Clariant continued to grow sales despite a slow start in Plastic & Coatings

Clariant AG / Clariant continued to grow sales despite a slow start in Plastic & Coatings . Processed and transmitted by West Corporation. The issuer is solely responsible for the content of this announcement.

| |

"In the first three months of this year, Clariant delivered continued organic sales growth despite the challenging macroeconomic environment," said Ernesto Occhiello, CEO of Clariant. "Our focus on customer experience and fast, reliable customer fulfillment is particularly noticeable in the progression of the Business Areas Care Chemicals, Catalysis and Natural Resources. Despite Plastics & Coatings being negatively impacted by the current economic and business environments, we are confident in our ability to progress throughout the year. We will continue to identify and address the next challenges and future demands of our customers, leading to above-market growth, higher profitability and stronger cash generation."

Key Financial Data

| First Quarter | ||||||||

| in CHF million | 2019 | 2018 | % CHF | % LC | ||||

| Sales | 1 715 | 1 722 | 0 | 2 | ||||

| EBITDA before exceptional items | 254 | 268 | -5 | |||||

| - margin | 14.8 % | 15.6 % | ||||||

| EBITDA after exceptional items | 236 | 256 | -8 | |||||

| - margin | 13.8 % | 14.9 % | ||||||

First Quarter 2019 - Higher local currency sales and improved profitability at Care Chemicals and Catalysis

Muttenz, April 30, 2019 - Clariant, a focused and innovative specialty chemical company, today announces first quarter 2019 sales of CHF 1.715 billion compared to CHF 1.722 billion in the first quarter of 2018. This corresponds to a good 2 % organic growth in local currency, driven by higher pricing in all Business Areas versus a high comparison base.

On a regional basis, the sales development in Latin America, Europe and the Middle East & Africa all reflected single-digit growth in local currency. Both North America and Asia reported slightly negative growth of 1 %. The continued weaker demand in China negatively influenced the Group sales development in the first quarter.

The improved sales performance in the first quarter of 2019 resulted from expansion in the Business Areas Care Chemicals, Catalysis and Natural Resources. Sales in Care Chemicals increased by 2 % in local currency although they were unfavorably impacted by the Aviation business due to the mild weather. Excluding Aviation, Care Chemicals sales rose in good mid-single digits in local currency. This growth was primarily driven by an excellent Consumer Care development. Catalysis sales grew by a good 4 % in local currency compared to a record first quarter in the previous year. Natural Resources sales accelerated by 10 % in local currency, mainly lifted by good Oil & Mining Services demand but also solid growth in Functional Minerals.

In Plastics & Coatings, sales declined by 2 % in local currency, largely as a result of the weaker than anticipated automotive and plastics markets as well as the further economic slowdown, particularly in China. However, the underlying demand in China remains solid and Clariant expects to see a gradual improvement throughout the remainder of 2019.

The newly reported EBITDA after exceptional items reached CHF 236 million with a corresponding margin of 13.8 %. The 8 % lower absolute EBITDA after exceptional items is the result of weaker profitability in Plastics & Coatings and higher project costs relating to Clariant's step change into higher value specialties announced in September 2018. The work on the respective projects is progressing well. Care Chemicals and Catalysis both reported a significant positive progression year-on-year, while Natural Resources also delivered a sound profitability improvement quarter-on-quarter as anticipated.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Clariant | ||

|

MA3XET

| Ask: 4,12 | Hebel: 5,69 |

| mit moderatem Hebel |

Zum Produkt

| |

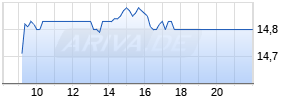

Kurse

|

Outlook 2021 - Above-market growth, higher profitability and stronger cash generation

Clariant is a focused and innovative specialty chemical company. We aim to provide more than just customer-oriented products. We strive to provide the best customer experience and fast, reliable customer fulfillment in the industry by setting the right priorities.

Our aim is to make our customers more successful. We therefore constantly focus on timely and rewarding innovations, products that are difficult to imitate, sustainability, agility as well as ethical practices. We will only be satisfied with the highest level of excellence in every function within the Group. Our success will be realized through the execution of our strategy.

We confirm our 2021 guidance to achieve above-market growth, higher profitability and stronger cash generation.

| Corporate Media Relations | Investor Relations |

| Jochen Dubiel Phone +41 61 469 63 63 jochen.dubiel@clariant.com | Anja Pomrehn Phone +41 61 469 67 45 anja.pomrehn@clariant.com |

| Thijs Bouwens Phone +41 61 469 63 63 thijs.bouwens@clariant.com | Maria Ivek Phone +41 61 469 63 73 maria.ivek@clariant.com |

| Follow us on Twitter, Facebook, Google Plus, LinkedIn. |

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Clariant AG via Globenewswire

--- End of Message ---

Clariant AG

Rothausstrasse 61 Muttenz 1 Switzerland

ISIN: CH0012142631;

Mehr Nachrichten zur Clariant Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.