Imation Corp. Sends Letter To Arlington Asset Shareholders Highlighting Urgent Need For Board Change

PR Newswire

NEW YORK, May 11, 2016

NEW YORK, May 11, 2016 /PRNewswire/ -- Imation Corp. ("Imation") (NYSE: IMN), a shareholder of Arlington Asset Investment Corp. ("Arlington" or the "Company") (NYSE: AI), today sent a letter to Arlington shareholders highlighting the need for significant and immediate Board change at Arlington.

The full text of the letter is below and available at www.RISEUPARLINGTON.com:

May 11, 2016

Dear Fellow Arlington Asset Shareholder:

THE VALUE OF YOUR INVESTMENT IN ARLINGTON ASSET IS AT RISK

Arlington Asset Investment Corp.'s ("Arlington Asset") annual meeting of shareholders is less than a month away and you have an important decision to make that will impact the value of your investment. As owners of Arlington's common stock, we cannot stand idly by and watch Arlington's board (the "Board") oversee a management team that squanders shareholder resources, consistently underperforms its peer group and broader market benchmarks, and executes ill-conceived strategies that threaten the Company's dividend, all while taking home millions in compensation.

It's clear to us that Arlington's incumbent, legacy directors are content with the status quo and incapable —or unwilling —to make the right choices or act in the best interests of all shareholders.

ARIVA.DE Börsen-Geflüster

Kurse

|

|

We strongly urge you to help protect value at Arlington by voting on the GOLD proxy card FOR the election of Imation's five director nominees to the Board — Scott R. Arnold, Barry L. Kasoff, Raymond C. Mikulich, Donald H. Putnam and W. Brian Maillian. Our highly-qualified, independent, shareholder-first nominees have the necessary expertise in the sophisticated and complex mortgage-backed securities ("MBS") and asset management arenas to make changes at Arlington for the benefit of ALL shareholders.

ARLINGTON HAS UNDERPERFORMED FOR YEARS AND MANAGEMENT COMPENSATION IS EXCESSIVE AND MISALIGNED

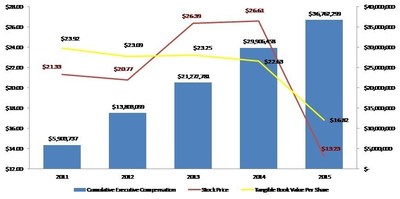

Arlington has significantly underperformed over the last five years both on an absolute and a relative basis and is suffering the consequences of a poorly thought-out and poorly executed hedging strategy. However, management continues to cash big checks.

Over the last five years, Arlington's stock price has plummeted 15.3% on a dividend adjusted basis. By comparison, over the same time frame, Arlington's self-selected peer group as listed in its 2016 proxy statement had a dividend adjusted performance of positive 40%.

Importantly, even as shareholder value has nosedived, Arlington's management and the Board have been richly compensated. During this same five-year period, total compensation for Arlington's named executive officers was $36.7 million and total Board compensation was $4.9 million. We believe this level of compensation is unwarranted, excessive and misaligned with shareholder interests. Notably, we believe Arlington's richly paid Board and management team have lost faith in their company – the current Board has sold nearly $15 million of Arlington stock at prices above $25 per share, and management and the Chairman of the Board have not purchased one share of Arlington stock in the open market in the last five years.

If elected, Imation's nominees pledge to overhaul the Company's compensation practices with an owner's eye to create true alignment of interest between management and shareholders. Additionally, unlike Arlington's current management and Board, we plan to put our money where our mouth is. If we receive a voice in the boardroom and approve the go-forward management structure and strategy at Arlington, we would be prepared to invest up to 15% of the outstanding stock at 1.0x tangible book value[i] to buy out shareholders or improve the balance sheet. This represents an investment of up to $60 million at a premium to current stock trading levels.

ARLINGTON'S HEDGE POSITION IS POOR AND ITS DIVIDEND IS NOT SUSTAINABLE

For supposedly being "experts" at developing investment strategies, we believe Arlington's ability to develop proper hedging strategies is laughable. In fact, Arlington's incumbent slate has no direct MBS investing experience outside of its management representatives. As a shareholder you must ask: How is the incumbent Board qualified to oversee management when they lack basic industry expertise? Case in point— Arlington's current hedged positions are failing miserably. At the end of the third quarter of 2015, Arlington reported a core short in the ten-year sector of the yield curve, as opposed to spreading out its hedging vehicles similar to the sensitivities of the MBS portfolio they were managing.

On the other hand, Imation's nominees collectively have decades of experience trading, structuring, hedging and investing in MBS, advising government sponsored entities that issue MBS and operating and serving as investment professionals in asset management. We are confident that, if elected, our nominees will be able to diversify Arlington's portfolio to yield higher returns and recalibrate the hedges to reduce investment losses.

Furthermore, while Arlington's dividend may appear attractive on its face, a simple close examination reveals that the dividend is in fact unsustainable at current levels. When claiming that the stock has performed well, the Company does not take into account dividends reinvested in the Company, which is how a long term shareholder evaluates performance. We believe dividends need to be looked at in conjunction with examining tangible book value or even stock price. The Company should pay dividends from its operating earnings; dividends should not just be a return of capital. We believe that under the Company's current dividend policy, a portion of the dividend represents a return of capital rather than a distribution from true economic earnings— essentially a strategy of Paul robbing Peter to pay Mary.

IMMEDIATE ACTION IS REQUIRED — NOW IS THE TIME FOR CHANGE AT ARLINGTON

As a fellow shareholder, we want you to understand the risks presently plague Arlington— leverage is too high, the ongoing dividend appears to be unsustainable and the hedge position has failed, costing you millions. Meanwhile, management continues to get rich with no accountability.

Imation is committed to changing Arlington for the better and investing significant capital for the benefit of all shareholders. We are taking this risk because we strongly believe our nominees have the skillset to reduce the risks that currently haunt Arlington and enhance returns at the Company.

As an investor, you are not required to continue to passively accept painful investment losses. Instead, VOTE THE GOLD PROXY CARD TODAY to elect Imation's nominees who pledge to articulate a superior strategy for Arlington to restore shareholder value.

The future of Arlington is in your hands. We urge you to VOTE THE GOLD PROXY CARD TODAY to elect Imation's nominees who we believe will effectively steward your investment at Arlington.

LEARN MORE AT www.RISEUPARLINGTON.com

Your Vote Is Important. No matter how many shares of Arlington you own, we urge you to vote your GOLD proxy today, to ensure that your instructions are received in a timely manner. Please vote by telephone or Internet by following the instructions on the enclosed gold proxy card or by signing, dating and mailing your card in the enclosed envelope.

If any of your shares of common stock are held in the name of a brokerage firm, bank, bank nominee or other institution, they can only vote your shares upon receipt of your specific instructions.

If you have any questions or require any additional information concerning the Arlington Asset Annual Meeting, please contact our proxy solicitor, Okapi Partners at:

| OKAPI PARTNERS |

Thank you for your support,

Joseph A. De Perio

Chairman of the Board, Imation Corp.

About Imation Corp.

Imation (NYSE: IMN) is a holding company that operates through a subsidiary engaged in global data storage and data security business. At the corporate level, there is an ongoing strategic review as Imation expects to seek and explore new opportunities that will allow it to pursue a diverse range of business opportunities and deploy its excess cash. For more information, visit www.imation.com.

IMATION CORP., ROBERT B. FERNANDER, CLINTON MAGNOLIA MASTER FUND, LTD., CLINTON GROUP, INC., JOSEPH A. DE PERIO, AND GEORGE E. HALL, SCOTT R. ARNOLD, BARRY L. KASOFF, W. BRIAN MAILLIAN, RAYMOND C. MIKULICH, AND DONALD H. PUTNAM (COLLECTIVELY, THE "PARTICIPANTS") HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC") A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM THE SHAREHOLDERS OF ARLINGTON ASSET INVESTMENT CORP., INC. (THE "COMPANY") FOR USE AT THE COMPANY'S 2016 ANNUAL MEETING OF SHAREHOLDERS (THE "PROXY SOLICITATION"). ALL SHAREHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE PROXY SOLICITATION BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE COMPANY'S SHAREHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV/.

INFORMATION ABOUT THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS IS CONTAINED IN THE DEFINITIVE PROXY STATEMENT ON SCHEDULE 14A FILED BY IMATION WITH THE SEC ON MAY 4, 2016. THIS DOCUMENT CAN BE OBTAINED FREE OF CHARGE FROM THE SOURCE INDICATED ABOVE.

[i] The Company's tangible book value was $14.45 per share as of 3/31/2016 according to the Company's Quarterly Report on Form 10-Q filed with the SEC on May 10, 2016.

Photo - http://photos.prnewswire.com/prnh/20160510/366262

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/imation-corp-sends-letter-to-arlington-asset-shareholders-highlighting-urgent-need-for-board-change-300266651.html

SOURCE Imation Corp.

Mehr Nachrichten zur GlassBridge Enterprises Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.