Got Paycheck? Consider Disability Insurance.

PR Newswire

RADNOR, Pa., May 7, 2013

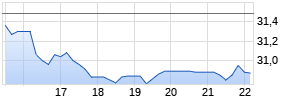

RADNOR, Pa., May 7, 2013 /PRNewswire/ -- May is Disability Insurance Awareness Month, and Lincoln Financial Group (NYSE:LNC) is joining the industry and Council for Disability Awareness (CDA) – an organization dedicated to raising awareness about the risks and consequences of disability – to encourage the public to take charge of their financial security by better understanding the role disability insurance can play in protecting their income, families and business.

Disability insurance is intended to replace or supplement income while employees are out of the workplace due to a covered disabling injury or illness, and can be critical in helping address basic physical needs and daily living expenses.

"If you receive a paycheck, you should strongly consider purchasing adequate disability insurance," said Rob Grubka, president, Group Protection, Lincoln Financial Group. "A disabling illness or injury can prevent you from working and earning a paycheck – and that's a financial risk most of us cannot afford to take. The financial impact of a disability can be devastating, and that is why we recommend you consider income protection as a critical part of your financial plan."

Lincoln is dedicated to developing educational materials, resources, interactive tools and ongoing guidance to support individuals in making informed decisions about protecting their future – such as purchasing disability insurance. Recently, Lincoln launched Lincoln for Living, or LincolnforLiving.com – an innovative website that offers consumers an inventive way to connect to their benefits by using their lifestyle to guide benefit education. The website takes a two-prong approach to benefit education, using information specific to designated life stages alongside a digital tool library.

In addition, Lincoln, a founding member of the CDA, joined forces with other CDA member companies in 2012 to support the Defend Your Income movement — an educational program designed to unite consumers, advisors, employers and insurers in the fight to protect the incomes of working Americans from the financial risk caused by illness and injury. The hub of the Defend Your Income program, which can be accessed at http://www.defendyourincome.org, is a highly engaging web experience, set in a martial arts dojo. The site engages visitors/players to actively learn how to defend their income by meeting their "attackers" and learning about the top threats to their income. Visitors fight off those attackers in the interactive game — and through a series of quizzes, they can also earn their "black belt" in Income Defense. Visitors can also calculate their own Earnable Income Quotient (EIQ) to see their lifetime income-earning potential, and what's at stake.

"Many people in today's workforce don't think about disability until an illness or injury prevents them from working, "said Eric Reisenwitz, senior vice president, Group Protection Market Solutions, Lincoln Financial Group. "Now is the perfect time – during Disability Insurance Awareness Month – for people to perform a disability insurance "reality check" by reviewing their current benefits and consider what changes, if any, they may want to make in order to protect their income in the event that a disabling event or disease keeps them out of work for an extended period of time,"

About Lincoln Financial Group Lincoln Financial Group is the marketing name for Lincoln National Corporation (NYSE:LNC) and its affiliates. With headquarters in the Philadelphia region, the companies of Lincoln Financial Group had assets under management of $186 billion as of March 31, 2013. Through its affiliated companies, Lincoln Financial Group offers: annuities; life, group life, disability and dental insurance; employer-sponsored retirement plans; savings plans; and comprehensive financial planning and advisory services. For more information, including a copy of our most recent SEC reports containing our balance sheets, please visit www.lincolnfinancial.com.

(Logo: http://photos.prnewswire.com/prnh/20050830/LFLOGO)

SOURCE Lincoln Financial Group

Mehr Nachrichten zur Lincoln National Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.