Wabtec Reports Record Quarterly Sales and Earnings; 2Q EPS of 91 Cents, Up 18 Percent; Increases Full-Year EPS Guidance

PR Newswire

WILMERDING, Pa., July 24, 2014

WILMERDING, Pa., July 24, 2014 /PRNewswire/ -- Wabtec Corporation (NYSE: WAB) today reported record results for the 2014 second quarter, including the following:

- Second quarter sales were a record $731 million, 15 percent higher than the year-ago quarter, due to strong growth in both the Freight and Transit segments.

- Income from operations was a record $132 million, or 18.1 percent of sales, compared to

17.6 percent in the year-ago quarter. - Earnings per diluted share were a record 91 cents, which was 18 percent higher than the

year-ago quarter. - Cash flow from operations in the quarter was $111 million, or 15 percent of sales. At

June 30, 2014, the company had cash of $226 million and debt of $501 million. During the quarter, the company repurchased 194,700 shares of company stock for $14 million.

Based on Wabtec's first half results and outlook for the rest of the year, the company increased its 2014 guidance for earnings per diluted share to about $3.52, with revenues expected to be up about

15 percent for the year.

Albert J. Neupaver, Wabtec's executive chairman, said: "The company had a strong operating quarter, with record sales, earnings and margins, as we continued to execute our growth strategies and internal improvement initiatives. We are optimistic about our future growth prospects, given the diversity of our business model, strong global investment in transportation and infrastructure projects, and the power of our Wabtec Performance System to drive efficiency and cost reductions."

Raymond T. Betler, Wabtec's president and chief executive officer, said: "During the quarter we also completed the acquisition of Fandstan Electric Group, a leading manufacturer of pantographs and other products for rail and tram transportation, and industrial and energy markets. Fandstan Electric fits all of our strategic growth initiatives, and our integration efforts are already well underway."

Wabtec Corporation (www.wabtec.com) is a global provider of value-added, technology-based products and services for rail and other industrial markets.

This release contains forward-looking statements, such as statements regarding the company's expectations about future earnings. Actual results could differ materially from the results suggested in any forward-looking statement. Factors that could cause or contribute to these material differences include, but are not limited to, an economic slowdown in the markets we serve; a decrease in freight or passenger rail traffic; an increase in manufacturing costs; and other factors contained in the company's filings with the Securities and Exchange Commission. The company assumes no obligation to update these statements or advise of changes in the assumptions on which they are based.

Wabtec will host a call with analysts and investors at 10 a.m., eastern time, today. To listen, go to www.wabtec.com and click on the "Webcasts" tab in the "Investor Relations" section.

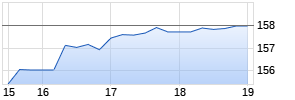

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Wabtec | ||

|

ME5SYG

| Ask: 2,09 | Hebel: 5,68 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

| WABTEC CORPORATION | |||||

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS | |||||

| FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2014 AND 2013 | |||||

| (DOLLARS IN THOUSANDS EXCEPT PER SHARE DATA) | |||||

| (UNAUDITED) | |||||

| | | | | | |

| | | | | | |

| | Second | Second | | For the | For the |

| | Quarter | Quarter | | Six Months | Six Months |

| | 2014 | 2013 | | 2014 | 2013 |

| | | | | | |

| Net sales | $ 731,068 | $ 638,002 | | $ 1,426,317 | $ 1,253,512 |

| Cost of sales | (506,410) | (445,121) | | (992,090) | (877,743) |

| Gross profit | 224,658 | 192,881 | | 434,227 | 375,769 |

| Gross profit as a % of Net Sales | 30.7% | 30.2% | | 30.4% | 30.0% |

| | | | | | |

| Selling, general and administrative expenses | (72,982) | (63,874) | | (143,063) | (128,174) |

| Engineering expenses | (14,221) | (11,280) | | (27,167) | (22,614) |

| Amortization expense | (5,132) | (5,173) | | (9,828) | (8,760) |

| Total operating expenses | (92,335) | (80,327) | | (180,058) | (159,548) |

| Operating expenses as a % of Net Sales | 12.6% | 12.6% | | 12.6% | 12.7% |

| | | | | | |

| Income from operations | 132,323 | 112,554 | | 254,169 | 216,221 |

| Income from operations as a % of Net Sales | 18.1% | 17.6% | | 17.8% | 17.2% |

| | | | | | |

| Interest (expense) income, net | (4,525) | (3,271) | | (8,975) | (6,885) |

| Other income (expense), net | 243 | 406 | | 226 | (175) |

| Income from operations before income taxes | 128,041 | 109,689 | | 245,420 | 209,161 |

| | | | | | |

| Income tax expense | (39,336) | (35,051) Werbung Mehr Nachrichten zur Wabtec Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||