Bornheim bei Landau, September 11, 2007. The business performance of the HORNBACH-Baumarkt-AG Group was unsatisfactory in the 2nd quarter of the current financial year (June 1 - August 31, 2007). Consolidated sales (net), which rose by 2.3 % to ¤ 653 million (previous year: ¤ 638.5m), fell short of expectations. This was due to a negative like-for-like sales performance in Germany. In particular, changeable weather conditions in summer 2007 led to a tangible downturn in sales in weather-dependent product groups, such as sun protection, air-conditioning equipment and most garden items. Net like-for-like sales declined by 4.2 % (including sales tax: minus 1.8%) in Germany in the 2nd quarter. HORNBACH nevertheless outperformed the sector once again by a clear margin. According to the BHB sector association, like-for-like gross sales at German DIY stores and garden centers fell by up to 7 % in July and August 2007 alone. Consumer demand for DIY products was also said to have been additionally dampened by the sales tax increase, rising interest rates and higher costs of living (energy, gasoline, food). HORNBACH continued to achieve pleasing growth rates at its stores outside Germany, at which like-for-like sales rose by 4.5 %. Based on initial preliminary figures, operating earnings (EBIT) amounted to just under ¤ 40 million in the 2nd quarter, and were thus around 15 % down on the previous year (¤ 47.0m), against minus 20.7% in the previous quarter. Consolidated net income for the quarter nevertheless rose by more than 12 % to over ¤ 32 million (previous year: ¤ 28.7m). This is chiefly due to one-off tax-related income amounting to ¤ 8.3 million resulting from the revaluation of deferred tax assets and liabilities required by the corporate tax reform. The outlook for the financial year as a whole (March 1, 2007 - February 19, 2008) has been amended on account of the current business performance in Germany. Consolidated sales at HORNBACH-Baumarkt-AG are expected to range between ¤ 2.45 billion and ¤ 2.5 billion. Operating earnings (EBIT) for the financial year as a whole will also fall significantly short of the previous year's figure (¤ 96.1m). Further details will be announced in the 2007/2008 half-year report, which will be published in the investor relations section of the company's website at www.hornbach-group.com on September 27, 2007. Contact: Axel Müller Investor Relations Tel. +49-6348-60 2444 axel.mueller@hornbach.com --- End of Message --- Hornbach-Baumarkt-AG Hornbachstrasse 11 Bornheim bei Landau WKN: 608440; ISIN: DE0006084403; Index: CDAX, Prime All Share, SDAX; Listed: Amtlicher Markt in Frankfurter Wertpapierbörse, Prime Standard in Frankfurter Wertpapierbörse;

Top-News

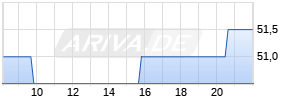

Ad hoc: Hornbach-Baumarkt-AG: EBIT in Q2 2007/2008 15% down on previous year - net income benefitsfrom corporate tax reform

Dienstag, 11.09.2007 18:05 von Hugin - Aufrufe: 478

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

-1

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.