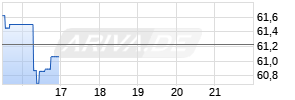

Ameris Bancorp Announces 2017 Financial Results

PR Newswire

MOULTRIE, Ga., Jan. 26, 2018

MOULTRIE, Ga., Jan. 26, 2018 /PRNewswire/ -- Ameris Bancorp (Nasdaq: ABCB) (the "Company") today reported net income of $73.5 million, or $1.98 per diluted share, for the year ended December 31, 2017, compared with $72.1 million, or $2.08 per diluted share, for 2016. For the quarter ending December 31, 2017, reported results include net income of $9.2 million, or $0.24 per diluted share, compared with $18.2 million, or $0.52 per diluted share, for the same period in 2016. The financial results include a charge of $13.4 million to income tax expense related to the valuation of the Company's deferred tax asset, due to the recent tax legislation that reduces the future corporate tax rate for the Company.

The Company reported adjusted operating net income of $92.3 million, or $2.48 per diluted share, for the year ended December 31, 2017, compared with $80.6 million, or $2.32 per diluted share, for 2016. Adjusted operating net income for the fourth quarter of 2017 was $23.6 million, or $0.63 per diluted share, compared with $22.2 million, or $0.63 per diluted share, for the same quarter of 2016.

For the year ended December 31, 2017, the Company's adjusted operating return on average assets was 1.26%, compared with 1.31% for 2016. For the fourth quarter of 2017, the Company's adjusted operating return on average assets was 1.20%, compared with 1.34% in the same quarter of 2016. Commenting on the Company's earnings, Edwin W. Hortman, Jr., Executive Chairman, President and Chief Executive Officer of the Company, said, "Our successes in 2017 show the strength of our team and dedication our bankers have to growing our bank in the communities we serve. During 2017, we grew loans 20% from organic growth within our existing markets and grew core deposits 16%, all while improving our margin by five basis points, exclusive of accretion from prior acquisitions, and improving asset quality."

Following is a summary of the adjustments between reported net income and adjusted operating net income:

| Adjusted Operating Net Income Reconciliation | | | | | | | | ||||||||

| | Three Months Ended | | Twelve Months Ended | ||||||||||||

| | Dec | | Dec | | Dec | | Dec | ||||||||

| (dollars in thousands except per share data) | 2017 | | 2016 | | 2017 | | 2016 | ||||||||

| Net income available to common shareholders | $ | 9,150 | | | $ | 18,177 | | | $ | 73,548 | | | $ | 72,100 | |

| | | | | | | | | ||||||||

| Merger and conversion charges | 421 | | | 17 | | | 915 | | | 6,376 | | ||||

| Certain compliance resolution expenses | 434 | | | 5,750 | | | 5,163 | | | 5,750 | | ||||

| Accelerated premium amortization on loans sold from purchased loan pools | 456 | | | — | | | 456 | | | — | | ||||

| Financial impact of Hurricane Irma | — | | | — | | | 410 | | | — | | ||||

| Loss on sale of premises | 308 | | | 430 | | | 1,264 | | | 992 | | ||||

| Tax effect of management-adjusted charges | (567) | | | (2,169) | | | (2,873) | | | (4,591) | | ||||

| After tax management-adjusted charges | 1,052 | | | 4,028 | | | 5,335 | | | 8,527 | | ||||

| Tax expense attributable to remeasurement of deferred tax assets and | 13,388 | | | — | | | 13,388 | | | — | | ||||

| Adjusted operating net income | $ | 23,590 | | | $ | 22,205 | | | $ | 92,271 | | | $ | 80,627 | |

| | | | | | | | | ||||||||

| Reported net income per diluted share | $ | 0.24 | | | $ | 0.52 | | | $ | 1.98 | | | $ | 2.08 | |

| Adjusted operating net income per diluted share | $ | 0.63 | | | $ | 0.63 | | | $ | 2.48 | | | $ | 2.32 | |

| | | | | | | | | ||||||||

| Reported return on average assets | 0.47 | % | | 1.10 Werbung Mehr Nachrichten zur AMERIS BANCORP. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||