Wajax Announces 2015 Fourth Quarter Results, Including a Goodwill Impairment and Plans for Strategic Reorganization

Canada NewsWire

TORONTO, March 1, 2016

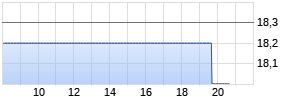

TSX Symbol: WJX

| | | | ||||

| (Dollars in millions, except per share data) | Three Months Ended December 31 | Year Ended December 31 | ||||

| | 2015 | 2014 | | 2015 | 2014 | |

| CONSOLIDATED RESULTS | | | | | | |

| Revenue | $324.4 | $386.1 | | $1,273.3 | $1,451.3 | |

| | | | | | | |

| Net (loss) earnings | $(33.3) | $11.2 | | $(11.0) | $41.2 | |

| Basic (loss) earnings per share | $(1.66) | $0.67 | | $(0.59) | $2.46 | |

|

Adjusted net earnings (1)(2) |

$4.0 |

$11.0 | |

$27.8 |

$43.3 | |

| Adjusted basic earnings per share (1)(3) | $0.20 | $0.66 | | $1.50 | $2.58 | |

| | | | | | | |

TORONTO, March 1, 2016 /CNW/ - Wajax Corporation ("Wajax" or the "Corporation") today announced its 2015 fourth quarter results, including a goodwill and intangible asset impairment charge, plans to reorganize its business segments and the entering into of an agreement to acquire Wilson Machine Co. Ltd..

Fourth Quarter Highlights

- Consolidated fourth quarter revenue of $324.4 million decreased $61.7 million, or 16%, compared to last year. All three segments recorded reduced revenue compared to the previous year primarily as a result of the energy sector related slowdown in western Canada.

- A net loss for the quarter of $33.3 million, or $1.66 per share, included a $41.2 million ($37.3 million after-tax) impairment of goodwill and intangible assets related to the Power Systems and Industrial Components segments. Excluding the asset impairment expense and 2014 restructuring recovery, adjusted net earnings of $4.0 million, or $0.20 per share, declined from $11.0 million, or $0.66 per share, recorded in 2014. Segment earnings before impairment of goodwill and intangible assets and restructuring recovery declined in all three segments largely as a result of the lower volume. On a consolidated basis, the negative effect of lower revenue was only partially offset by a $3.6 million reduction in selling and administrative expenses as a result of lower personnel costs and a $0.4 million reduction in finance costs on lower debt levels.

- Consolidated backlog of $169.2 million at December 31, 2015 increased $13.1 million compared to September 30, 2015 driven by higher Equipment segment crane orders.(2)

- Funded net debt at December 31, 2015 of $149.0 million decreased $18.5 million compared to September 30, 2015, primarily as a result of a $22.0 million reduction in non-cash operating working capital.(2)

Wajax declared a first quarter 2016 dividend of $0.25 per share payable on April 4, 2016 to shareholders of record on March 15, 2016.

Strategic Reorganization

The Corporation also announced today that, during 2016, it will be transitioning from its current three independent product divisions to a leaner and more integrated organization. The new organization will be based on three main functional groups: business development, service operations and vendor development. These groups will be supported by centralized functions including supply chain, information systems, human resources, environmental health and safety and finance. The new structure is intended to improve the Corporation's cross-company customer focus, closely align resources to the 4 Points of Growth strategy, improve operational leverage, and lower costs through productivity gains and the elimination of redundancy inherent in the current structure. Excluding an estimated $12 million restructuring provision in the first quarter of 2016, an estimated net benefit of approximately $4 million is expected to occur in 2016, with anticipated annual cost savings of approximately $15 million flowing into 2017 earnings. While ongoing cost reduction is necessary due to market conditions, it is a byproduct of the Corporation's primary objective to re-align its organizational structure to enhance the execution of its strategy. Upon successful completion of this restructuring, the Corporation will have reduced headcount across its Canada-wide organization by approximately 10% since the beginning of 2015.

Acquisition of Wilson Machine Co. Ltd.

On February 12, 2016, the Corporation entered into an agreement to acquire the assets of Montreal- based Wilson Machine Co. Ltd ("Wilson") for approximately $5 million. Subject to the satisfaction of customary closing conditions, the acquisition is expected to be completed within the next 60 days. Wilson is a North American leader in the manufacturing and repair of precision rotating machinery and gearboxes with annual sales of approximately $6 million, and its major customers in eastern Canada align well with Wajax's existing customer base. Wilson's service offerings are an ideal fit for Wajax's 4 Points of Growth strategy and management believes it can leverage the Corporation's sales force and larger geographic footprint to significantly grow the business.

Outlook

Commenting on the fourth quarter of 2015 and the Corporation's outlook for 2016, Mark Foote, President and CEO, stated:

"On an adjusted net earnings basis, fourth quarter results were significantly negatively impacted by the energy sector related slowdown in western Canada. Results from the Power Systems and Industrial Components segments were softer than expected, as reductions in selling and administrative costs could not offset lower than expected volumes and gross margins, primarily in western Canada. However, in light of the economic pressures faced in western Canada, we were pleased with results from the Equipment segment.

The Power Systems segment continued to progress as expected in executing the restructuring plan announced in the second quarter of 2015, with anticipated cost savings realized in the fourth quarter. In addition, we generated $22.0 million of cash from reduced operating working capital, the majority of which was used to reduce indebtedness.

Our outlook for 2016 is that market conditions will remain very challenging. We expect that earnings will be under significant pressure due to ongoing market conditions in western Canada, resource customer capital and operating expenditure reductions and a weak Canadian dollar. Excluding the impact of the $12 million restructuring provision, we expect lower year-over-year earnings in the first half of 2016. During the second half of 2016, earnings are expected to improve slightly, driven by customer equipment deliveries and cost reductions. We will continue to manage our balance sheet carefully throughout 2016 and expect our leverage ratio to be within a reasonable tolerance of our target range of 1.5x – 2.0x(1). With respect to our dividend, the current quarterly amount of $0.25 per share was established in March 2015 at a level that we believe is sustainable through our expectations of a negative cycle. We will continue to consider the amount of the dividend quarterly, taking into account the Corporation's forecasted earnings, leverage and other investment opportunities.

As a result of the greater than expected decline in the western Canada economy and the difficulty in predicting the duration of this decline, we will no longer provide a net earnings CAGR target for the 2015 – 2019 outlook period. While conditions remain challenging, we are very confident in the growth activities outlined in our 4 Points of Growth strategy. Our confidence is strengthened by the enhanced earnings potential of a reorganized Corporation and the relationships we have with customers and vendors.

Wajax Corporation

Wajax is a leading Canadian distributor engaged in the sale, rental and after-sale parts and service support of equipment, power systems and industrial components, through a network of 123 branches across Canada. The Corporation is a multi-line distributor and represents a number of leading worldwide manufacturers across its core businesses. Its customer base is diversified, spanning natural resources, construction, transportation, manufacturing, industrial processing and utilities.

Wajax will Webcast its Fourth Quarter Financial Results Conference Call. You are invited to listen to the live Webcast on Tuesday, March 1, 2016 at 1:30 p.m. ET. To access the Webcast, enter www.wajax.com and click on the link for the Webcast on the Investor Relations page.

Notes

| (1) | "Adjusted net earnings", "Adjusted basic earnings per share", "Consolidated backlog", "funded net debt" and "leverage ratio" are financial measures which do not have a standardized meaning prescribed under generally accepted accounting principles (GAAP), and may not be comparable to similar measures presented by other issuers. The Corporation's Management's Discussion and Analysis (MD&A) includes additional information regarding these financial measures, including definitions and reconciliations to the most comparable GAAP measures, under the heading "Non-GAAP and Additional GAAP Measures". |

| (2) | Adjusted net earnings for the three months ended December 31, 2015: Net (loss) earnings excluding after tax goodwill and intangibles impairment in 2015 of $37.3 million, or $1.87 per share basic, and after-tax restructuring recovery in 2014 of $0.2 million, or $0.01 per share basic. |

| | Adjusted net earnings for the twelve months ended December 31, 2015: Net (loss) earnings excluding after-tax goodwill and intangibles impairment of $37.3 million or $2.01 per share basic (2014 - $nil) and after-tax restructuring costs of $1.5 million or $0.08 per share (2014 - $2.1 million or $0.12 per share basic). |

| (3) | For the three months ended December 31, 2015, the numbers of basic shares outstanding were 19,983,800 (2014 - 16,778,883). For the twelve months ended December 31, 2015, the numbers of basic shares outstanding were 18,559,558 (2014 - 16,772,769). |

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking statements and forward-looking information, as defined in applicable securities laws (collectively, "forward-looking statements"). These forward-looking statements relate to future events or the Corporation's future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward looking statements can be identified by the use of words such as "plans", "anticipates", "intends", "predicts", "expects", "is expected", "scheduled", "believes", "estimates", "projects" or "forecasts", or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. Forward looking statements involve known and unknown risks, uncertainties and other factors beyond the Corporation's ability to predict or control which may cause actual results, performance and achievements to differ materially from those anticipated or implied in such forward looking statements. There can be no assurance that any forward looking statement will materialize. Accordingly, readers should not place undue reliance on forward looking statements. The forward looking statements in this news release are made as of the date of this news release, reflect management's current beliefs and are based on information currently available to management. Although management believes that the expectations represented in such forward-looking statements are reasonable, there is no assurance that such expectations will prove to be correct. Specifically, this news release includes forward looking statements regarding, among other things, our planned strategic reorganization and the benefits we expect to achieve therefrom, including, without limitation, improved operational leverage, cost savings of $4 million in 2016 and $15 million in 2017, and the enhanced ability to execute our growth strategy; our expected completion of the Wilson acquisition and our belief that we can leverage our sales force and geographic footprint to significantly grow the Wilson business; our outlook for 2016, including the expected effect of market conditions in western Canada, reduced resource customer expenditures and a weak Canadian dollar on our earnings, our expectation for year-over-year earnings in the first and the second halves of 2016; our expected leverage range for 2016; the current amount of our dividend being sustainable throughout our expectations of a negative cycle; and our confidence in our 4 Points of Growth strategy. These statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions regarding general business and economic conditions; the supply and demand for, and the level and volatility of prices for, oil and other commodities; financial market conditions, including interest rates; our ability to execute our 4 Points of Growth strategy, including our ability to develop our core capabilities, execute on our organic growth priorities, complete and effectively integrate acquisitions and to successfully implement new information technology platforms, systems and software; the future financial performance of the Corporation; our costs; market competition; our ability to attract and retain skilled staff; our ability to procure quality products and inventory; and our ongoing relations with suppliers, employees and customers. The foregoing list of assumptions is not exhaustive. Factors that may cause actual results to vary materially include, but are not limited to, a deterioration in general business and economic conditions; volatility in the supply and demand for, and the level of prices for, oil and other commodities; a continued or prolonged decrease in the price of oil; fluctuations in financial market conditions, including interest rates; the level of demand for, and prices of, the products and services we offer; levels of customer confidence and spending; market acceptance of the products we offer; termination of distribution or original equipment manufacturer agreements; unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost escalation, our inability to reduce costs in response to slow-downs in market activity, unavailability of quality products or inventory, supply disruptions, job action and unanticipated events related to health, safety and environmental matters), our ability to attract and retain skilled staff and our ability to maintain our relationships with suppliers, employees and customers. The foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement. The Corporation does not undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless so required by applicable securities laws. Further information concerning the risks and uncertainties associated with these forward looking statements and the Corporation's business may be found in our Annual Information Form for the year ended December 31, 2015, filed on SEDAR.

Management's Discussion and Analysis – 2015

The following management's discussion and analysis ("MD&A") discusses the consolidated financial condition and results of operations of Wajax Corporation ("Wajax" or the "Corporation") for the year ended December 31, 2015. This MD&A should be read in conjunction with the information contained in the Corporation's Consolidated Financial Statements and accompanying notes for the year ended December 31, 2015. Information contained in this MD&A is based on information available to management as of March 1, 2016.

Unless otherwise indicated, all financial information within this MD&A is in millions of Canadian dollars, except ratio calculations, share, share rights and per share data. Additional information, including Wajax's Annual Report and Annual Information Form, are available on SEDAR at www.sedar.com.

Responsibility of Management and the Board of Directors

Management is responsible for the information disclosed in this MD&A and the Consolidated Financial Statements and accompanying notes, and has in place appropriate information systems, procedures and controls to ensure that information used internally by management and disclosed externally is materially complete and reliable. Wajax's Board of Directors has approved this MD&A and the Consolidated Financial Statements and accompanying notes. In addition, Wajax's Audit Committee, on behalf of the Board of Directors, provides an oversight role with respect to all public financial disclosures made by Wajax and has reviewed this MD&A and the Consolidated Financial Statements and accompanying notes.

Disclosure Controls and Procedures and Internal Control over Financial Reporting

Wajax's management, under the supervision of its Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO"), is responsible for establishing and maintaining disclosure controls and procedures ("DC&P") and internal control over financial reporting ("ICFR").

As at December 31, 2015, Wajax's management, under the supervision of its CEO and CFO, had designed DC&P to provide reasonable assurance that information required to be disclosed by Wajax in annual filings, interim filings or other reports filed or submitted under applicable securities legislation is recorded, processed, summarized and reported within the time periods specified in such securities legislation. DC&P are designed to ensure that information required to be disclosed by Wajax in annual filings, interim filings or other reports filed or submitted under applicable securities legislation is accumulated and communicated to Wajax's management, including its CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

As at December 31, 2015, Wajax's management, under the supervision of its CEO and CFO, had designed internal control over financial reporting ("ICFR") to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards ("IFRS"). In completing the design, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") in its 2013 version of Internal Control – Integrated Framework. With regard to general controls over information technology, management also used the set of practices of Control Objectives for Information and related Technology ("COBIT") created by the IT Governance Institute.

During the year, Wajax's management, under the supervision of its CEO and CFO, evaluated the effectiveness and operation of its DC&P and ICFR. This evaluation included a risk evaluation, documentation of key processes and tests of effectiveness conducted on a sample basis throughout the year. Due to the inherent limitations in all control systems, an evaluation of the DC&P and ICFR can only provide reasonable assurance over the effectiveness of the controls. As a result, DC&P and ICFR are not expected to prevent and detect all misstatements due to error or fraud. The CEO and CFO have concluded that Wajax's DC&P and ICFR were effective as at December 31, 2015.

There was no change in Wajax's ICFR that occurred during the three months ended December 31, 2015 that has materially affected, or is reasonably likely to materially affect, Wajax's ICFR.

Cautionary Statement Regarding Forward-Looking Information

This MD&A contains certain forward-looking statements and forward-looking information, as defined in applicable securities laws (collectively, "forward-looking statements"). These forward-looking statements relate to future events or the Corporation's future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward looking statements can be identified by the use of words such as "plans", "anticipates", "intends", "predicts", "expects", "is expected", "scheduled", "believes", "estimates", "projects" or "forecasts", or variations of, or the negatives of, such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. Forward looking statements involve known and unknown risks, uncertainties and other factors beyond the Corporation's ability to predict or control which may cause actual results, performance and achievements to differ materially from those anticipated or implied in such forward looking statements. There can be no assurance that any forward looking statement will materialize. Accordingly, readers should not place undue reliance on forward looking statements. The forward looking statements in this MD&A are made as of the date of this MD&A, reflect management's current beliefs and are based on information currently available to management. Although management believes that the expectations represented in such forward-looking statements are reasonable, there is no assurance that such expectations will prove to be correct. Specifically, this MD&A includes forward looking statements regarding, among other things, our 4 Points of Growth Strategy and the goals for such strategy, including our goal of becoming Canada's leading industrial products and services provider; our "4 Points of Growth" framework to grow the corporation; our target leverage ratio range of 1.5 – 2.0 times; our continued focus on investments and strategies with respect to our core capabilities, organic growth programs, acquisitions and information systems/technology, as well as the expected benefits therefrom and our plans to manage these plans and programs, and our inventory, prudently given our expectation of continued weak market conditions; our planned strategic reorganization and the benefits we expect to achieve therefrom, including, without limitation, improved operational leverage, cost savings of $5 million in 2016 and $15 million in 2017, and the enhanced ability to execute our growth strategy; the completion of the restructuring of our Power Systems segment which began in Q2 2015 and the cost savings we expect will result therefrom; our financing, working and maintenance capital requirements, as well as our capital structure and leverage ratio; our foreign exchange risks and exposures, including the impact of fluctuations in foreign currency values; our obligation to fund pension benefits; the adequacy of our debt capacity; our intention and ability to access debt and equity markets should additional capital be required; our expected completion of the Wilson acquisition and our belief that we can leverage our sales force and geographic footprint to significantly grow the Wilson business; our outlook for 2016, including the expected effect of market conditions in western Canada, reduced resource customer expenditures and a weak Canadian dollar on our earnings; our expectation for year-over-year earnings in the first and the second halves of 2016; our expected leverage range for 2016; the current amount of our dividend being sustainable throughout our expectations of a negative cycle; and our confidence in our 4 Points of Growth strategy. These statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions regarding general business and economic conditions; the supply and demand for, and the level and volatility of prices for, oil and other commodities; financial market conditions, including interest rates; our ability to execute our 4 Points of Growth strategy, including our ability to develop our core capabilities, execute on our organic growth priorities, complete and effectively integrate acquisitions and to successfully implement new information technology platforms, systems and software; the future financial performance of the Corporation; our costs; market competition; our ability to attract and retain skilled staff; our ability to procure quality products and inventory; and our ongoing relations with suppliers, employees and customers. The foregoing list of assumptions is not exhaustive. Factors that may cause actual results to vary materially include, but are not limited to, a deterioration in general business and economic conditions; volatility in the supply and demand for, and the level of prices for, oil and other commodities; a continued or prolonged decrease in the price of oil; fluctuations in financial market conditions, including interest rates; the level of demand for, and prices of, the products and services we offer; levels of customer confidence and spending; market acceptance of the products we offer; termination of distribution or original equipment manufacturer agreements; unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications or expectations, cost escalation, our inability to reduce costs in response to slow-downs in market activity, unavailability of quality products or inventory, supply disruptions, job action and unanticipated events related to health, safety and environmental matters); our ability to attract and retain skilled staff and our ability to maintain our relationships with suppliers, employees and customers. The foregoing list of factors is not exhaustive. Further information concerning the risks and uncertainties associated with these forward looking statements and the Corporation's business may be found in this MD&A under the heading "Risk Management and Uncertainties" and in our Annual Information Form for the year ended December 31, 2015, filed on SEDAR. The forward-looking statements contained in this MD&A are expressly qualified in their entirety by this cautionary statement. The Corporation does not undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless so required by applicable securities laws. Readers are further cautioned that the preparation of financial statements in accordance with IFRS requires management to make certain judgements and estimates that affect the reported amounts of assets, liabilities, revenues and expenses. These estimates may change, having either a negative or positive effect on net earnings as further information becomes available, and as the economic environment changes.

Non-GAAP and Additional GAAP Measures

This MD&A contains both non-GAAP and additional GAAP measures that do not have a standardized meaning prescribed by GAAP. These measures are defined and reconciled to the most comparable GAAP measure in the Non-GAAP and Additional GAAP Measures section.

Wajax Corporation Overview

Wajax is a leading Canadian distributor engaged in the sale and service support of mobile equipment, power systems and industrial components through a network of 123 branches across Canada. Reflecting a diversified exposure to the Canadian economy, Wajax's customer base covers core sectors of the Canadian economy, including construction, industrial and commercial, transportation, the oil sands, forestry, oil and gas, metal processing and mining.

On March 1, 2016, Wajax announced that it will be transitioning from its current three independent product divisions to a leaner and more integrated organization. The new organization will be based on three main functional groups: business development, service operations and vendor development. These groups will be supported by centralized functions including supply chain, information systems, human resources, environmental, health and safety and finance. The new structure is intended to improve Wajax's cross-company customer focus, closely align resources to the 4 Points of Growth strategy, improve operational leverage, and lower costs through productivity gains and the elimination of redundancy inherent in the current structure. See the Reorganization section below.

Strategy

On March 3, 2015, the Corporation introduced the 4 Points of Growth long-term strategy. The Corporation's goal is to be Canada's leading industrial products and services provider, distinguished through: sales force excellence, breadth and efficiency of repair and maintenance operations and an ability to work closely with existing and new vendor partners to constantly expand its product offering to customers.

As one of Canada's most diversified industrial distributors, the strategy builds upon the Corporation's dedicated team, national branch network, diverse end market expertise, world-class vendor base and strong customer relationships. These existing strengths will be leveraged through the following "4 Points of Growth":

1) Development of Core Capabilities including Sales Force Excellence, Repair and Maintenance Operations and Product and Vendor Development;

2) Clear organic growth priorities;

3) Building the Corporation's capacity to complete and integrate Engineered Repair Services ("ERS") acquisitions; and

4) Investment in systems that will improve operational efficiencies and customer service.

As part of its long-term strategy, the Corporation established financial targets for the 5-year timeframe from 2015 – 2019. Goals over that period were to grow net earnings at a minimum compounded annual growth rate ("CAGR") of 7.5% and to target a leverage ratio range of 1.5 – 2.0 times.

As a result of the greater than expected decline in the western Canada economy and the difficulty in predicting the duration of this decline, the Corporation will no longer provide a net earnings CAGR target for the 2015 – 2019 outlook period. While conditions remain challenging, management is very confident in the growth activities outlined in the 4 Points of Growth strategy. Their confidence is strengthened by the enhanced earnings potential of a reorganized Corporation and its relationships with customers and vendors. See the Reorganization and Non-GAAP and Additional GAAP Measures sections.

The Corporation has made progress moving forward on its strategy in 2015 and will continue to execute the initiatives that advance each of the components of the 4 Points of Growth Strategy as follows:

- Core Capabilities: Significant progress is being made to drive core capabilities:

Sales Force Excellence: Wajax designed and trained almost 500 of its sales professionals on a new standard sales process which focuses on building a stronger future sales pipeline and improving close rates. A CRM system was designed and is scheduled for deployment in March 2016. In addition, a Key Account Program was developed based on the needs and expectations of major customers and will be introduced in 2016 to a limited number of large mining and oil sands customers.

Repair and Maintenance Operations: A national Service Advisory Committee was created in 2015 to design standard service operations processes and measurement systems for application at branches with core on-highway and off-highway businesses. New training programs will be rolled out to service leaders in 2016 covering safety, customer service, operational processes and financial results and measures.

Product and Vendor Development: A new product and service development process to identify market and customer needs, including vendor relationships, was implemented in the Industrial Components segment where over $50 million of future opportunities are at various stages of development. In addition, in the Power Systems segment, new product and service opportunities have been secured to diversify into aftermarket-oriented products and growth businesses such as power generation and marine.

- Organic Growth: Organic growth programs hold the most significant long-term growth opportunities for Wajax, although expected growth in 2015 was not achieved due primarily to weak market conditions in western Canada. In particular, ERS sales were $61 million in 2015, down 11% due to a 20% decline in western Canada. The ERS business in the rest of Canada, however, grew 10%. Power Generation sales were $82 million in 2015, down 6% due in part to a 15% decline in western Canada. Mining sales in the Equipment segment were $86 million in 2015, down 35% due to declines in western Canada, although revenue improvements are expected in 2016 due to the delivery of 3 large mining shovels to customers in eastern and western Canada. Oil & Gas Diversification was impacted by the decline in oil prices which had a material effect on Wajax revenue in 2015 which totaled $64 million, a reduction of 41%. As such, Wajax will continue to manage its plans, programs and inventory prudently given our expectation that weak market conditions will continue.

Wajax remains committed to these initiatives despite current market conditions, as they offer improved earnings durability in the future, due to their significant aftermarket or services potential. Further, a number of these programs offer growth opportunity nationally, mitigating Wajax's exposure to the western Canadian economy.

In addition to these programs, Wajax will continue to focus in 2016 on improving market share in its construction equipment and forestry businesses and taking advantage of growth opportunities in the commercial and defense marine market.

- Acquisitions: As noted above, expanding Wajax's ERS business is an important growth program and acquisitions are integral to the strategic plan. Based on management's current view of the Canadian marketplace, it is anticipated that Wajax will allocate up to $100 million in capital for the acquisition of ERS businesses over the 5-year timeframe of 2015 – 2019. The acquisition pipeline of potential targets was strengthened in 2015 via the completion of a regional assessment in consultation with selected major customers. In furtherance of its ERS acquisition strategy, Wajax entered into an agreement on February 12, 2016 to acquire the assets of Montreal-based Wilson Machine Co. Ltd. ("Wilson") for approximately $5 million subject to the satisfaction of customary closing conditions. Wilson is a North American leader in the manufacturing and repair of precision rotating machinery and gearboxes with annual sales of approximately $6 million.

- Systems: Investment in systems remains an important aspect of Wajax's strategy. In 2015, a new digital learning platform was implemented for sales force and service operations training, as were new systems for health and safety and human resources management. Deployment of a CRM system commenced in 2016. Wajax plans to invest up to an incremental $30 million in systems during the 5 year outlook period, the majority of which will be directed towards a common ERP platform. The start-up of the ERP investment has been deferred until 2017 in order to allow the systems team to support the upcoming reorganization of Wajax. See the Reorganization section.

Reorganization

In addition to the 4 Four Points of Growth strategic initiatives, one of the Corporation's major objectives in 2016 will be the reorganization of the Corporation. The Corporation's business will now be based around the following three main functional groups:

- Business Development is the "front-end" of the business. The group will have the primary relationship with customers, represent products and services, provide solutions and will assist in the development of the market and customer knowledge necessary to drive the Corporation's new product and service pipeline. The group will include regional and category inside and outside sales teams along with specialized end market and major customer teams. Business Development will be accountable for the Core Capability of Sales Force Excellence.

- Service Operations will be the parts and service operation for the Corporation's main on-highway and off-highway product categories. The group will include service branch operations and the majority of technicians and parts and service personnel for both shop and field services. Service Operations will be accountable for the Core Capability of Repair and Maintenance Operations.

- Vendor Development will create a world-class interface between the Corporation's vendor partners and its main sales and service functions. Working with internal groups and partners, Vendor Development will be the backbone of a new product development pipeline and will be accountable for the Core Capability of Product and Vendor Development to constantly expand our offering to customers.

These groups will be supported by centralized functions including supply chain, information systems, human resources, environmental, health and safety and finance.

The new structure is intended to improve the Corporation's cross-company customer focus, closely align resources to the 4 Points of Growth strategy, improve operational leverage, and lower costs through productivity gains and the elimination of redundancy inherent in the current structure. The Corporation will transition into the new structure throughout 2016. Excluding an estimated $12 million restructuring provision in the first quarter of 2016, an estimated net benefit of approximately $4 million is expected to occur in 2016, with anticipated annual cost savings of approximately $15 million flowing into 2017 earnings. While ongoing cost reduction is necessary due to market conditions, it is a by-product of the Corporation's primary objective to re-align its organization structure to enhance the execution of its strategy. Upon successful completion of the restructuring, the Corporation will have reduced headcount across its Canada-wide organization by approximately 10% since the beginning of 2015. See the Strategy section.

Annual Consolidated Results

| | | | | | | 2015 | | 2014 Werbung Mehr Nachrichten zur WAJAX CORP. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |