Middlefield Banc Corp. Reports Earnings for Third Quarter and Year-to-Date 2013

PR Newswire

MIDDLEFIELD, Ohio, Oct. 31, 2013

MIDDLEFIELD, Ohio, Oct. 31, 2013 /PRNewswire/ -- Middlefield Banc Corp. (OTCQB: MBCN) reported financial results for the three and nine months ended September 30, 2013.

Net income for the three month period ended September 30, 2013 was $1.9 million, compared to $1.8 million for the same period of 2012. On a per share basis, net income for the third quarter of 2013 was $0.92 per diluted share, compared to $0.93 for the third quarter of 2012. For the nine months ended September 30, 2013 net income was $5.2 million, while the net income for the comparable period of 2012 was $5.0 million. On a per share basis, net income for the nine months ended September 30, 2013 was $2.58 per diluted share. For the same period of 2012, net income per diluted share was $2.65.

Annualized returns on average equity ("ROE") and average assets ("ROA") for the 2013 third quarter were 13.66% and 1.12%, respectively, compared with 16.57% and 1.12% for the third quarter of 2012. ROE and ROA were 12.74% and 1.05%, respectively, for the nine month period of 2013. Comparable results for the 2012 nine month period were 15.26% and 1.02%, respectively.

"We are pleased with our quarter and year-to-date results," stated Thomas G. Caldwell, President and Chief Executive Officer. "With an economy that is growing very slowly, we continue to encounter pockets of soft loan demand. In response, our team has become even more cohesive and continues to develop strong relationships within our markets, while remaining mindful of the necessity of proper expense control. To have been able to achieve these results during a period of continued economic and regulatory uncertainty is testament to our strong staff and keen community banking focus."

"Our diligence in maintaining our community banking focus is key to our success. We will continue to expand our business development efforts to drive prudent asset growth. We will remain firmly focused on delivering excellent customer service, increasing value to our shareholders, and operating our company under safe and sound banking principles," Caldwell concluded.

Net Interest Income

Net interest income for the 2013 third quarter of $5.8 million was 1.8% higher than the $5.7 million reported for the same quarter of 2012. The 2013 nine month period saw net interest income of $17.0 million as compared to $16.9 million reported for the same period of 2012, an increase of 1.0%. The net interest margin for the third quarter of 2013 increased 3 basis points to 4.05% compared to the 4.02% reported for the year-ago quarter. The net interest margin for the 2013 nine month period was 4.03%, an 8 basis point increase from the 3.95% reported for 2012.

Noninterest Income and Operating Expenses

Noninterest income decreased for both the three and nine month periods. The company experienced increases in revenue from deposit services charges and in other income which was offset by a decrease in the recognized gains on investment securities. During the third quarter of 2012, a gain of $0.2 million related to the sale of certain investment securities was recognized. In 2013 third quarter, no sales of securities took place. The first nine months of 2013 saw the company report a gain on the sale of securities equal to $0.2 million, while the same period of 2012 had a gain on the sale of securities of $0.4 million.

Noninterest expense for the third quarter of 2013 totaled $4.1 million, equaling the $4.1 million reported for the third quarter of 2012. Increases in salaries and employee benefits, occupancy, equipment expense and professional fees were nearly equally matched by reductions in Federal deposit insurance premiums and the recognition of a gain on the disposition of other real estate owned. For the first nine months of 2013, total noninterest expense of $12.1 million was $0.1 million more than the 2012 comparable period. The primary factors were nearly consistent with those of the third quarter.

Balance Sheet

The company's total assets at September 30, 2013 stood at $658.1 million, a decrease of $12.1 million, or 1.8%, from the figure reported at December 31, 2012. Net loans at September 30, 2013 were $411.2 million, representing an increase of $10.6 million, or 2.6%, over the year-end 2012 position. Total deposits stood at $579.2 million as of September 30, 2013. This figure represents a decrease of $14.1 million, or 2.4%, from year-end 2012. The investment portfolio, which is entirely classified as available for sale, was $180.8 million at September 30, 2013. This reflects a decrease of $13.7 million from December 31, 2012, with the funds being utilized for loan growth and deposit run-off.

Shareholders' Equity and Dividends

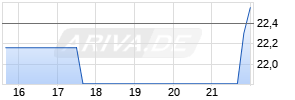

At September 30, 2013, shareholders' equity totaled $52.5 million, a decrease of $2.9 million, or 5.2%, from the $55.4 million reported at December 31, 2012, and a decrease of $2.6 million, or 4.6%, from the September 30, 2012 figure of $55.1 million. This change primarily results from certain mark-to-market adjustments in securities available for sale due to increases in long-term interest rates, offset by an increase in retained earnings. Tangible book value per share at September 30, 2013 was $23.59. The comparable figure at September 30, 2012, was $25.37. The decrease in tangible book value per share was also the result of the aforementioned mark-to-market adjustments in securities available for sale. Shareholders received a cash dividend of $0.26 per share in the third quarter of both 2013 and 2012.

Asset Quality

For the three months ended September 30, 2013, management added $0.2 million to the allowance for loan losses, which compares to $0.1 million for the same period of 2012. The comparable nine month figures are $0.8 million for 2013 and $1.2 million for 2012. Net charge-offs for the first nine months of 2013 were $0.7 million, or 0.23% of average loans. Figures for the comparable period of 2012 were $0.8 million and 0.28% of average loans, respectively. The allowance for loan losses at September 30, 2013 stood at $7.8 million, or 1.87% of total loans. At September 30, 2012, the allowance for loan losses was $7.2 million, representing 1.75% of total loans.

The following table provides a summary of asset quality and allowance for loan loss coverage ratios.

| | | Asset Quality History | |||||||||||||

| | | | | | | | | | | | | | | | |

| | | (dollars in thousands) | |||||||||||||

| | | | | | | | | | | | | | | | |

| | | | 9/30/2013 | | | 12/31/2012 | | | 9/30/2012 | | | 12/31/2011 | | | 12/31/2010 |

| | | | | | | | | | | | | | | | |

| Nonperforming loans | | $ | 13,607 | | $ | 14,194 | | $ | 15,404 | | $ | 24,546 | | $ | 19,986 |

| Real estate owned | | | 2,719 | | | 1,846 | | | 2,332 | | | 2,196 | | | 2,302 |

| | | | | | | | | | | | | | | | |

| Nonperforming assets | | $ | 16,326 | | $ | 16,040 | | $ | 17,736 | | $ | 26,742 | | $ | 22,288 |

| | | | | | | | | | | | | | | | |

| Allowance for loan losses | | $ | 7,821 | | $ | 7,779 | | $ | 7,173 | | $ | 6,819 | | $ | 6,221 |

| | | | | | | | | | | | | | | | |

| Ratios: | | | | | | | | | | | | | | | |

| Nonperforming loans to | | | | | | | | | | | | | | | |

| total loans | | | 3.25% | | | 3.48% | | | 3.76% | | | 6.12% | | | 5.37% |

| Nonperforming assets to | | | | | | | | | | | | | | | |

| total assets | | | 2.48% | | | 2.39% | | | 2.67% | | | 4.09% | | | 3.52% |

| Allowance for loan losses to | | | | | | | | | | | | | | | |

| total loans | | | 1.87% | | | 1.90% | | | 1.75% | | | 1.70% | | | 1.67% |

| Allowance for loan losses to | | | | | | | | | | | | | | | |

| nonperforming loans | | | 57.48% | | | 54.80% | | | 46.57% | | | 27.78% | | | 31.13% |

Middlefield Banc Corp. headquartered in Middlefield, Ohio is a multi-bank holding company with total assets of $658.1 million. The company's lead bank, The Middlefield Banking Company, operates full service banking centers and a LPL Financial® brokerage office serving Chardon, Cortland, Garrettsville, Mantua, Middlefield, Newbury, and Orwell. The company also serves the central Ohio market through its Emerald Bank subsidiary, with offices in Dublin and Westerville, Ohio. Additional information is available at www.middlefieldbank.com and www.emeraldbank.com

This press release of Middlefield Banc Corp. and the reports Middlefield Banc Corp. files with the Securities and Exchange Commission often contain "forward-looking statements" relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of Middlefield Banc Corp. These forward-looking statements involve certain risks and uncertainties. There are a number of important factors that could cause Middlefield Banc Corp.'s future results to differ materially from historical performance or projected performance. These factors include, but are not limited to: (1) a significant increase in competitive pressures among financial institutions; (2) changes in the interest rate environment that may reduce interest margins; (3) changes in prepayment speeds, charge-offs and loan loss provisions; (4) less favorable than expected general economic conditions; (5) legislative or regulatory changes that may adversely affect businesses in which Middlefield Banc Corp. is engaged; (6) technological issues which may adversely affect Middlefield Banc Corp.'s financial operations or customers; (7) changes in the securities markets; or (8) risk factors mentioned in the reports and registration statements Middlefield Banc Corp. files with the Securities and Exchange Commission. Middlefield Banc Corp. undertakes no obligation to release revisions to these forward-looking statements or to reflect events or circumstances after the date of this press release.

Contact: James R. Heslop, 2nd

Executive Vice President/Chief Operating Officer

(440) 632-1666 Ext. 3219

jheslop@middlefieldbank.com

Mehr Nachrichten zur Middlefield Banc Cor Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.