DirectBooks Continues Platform Expansion to Include Euro and Sterling Investment Grade Deals

PR Newswire

LONDON and NEW YORK, April 19, 2021

Announces Appointment of Head of Europe

LONDON and NEW YORK, April 19, 2021 /PRNewswire/ -- DirectBooks™, the capital markets consortium founded to optimize global financing markets, today announced the launch of Euro and Sterling Investment Grade deal announcements on the DirectBooks platform. The DirectBooks platform launched in Q4 2020 with deal announcement functionality for U.S. Dollar Investment Grade issuances globally, with a common set of structured deal data and document access for institutional investors.

As part of its European expansion, DirectBooks also announced the appointment of Duncan Phillips as Managing Director and Head of Europe. Duncan will be based in London and will lead the UK office, as well as the development of a cross-functional European team.

Duncan previously worked at Citi for 15 years, with Debt Syndicate roles in London, Tokyo, and Hong Kong. He later held executive roles as Global Head of Capital Markets at Ipreo and Chief Commercial Officer at Nivaura, a London-based start-up focused on capital markets workflow automation.

"The addition of Euro and Sterling deal announcements to the platform is another critical step in the evolution of the DirectBooks offering," said DirectBooks CEO, Rich Kerschner. "We are also excited to continue the growth of our company with the addition of Duncan to lead our UK office and European expansion."

"I am delighted to be joining DirectBooks at this important point in the platform's development," said Duncan Phillips. "I look forward to building the team and working with our buy-side and sell-side community to evolve the primary issuance workflow."

DirectBooks is simplifying the primary issuance process for fixed income by streamlining communications workflows for underwriters and institutional investors. The platform will continue to expand with the capability to optimize the communications of order and allocation information, as well as hedging instructions. High Yield and Emerging Markets issuances will be added to the platform later this year.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Bank of America | ||

|

VM6X80

| Ask: 0,66 | Hebel: 7,06 |

| mit moderatem Hebel |

Zum Produkt

| |

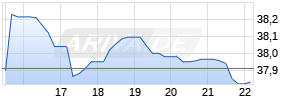

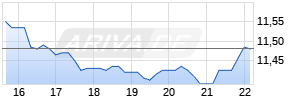

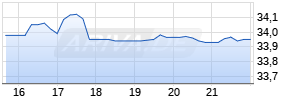

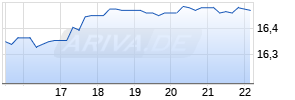

Kurse

|

|

|

|

|

|

|

|

|

ABOUT DIRECTBOOKS

DirectBooks leverages its technology expertise and market knowledge to optimize global financing markets. We are simplifying the primary issuance process for fixed income by streamlining communications workflows for underwriters and institutional investors. DirectBooks was formed by 9 global banks, consisting of Bank of America (NYSE:BAC), Barclays (NYSE:BCS), BNP Paribas (FR:BNP), Citi (NYSE:C), Deutsche Bank (NYSE:DB), Goldman Sachs (NYSE:GS), J.P. Morgan (NYSE:JPM), Morgan Stanley (NYSE:MS), Wells Fargo (NYSE:WFC). A complete list of participating banks can be found on our website. For additional information, please visit www.DirectBooks.com.

MEDIA CONTACT:

Chris Rodriguez

Chris.Rodriguez@DirectBooks.com

(848) 888-7704

Logo - https://mma.prnewswire.com/media/1178546/DirectBooks_Logo.jpg

Mehr Nachrichten zur Deutsche Bank Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.