Applied Materials Announces First Quarter 2015 Results

- Q1 net sales of $2.36 billion up 8% year over year led by growth in Applied Global Services and Display

- Q1 non-GAAP adjusted operating income of $447 million up 18% year over year; GAAP operating income of $458 million up 39% year over year

- Q1 non-GAAP adjusted EPS of $0.27 up 17% year over year; GAAP EPS of $0.28 up 33% year over year

SANTA CLARA, Calif., Feb. 11, 2015 - Applied Materials, Inc. (NASDAQ:AMAT), the global leader in precision materials engineering solutions for the semiconductor, display and solar industries, today reported results for its first quarter ended January 25, 2015.

First quarter orders were $2.27 billion, up 1 percent sequentially and down 1 percent year over year. Net sales were $2.36 billion, up 4 percent sequentially and up 8 percent year over year.

On a non-GAAP adjusted basis, the company reported gross margin of 42.3 percent, operating income of $447 million, and net income of $338 million or $0.27 per diluted share. The company recorded GAAP gross margin of 40.7 percent, operating income of $458 million, and net income of $348 million or $0.28 per diluted share.

"Major technology inflections in semiconductor and display are creating new growth opportunities for Applied's precision materials engineering products and services," said Gary Dickerson, president and chief executive officer. "With focus and execution, we are gaining momentum toward our long-term strategic goals, and this progress will be accelerated by our planned merger with Tokyo Electron."

Quarterly Results Summary

| Change | ||||||||||

| GAAP Results | Q1 FY2015 | Q4 FY2014 | Q1 FY2014 | Q1 FY2015 vs. Q4 FY2014 | Q1 FY2015 vs. Q1 FY2014 | |||||

| Net sales | $2.36 billion | $2.26 billion | $2.19 billion | 4% | 8% | |||||

| Gross profit | $959 million | $959 million | $891 million | flat | 8% | |||||

| Operating income | $458 million | $412 million | $330 million | 11% | 39% | |||||

| Net income | $348 million | $256 million | $253 million | 36% | 38% | |||||

| Diluted earnings per share (EPS) | $0.28 | $0.21 | $0.21 | 33% | 33% | |||||

| Non-GAAP Adjusted Results | ||||||||||

| Non-GAAP adjusted gross profit | $1.00 billion | $1.00 billion | $930 million | flat | 7% | |||||

| Non-GAAP adjusted operating income | $447 million | $442 million | $380 million | 1% | 18% | |||||

| Non-GAAP adjusted net income | $338 million | $338 million | $279 million | flat | 21% | |||||

| Non-GAAP adjusted diluted EPS | $0.27 | $0.27 | $0.23 | flat | 17% | |||||

Applied's non-GAAP adjusted results exclude the impact of the following, where applicable: certain items related to acquisitions or the announced business combination; restructuring charges and any associated adjustments; impairments of assets, goodwill, or investments; gain or loss on sale of strategic investments or facilities; and certain tax items. A reconciliation of the GAAP and non-GAAP adjusted results is provided in the financial tables included in this release. See also "Use of Non-GAAP Adjusted Financial Measures" section.

First Quarter Reportable Segment Results and Comparisons to the Prior Quarter

Silicon Systems Group (SSG) orders were $1.43 billion, up 7 percent, with increases in DRAM and NAND, and decreases in foundry and logic/other. Net sales increased by 1 percent to $1.45 billion. Non-GAAP adjusted operating income decreased by 1 percent to $350 million or 24.2 percent of net sales. GAAP operating income increased by 1 percent to $307 million or 21.2 percent of net sales. New order composition was: foundry 34 percent; DRAM 34 percent; flash 18 percent and logic/other 14 percent.

Applied Global Services (AGS) orders of $690 million were the second highest in group history and declined 8 percent from the record set in the previous quarter due to decreases in semiconductor services and 200mm equipment orders. Net sales of $583 million declined 2 percent. Non-GAAP adjusted operating income increased by 5 percent to $154 million or 26.4 percent of net sales. GAAP operating income increased by 5 percent to $153 million or 26.2 percent of net sales.

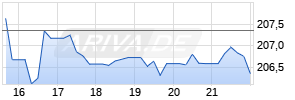

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Applied Materials Inc. | ||

|

ME9D0E

| Ask: 3,64 | Hebel: 7,02 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Display orders of $107 million were down 18 percent reflecting a decrease in TV equipment orders. Net sales increased by 45 percent to $275 million. Non-GAAP adjusted operating income increased by 40 percent to $73 million or 26.5 percent of net sales. GAAP operating income increased by 38 percent to $72 million or 26.2 percent of net sales.

Energy and Environmental Solutions (EES) orders increased by 14 percent to $50 million, and net sales increased by 15 percent to $55 million. EES reported a non-GAAP adjusted operating loss of $3 million and a GAAP operating loss of $4 million.

Applied's backlog declined by 5 percent to $2.78 billion and included negative adjustments of $53 million, primarily consisting of currency adjustments. Backlog composition by segment was: SSG 49 percent; AGS 30 percent; Display 15 percent; and EES 6 percent.

Business Outlook

For the second quarter of fiscal 2015, Applied expects net sales to be in the range of flat to up a couple of percentage points from the previous quarter. Non-GAAP adjusted diluted EPS is expected to be in the range of $0.26 to $0.30. This outlook excludes known charges related to completed acquisitions of $0.03 per share. The outlook does not exclude other non-GAAP adjustments that may arise subsequent to this release.

Use of Non-GAAP Adjusted Financial Measures

Management uses non-GAAP adjusted results to evaluate the company's operating and financial performance in light of business objectives and for planning purposes. These measures are not in accordance with GAAP and may differ from non-GAAP methods of accounting and reporting used by other companies. Applied believes these measures enhance investors' ability to review the company's business from the same perspective as the company's management and facilitate comparisons of this period's results with prior periods. The presentation of this additional information should not be considered a substitute for results prepared in accordance with GAAP.

Webcast Information

Applied Materials will discuss these results during an earnings call that begins at 1:30 p.m. Pacific Time today. A live webcast will be available at www.appliedmaterials.com. A replay will be available on the website beginning at 5:00 p.m. Pacific Time today.

Forward-Looking Statements

This press release contains forward-looking statements, including those regarding Applied's performance, strategies, industry outlooks, and business outlook for the second quarter of fiscal 2015. These statements and their underlying assumptions are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to: the level of demand for Applied's products, which is subject to many factors, including uncertain global economic and industry conditions, end-demand for electronic products and semiconductors, and customers' new technology and capacity requirements; the timing and nature of technology transitions; the concentrated nature of Applied's customer base; Applied's ability to (i) develop, deliver and support a broad range of products and expand its markets, (ii) achieve the objectives of operational and strategic initiatives, (iii) obtain and protect intellectual property rights in key technologies, (iv) attract, motivate and retain key employees, (v) successfully complete the announced business combination and realize expected benefits and synergies, and (vi) accurately forecast future results, which depends on multiple assumptions related to, without limitation, market conditions, customer requirements and business needs; and other risks described in Applied's SEC filings, including its most recent Forms 10-K and 8-K. All forward-looking statements are based on management's estimates, projections and assumptions as of the date hereof. The company undertakes no obligation to update any forward-looking statements.

About Applied Materials

Applied Materials, Inc. (Nasdaq:AMAT) is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Our technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world. Learn more at www.appliedmaterials.com.

Contact:

Kevin Winston (editorial/media) 408.235.4498

Michael Sullivan (financial community) 408.986.7977

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

| Three Months Ended | ||||||||||||

| (In millions, except per share amounts) | January 25, 2015 | October 26, 2014 | January 26, 2014 | |||||||||

| Net sales | $ | 2,359 | $ | 2,264 | $ | 2,190 | ||||||

| Cost of products sold | 1,400 | 1,305 | 1,299 | |||||||||

| Gross profit | 959 | 959 | 891 | |||||||||

| Operating expenses: | ||||||||||||

| Research, development and engineering | 351 | 360 | 356 | |||||||||

| Marketing and selling | 111 | 99 | 109 | |||||||||

| General and administrative | 39 | 88 | 96 | |||||||||

| Total operating expenses | 501 | 547 | 561 | |||||||||

| Income from operations | 458 | 412 | 330 | |||||||||

| Interest expense | 23 | 23 | 25 | |||||||||

| Interest and other income, net | 2 | 9 | 10 | |||||||||

| Income before income taxes | 437 | 398 | 315 | |||||||||

| Provision for income taxes | 89 | 142 | 62 | |||||||||

| Net income | $ | 348 | $ | 256 | $ | 253 | ||||||

| Earnings per share: | ||||||||||||

| Basic and diluted | $ | 0.28 | $ | 0.21 | $ | 0.21 | ||||||

| Weighted average number of shares: | ||||||||||||

| Basic | 1,224 | 1,220 | 1,206 | |||||||||

| Diluted | 1,240 | 1,236 | 1,225 | |||||||||

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED BALANCE SHEETS

| (In millions) | January 25, 2015 | October 26, 2014 | ||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 2,929 | $ | 3,002 | ||||

| Short-term investments | 158 | 160 | ||||||

| Accounts receivable, net | 1,580 | 1,670 | ||||||

| Inventories | 1,641 | 1,567 | ||||||

| Other current assets | 625 | 568 | ||||||

| Total current assets | 6,933 | 6,967 | ||||||

| Long-term investments | 930 | 935 | ||||||

| Property, plant and equipment, net | 864 | 861 | ||||||

| Goodwill | 3,304 | 3,304 | ||||||

| Purchased technology and other intangible assets, net | 905 | 951 | ||||||

| Deferred income taxes and other assets | 137 | 156 | ||||||

| Total assets | $ | 13,073 | $ | 13,174 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 1,737 | $ | 1,883 | ||||

| Customer deposits and deferred revenue | 784 | 940 | ||||||

| Total current liabilities | 2,521 | 2,823 | ||||||

| Long-term debt | 1,947 | 1,947 | ||||||

| Other liabilities | 533 | 536 | ||||||

| Total liabilities | 5,001 | 5,306 | ||||||

| Total stockholders' equity | 8,072 | 7,868 | ||||||

| Total liabilities and stockholders' equity | $ | 13,073 | $ | 13,174 | ||||

APPLIED MATERIALS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

| (In millions) | Three Months Ended | ||||||||||

| January 25, 2015 | October 26, 2014 | January 26, 2014 | |||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | 348 | $ | 256 | $ | 253 | |||||

| Adjustments required to reconcile net income to cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 92 | 94 | 94 | ||||||||

| Unrealized loss (gain) on derivative associated with announced business combination | (78 | ) | 12 | (24 | ) | ||||||

| Share-based compensation | 48 | 45 | 46 | ||||||||

| Excess tax benefits from share-based compensation | (39 | ) | (4 | ) | (18 | ) | |||||

| Other | 36 | 1 | 9 | ||||||||

| Net change in operating assets and liabilities | (347 | ) | 3 | 12 | |||||||

| Cash provided by operating activities | 60 | 407 | 372 | ||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (49 | ) | (63 | ) | (48 | ) | |||||

| Cash paid for acquisition, net of cash acquired | - | (12 | ) | - | |||||||

| Proceeds from sale of facility | - | 25 | - | ||||||||

| Proceeds from sales and maturities of investments | 140 | 176 | 364 | ||||||||

| Purchases of investments | (141 | ) | (179 | ) | (163 | ) | |||||

| Cash provided by (used in) investing activities | (50 | ) | (53 | ) | 153 | ||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from common stock issuances and others, net | - | 40 | 10 | ||||||||

| Excess tax benefits from share-based compensation | 39 | 4 | 18 | ||||||||

| Payments of dividends to stockholders | (122 | ) | (122 | ) | (120 | ) | |||||

| Cash used in financing activities | (83 | ) | (78 | ) | (92 | ) | |||||

| Increase (decrease) in cash and cash equivalents | (73 | ) | 276 | 433 | |||||||

| Cash and cash equivalents - beginning of period | 3,002 | 2,726 | 1,711 | ||||||||

| Cash and cash equivalents - end of period | $ | 2,929 | $ | 3,002 | $ | 2,144 | |||||

| Supplemental cash flow information: | |||||||||||

| Cash payments for income taxes | $ | 89 | $ | 87 | $ | 26 | |||||

| Cash refunds from income taxes | $ | 3 | $ | 78 | $ | 9 | |||||

| Cash payments for interest | $ | 39 | $ | 7 | $ | 39 | |||||

APPLIED MATERIALS, INC.

UNAUDITED SUPPLEMENTAL INFORMATION

Reportable Segment Results

| Q1 FY2015 | Q4 FY2014 | Q1 FY2014 | ||||||||||||||||||||||||||||||||||

| (In millions) | New Orders | Net Sales | Operating Income (Loss) | New Orders | Net Sales | Operating Income (Loss) | New Orders | Net Sales | Operating Income (Loss) | |||||||||||||||||||||||||||

| SSG | $ | 1,426 | $ | 1,446 | $ | 307 | $ | 1,334 | $ | 1,434 | $ | 305 | $ | 1,569 | $ | 1,484 | $ | 314 | ||||||||||||||||||

| AGS | 690 | 583 | 153 | 747 | 592 | 146 | 597 | 507 | 125 | |||||||||||||||||||||||||||

| Display | 107 | 275 | 72 | 130 | 190 | 52 | 79 | 159 | 26 | |||||||||||||||||||||||||||

| EES | 50 | 55 | (4 | ) | 44 | 48 | (3 | ) | 40 | 40 | (11 | ) | ||||||||||||||||||||||||

| Corporate | - | - | (70 | ) | - | - | (88 | ) | - | - | (124 | ) | ||||||||||||||||||||||||

| Consoli- dated | $ | 2,273 | $ | 2,359 | $ | 458 | $ | 2,255 | $ | 2,264 | $ | 412 | $ | 2,285 | $ | 2,190 | $ | 330 | ||||||||||||||||||

Corporate Unallocated Expenses

| (In millions) | Q1 FY2015 | Q4 FY2014 | Q1 FY2014 | |||||||||

| Share-based compensation | 48 | 45 | 46 | |||||||||

| Certain items associated with announced business combination | 20 | 23 | 11 | |||||||||

| Gain on derivative associated with announced business combination, net | (78 | ) | (39 | ) | (24 | ) | ||||||

| Restructuring charges and asset impairments | - | (2 | ) | 7 | ||||||||

| Gain on sale of facility | - | (4 | ) | - | ||||||||

| Other unallocated expenses | 80 | 65 | 84 | |||||||||

| Total corporate | $ | 70 | $ | 88 | $ | 124 | ||||||

APPLIED MATERIALS, INC.

UNAUDITED SUPPLEMENTAL INFORMATION

Additional Information

| Q1 FY2015 | Q4 FY2014 | Q1 FY2014 | ||||||||||||||||

| New Orders and Net Sales by Geography | ||||||||||||||||||

| (In $ millions) | New Orders | Net Sales | New Orders | Net Sales | New Orders | Net Sales | ||||||||||||

| United States | 411 | 529 | 596 | 633 | 403 | 280 | ||||||||||||

| % of Total | 18 | % | 22 | % | 26 | % | 28 | % | 18 | % | 13 | % | ||||||

| Europe | 148 | 143 | 198 | 178 | 119 | 164 | ||||||||||||

| % of Total | 6 | % | 6 | % | 9 | % | 8 | % | 5 | % | 7 | % | ||||||

| Japan | 242 | 231 | 287 | 209 | 163 | 164 | ||||||||||||

| % of Total | 11 | % | 10 | % | 13 | % | 9 | % | 7 | % | 8 | % | ||||||

| Korea | 546 | 464 | 251 | 187 | 240 | 201 | ||||||||||||

| % of Total | 24 | % | 20 | % | 11 | % | 8 | % | 11 | % | 9 | % | ||||||

| Taiwan | 545 | 519 | 599 | 618 | 984 | 705 | ||||||||||||

| % of Total | 24 | % | 22 | % | 27 | % | 27 | % | 43 | % | 32 | % | ||||||

| Southeast Asia | 85 | 85 | 113 | 136 | 50 | 87 | ||||||||||||

| % of Total | 4 | % | 4 | % | 5 | % | 6 | % | 2 | % | 4 | % | ||||||

| China | 296 | 388 | 211 | 303 | 326 | 589 | ||||||||||||

| % of Total | 13 | % | 16 | % | 9 | % | 14 | % | 14 | % | 27 | % | ||||||

| Employees (In thousands) | ||||||||||||||||||

| Regular Full Time | 14.1 | 14.0 | 13.6 | |||||||||||||||

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

| Three Months Ended | ||||||||||||

| (In millions, except percentages) | January 25, 2015 | October 26, 2014 | January 26, 2014 | |||||||||

| Non-GAAP Adjusted Gross Profit | ||||||||||||

| Reported gross profit - GAAP basis | $ | 959 | $ | 959 | $ | 891 | ||||||

| Certain items associated with acquisitions1 | 40 | 42 | 39 | |||||||||

| Non-GAAP adjusted gross profit | $ | 999 | $ | 1,001 | $ | 930 | ||||||

| Non-GAAP adjusted gross margin (% of net sales) | 42.3 | % | 44.2 | % | 42.5 | % | ||||||

| Non-GAAP Adjusted Operating Income | ||||||||||||

| Reported operating income - GAAP basis | $ | 458 | $ | 412 | $ | 330 | ||||||

| Certain items associated with acquisitions1 | 46 | 48 | 45 | |||||||||

| Acquisition integration costs | 1 | 4 | 11 | |||||||||

| Gain on derivative associated with announced business combination, net | (78 | ) | (39 | ) | (24 | ) | ||||||

| Certain items associated with announced business combination2 | 20 | 23 | 11 | |||||||||

| Restructuring charges and asset impairments3 | - | (2 | ) | 7 | ||||||||

| Gain on sale of facility | - | (4 | ) | - | ||||||||

| Non-GAAP adjusted operating income | $ | 447 | $ | 442 | $ | 380 | ||||||

| Non-GAAP adjusted operating margin (% of net sales) | 18.9 | % | 19.5 | % | 17.4 | % | ||||||

| Non-GAAP Adjusted Net Income | ||||||||||||

| Reported net income - GAAP basis | $ | 348 | $ | 256 | $ | 253 | ||||||

| Certain items associated with acquisitions1 | 46 | 48 | 45 | |||||||||

| Acquisition integration costs | 1 | 4 | 11 | |||||||||

| Gain on derivative associated with announced business combination, net | (78 | ) | (39 | ) | (24 | ) | ||||||

| Certain items associated with announced business combination2 | 20 | 23 | 11 | |||||||||

| Restructuring charges and asset impairments3 | - | (2 | ) | 7 | ||||||||

| Gain on sale of facility | - | (4 | ) | - | ||||||||

| Impairment (gain on sale) of strategic investments, net | 1 | (5 | ) | (5 | ) | |||||||

| Reinstatement of federal R&D tax credit, resolution of prior years' income tax filings and other tax items | (17 | ) | 50 | (15 | ) | |||||||

| Income tax effect of non-GAAP adjustments | 17 | 7 | (4 | ) | ||||||||

| Non-GAAP adjusted net income | $ | 338 | $ | 338 | $ | 279 | ||||||

| 1 | These items are incremental charges attributable to completed acquisitions, consisting of amortization of purchased intangible assets. |

| 2 | These items are incremental charges related to the announced business combination agreement with Tokyo Electron Limited, consisting of acquisition-related and integration planning costs. |

| 3 | Results for the three months ended October 26, 2014 and January 26, 2014 included a $2 million favorable adjustment of restructuring reserve and $7 million of employee-related costs, respectively, related to the restructuring program announced on October 3, 2012. |

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

| Three Months Ended | ||||||||||||

| (In millions except per share amounts) | January 25, 2015 | October 26, 2014 | January 26, 2014 | |||||||||

| Non-GAAP Adjusted Earnings Per Diluted Share | ||||||||||||

| Reported earnings per diluted share - GAAP basis | $ | 0.28 | $ | 0.21 | $ | 0.21 | ||||||

| Certain items associated with acquisitions | 0.03 | 0.04 | 0.03 | |||||||||

| Acquisition integration costs | - | - | 0.01 | |||||||||

| Certain items associated with announced business combination | 0.01 | 0.01 | - | |||||||||

| Gain on derivative associated with announced business combination, net | (0.04 | ) | (0.02 | ) | (0.01 | ) | ||||||

| Reinstatement of federal R&D tax credit, resolution of prior years' income tax filings and other tax items | (0.01 | ) | 0.03 | (0.01 | ) | |||||||

| Non-GAAP adjusted earnings per diluted share | $ | 0.27 | $ | 0.27 | $ | 0.23 | ||||||

| Weighted average number of diluted shares | 1,240 | 1,236 | 1,225 | |||||||||

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED RESULTS

| Three Months Ended | ||||||||||||

| (In millions, except percentages) | January 25, 2015 | October 26, 2014 | January 26, 2014 | |||||||||

| SSG Non-GAAP Adjusted Operating Income | ||||||||||||

| Reported operating income - GAAP basis | $ | 307 | $ | 305 | $ | 314 | ||||||

| Certain items associated with acquisitions1 | 43 | 46 | 42 | |||||||||

| Acquisition integration costs | - | 1 | 1 | |||||||||

| Non-GAAP adjusted operating income | $ | 350 | $ | 352 | $ | 357 | ||||||

| Non-GAAP adjusted operating margin (% of net sales) | 24.2 | % | 24.5 | % | 24.1 | % | ||||||

| AGS Non-GAAP Adjusted Operating Income | ||||||||||||

| Reported operating income - GAAP basis | $ | 153 | $ | 146 | $ | 125 | ||||||

| Certain items associated with acquisitions1 | 1 | - | 1 | |||||||||

| Non-GAAP adjusted operating income | $ | 154 | $ | 146 | $ | 126 | ||||||

| Non-GAAP adjusted operating margin (% of net sales) | 26.4 | % | 24.7 | % | 24.9 | % | ||||||

| Display Non-GAAP Adjusted Operating Income | ||||||||||||

| Reported operating income - GAAP basis | $ | 72 | $ | 52 | $ | 26 | ||||||

| Certain items associated with acquisitions1 | 1 | - | 1 | |||||||||

| Non-GAAP adjusted operating income | $ | 73 | $ | 52 | $ | 27 | ||||||

| Non-GAAP adjusted operating margin (% of net sales) | 26.5 | % | 27.4 | % | 17.0 | % | ||||||

| EES Non-GAAP Adjusted Operating Loss | ||||||||||||

| Reported operating loss - GAAP basis | $ | (4 | ) | $ | (3 | ) | $ | (11 | ) | |||

| Certain items associated with acquisitions1 | 1 | 2 | 1 | |||||||||

| Non-GAAP adjusted operating loss | $ | (3 | ) | $ | (1 | ) | $ | (10 | ) | |||

| Non-GAAP adjusted operating margin (% of net sales) | (5.5 | )% | (2.1 | )% | (25.0 | )% | ||||||

| 1 | These items are incremental charges attributable to completed acquisitions, consisting of amortization of purchased intangible assets. |

APPLIED MATERIALS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED OPERATING EXPENSES

| Three Months Ended | |||||||

| (In millions) | January 25, 2015 | October 26, 2014 | |||||

| Operating expenses - GAAP basis | $ | 501 | $ | 547 | |||

| Gain on derivative associated with announced business combination, net | 78 | 39 | |||||

| Restructuring charges and asset impairments | - | 2 | |||||

| Certain items associated with acquisitions | (6 | ) | (6 | ) | |||

| Acquisition integration costs | (1 | ) | (4 | ) | |||

| Certain items associated with announced business combination | (20 | ) | (23 | ) | |||

| Gain on sale of facility | - | 4 | |||||

| Non-GAAP adjusted operating expenses | $ | 552 | $ | 559 | |||

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ADJUSTED EFFECTIVE INCOME TAX RATE

| Three Months Ended | |||

| (In millions, except percentages) | January 25, 2015 | ||

| Provision for income taxes - GAAP basis (a) | $ | 89 | |

| Reinstatement of federal R&D tax credit, resolutions of prior years' income tax filings and other tax items | 17 | ||

| Income tax effect of non-GAAP adjustments | (17 | ) | |

| Non-GAAP adjusted provision for income taxes (b) | $ | 89 | |

| Income before income taxes - GAAP basis (c) | $ | 437 | |

| Certain items associated with acquisitions | 46 | ||

| Acquisition integration costs | 1 | ||

| Gain on derivative associated with announced business combination | (78 | ) | |

| Certain items associated with announced business combination | 20 | ||

| Impairment of strategic investments | 1 | ||

| Non-GAAP adjusted income before income taxes (d) | $ | 427 | |

| Effective income tax rate - GAAP basis (a/c) | 20.4 | % | |

| Non-GAAP adjusted effective income tax rate (b/d) | 20.8 | % | |

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Applied Materials via Globenewswire

Mehr Nachrichten zur Applied Materials Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.