Wellington Financial Hits 'Hard Cap' On New $300 Million Fund V

PR Newswire

SILICON VALLEY, CA, SANTA MONICA, CA and TORONTO, Nov. 2, 2015

SILICON VALLEY, CA, SANTA MONICA, CA and TORONTO, Nov. 2, 2015 /PRNewswire/ - Wellington Financial LP, a privately held specialty finance firm providing growth capital to Canadian, U.S. and U.K.-based companies, is pleased to announce the final fundraising close of its new investment program.

The launch of Wellington Financial Fund V was announced four weeks ago. With today's second and final close, the firm has hit its 'hard cap' of $300 million of subscriptions from Canadian institutional investors and family offices. Wellington Financial Fund V is now the largest technology-focused private fund in Canada.

Wellington Financial Fund IV, capitalized with $200 million of re-circulating equity capital in 2012, was a successor fund to three previous entities. Fund IV committed more than $225 million via 28 growth capital transactions over a 3-year period.

"Our corporate passion is to back as many of the best companies as we can find, and this new fund gives us the capital we need to support entrepreneurs in Canada, the United States as well as the United Kingdom," said Mark McQueen, Wellington Financial's President and Chief Executive Officer. "Whether you are looking for $2 million or $40 million of growth capital, Wellington will meet your needs with a very attractive cost of capital."

"Over the past 15 years, Wellington Financial has supported many of North America's highest quality, privately-held growth stories, including Belair Networks, folioDynamix, Maxymiser, OZ Communications, Real Matters, Vision Critical and Xactly," continued Ken Rotman, Chairman of Wellington Financial and Co-CEO of Clairvest Group Inc. "This new fund will build on Wellington's well-earned reputation as an agile, professional, supportive and ethical place to raise growth capital for your business. Just ask some of our portfolio companies…."

"The team at Wellington are true professionals and added meaningful value to our business," said Joe Consul, CFO of Xactly Corp. of San Jose, California. Added Javier Brage, CFO of New York and London, UK-based Maxymiser: "The Wellington Financial team was true to their word and trusted our executive team." In June, Xactly, a Wellington Financial Fund IV portfolio company, completed its successful initial public offering on the New York Stock Exchange. In September, Maxymiser, also a Fund IV portfolio company, was acquired by Oracle.

Wellington Financial Fund V will continue to follow the same proven model by assisting both public and private companies with a demonstrated customer following, minimum of $5 million in trailing revenue, talented management and well-defined growth strategies.

About Wellington Financial LP

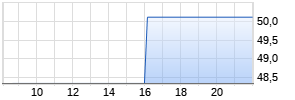

Wellington Financial LP is a privately-held specialty finance firm providing term, venture and amortizing loans up to $40 million. Wellington Financial LP is currently managing a $900 million investment program with offices in Silicon Valley, Santa Monica and Toronto. Wellington Financial LP is managed by a partnership controlled by fund management and Clairvest Group Inc. (CVG:TSX), who jointly have contributed a large financial stake to the Fund. LPs have included many of Canada's largest institutional investors, crown corporations, financial institutions and pension funds. Please visit the fund website at www.wellingtonfund.com, or the Wellington Financial team blog at www.wellingtonfund.com/blog.

SOURCE Wellington Financial LP

Mehr Nachrichten zur CLAIRVEST GROUP Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.