SHAREHOLDER ALERT: Weiss Law Reminds CMAX, HR, CVET, and WRMK Shareholders About Its Ongoing Investigations

PR Newswire

NEW YORK, June 15, 2022

NEW YORK, June 15, 2022 /PRNewswire/ --

If you own shares in any of the companies listed above and

would like to discuss our investigations or have any questions concerning

this notice or your rights or interests, please contact:

Joshua Rubin, Esq.

Weiss Law

305 Broadway, 7th Floor

New York, NY 10007

(212) 682-3025

(888) 593-4771

stockinfo@weisslawllp.com

CareMax, Inc. (NASDAQ: CMAX)

Weiss Law is investigating possible breaches of fiduciary duty and other violations of law by the board of directors of CareMax, Inc. (NASDAQ: CMAX), in connection with the proposed transaction with Steward Health Care System ("Steward"). Upon completion of the transaction, CMAX will pay $25 million in cash and issue 23.5 million shares of CMAX's Class A common stock to the equity holders of Steward. If you own CMAX shares and wish to discuss this investigation or your rights, please call us at one of the numbers listed above or visit our website: https://www.weisslaw.co/news-and-cases/cmax

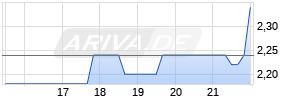

Healthcare Realty Trust Incorporated (NYSE: HR)

ARIVA.DE Börsen-Geflüster

Kurse

|

|

|

|

Weiss Law is investigating possible breaches of fiduciary duty and other violations of law by the board of directors of Healthcare Realty Trust Incorporated (NYSE: HR), in connection with the proposed merger of HR with Healthcare Trust of America, Inc. ("HTA"). Under the terms of the merger agreement, each share of HR common stock will be exchanged for one share of HTA common stock, at a fixed ratio. If you own HR shares and wish to discuss this investigation or your rights, please call us at one of the numbers listed above or visit our website: https://www.weisslaw.co/news-and-cases/hr

Covetrus, Inc. (NASDAQ: CVET)

Weiss Law is investigating possible breaches of fiduciary duty and other violations of law by the board of directors of Covetrus, Inc. (NASDAQ: CVET), in connection with the proposed acquisition of CVET by funds affiliated with Clayton, Dubilier & Rice and TPG Capital. Under the terms of the merger agreement, CVET shareholders will receive $21.00 in cash for each share of CVET common stock owned. If you own CVET shares and wish to discuss this investigation or your rights, please call us at one of the numbers listed above or visit our website: https://www.weisslaw.co/news-and-cases/cvet

Watermark Lodging Trust, Inc. (OTC: WRMK)

Weiss Law is investigating possible breaches of fiduciary duty and other violations of law by the board of directors of Watermark Lodging Trust, Inc. (OTC: WRMK), in connection with the proposed acquisition of WRMK by funds managed by Brookfield. Under the terms of the merger agreement, WRMK shareholders will receive $6.768 in cash for each Class A share of WRMK common stock owned and $6.699 in cash for each Class T share of WRMK common stock owned. If you own WRMK shares and wish to discuss this investigation or your rights, please call us at one of the numbers listed above or visit our website: https://www.weisslaw.co/news-and-cases/wrmk

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/shareholder-alert-weiss-law-reminds-cmax-hr-cvet-and-wrmk-shareholders-about-its-ongoing-investigations-301568891.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/shareholder-alert-weiss-law-reminds-cmax-hr-cvet-and-wrmk-shareholders-about-its-ongoing-investigations-301568891.html

SOURCE Weiss Law

Mehr Nachrichten zur Healthcare Realty Trust Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.