in part reflects the performance of the unlisted fintech companies, was once again high at EUR 16.29 million (previous year: EUR 13.00 million).

It is also worth mentioning here that the Company is not necessarily reliant on the performance of the portfolio companies or on the sale of shares. The provision of services to subsidiaries and portfolio companies, as well as dividend income, represent a steady stream of income for FinLab AG. This is sufficient to cover personnel and material costs, and FinLab is therefore 'self-sustaining'. This is not always the case for investment companies. Accordingly, EBIT in the past financial year was also positive at EUR 0.79 million (previous year: EUR 1.46 million).

The positive performance of the portfolio companies stands in contrast to price losses in the largest investment, the listed Heliad Equity Partners GmbH & Co. KGaA. In the past financial year, as a result of amortisations of shareholdings, Heliad has reported a significant fall in its NAV to EUR 6.20 per share (31/12/17: EUR 12.22 per share), which has led to a significant decline in the Heliad share price. FinLab's equity, and therefore also FinLab's NAV, fell by EUR 20.59 million as a result, having benefited from a consistently positive impetus from this investment in previous years.

Our valuation of FinLab AG is based on NAV, taking into account possible hidden reserves in equity. These hidden reserves consist primarily of the valuations of the fintech portfolio companies and the NAV of the HELIAD shareholding. On this basis, we have calculated a NAV per share of EUR 28.87 (previously: EUR 32.75), which, at the current share price, still offers significant upside potential. The lower Heliad NAV is reflected in the fall in the fair value as calculated by us. We therefore continue to assign the BUY rating.

Die vollständige Analyse können Sie hier downloaden: http://www.more-ir.de/d/17939.pdf

Kontakt für Rückfragen Jörg Grunwald Vorstand GBC AG Halderstraße 27 86150 Augsburg 0821 / 241133 0 research@gbc-ag.de ++++++++++++++++ Offenlegung möglicher Interessenskonflikte nach § 85 WpHG und Art. 20 MAR Beim oben analysierten Unternehmen ist folgender möglicher Interessenkonflikt gegeben: (5a,6a,11); Einen Katalog möglicher Interessenkonflikte finden Sie unter: http://www.gbc-ag.de/de/Offenlegung.htm +++++++++++++++ Date and time of completion (german version): 23/04/2019 (2:13 pm) Date and time of first distribution (german version): 24/04/2019 (9:00 am) Date and time of completion (english version): 03/05/2019 (2:13 pm) Date and time of first distribution (english version): 03/05/2019 (3:00 pm)

-------------------übermittelt durch die EQS Group AG.-------------------

Für den Inhalt der Mitteilung bzw. Research ist alleine der Herausgeber bzw. Ersteller der Studie verantwortlich. Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte.