Eaton Vance Closed-End Municipal Bond Funds Declare Monthly Distributions

PR Newswire

BOSTON, May 30, 2014

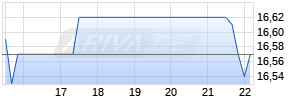

BOSTON, May 30, 2014 /PRNewswire/ -- Eaton Vance Management, the Boston-based investment adviser, today announced the monthly distributions declared on the common shares of thirteen of its closed-end municipal bond funds (the "Funds"). The record date for the distributions is June 23, 2014, and the payable date is June 30, 2014. The ex-date is June 19, 2014. The distribution per share, closing market price on May 29, 2014 (or last trade price), and annualized market yield for each Fund are as follows:

| | Distribution | Closing | Annualized | ||||||||||||||

| Fund | Per Share | Market Price ARIVA.DE Börsen-GeflüsterKurse

| Yield | ||||||||||||||

| Eaton Vance Municipal Bond Fund (NYSE MKT: EIM) | $0.063835 | $12.57 | 6.09% | ||||||||||||||

| Eaton Vance Municipal Bond Fund II (NYSE MKT: EIV) | $0.063124 | $12.49 | 6.06% | ||||||||||||||

| Eaton Vance California Municipal Bond Fund (NYSE MKT: EVM) | $0.054500 | $11.72 | 5.58% | ||||||||||||||

| Eaton Vance California Municipal Bond Fund II (NYSE MKT: EIA) | $0.060916 | $12.31 | 5.94% | ||||||||||||||

| Eaton Vance Massachusetts Municipal Bond Fund (NYSE MKT: MAB) | $0.063333 | $14.19 | 5.36% | ||||||||||||||

| Eaton Vance Michigan Municipal Bond Fund (NYSE MKT: MIW) | $0.060749 | $13.26 | 5.50% | ||||||||||||||

| Eaton Vance New Jersey Municipal Bond Fund (NYSE MKT: EMJ) | $0.058333 | $13.00 | 5.38% | ||||||||||||||

| Eaton Vance New York Municipal Bond Fund (NYSE MKT: ENX) | $0.057333 | $12.61 | 5.46% | ||||||||||||||

| Eaton Vance New York Municipal Bond Fund II (NYSE MKT: NYH) | $0.057250 | $12.63 | 5.44% | ||||||||||||||

| Eaton Vance Ohio Municipal Bond Fund (NYSE MKT: EIO) | $0.058500 | $12.62 | 5.56% | ||||||||||||||

| Eaton Vance Pennsylvania Municipal Bond Fund (NYSE MKT: EIP) | $0.064417 | $13.21 | 5.85% | ||||||||||||||

| Eaton Vance National Municipal Opportunities Trust (NYSE: EOT) | $0.085834 | $20.14 | 5.11% | ||||||||||||||

| Eaton Vance Municipal Income Term Trust (NYSE: ETX) | $0.070833 | $17.03 | 4.99% |

The amount of monthly distributions may vary depending on a number of factors. As portfolio and market conditions change, the rate of distributions on the Funds' common shares could change.

The Funds are managed by Eaton Vance Management, a subsidiary of Eaton Vance Corp. (NYSE: EV), based in Boston, one of the oldest investment management firms in the United States, with a history dating back to 1924. Eaton Vance and its affiliates managed $285.9 billion in assets as of April 30, 2014, offering individuals and institutions a broad array of investment strategies and wealth management solutions. The Company's long record of providing exemplary service and attractive returns through a variety of market conditions has made Eaton Vance the investment manager of choice for many of today's most discerning investors. For more information about Eaton Vance, visit www.eatonvance.com.

Shares of closed-end funds often trade at a discount from their net asset value. The market price of Fund shares may vary from net asset value based on factors affecting the supply and demand for shares, such as Fund distribution rates relative to similar investments, investors' expectations for future distribution changes, the clarity of the Fund's investment strategy and future return expectations, and investors' confidence in the underlying markets in which the Fund invests. Fund shares are subject to investment risk, including possible loss of principal invested. No Fund is a complete investment program and you may lose money investing in a Fund. An investment in a Fund may not be appropriate for all investors. Before investing, prospective investors should consider carefully the Fund's investment objective, risks, charges and expenses.

SOURCE Eaton Vance Management

Mehr Nachrichten zur Eaton Vance Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.