Nutrien's First-Quarter 2018 Impacted by Delayed Spring Season, Expect Strong Second-Quarter Results

PR Newswire

SASKATOON, May 7, 2018

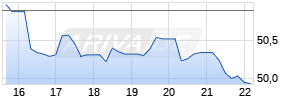

NYSE, TSX: NTR

SASKATOON, May 7, 2018 /PRNewswire/ - Nutrien Ltd. (Nutrien) announced today its 2018 first-quarter results, with a net loss from continuing operations of $1 million1 ($nil2 diluted earnings per share) and EBITDA3 of $487 million.

HIGHLIGHTS

- Nutrien first-quarter earnings from continuing operations, adjusted for purchase price allocation ($74 million or $0.08 per share) and merger-related costs ($66 million or $0.08 per share) not included in guidance, were $0.16 per share4. First-quarter EBITDA adjusted for merger related costs was $553 million4.

- Retail earnings in the first quarter were impacted by a late spring season in North America, with sales and earnings shifted to the second quarter.

- Nutrien acquired 29 retail locations with estimated annual revenues of approximately $280 million through April 2018; announced the newly branded Retail business, Nutrien Ag Solutions™; and launched an integrated digital platform enabling year-round commercial and agronomic digital management for growers.

- Potash segment earnings in the first quarter increased due to higher prices, lower production costs, merger synergies and strong offshore sales volumes, despite experiencing significant rail issues during the quarter.

- Nutrien full-year 2018 guidance was raised to $2.20 to $2.60 diluted earnings per share from continuing operations, up from $2.10 to $2.60 previously, and first-half 2018 guidance is provided at $1.50 to $1.65 earnings per share.

- Nutrien executed on its capital priorities by declaring a quarterly dividend of $0.40 per share and repurchasing 10.3 million shares under its normal course issuer bid program year-to-date (approximately 1.6 percent of shares outstanding).

- Nutrien has achieved $150 million in run-rate synergies as at March 31, 2018.

- We completed our obligor exchange and successfully converted legacy company bonds to a simplified Nutrien indenture platform that aligns covenants and reduces administrative costs.

"Nutrien's first quarter was affected by a late start to the spring season across North America and west coast rail performance issues. However, we expect a strong second quarter with improved grower margins and strong demand and firm prices for most crop inputs," commented Chuck Magro, Nutrien's President and CEO.

"We executed on our strategic and capital priorities with a meaningful return of capital to shareholders, including an increase in our dividend and half a billion dollars in shares repurchased. We made significant progress towards achieving our annual synergy target of $500 million. We also continued to grow our leading global retail network, through numerous accretive acquisitions and the launch of our digital platform. The divestiture of equity investments remains on track and the expected funds will provide further opportunity to accelerate growth and enhance shareholder returns," added Mr. Magro.

MARKET OUTLOOK

Agriculture Fundamentals

- Delayed planting in North America has supported crop prices. Additional support has been provided by the continued degradation of the Argentine corn and soybean crops, which the United States Department of Agriculture (USDA) projects will decline by 20 percent and more than 30 percent, respectively, reducing export supplies and supporting export demand for U.S. and Brazilian corn and soybeans.

- Despite the second-highest production of global grains and oilseeds on record, the USDA projects that inventories of those crops will decline by nearly three percent in 2017/18, the first decline in five years and the largest year-over-year decline since 2010/11. While relatively high carry-in inventories provide a buffer, tightened ending stocks increase the importance of strong production in 2018.

- Extended winter weather throughout much of North America delayed nutrient applications and planting, which we expect will lead to a more compressed planting season. Depending on weather over the coming weeks, there is some risk to total crop nutrient demand in the first half of 2018, in particular for ammonia. Growers could potentially cover a higher proportion of nitrogen needs through top and side dress applications after plantings are complete.

- North American growers are generally positive going into the spring season, despite the late start to planting and uncertainty over trade issues. This includes a potential escalation of trade restrictions between the U.S. and China and the ongoing negotiations of the North American Free Trade Agreement (NAFTA).

- The USDA projects that U.S. combined corn, soybean and cotton area will decline by just over one percent year-over-year, which may lead to lower overall seed expenditures in 2018. However, we expect U.S. soybean growers to continue their rapid adoption of dicamba-resistant soybeans.

Potash

- Strong customer engagement and positive potash sector fundamentals continued to support potash deliveries during the first quarter of 2018, and we expect potash demand to remain robust as a result of high underlying consumption and relatively low inventory levels in most major markets. We have increased our global potash shipment forecast to 64.5 to 66.5 million tonnes for 2018.

- We expect normal North American potash application rates, supported by affordable potash prices and the need to replace nutrients removed by last year's harvest.

- Prices continued to firm in key spot markets, particularly in Brazil, where granular potash prices have continued to increase on new sales since the beginning of 2018. The Brazilian potash import pace is relatively flat compared to the record level in 2017, mostly supported by strong crop production and improved crop economics, particularly for soybeans.

- In China, potash demand continued to be underpinned by supportive crop prices and farmers switching to more intensive fruit and vegetable production. In India, consecutive years of strong crop production in combination with some improvements in agronomic management have supported underlying potash consumption growth. We do not expect the recent reductions in the potash subsidy rates and the slight increase in the maximum retail prices to have a significant impact on Indian consumption growth in 2018. Potash demand remains reasonably strong in other Asian countries amid stable and profitable prices for a wide range of key crops.

- Several global potash suppliers, including Canpotex5, announced they are fully committed through at least June 2018. There has been limited saleable production from new greenfield mines to date and while these projects are anticipated to continue to ramp up, a portion of the new capacity is expected to be offset by the closure of mines reaching end of life and product mix changes by some producers.

Nitrogen

- The delayed start to the spring application season led to pressure on nitrogen prices as the supply chain filled and retailers were comfortable with inventory positions entering the spring application season.

- However, we expect that the North American in-market urea and urea ammonium nitrate (UAN) supply and demand balance will remain tight through the end of the spring season, as combined supplies of the two products are down approximately 10 percent in the fertilizer-year-to-date due to the slow pace of offshore imports.

- Chinese exportable urea supplies remain low and port inventories are down significantly year-over-year. Production levels have increased since early February 2018, which was expected in order to meet domestic spring demand. We expect between three and four million tonnes of Chinese urea exports in 2018, down from 4.7 million tonnes last year.

- India has been an important source of urea demand in early 2018 as inventories began the year at low levels. Indian imports were up 100 percent year-over-year in the first quarter of 2018 and we expect imports to be supported by low inventories, but potential policy changes and the monsoon rainfall will be important drivers in the second half of the year.

Phosphate and Sulfate

- Phosphate fertilizer prices have remained relatively firm and there is optimism among analysts about Indian demand, driven by tight diammonium phosphate (DAP) inventories and the increase in the second-quarter phosphoric acid price. However, exportable supplies are expected to increase in the second quarter as Chinese prices have become more competitive, and new supply ramps up in Saudi Arabia and Morocco.

- Sulfur prices have remained firm in the U.S., driven by tight supplies from traditional offshore suppliers, resulting in higher year-over-year production costs.

FINANCIAL OUTLOOK AND GUIDANCE

Taking the above market factors into consideration, we have raised the guidance range for Potash sales volumes and EBITDA to 12.0 to 12.5 million tonnes and $1.2 to $1.4 billion respectively. Our guidance for Nitrogen EBITDA increased to $1.0 to $1.2 billion.

We are providing Phosphate and Sulfate EBITDA guidance of $0.20 billion to $0.25 billion, which is in line with our previous year's results.

Our effective tax rate on continuing operations range of 22 to 24 percent is down from our previous guidance primarily due to changes in forecasted earnings mix.

Income from investments in Arab Potash Company (APC) and Sociedad Quimica y Minera de Chile S.A. (SQM) will be recorded as dividend income (net of tax) in discontinued operations and is expected to range between $140 to $150 million. These amounts are included in our earnings per share guidance but are not included in EBITDA guidance.

We have revised our full-year foreign exchange rate assumption to CAD$1.27 per US dollar, slightly higher than previous guidance.

Based on these factors, we are increasing our full-year 2018 earnings guidance to $2.20 to $2.60 per share and providing first half 2018 guidance of $1.50 to $1.65 earnings per share.

All of the guidance numbers include the impact of expected in-year realized cash synergies of $175 to $225 million. Excluded from guidance are costs to achieve these ongoing synergies of $50 to $75 million as well as the impact of incremental depreciation and amortization of $250 million to $350 million resulting from the fair valuing of Agrium's assets and liabilities as of January 1, 2018 in accordance with purchase accounting.

All annual guidance numbers, including those noted above, are outlined in the table below:

| | | |

| 2018 Guidance Ranges | Low | High |

| (Annual Guidance, except where noted) | | |

| Adjusted annual earnings per share | $2.20 | $2.60 |

| Adjusted first-half 2018 earnings per share | $1.50 | $1.65 |

| Consolidated EBITDA (billions) | $3.3 | $3.7 |

| Retail EBITDA (billions) | $1.2 | $1.3 |

| Potash EBITDA (billions) | $1.2 | $1.4 |

| Nitrogen EBITDA (billions) | $1.0 | $1.2 |

| Phosphate and Sulfate EBITDA (billions) | $0.2 | $0.25 |

| Potash sales tonnes (millions) (a) | 12.0 | 12.5 |

| Nitrogen sales tonnes (millions) (a) | 10.0 | 10.4 |

| Depreciation and amortization including purchase price allocation impact (billions) | $1.5 | $1.7 |

| Integration and synergy costs (millions) | $50 | $75 |

| Effective tax rate on continuing operations | 22% | 24% |

| Sustaining capital expenditures (billions) | $1.0 | $1.1 |

| | ||

| 2018 Annual Assumptions & Sensitivities | ||

| | ||

| FX rate CAD to USD

| | $1.27 |

| NYMEX natural gas ($US/MMBtu) | | $3.00 |

| $1/MMBtu increase in NYMEX ($/share) (b) | | $(0.19) |

| $20/tonne change in realized Potash selling prices ($/share)(b) | | $0.25 |

| $20/tonne change in realized Ammonia selling prices ($/share)(b) | | $0.06 |

| $20/tonne change in realized Urea selling prices ($/share)(b) | | $0.09 |

| (a) | Potash and nitrogen sales tonnes include manufactured product only. Nitrogen sales tonnes exclude ESN® and Rainbow products. |

| (b) | Sensitivities are calculated pre-synergies. |

FIRST QUARTER RESULTS

The comparative figures throughout this release are the historical combined results of legacy Potash Corporation of Saskatchewan Inc. (PotashCorp) and Agrium Inc. (Agrium) for the three months ended March 31, 2017 and are considered to be non-IFRS measures. For IFRS purposes, the comparative amounts are the results of legacy PotashCorp, which is the accounting acquirer. Compared to the IFRS figures, the change is the result of the merger involving Agrium and PotashCorp. Refer to the Selected Non-IFRS Financial Measures and Reconciliations and Supplemental information section.

Consolidated

| | | | | ||

| | | | Three months ended March 31 | ||

|

(millions of U.S. dollars) | | | 2018 Actual | 2017 Combined | Change |

| Sales | | | 3,695 | 3,737 | (42) |

| Freight, transportation and distribution | | | (208) Werbung Mehr Nachrichten zur Nutrien Ltd. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||