Alexandria Real Estate Equities, Inc. Reports: 1Q23 Net Income per Share - Diluted of $0.44; and 1Q23 FFO per Share - Diluted, As Adjusted, of $2.19

PR Newswire

PASADENA, Calif., April 24, 2023

PASADENA, Calif., April 24, 2023 /PRNewswire/ -- Alexandria Real Estate Equities, Inc. (NYSE: ARE) announced financial and operating results for the first quarter ended March 31, 2023.

| Key highlights | | | | | |

| Operating results | 1Q23 | | 1Q22 | | |

| Total revenues: | | | | | |

| In millions | $ 700.8 | | $ 615.1 | | |

| Growth | 13.9 % | | | | |

| Net income (loss) attributable to Alexandria's common stockholders – diluted | | ||||

| In millions | $ 75.3 | | $ (151.7) | | |

| Per share | $ 0.44 | | $ (0.96) | | |

| Funds from operations attributable to Alexandria's common stockholders – diluted, as adjusted | | ||||

| In millions | $ 373.7 | | $ 324.6 | | |

| Per share (refer to footnote 1 on page 9) | $ 2.19 | | $ 2.05 | | |

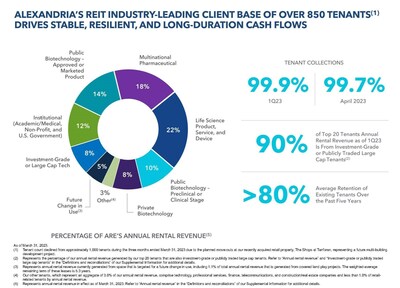

An operationally excellent, industry-leading REIT with a high-quality and diverse client base of over 850 tenants supporting high-quality revenues, stable cash flows, and strong margins

| Percentage of total annual rental revenue in effect from investment-grade or | 49 % | | | |

| Sustained strength in tenant collections: | | | | |

| Tenant receivables as of March 31, 2023 | $ 8.2 | million | | |

| April 2023 tenant rent and receivables collected as of April 24, 2023 | 99.7 % | | | |

| 1Q23 tenant rent and receivables collected as of April 24, 2023 | 99.9 % | | | |

| On March 10, 2023, we held $108.3 million in letters of credit originally issued by Silicon Valley Bank, | | |||

| Occupancy of operating properties in North America | 93.6 % | | | |

| Operating margin | 70 % | | | |

| Adjusted EBITDA margin | 69 % | | | |

| Weighted-average remaining lease term: | | | | |

| All tenants | 7.2 | years | | |

| Top 20 tenants | 9.5 | years | | |

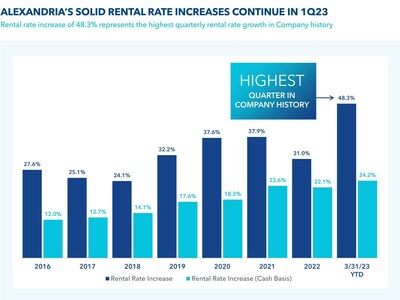

Continued strong leasing volume and rental rate increases

- For 1Q23, rental rate increase of 48.3% represents the highest quarterly rental rate growth in Company history.

- Strong leasing activity continued in 1Q23 with leasing volume aggregating 1.2 million RSF, exceeding the 1.1 million RSF average in quarterly leasing for the five-year period prior to 2021, with 85% generated from our client base of over 850 tenants.

| | | 1Q23 | | |

| Total leasing activity – RSF | | 1,223,427 | | |

| Lease renewals and re-leasing of space: | | | | |

| RSF (included in total leasing activity above) | | 1,120,038 | | |

| Rental rate increase | | 48.3 % | | |

| Rental rate increase (cash basis) | | 24.2 % | | |

Continued strong net operating income and internal growth

- Net operating income (cash basis) of $1.8 billion for 1Q23 annualized, up $245.0 million, or 16.2%, compared to 1Q22 annualized.

- Same property net operating income growth:

- 3.7% and 9.0% (cash basis) for 1Q23 over 1Q22.

- Our 1Q23 same property growth outperformed our 10-year averages of 3.6% and 6.6% (cash basis).

- 95% of our leases contain contractual annual rent escalations approximating 3%.

Key updates to our 2023 sources and uses of capital guidance

- $325 million reduction in total uses of capital to $2.95 billion.

- $325 million reduction in sources of capital to $2.95 billion.

- $950 million in net incremental debt for 2023 ($1.0 billion of unsecured senior notes payable issued in February 2023).

- $375 million in net cash provided by operating activities after dividends.

- $1.625 billion in dispositions, sales of partial interests, and future settlement of forward equity sales agreements that were outstanding as of December 31, 2022.

- $965.4 million, or 59%, completed or subject to executed letters of intent or purchase and sale agreements, including $865.4 million from dispositions and sales of partial interests and approximately $100 million from forward equity sales agreements that were outstanding as of December 31, 2022.

- $659.6 million of targeted dispositions and sales of partial interests.

- $275 million of excess bond offering proceeds to reduce debt capital for 2024.

Continued strong and flexible balance sheet with 13.4 years of remaining term of debt

- Investment-grade credit ratings ranked in the top 10% among all publicly traded U.S. REITs.

- $5.3 billion of liquidity.

- No debt maturities prior to 2025.

- 13.4 years weighted-average remaining term of debt.

- 96.1% of our debt has a fixed rate.

- Net debt and preferred stock to Adjusted EBITDA of 5.3x and fixed-charge coverage ratio of 5.0x for 1Q23 annualized.

- Total debt and preferred stock to gross assets of 28%.

- In February 2023, we issued unsecured senior notes payable aggregating $1.0 billion at 4.95% for average term of 21.2 years.

- $1.4 billion of expected capital contributions from existing real estate joint venture partners from 2Q23 through 2026 to fund construction.

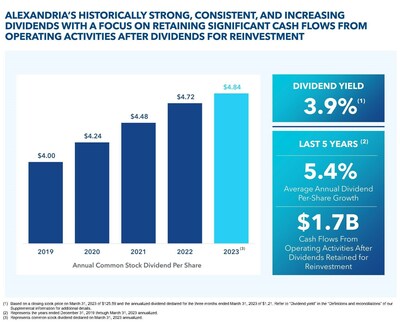

Continued strong and increasing dividends with a focus on retaining significant net cash flows from operating activities after dividends for reinvestment

- Common stock dividend declared for 1Q23 of $1.21 per common share, aggregating $4.78 per common share for the twelve months ended March 31, 2023, up 24 cents, or 5%, over the twelve months ended March 31, 2022.

- Dividend yield of 3.9% as of March 31, 2023.

- Dividend payout ratio of 55% for the three months ended March 31, 2023.

- Average annual dividend per-share growth of 5.4% from 2019 to 1Q23 annualized.

Strong balance sheet management

Key metrics as of March 31, 2023

- $33.0 billion in total market capitalization.

- $21.5 billion in total equity capitalization, which ranks in the top 10% among all publicly traded U.S. REITs.

| | | 1Q23 | | Goal | |||

| | | Quarter | | Trailing | | 4Q23 | |

| Net debt and preferred stock to | | 5.3x | | 5.6x | | Less than or equal to 5.1x | |

| Fixed-charge coverage ratio | | 5.0x | | 5.0x | | 4.5x to 5.0x Werbung Mehr Nachrichten zur Alexandria Real Estate Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |