HAGENS BERMAN, NATIONAL TRIAL ATTORNEYS, Files Securities Class Action Complaint against Aurora Cannabis (ACB) and Its Senior Executives Extending Period of Alleged False Statements: Firm Urges Aurora Cannabis (ACB) Investors With $500k+ Losses To Contact Its Attorneys As Application Deadline Looms

PR Newswire

SAN FRANCISCO, Jan. 12, 2020

SAN FRANCISCO, Jan. 12, 2020 /PRNewswire/ -- Hagens Berman has filed a class action Complaint on behalf of investors in Aurora Cannabis Inc. (NYSE: ACB). The firm urges ACB investors who have suffered losses in excess of $500,000 to submit their losses now to learn if they qualify to recover their investment losses.

| Class Period: Oct. 23, 2018 - Jan. 6, 2020 | |

| Lead Plaintiff Deadline: Jan. 21, 2020 | |

| Sign Up: www.hbsslaw.com/investor-fraud/ACB | |

| Contact An Attorney Now: | |

| | 844-916-0895 |

Hagens Berman's Aurora Cannabis (ACB) Securities Class Action:

The Complaint is brought on behalf of all investors who purchased or otherwise acquired Aurora Cannabis securities during the Expanded Class Period – between Oct. 23, 2018 and Jan. 6, 2020, inclusive. The Complaint, filed in the United States District Court for the Southern District of New York and captioned Eaton v. Aurora Cannabis Inc., et al., (Case No. 1:20-cv-00274), pursues claims against the Defendants under the Securities Exchange Act of 1934 (the "Exchange Act").

According to the detailed Complaint filed by Hagens Berman, throughout the Extended Class Period, Defendants made materially false and misleading statements regarding the Company's business, operational and compliance policies. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) Aurora had exaggerated and/or overestimated the demand for and potential market for its consumer use cannabis products; (ii) as a result, Aurora was overproducing consumer use cannabis products, leading to construction and production inefficiencies as well as the oversupply of products to its non-warehouse and warehouse customers; (iii) Aurora was utilizing an unpermitted, proprietary form of treatment in the production process of its medical Cannabis geared to obtain a longer shelf life of the products, which violates German law mandating that companies receive special permission to distribute medical products exposed to ionizing irradiation; and (iv) all of the foregoing was reasonably likely to have a material negative impact on the Company's financial results.

The Complaint alleges that the truth emerged through a series of disclosures occurring between Oct. 23, 2018 and Jan. 6, 2020, when the Company announced that it would be selling one of its largest greenhouses to raise cash.

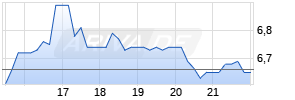

As a result of these disclosures, the value of Aurora stock has consistently decreased, damaging investors.

"We're focused on recovering investors' losses and proving Aurora misled investors about its operations and growth initiatives," said Reed Kathrein, the Hagens Berman partner leading the investigation.

If you purchased shares of Aurora stock and suffered significant losses, click here to discuss your legal rights with Hagens Berman.

Lead Plaintiff Process: The Private Securities Litigation Reform Act of 1995 permits any investor who purchased Aurora securities during the Expanded Class Period to seek appointment as lead plaintiff. A lead plaintiff acts on behalf of all other class members in directing the litigation. The lead plaintiff can select a law firm of its choice. An investor's ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Whistleblowers: Persons with non-public information regarding Aurora should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email ACB@hbsslaw.com.

About Hagens Berman

Hagens Berman is a national law firm with nine offices in eight cities around the country and eighty attorneys. The firm represents investors, whistleblowers, workers and consumers in complex litigation. More about the firm and its successes is located at hbsslaw.com. For the latest news visit our newsroom or follow us on Twitter at @classactionlaw.

Contact:

Reed Kathrein, 844-916-0895

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/hagens-berman-national-trial-attorneys-files-securities-class-action-complaint-against-aurora-cannabis-acb-and-its-senior-executives-extending-period-of-alleged-false-statements-firm-urges-aurora-cannabis-acb-investors-with-300985367.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/hagens-berman-national-trial-attorneys-files-securities-class-action-complaint-against-aurora-cannabis-acb-and-its-senior-executives-extending-period-of-alleged-false-statements-firm-urges-aurora-cannabis-acb-investors-with-300985367.html

SOURCE Hagens Berman Sobol Shapiro LLP

Mehr Nachrichten zur Aurora Cannabis Inc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.