Broadcom Inc. Announces Third Quarter Fiscal Year 2018 Financial Results and Quarterly Dividend

PR Newswire

SAN JOSE, Calif., Sept. 6, 2018

SAN JOSE, Calif., Sept. 6, 2018 /PRNewswire/ -- Broadcom Inc. (Nasdaq: AVGO), a leading semiconductor device supplier to the wired, wireless, enterprise storage, and industrial end markets, today reported financial results for its third quarter of fiscal year 2018, ended August 5, 2018, provided guidance for the fourth quarter of its fiscal year 2018 and announced a quarterly dividend.

"Datacenter demand is driving strong growth in more than 50 percent of our consolidated revenue," said Hock Tan, President and CEO of Broadcom Inc. "Through the strength of our franchise business model, we delivered another quarter of sustained revenues and strong free cash flows."

"During the quarter, we repurchased 24 million shares, returning approximately $5.38 billion to our stockholders," said Tom Krause, CFO of Broadcom. "Consistent with our stated capital allocation plan, we intend to return to stockholders 50 percent of the prior fiscal year free cash flow in the form of cash dividends. With the balance of our free cash flow, we have the financial flexibility to fund a combination of share repurchases and future acquisitions to expand earnings capacity."

Third Quarter Fiscal Year 2018 GAAP Results

Net revenue was $5,063 million, an increase of 1 percent from $5,014 million in the previous quarter and an increase of 13 percent from $4,463 million in the same quarter last year.

Gross margin was $2,619 million, or 51.7 percent of net revenue. This compares with gross margin of $2,551 million, or 50.9 percent of net revenue, in the prior quarter, and gross margin of $2,149 million, or 48.2 percent of net revenue, in the same quarter last year.

Operating expenses were $1,280 million. This compares with $1,350 million in the prior quarter and $1,501 million in the same quarter last year.

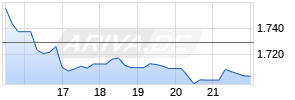

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Broadcom | ||

|

VM8W0R

| Ask: 27,33 | Hebel: 6,37 |

| mit moderatem Hebel |

Zum Produkt

| |

Operating income was $1,339 million, or 26.4 percent of net revenue. This compares with operating income of $1,201 million, or 24.0 percent of net revenue, in the prior quarter, and operating income of $648 million, or 14.5 percent of net revenue, in the same quarter last year.

Net income, which includes the impact of discontinued operations, was $1,196 million, or $2.71 per diluted share. This compares with net income of $3,733 million, or $8.33 per diluted share, in the prior quarter, and net income of $507 million, or $1.14 per diluted share, in the same quarter last year.

| Third Quarter Fiscal Year 2018 GAAP Results | | | | | | | | Change | ||||||||

| (Dollars in millions, except per share data) | | Q3 18 | | Q2 18 | | Q3 17 | | Q/Q | | Y/Y | ||||||

| Net revenue | | $ | 5,063 | | $ | 5,014 | | $ | 4,463 | | +1% | | +13% | |||

| Gross margin | | | 51.7% | | | 50.9% | | | 48.2% | | +80bps | | +350bps | |||

| Operating expenses | | $ | 1,280 | | $ | 1,350 | | $ | 1,501 | | -$70 | | -$221 | |||

| Net income | | $ | 1,196 | | $ | 3,733 | | $ | 507 | | -$2,537 | | +$689 | |||

| Net income attributable to noncontrolling interest | | $ | — | | $ | 15 | | $ | 26 | | -$15 | | -$26 | |||

| Net income attributable to common stock | | $ | 1,196 | | $ | 3,718 | | $ | 481 | | -$2,522 | | +$715 | |||

| Earnings per share - diluted | | $ | 2.71 | | $ | 8.33 | | $ | 1.14 | | -$5.62 | | +$1.57 | |||

The Company's cash balance at the end of the third fiscal quarter was $4,136 million, compared to $8,187 million at the end of the prior quarter.

During the third fiscal quarter, the Company generated $2,247 million in cash from operations and spent $5,378 million repurchasing an aggregate of 24 million shares and $120 million in capital expenditures.

On June 29, 2018, the Company paid a cash dividend of $1.75 per share of common stock, totaling $754 million.

Third Quarter Fiscal Year 2018 Non-GAAP Results From Continuing Operations

The differences between the Company's GAAP and non-GAAP results are described generally under "Non-GAAP Financial Measures" below, and presented in detail in the financial reconciliation tables attached to this release.

Net revenue from continuing operations was $5,066 million, an increase of 1 percent from $5,017 million in the previous quarter, and an increase of 13 percent from $4,467 million in the same quarter last year.

Gross margin from continuing operations was $3,410 million, or 67.3 percent of net revenue. This compares with gross margin from continuing operations of $3,342 million, or 66.6 percent of net revenue, in the prior quarter, and $2,827 million, or 63.3 percent of net revenue, in the same quarter last year.

Operating income from continuing operations was $2,536 million, or 50.1 percent of net revenue. This compares with operating income from continuing operations of $2,455 million, or 48.9 percent of net revenue, in the prior quarter, and $2,059 million, or 46.1 percent of net revenue, in the same quarter last year.

Net income from continuing operations was $2,257 million, or $4.98 per diluted share. This compares with net income of $2,243 million, or $4.88 per diluted share, in the prior quarter, and net income of $1,871 million, or $4.10 per diluted share, in the same quarter last year.

Free cash flow, defined as cash from operations less capital expenditures, was $2,127 million in the quarter.

| Third Quarter Fiscal Year 2018 Non-GAAP Results | | | | | | | | Change | ||||||||

| (Dollars in millions, except per share data) | | Q3 18 | | Q2 18 | | Q3 17 | | Q/Q | | Y/Y Werbung Mehr Nachrichten zur CA Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||