L'Oréal: News release: "First Quarter 2020 Sales"

Clichy, 16 April 2020 at 6:00 p.m.

First Quarter 2020 Sales

Sales evolution: -4.8% 1

- Sales: 7.22 billion euros

- -4.8% like-for-like 1

- -5.0% at constant exchange rates

- -4.3% based on reported figures

- Resumption of business in China, +6.4% in first quarter 1

- Growth in e-commerce: +52.6% 2

- Active Cosmetics Division still posting double-digit growth

- All L’Oréal teams strongly mobilised

Commenting on the figures, Mr Jean-Paul Agon, Chairman and CEO of L'Oréal, said:

“In a situation marked by the expansion of the Covid-19 pandemic, which first appeared in China and has spread to the rest of the world, L’Oréal’s number one priority is to ensure the protection of its employees. The Group has also taken a large number of solidarity measures for its customers and partners, and is providing support to health authorities 3.

The first quarter of 2020 has seen a decline in the cosmetics market of around -8%. In these difficult circumstances, L’Oréal has succeeded in outperforming the market with sales at -4.8% like-for-like 1. The performances by Division are contrasted. The L’Oréal Luxe and Professional Products Divisions are the most impacted due to the closure of perfumeries, department stores and hair salons in many countries. The Consumer Products Division however has seen a more moderate decline, largely because the activity in mass-market retail has been maintained. Lastly, the Active Cosmetics Division is still posting double-digit growth, with the pharmacy channel still open, and a portfolio of brands that is adapted to the strong demand for health-related products.

All geographic Zones have progressively been impacted by the closure of sales outlets and the introduction of lockdown measures: first of all in China from January, and then in the rest of the world, particularly in Western Europe from the beginning of March, and in North America from the end of March. As for Travel Retail, it has been heavily impacted by the sharp restrictions on travel worldwide.

Note that China is already seeing an encouraging recovery in beauty product consumption.

E-commerce, a key growth driver for the Group, is growing at +52.6%, and now represents close to 20% of sales 2. The current crisis has led to a strong acceleration of the digital transformation on which L’Oréal is particularly well positioned thanks to its strength in e-commerce and its expertise in digital media, content and services which enrich the consumer experience.

In an environment that is evolving every day, lockdown measures will clearly continue to have a significant impact on the consumption of skincare and beauty products, and consequently on our business in the second quarter. However, as the example of China has shown, the current situation does not call into question consumers’ strong appetite for beauty products, which remains intact. The market should recover quickly as soon as measures to close sales outlets are lifted.

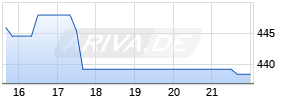

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in L'Oréal SA | ||

|

MB3XU1

| Ask: 8,60 | Hebel: 4,72 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

In this context L’Oréal’s fundamentals remain more relevant than ever. First of all, our strength rests on our balanced business model, with our presence in all distribution channels and all categories. In addition, the Group has already introduced very strict measures in terms of operational discipline, with a freeze on the worldwide headcount, a freeze on travel, a reduction in non-essential spending, and a thorough review of business drivers and investments. Furthermore, L’Oréal entered this period with a robust balance sheet, a high level of shareholders’ equity, a positive net cash situation, and with very substantial credit lines available. Finally, it is the outstanding talent and commitment of L’Oréal teams all over the world, and the agility of its organisation, which enable the company to adapt, country by country, to the constantly changing situation.

We are therefore confident in our ability to traverse this period of crisis in the best possible conditions and to reaccelerate as soon as conditions permit in each geographic Zone.”

First quarter 2020 sales

Like-for-like, i.e. based on a comparable scope of consolidation and constant exchange rates, the L’Oréal group sales were at -4.8%.

The net impact of changes in the scope of consolidation was -0.2%.

Evolution at constant exchange rates amounted to -5.0%.

Currency fluctuations had a positive impact of +0.7%. Extrapolating from the exchange rates on 31 March 2020, i.e. with €1 = $1.095 up to 31 December, the impact of currency fluctuations on sales for the full year 2020 would be approximately -1.0%.

Based on reported figures, the Group’s sales, at 31 March 2020, amounted to 7.22 billion euros, that is -4.3%.

Sales by Division and geographic Zone

| Quarterly sales | Evolution | |||

| € million | 1st quarter 2019 | 1st quarter 2020 | Like-for-like | Reported |

| By Division | ||||

| Professional Products | 835.3 | 751.1 | -10.5% | -10.1% |

| Consumer Products | 3,284.5 | 3,169.8 | -3.6% | -3.5% |

| L’Oréal Luxe | 2,679.6 | 2,464.4 | -9.3% | -8.0% |

| Active Cosmetics | 751.0 | 839.9 | +13.2% | +11.8% |

| Group total | 7,550.5 | 7,225.2 | -4.8% | -4.3% |

| By geographic Zone | ||||

| Western Europe | 2,169.0 | 1,997.7 | -7.7% | -7.9% |

| North America | 1,895.5 | 1,847.2 | -4.8% | -2.5% |

| New Markets, of which: | 3,486.0 | 3,380.3 | -2.9% | -3.0% |

| - Asia Pacific | 2,398.0 | 2,337.2 | -3.7% | -2.5% |

| - Latin America | 422.3 | 394.8 | +0.8% | -6.5% |

| - Eastern Europe | 483.5 | 479.6 | -1.4% | -0.8% |

| - Africa, Middle East | 182.1 | 170.7 | -5.6% | -6.3% |

| Group total | 7,550.5 | 7,225.2 | -4.8% | -4.3% |

Summary by Division

PROFESSIONAL PRODUCTS

At the end of March, the Professional Products Division is at -10.5% like-for-like and -10.1% reported.

After a good start to the year – particularly for its biggest brand, L’Oréal Professionnel, confirming that its transformation is paying off – the Professional Products Division saw its growth brake sharply in March, with the progressive closure of hair salons in many Zones, particularly in Europe and the United States. Kérastase posted growth in the first quarter, thanks to the launch of its new anti-hair loss range Genesis and the recovery of business in the Asia Zone, especially in China. The brand is also driven by the global dynamism of the Division’s e-commerce.

The historic partner of hairdressers, the Professional Products Division is committed to them more than ever in this current period, first by freezing the debts of small independent salons until they resume their activity, and second by stepping up its digital services, making its L’Oréal Access e-learning platform available to hairdressers. Thanks to digital activation, it is preparing and supporting hairdressers so they can resume business in the best possible conditions.

CONSUMER PRODUCTS

After a dynamic month of January maintaining the fourth quarter momentum, the Division posted a first quarter at -3.6% like-for-like and -3.5% reported.

The health crisis has had a widely contrasted impact on categories, distribution channels, regions and therefore brands. The category most affected is makeup, resulting in a clear temporary slowdown for Maybelline New York and NYX Professional Makeup, after a good start to the year. Facial skincare has also slowed, while in contrast facial cleansing, hygiene, hair care and above all home-use hair colour are accelerating, to the benefit of Garnier in particular in the final weeks of March in the Western countries. The current situation is favourable to convenience store food retail, and is rapidly accelerating the transition to e-commerce, where the Division recorded strong growth in the first quarter.

The Division has set itself three major priorities to combat the effects of the crisis and emerge from it stronger than before. First of all, the maximisation of e-commerce opportunities thanks to L’Oréal’s unique expertise in China and acceleration plans in place all over the world. Secondly, the adaptation of communication plans in the light of this new reality, by drawing on our digital leadership. The strength of our brands on social media enables us to adapt our content in real time, and to remain in close touch with our consumers while keeping costs under control. Thirdly, the strengthening of our action plans in categories where demand is accelerating and worldwide mobilisation to ensure the availability of our products.

L’ORÉAL LUXE

L’Oréal Luxe ended the quarter at -9.3% like-for-like and -8.0% reported, but was above the worldwide luxury beauty market, estimated at around -16%.

After a highly dynamic start across all geographic Zones, the Covid-19 crisis led to the closure of most brick-and-mortar and airport sales outlets in all of our major markets: Northern Asia and Travel Retail from February, and North America and Western Europe from March. This part of our business is therefore down sharply, while e-commerce on the other hand remains very buoyant, up by +57% 2 worldwide.

The category most affected by the crisis is makeup, while skincare and fragrances are proving more resilient, reflecting consumer demand for products linked to well-being and personal care. As a result, our big brands with a large proportion of skincare, such as Kiehl’s, Lancôme and Helena Rubinstein, are significantly outperforming the market. Our 2019 fragrance launches have maintained momentum, alongside our historic pillars, and have enabled our couture brands – Giorgio Armani, Yves Saint Laurent and Ralph Lauren – to resist well.

In the first quarter, the Division adapted very quickly to these new market conditions by reshaping and reallocating its business drivers across its digital ecosystem. It is counting in the short term on its strength in e-commerce across all Zones and on its leadership in China, where there are clear and encouraging signs of a recovery in consumption. As soon as conditions permit, it will be ready to grow once again, with a sustained and concentrated plan of major global launches in the second half of the year across the whole portfolio.

ACTIVE COSMETICS

Despite the health crisis that hit Asia and is spreading in Europe, the Active Cosmetics Division has performed very well, at +13.2% like-for-like and +11.8% reported.

Some two-thirds of the Division’s sales are through pharmacies and drugstores. These channels, whose main priority is to supply medicine, have remained open since the beginning of the crisis. This means that our major dermatological brands, particularly CeraVe and La Roche-Posay, are well positioned to meet consumer expectations for hygiene and daily skincare products.

The Division is growing in all geographic Zones. In Asia, double-digit growth is driven in particular by China, Japan and Australia. China has maintained a robust growth curve, despite the closure of department stores, thanks to the digital activation of our brands and the outperformance of e-commerce, the Division’s number one distribution channel. The great success of SkinCeuticals is confirmed. North America also remained extremely dynamic before the epidemic began, with double-digit growth rates for the SkinCeuticals and CeraVe brands. Western Europe, which has posted slight growth, has been impacted since March by the lower footfall in sales outlets, particularly in large urban pharmacies.

The Division has taken initiatives to accelerate the expansion of e-commerce.

The La Roche-Posay brand has been at the forefront of producing hand sanitiser gel and making it available to health professionals, hospitals, residential care homes for the elderly, and partner pharmacies.

Summary by geographic Zone

WESTERN EUROPE

In the first quarter the Western Europe Zone saw its sales decline by -7.7% like-for-like and by -7.9% reported.

Business was impacted by lockdown measures, and by the closure of hair salons and perfumeries in almost all countries in the Zone in March. Italy in particular has been adversely affected, and over recent weeks Spain and the United Kingdom. The Scandinavian countries, the Netherlands and Germany have been more resilient.

L’Oréal Luxe and the Professional Products Division in particular have been affected by the closure of sales outlets. The Consumer Products Division has been held back in makeup, but sell-out has accelerated in recent weeks in the haircare category and particularly in home-use hair colour. The Active Cosmetics Division has grown, thanks to the dynamism of La Roche-Posay and the strong acceleration of CeraVe.

The significant weight of e-commerce in Northern Europe and the United Kingdom has limited the impact of the closure of sales outlets. In this channel, L’Oréal can take advantage of the powerful reputation of its brands and from the investment made in digital over the last few years. The Southern countries are however benefiting less, due to the lower penetration of e-commerce and the saturation of our clients’ logistic capacities.

To make the most of the rebound as soon as it happens, each country has drawn up a dynamic commercial plan, with logistic capacities that will ensure good levels of service to our clients.

NORTH AMERICA

The North America Zone is at -4.8% like-for-like and -2.5% reported. Despite a good start to the year, business slowed sharply towards the end of March.

Selective and professional distribution are the sectors most affected by the closure of many sales outlets.

L’Oréal Luxe is mobilising all its resources to accelerate online sales both on its own brand websites and on its partners’ e-commerce websites. The Professional Products Division has launched a solidarity plan for hairdressers, has taken initiatives to modernise and digitalise its training, and is mobilising all its brands’ social media to enable interaction with hairdressers. The SalonCentric e-commerce platform also enables independent hairdressers to obtain supplies and continue their activities. Most mass-market retail outlets remain open. The Consumer Products Division is therefore adapting its commercial and activation plans to meet the needs of new home beauty trends. In particular it is seeing a sharp acceleration of its hair colour sales, bringing market share gains and reinforcing its leadership. The Division is modernising and accelerating the omni-channel experience with its distribution partners, as well as “click and collect”. The Active Cosmetics Division, despite a slowdown since mid-March, has posted strong double-digit growth, driven by all of its brands and especially by CeraVe at more than 40%. E-commerce too is growing very fast. Medical visits now take place remotely, encouraging online sales.

Faced with the current exceptional situation, all our teams are mobilised to reinvent the way we interact with consumers and to create new digital formats and connections.

NEW MARKETS

Asia Pacific: the Zone is at -3.7% like-for-like and -2.5% reported, with a quarter very contrasted geographically.

Mainland China

After a strong start to the year prior to the Chinese New Year break, the lockdown following the outbreak of Covid-19 led to the closure of many stores, and as a result had an impact on the business in February. The month of March showed progressive signs of recovery. L’Oréal was able to rebound quickly to achieve growth in March and a positive first quarter, gaining market share and reinforcing its leadership position on the beauty market. This rebound was due to the early restoration of operational capabilities in February, strict application of safety measures to ensure a safe working environment, as well as the rapid adjustment of activation plans in favour of Online and O+O (Online + Offline) activities. A strong bet on the Women’s Day Festival triggered the recovery. During this online festival, L’Oréal China gained significant market shares with a strong contribution from L’Oréal Paris, Lancôme, SkinCeuticals, Helena Rubenstein, 3CE Stylenanda and Kérastase.

In Asia Pacific, tourist markets were severely impacted due to the absence of Chinese shoppers. Other countries resisted at the beginning of the year, but from March were heavily impacted by lockdown causing business disruption in all markets. Nevertheless, Indonesia posted double-digit growth, and Australia is growing.

Skincare has been the most resilient category. The Active Cosmetics Division posted strong growth across the Zone, especially in China, Japan and Australia. The Professional Products Division was severely affected due to the closure of hair salons in all markets.

E-commerce continues to grow at more than 60%, especially in China, Japan, Australia, Thailand and Indonesia 2.

Latin America: the Zone is at +0.8% like-for-like and -6.5% reported. The quarter was contrasted with double-digit growth over the first two months and a sharp deceleration in March.

Brazil, Chile and Uruguay remained positive for the quarter. Mexico had mixed results. Columbia and Peru were heavily impacted by the closure of beauty stores and perfumeries.

The Professional Products and L’Oréal Luxe Divisions both declined due to the closure of malls and salons in the Zone. The Consumer Product Division was less heavily impacted and grew over the quarter in Brazil and Chile. Active Cosmetics maintained a strong rhythm of double-digit growth. By category, makeup and hair colour have slowed given the closure of many distribution channels, while skincare remains dynamic.

The Zone has quickly adapted to the environment with a strong focus on e-commerce, up by +45% 2.

Eastern Europe: The Zone is at -1.4% like-for-like and -0.8% reported. After a good start of the year, the month of March was impacted by lockdowns and store closures in many countries of Central Europe, as well as Israel, whilst countries such as Russia or Turkey have gone through partial shutdown. The Zone experienced a drop in sales as of mid-March. Turkey, Czech Republic, Romania and Ukraine remain positive. Food stores, pharmacies, convenience stores and hard discounters have remained open in many countries, however drug chains, perfumeries, luxury retail and hair salons have come to a stop.

In this context, the Zone is focused on e-commerce (e-retailers, pure players, our brands’ own websites) as well as food stores and pharmacies. In terms of categories, the Zone focuses on hair colour at home, haircare, face care and hygiene products.

Africa, Middle East: the Zone is at -5.6% like-for-like and -6.3% reported. Middle Eastern and North African countries were hit by lockdown measures in early March. The major malls in the Middle East have closed, food stores and pharmacies remain open. Saudi Arabia, Egypt and Pakistan posted strong growth. South Africa reacted with a complete shutdown in the last week of March, which has had an immediate and important impact on sales.

In the second quarter, the focus will be on e-commerce, food stores and pharmacies, as well as home-use hair colour, haircare and face care by category.

TRAVEL RETAIL

Despite an outstanding start to the year for our global brands, Lancôme, Giorgio Armani, Yves Saint Laurent, Kiehl’s and L’Oréal Paris, this channel ended the first quarter with a double-digit decrease 1.

The Travel Retail market has fallen in all geographic Zones following the progressive closure of airports and stores, and the standstill in air traffic. It should be stressed however the progressive reopening of stores in Northern Asia in particular. Note that the importance of our major fragrances has been confirmed, as well as skincare – especially dermocosmetics – in airport outlets.

L’Oréal, in close collaboration with duty free operators, is preparing for a gradual recovery by geographic Zone.

Covid-19: Overview of measures taken by the L’Oréal group

In view of the spread of the Covid-19 virus, L’Oréal’s absolute priority is to protect the health of its employees worldwide, while also ensuring that the Group provides all its help and solidarity wherever possible. A number of measures have therefore been taken, related to health, salaries and economic matters.

Health measures

- All the L’Oréal group factories worldwide equipped with a certified unit for handling alcohol and flammable substances (28 out of 39 factories) are today being used to produce hand sanitiser gel in Europe, the United States, Latin America, Asia and Africa. In all, some 2,400 tonnes of gel, representing more than 14 million units, will be produced by the end of May 2020.

- Moisturising hand creams have also been donated for the use of medical personnel.

- L’Oréal has mobilised its operational infrastructures in France and China and placed them at the disposal of the French authorities for ordering large quantities of medical equipment, including hundreds of respirators and tens of millions of masks, which will be transported to France in accordance with the government’s instructions.

- Numerous health initiatives have been set up in the countries where L’Oréal operates. In the United States, for example, the Group has donated more than one million dollars worth of hygiene and personal care products, and USD 250,000 to non-profit organisations providing emergency support across America to families suffering from financial or food insecurity. In Canada, L’Oréal has also made a donation totalling CAD 200,000, comprising both funding and hygiene products. In China, L’Oréal has donated RMB 5 million to the Chinese Red Cross for the purchase of emergency medical supplies.

Salary measures

- L’Oréal maintains jobs and salaries for all L’Oréal employees worldwide.

- In France, L’Oréal will not furlough employees between now and the end of June, even though in many fields of activity several categories of employees are at a partial or total standstill.

Economic measures and corporate citizenship

- All over the world, L’Oréal has chosen to help its small professional clients and small perfumeries to defer the payment of their debts in light of cash flow difficulties they may be facing, until their activities recover. L’Oréal has shortened the delay of payments to its most seriously affected suppliers.

- In France, the Group has given an undertaking that it will not postpone the payment of any social or tax charges (contributions, taxes, etc.) during this period.

L’Oréal Foundation

To contribute to the fight against the coronavirus pandemic and its consequences for the most vulnerable members of society, the L’Oréal Foundation has decided to donate one million euros to associations, some of which are already partners in the Foundation’s programmes, working in France to combat deprivation. The L’Oréal Foundation will also provide support to Emergency and Banco Alimentare in Italy.

Important events during the period 01/01/20 to 31/03/20

- On 26 February, L’Oréal was recognised as one of the World’s Most Ethical Companies by the Ethisphere Institute, a global leader in defining and advancing the ethical standards of business practices. This is the eleventh time that L’Oréal has achieved this recognition, underscoring its commitment to leading with integrity and prioritising ethical business practices.

- On 17 March, the 2019 Universal Registration Document was registered with the French Market Authorities. The Universal Registration Document comprises the annual financial report, an integrated report, the reports from the Auditors and their fees, and the information required for the share buy-back programme.

- On 30 March, the Board of Directors of L’Oréal held a meeting, and in view of exceptional circumstances linked to the Covid-19 epidemic, decided to postpone the Annual General Meeting, initially scheduled for 21 April, to 30 June 2020. The Board of Directors will in due course determine the arrangements to be made for the holding of the Meeting, as well as for the dividend and its date of payment.

- On 31 March, after obtaining the necessary authorisations from the relevant authorities, L’Oréal finalised the acquisition of the Mugler brands and Azzaro fragrances from Clarins Group, in accordance with the terms announced on 21 October 2019.

“This news release does not constitute an offer to sell, or a solicitation of an offer to buy L’Oréal shares. If you wish to obtain more comprehensive information about L’Oréal, please refer to the public documents registered in France with the Autorité des Marchés Financiers, also available in English on our Internet site www.loreal-finance.com.

This news release may contain some forward-looking statements. Although the Company considers that these statements are based on reasonable hypotheses at the date of publication of this release, they are by their nature subject to risks and uncertainties which could cause actual results to differ materially from those indicated or projected in these statements.”

This is a free translation into English of the First quarter 2020 sales news release issued in the French language and is provided solely for the convenience of English-speaking readers. In case of discrepancy, the French version prevails.

Contacts at L'Oréal

Individual shareholders and market authorities

Mr Jean Régis CAROF

Tel: +33 1 47 56 83 02

jean-regis.carof@loreal.com

Financial analysts and Institutional investors

Mrs Françoise LAUVIN

Tel: +33 1 47 56 86 82

francoise.lauvin@loreal.com

Journalists

Mme Domitille FAFIN

Tel: +33 1 47 56 76 71

domitille.fafin@loreal.com

Switchboard: +33 1 47 56 70 00

For more information, please contact your bank, broker or financial institution (I.S.I.N. code: FR0000120321), and consult your usual newspapers, the Internet site for shareholders and investors, www.loreal-finance.com or the L’Oréal Finance app, alternatively, call +33 1 40 14 80 50.

Appendix

L’Oréal group sales 2019/2020 (€ million)

| 2019 | 2020 | |

| First quarter | 7,550.5 | 7,225.2 |

| Second quarter | 7,261.0 | |

| First half total | 14,811.5 | |

| Third quarter | 7,182.8 | |

| Nine months total | 21,994.3 | |

| Fourth quarter | 7,879.3 | |

| Full year total | 29,873.6 |

www.loreal-finance.com - Follow us on Twitter @loreal

1 Like-for-like: based on a comparable scope of consolidation and constant exchange rates.

2 Sales achieved on our brands’ own websites + estimated sales achieved by our brands corresponding to sales through our retailers’ e-commerce websites (non-audited data).

3 The measures are detailed further in this article.

Attachment

Mehr Nachrichten zur L'Oréal SA Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.