AT&T CFO Updates Shareholders at the Annual Deutsche Bank Media, Internet & Telecom Conference

PR Newswire

DALLAS, Feb. 27, 2023

DALLAS, Feb. 27, 2023 /PRNewswire/ -- Pascal Desroches, senior executive vice president and chief financial officer, AT&T Inc., AT&T* (NYSE:T) spoke today at the Annual Deutsche Bank Media, Internet & Telecom Conference where he provided an update to shareholders. Desroches made the following points:

- The company continues to focus its efforts on 5G and fiber services by growing customer relationships in a disciplined manner. While the company does not expect wireless industry growth levels to mirror those experienced in 2021 and the first half of 2022, Desroches indicated that demand levels are largely tracking in-line with recent trends. The company continues to add customers thanks to both its consistent go-to-market approach and continued success in targeting subsegments of the market where historically AT&T has underperformed.

- AT&T remains committed to its strategy of becoming a scaled 5G and fiber provider. Desroches reiterated that he expects capital investment to peak in 2022 and 2023. The company remains on target to reach more than 200 million people with mid-band 5G by the end of the year and expects to pass 30 million-plus consumer and business fiber locations by the end of 2025. While AT&T has not provided annual fiber build targets — largely to maintain a level of flexibility as the market evolves — the company is currently focused on driving steady penetration rates while prudently expanding the company's fiber footprint.

- Desroches indicated that he expects 2023 free cash flow growth to be supported by wireless and fiber revenue growth as well as benefits from ongoing cost transformation initiatives, which are expected to increasingly support the company's profitability. Similar to 2022, he expects free cash flow to be greater in the back half of the year due to the timing of capital investments and device payments as well as incentive compensation impacts, particularly in the first quarter of the year and moderating throughout the year.

- Desroches said the company is maintaining a sharp focus on proactively reducing costs and deliberately allocating capital. The company is using free cash flow after dividends to help reduce debt as it seeks to achieve net debt-to-adjusted EBITDA in the 2.5x range by early 2025.

As AT&T indicated when it announced its fourth-quarter 2022 results, it plans to provide recast historical financial results in early March because it will no longer record prior service credit benefits to the individual business units with a corporate elimination. Instead, these credits will only be recorded in Other Income. Recast historical results will reflect adjustments in business unit margins, particularly Business and Consumer Wireline, with a corresponding benefit to the corporate segment. This change will not impact consolidated EBITDA or previously provided guidance — including expectations on the trajectory of the business units — for the year.

*About AT&T

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Cautionary Language Concerning Forward-Looking Statements

Information set forth in this news release contains financial estimates and other forward-looking statements that are subject to risks and uncertainties, and actual results might differ materially. A discussion of factors that may affect future results is contained in AT&T's filings with the Securities and Exchange Commission. AT&T disclaims any obligation to update and revise statements contained in this news release based on new information or otherwise.

This news release may contain certain non-GAAP financial measures. Reconciliations between the non-GAAP financial measures and the GAAP financial measures are available on the company's website at https://investors.att.com.

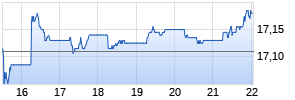

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in AT&T | ||

|

VM3N53

| Ask: 2,38 | Hebel: 5,88 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

© 2023 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/att-cfo-updates-shareholders-at-the-annual-deutsche-bank-media-internet--telecom-conference-301757248.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/att-cfo-updates-shareholders-at-the-annual-deutsche-bank-media-internet--telecom-conference-301757248.html

SOURCE AT&T

Mehr Nachrichten zur AT&T Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.