Excellent first half for LVMH

Paris, 24 July 2019

LVMH Moët Hennessy Louis Vuitton, the world’s leading luxury products group, recorded revenue of 25.1 billion euros in the first half of 2019, up 15%. Organic sales growth was 12% compared to the same period in 2018.

In the second quarter, revenue increased by 15% compared to the same period in 2018. Organic revenue growth was 12%, a performance in line with the trends of the beginning of the year. The United States, Asia and Europe saw good growth with, in particular, a rebound in France in the second quarter.

Profit from recurring operations was € 5 295 million for the first half of 2019, an increase of 14%. Operating margin reached 21.1%, broadly in-line with the first half of 2018. Group share of net profit amounted to € 3 268 million, an increase of 9%.

Bernard Arnault, Chairman and CEO of LVMH, said: "LVMH has made an excellent start to the year. These results once again illustrate the effectiveness of our strategy and the exceptional desirability of our Maisons, whose products transcend time. Their constant demand for quality and their consistently refreshed creativity are key to LVMH's success, always guided by a long-term vision, combining exemplarity and responsibility in all the company's actions. Despite buoyant demand, we will continue to manage costs and remain vigilant into the second half of the year. We are therefore entering the second half of the year with confidence and count on the talent of our teams and their shared entrepreneurial passion to further increase, once again in 2019, our leadership in the world of high-quality products."

Highlights of the first half of 2019 include:

- Further double-digit increases in revenue and profit from recurring operations,

- Strong growth in Asia, the United States and Europe, particularly in France, which saw a rebound in the second quarter,

- Good start to the year for Wines and Spirits,

- Remarkable momentum at Louis Vuitton where profitability remains at an exceptional level,

- Remarkable performance of Christian Dior Couture,

- Rapid progress of LVMH’s perfumes and cosmetics flagship brands,

- Good progress in jewelry, in particular for Bvlgari,

- Sephora's strong revenue growth in stores and online,

- Solid progress of DFS, particularly in Europe, benefiting from the rise in international travelers,

- The completion in April of the acquisition of the Belmond hotel group, whose activity will be consolidated in the third quarter of 2019,

- Announcement of the agreement with Stella McCartney House,

- Operating free cash flow of €1.7 billion,

- Net debt to equity ratio (“gearing”) of 24.5% as at the end of June 2019.

Key figures

| Euro millions | First half 2018 | First half 2019* | % change |

| Revenue | 21 750 | 25 082 | + 15 % |

| Profit from recurring operations | 4 648 | 5 295 | + 14 % |

| Group share of net profit | 3 004 | 3 268 | + 9 % |

| Cash from operations before changes in working capital | 5 464 | 7 399 | n.a |

| Net cash from operating activities | 3 161 | 4 189 | n.a |

| Net Financial debt | 7 359 | 8 684 | + 18 % |

| Total equity | 31 482 | 35 390 | + 12 % |

* Incorporating for the first time the effects of the application of IFRS 16 Leases.

Revenue by business group

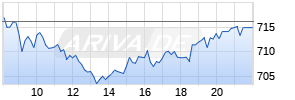

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in LVMH - Moet Hennessy Louis Vuitton SE | ||

|

UL38V4

| Ask: 1,70 | Hebel: 6,48 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

| Euro millions | First half 2018 | First half 2019 | % change Reported Organic* | |

| Wines & Spirits | 2 271 | 2 486 | + 9 % | + 6 % |

| Fashion & Leather Goods | 8 594 | 10 425 | + 21 % | + 18 % |

| Perfumes & Cosmetics | 2 877 | 3 236 | + 12 % | + 9 % |

| Watches & Jewelry | 1 978 | 2 135 | + 8 % | + 4 % |

| Selective Retailing | 6 325 | 7 098 | + 12 % | + 8 % |

| Other activities and eliminations | (295) | (298) | - | - |

| Total LVMH | 21 750 | 25 082 | + 15 % | + 12 % |

* With comparable structure and constant exchange rates. The currency effect for the Group is + 3%.

Profit from recurring operations by business group:

| Euro millions | First half 2018 | First half 2019* | % change |

| Wines & Spirits | 726 | 772 | + 6 % |

| Fashion & Leather Goods | 2 775 | 3 248 | + 17 % |

| Perfumes & Cosmetics | 364 | 387 | + 6 % |

| Watches & Jewelry | 342 | 357 | + 5 % |

| Selective Retailing | 612 | 714 | + 17 % |

| Other activities and eliminations | (171) | (183) | - |

| Total LVMH | 4 648 | 5 295 | + 14 % |

* Incorporating for the first time the effects of the application of IFRS 16 Leases.

Wines & Spirits: strong momentum in China and the United States

The Wines & Spirits business recorded organic revenue growth of 6%. Profit from recurring operations increased by 6%. The business group pursued its value strategy based on a strong policy of innovation and targeted investments in communication. The momentum was particularly strong in the United States, Asia and emerging markets. In the Champagne business, prestige vintages saw strong growth, while the price increase policy continued throughout the range. Hennessy cognac, which recorded solid growth, became the leading international premium spirits brand. The acquisition of Château du Galoupet, a prestige Côtes-de-Provence classified vintage wine, marks LVMH's entry into quality rosé wines.

Fashion & Leather Goods: exceptional performances at Louis Vuitton and Christian Dior

The Fashion & Leather Goods business group recorded organic revenue growth of 18%. Profit from recurring operations was up 17%. Louis Vuitton achieved remarkable growth in all its businesses and in all regions. The iconic lines and new creations equally contributed to the continued revenue growth. Of note during the first half were the Men’s and Women’s fashion shows which were enthusiastically received. Christian Dior had a remarkable performance during the first half. The new line, 30 Montaigne, which is a great success, illustrates the timeless elegance and savoir-faire of the Maison. An exceptional new store on the Champs-Elysées in Paris has temporarily taken over from the historic address of Avenue Montaigne, which is undergoing major renovations. Fendi celebrated Karl Lagerfeld's 54 years with the Maison and the Fendi family at several fashion shows which paid tribute to the designer. Celine is beginning to roll out its new store concept. The fashion shows presented in the first half, which were very well received, reflected the new identity of the Maison. Loro Piana recorded steady growth with, in particular, the success of a new personalized shoe service and a temporary boutique in New York. Loewe had an excellent performance, driven in particular by the success of its new collections. Rimowa had a very good start to the year. The other Maisons were further strengthened.

Perfumes & Cosmetics: excellent growth of flagship brands and rapid progress in Asia

The Perfumes & Cosmetics business group recorded organic revenue growth of 9%, mainly driven by the performance of flagship brands. Profit from recurring operations was up 6%. Parfums Christian Dior maintained strong momentum, driven by the vitality of its iconic perfumes and the rapid progress of its makeup and skincare lines. Guerlain had an excellent start to the year. Its iconic Rouge G lipstick and Abeille Royale skincare line were particularly strong. Guerlain's launch of the first digital transparency and product traceability platform was a highlight of the first half. Parfums Givenchy benefited from its rapid progress in makeup and the good performance of its L'Interdit perfume. Benefit continued to grow its Eyebrow collection while Fresh continued its expansion in China.

Watches & Jewelry: good growth of Bvlgari and further repositioning of TAG Heuer

The Watches & Jewelry business recorded organic revenue growth of 4%, driven by jewelry. Profit from recurring operations was up 5%. Bvlgari made good progress in its stores and continued to gain market share. The iconic lines Serpenti, B.Zero1, Diva and Fiorever contributed to this performance. Its new high-end jewelry collection, Cinemagia, presented in June in Capri, was very well received. At Chaumet, the success of its Bee My Love collection and its iconic Liens and Josephine lines were the main growth drivers of the Maison. TAG Heuer continued to focus on its flagship lines, while Hublot continued to actively grow and develop its store network. The organisation of the first exhibition of the LVMH Swiss watch Maisons was announced for January 2020 in Dubai.

Selective Retailing: Strong growth at Sephora and sustained development of DFS in Europe

The Selective Retailing business group achieved organic revenue growth of 8%. Profit from recurring operations was up 17%. Sephora recorded strong revenue growth and gained market share in all of its locations. Already present in 34 countries, the brand continued to expand its store network while online sales advanced rapidly. Le Bon Marché continued to cultivate its unique identity and the exclusivity of its product offering. DFS performed very well in the Venice Galleria, its first European location. Although a slowdown in demand has been observed in Hong Kong and Macao over the past few months, DFS's performance in these markets was good in the first half.

Outlook 2019

In the buoyant environment of the beginning of this year, albeit marked by geopolitical uncertainties, LVMH will continue to pursue gains in market share through the numerous product launches planned before the end of the year and its geographic expansion in promising markets, while continuing to manage costs.

Our strategy of focusing on the highest quality across all our activities, combined with the dynamism and unparalleled creativity of our teams, will enable us to reinforce LVMH’s global leadership position in luxury goods once again in 2019.

An interim dividend of € 2.20 will be paid on December 10th, 2019.

Regulated information related to this press release, the half year results presentation and the half year financial statement are available on our internet site www.lvmh.com

Limited review procedures have been carried out, the related report will be issued following the Board meeting.

ANNEX

LVMH – Revenue by business group and by quarter

Revenue first half 2019 (Euro millions)

| 2019 | Wines & Spirits | Fashion & Leather Goods | Perfumes & Cosmetics | Watches & Jewelry | Selective Retailing | Other activities and eliminations | Total |

| First quarter | 1 349 | 5 111 | 1 687 | 1 046 | 3 510 | (165) | 12 538 |

| Second quarter | 1 137 | 5 314 | 1 549 | 1 089 | 3 588 | (133) | 12 544 |

| First half | 2 486 | 10 425 | 3 236 | 2 135 | 7 098 | (298) | 25 082 |

Revenue first half 2019 (organic growth compared to the first half of 2018)

| 2019 | Wines & Spirits | Fashion & Leather Goods | Perfumes & Cosmetics | Watches & Jewelry | Selective Retailing | Other activities and eliminations | Total |

| First quarter | +9% | +15% | +9% | +4% | +8% | - | +11% |

| Second quarter | +4% | +20% | +10% | +4% | +7% | - | +12% |

| First half | +6% | +18% | +9% | +4% | +8% | - | +12% |

Revenue first half 2018 (Euro millions)

| 2018 | Wines & Spirits | Fashion & Leather Goods | Perfumes & Cosmetics | Watches & Jewelry | Selective Retailing | Other activities and eliminations | Total |

| First quarter | 1 195 | 4 270 | 1 500 | 959 | 3 104 | (174) | 10 854 |

| Second quarter | 1 076 | 4 324 | 1 377 | 1 019 | 3 221 | (121) | 10 896 |

| First half | 2 271 | 8 594 | 2 877 | 1 978 | 6 325 | (295) | 21 750 |

Alternative performance measures

For the purposes of its financial communication, in addition to the accounting aggregates defined by IAS / IFRS, LVMH uses alternative performance measures established in accordance with the AMF's position DOC-2015-12.

The table below lists these measures and the reference to their definition and their reconciliation with the aggregates defined by IAS / IFRS in published documents.

| Measures | Reference to published documents |

| Operating free cash flow | IFR (condensed consolidated interim financial statements, consolidated cash flow statement) |

| Net financial debt | RD (Note 1.20 of the appendix to the consolidated financial statements) IFR (note 19 of the appendix to the consolidated financial statements) |

| Gearing | IFR (Part 7, Comments on Consolidated Balance Sheet) |

| Organic growth | IFR (Part 1, Comments on the Consolidated Income Statement) |

IFR: Interim Financial Report as of June 30, 2019

RD: 2018 Reference Document

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in Wines and Spirits by a portfolio of brands that includes Moët & Chandon, Dom Pérignon, Veuve Clicquot Ponsardin, Krug, Ruinart, Mercier, Château d’Yquem, Domaine du Clos des Lambrays, Château Cheval Blanc, Colgin Cellars, Hennessy, Glenmorangie, Ardbeg, Belvedere, Woodinville, Volcán de Mi Tierra, Chandon, Cloudy Bay, Terrazas de los Andes, Cheval des Andes, Cape Mentelle, Newton, Bodega Numanthia and Ao Yun. Its Fashion and Leather Goods division includes Louis Vuitton, Christian Dior Couture, Celine, Loewe, Kenzo, Givenchy, Pink Shirtmaker, Fendi, Emilio Pucci, Marc Jacobs, Berluti, Nicholas Kirkwood, Loro Piana, RIMOWA, Patou and Fenty. LVMH is present in the Perfumes and Cosmetics sector with Parfums Christian Dior, Guerlain, Parfums Givenchy, Kenzo Parfums, Perfumes Loewe, Benefit Cosmetics, Make Up For Ever, Acqua di Parma, Fresh, Fenty Beauty by Rihanna and Maison Francis Kurkdjian. LVMH's Watches and Jewelry division comprises Bvlgari, TAG Heuer, Chaumet, Dior Watches, Zenith, Fred and Hublot. LVMH is also active in selective retailing as well as in other activities through DFS, Sephora, Le Bon Marché, La Samaritaine, Groupe Les Echos, Cova, Le Jardin d’Acclimatation, Royal Van Lent, Belmond and Cheval Blanc hotels.

“This document may contain certain forward looking statements which are based on estimations and forecasts. By their nature, these forward looking statements are subject to important risks and uncertainties and factors beyond our control or ability to predict, in particular those described in LVMH’s Reference Document which is available on the website (www.lvmh.com). These forward looking statements should not be considered as a guarantee of future performance, the actual results could differ materially from those expressed or implied by them. The forward looking statements only reflect LVMH’s views as of the date of this document, and LVMH does not undertake to revise or update these forward looking statements. The forward looking statements should be used with caution and circumspection and in no event can LVMH and its Management be held responsible for any investment or other decision based upon such statements. The information in this document does not constitute an offer to sell or an invitation to buy shares in LVMH or an invitation or inducement to engage in any other investment activities.”

LVMH CONTACTS

| Analysts and investors Chris Hollis LVMH + 33 1 4413 2122 | Media Jean-Charles Tréhan LVMH + 33 1 4413 2620 |

| MEDIA CONTACTS | |

| France Brune Diricq / Charlotte Mariné Publicis Consultants + 33 1 44 82 47 20 | France Michel Calzaroni / Olivier Labesse / Hugues Schmitt / Thomas Roborel de Climens DGM Conseil + 33 1 40 70 11 89 |

| Italy Michele Calcaterra, Matteo Steinbach SEC and Partners + 39 02 6249991 | UK Hugh Morrison, Charlotte McMullen Montfort Communications + 44 7921 881 800 |

| US James Fingeroth, Molly Morse, Anntal Silver Kekst & Company + 1 212 521 4800 | China Daniel Jeffreys Deluxewords +44 772 212 6562 |

Attachment

Mehr Nachrichten zur LVMH - Moet Hennessy Louis Vuitton SE Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.