Blackstone Mortgage Trust Announces First Quarter 2019 Earnings Release and Conference Call

PR Newswire

NEW YORK, April 3, 2019

NEW YORK, April 3, 2019 /PRNewswire/ -- Blackstone Mortgage Trust, Inc. (NYSE: BXMT) today announced that it will publish its first quarter 2019 earnings presentation on its website at www.bxmt.com and file its Form 10-Q after market close on Tuesday, April 23, 2019.

The company will also host a conference call to review results on Wednesday, April 24, 2019 at 10:00 a.m. ET. The conference call can be accessed by dialing +1 (888) 268-4178 (U.S. domestic) or +1 (617) 597-5494 (International) with the passcode 245-054-61# or by webcast at www.bxmt.com (listen only).

To pre-register for the conference call, please use the following link:

https://cossprereg.btci.com/prereg/key.process?key=PB8QNNVXU

For those unable to listen to the live broadcast, a recorded replay will be available on the company's website and by telephone dial in beginning approximately two hours after the event. The replay call number is +1 (888) 286-8010 (U.S. domestic) or +1 (617) 801-6888 (International) and the passcode number is 350-306-82#.

About Blackstone Mortgage Trust

Blackstone Mortgage Trust (NYSE:BXMT) is a real estate finance company that originates senior loans collateralized by commercial real estate in North America, Europe, and Australia. Our investment objective is to preserve and protect shareholder capital while producing attractive risk-adjusted returns primarily through dividends generated from current income from our loan portfolio. We are externally managed by BXMT Advisors L.L.C., a subsidiary of Blackstone. Further information is available at www.bxmt.com.

About Blackstone

Blackstone (NYSE:BX) is one of the world's leading investment firms. Blackstone seeks to create positive economic impact and long-term value for its investors, the companies it invests in, and the communities in which it works. Blackstone does this by using extraordinary people and flexible capital to help companies solve problems. Blackstone's asset management businesses, with $472 billion in assets under management, include investment vehicles focused on private equity, real estate, public debt and equity, non-investment grade credit, real assets and secondary funds, all on a global basis. Further information is available at www.blackstone.com. Follow Blackstone on Twitter @Blackstone.

Forward-Looking Statements

This release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect Blackstone Mortgage Trust's current views with respect to, among other things, Blackstone Mortgage Trust's operations and financial performance. You can identify these forward-looking statements by the use of words such as "outlook," "indicator," "believes," "expects," "potential," "continues," "may," "will," "should," "seeks," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Blackstone Mortgage Trust believes these factors include but are not limited to those described under the section entitled "Risk Factors" in its Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as such factors may be updated from time to time in its periodic filings with the Securities and Exchange Commission ("SEC") which are accessible on the SEC's website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in the filings. Blackstone Mortgage Trust assumes no obligation to update or supplement forward‐looking statements that become untrue because of subsequent events or circumstances.

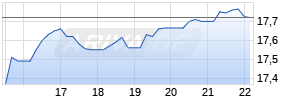

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Blackstone Group Inc. | ||

|

ME611Q

| Ask: 2,74 | Hebel: 4,50 |

| mit moderatem Hebel |

Zum Produkt

| |

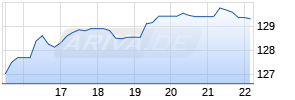

Kurse

|

|

![]() View original content:http://www.prnewswire.com/news-releases/blackstone-mortgage-trust-announces-first-quarter-2019-earnings-release-and-conference-call-300824279.html

View original content:http://www.prnewswire.com/news-releases/blackstone-mortgage-trust-announces-first-quarter-2019-earnings-release-and-conference-call-300824279.html

SOURCE Blackstone Mortgage Trust, Inc.

Mehr Nachrichten zur Blackstone Group Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.