Virbac: second quarter sales growth largely offsets the decline in the first quarter

Virbac: second quarter sales growth largely offsets the decline in the first quarter

Public release - July 17, 2017

Virbac consolidated revenue in the second quarter amounted to €234.8 million, up sharply by +7.5% compared to the same period in 2016, of which organic growth was +5.7%. The main contributors to this performance were the United States, which enjoyed sustained activity over the period (+21%), aquaculture, as well as China, Brazil and Mexico. The endectocides (Sentinel) and the specialties ranges for companion animals, and the parasiticides and vaccines for bovine are growing in the quarter.

Year-to-date, first-half sales have reached €434.5 million compared to

€430.0 million in the same period of 2016, with an overall evolution of +1.1%. Excluding the favorable impact of exchange rates, sales were down slightly to -1.2%.

In the United States, activity in the first half was down -10.7%, of which -12.1% at comparable exchange rates, an improvement, however, compared with the first quarter, which was down by -44 % at constant exchange rates. Sentinel was down in ex-Virbac net sales, although ex-distributor sales remained stable over the period. Virbac sales in the Iverhart range are down sharply, although they are growing at ex-distributor sales. This increase is nevertheless much lower than anticipated and did not allow a significant restocking of the distributors given their stock level. The other ranges are stable in ex-Virbac sales, but continue to increase in sales to clinics.

Outside of the United States, the Group achieved a good first half showing a +1.1% organic growth (+3.4% at actual rates).

Europe is generally stable at constant exchange rates, notably due to a downturn in the OTC (unfavorable base effect due to the launch of Fipro Duo parasiticides in early 2016). In the rest of the world, organic growth continues to be sustained in many emerging countries, particularly in China, Brazil and Mexico. Conversely, in India, performance was strongly influenced by the double impact of demonetization at the beginning of the year and the entry into force of the new tax regulations which led distributors to massively reduce their stock at the end of June. Performance was also more contrasted in Japan due to competition. Finally, in Chile, activity decreased slightly compared to 2016 with contrasting activity (vaccines in progress and antibiotic range down, but compared to a high base in the first half of 2016).

In terms of species, sales in the companion animals segment fell overall by -4.1%, of which -4.9% at constant scope and exchange rates, reflecting a slower than expected return in the United States. Outside the United States, the decline in activity was -0.7%, of which -1.2% organic growth. The ranges most negatively impacted in comparison to the same period in 2016 are the internal and external parasiticides for companion animals and dog vaccines that have suffered from the temporary reduction of production capacity. Conversely, the specialties ranges for dogs and cats continue to progress.

Business in the food producing animal segment recorded an overall increase of +8.7%, of which +4.4% at constant rates. The positive effect of exchange rates is in Asia-Pacific and Latin America. At constant rates and perimeter, the bovine and the industrial (swine and poultry) posted healthy growth of +5.7% and +4.2% respectively. The aquaculture sector was down slightly in the first half (-0.4% at constant exchange rates).

| Key figures |

| NET REVENUE FIRST HALF 2017 Estimate €434.5 M _________ TOTAL GROWTH +1.1% _________ GROWTH AT CONSTANT EXCHANGE RATES -1.2% _________ GROWTH AT CONSTANT SCOPE -1.2% Of which : COMPANION ANIMALS -4.9% FOOD PRODUCING ANIMALS +4.4% |

| CONSOLIDATED DATA Unaudited - in million Euros | 2017 | 2016 | % change | Evolution at constant exchange rates | Evolution at constant scope | |

| Net revenue - 1st quarter | 199.7 | 211.4 | -5.5% | -8.3% | -8.3% | |

| Net revenue - 2nd quarter | 234.8 | 218.6 | +7.5% | +5.7% | +5.7% | |

| Net revenue - 1st half | 434.5 | 430.0 | +1.1% | -1.2% | -1.2% | |

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Virbac via Globenewswire

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Virbac SA | ||

|

ME2K3H

| Ask: 10,18 | Hebel: 4,84 |

| mit moderatem Hebel |

Zum Produkt

| |

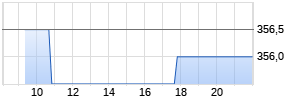

Kurse

|

Mehr Nachrichten zur Virbac SA Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.