Vipshop Reports Unaudited First Quarter 2017 Financial Results

PR Newswire

GUANGZHOU, China, May 15, 2017

GUANGZHOU, China, May 15, 2017 /PRNewswire/ -- Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced its unaudited financial results for the first quarter ended March 31, 2017.

First Quarter 2017 Highlights

- Total net revenue for the first quarter of 2017 increased by 31.1% to RMB15.95 billion (US$2.32 billion) from RMB12.17 billion in the prior year period.

- The number of active customers[1] for the first quarter of 2017 increased by 32% year over year to 26.0 million.

- Total orders[2] for the first quarter of 2017 increased by 23% year over year to 72.1 million.

- Gross profit for the first quarter of 2017 increased by 25.0% to RMB3.69 billion (US$536.7 million) from RMB2.96 billion in the prior year period.

- Net income attributable to Vipshop's shareholders for the first quarter of 2017 increased by 16.3% to RMB551.9 million (US$80.2 million) from RMB474.6 million in the prior year period.

- Non-GAAP net income attributable to Vipshop's shareholders[3] for the first quarter of 2017 increased by 28.2% to RMB799.4 million (US$116.1 million) from RMB623.4 million in the prior year period.

"We are pleased to have reported continued robust operational results with solid customer gains in the first quarter of 2017, starting the year on a strong note," said Mr. Eric Shen, chairman and chief executive officer of Vipshop. "Our strong results highlight the effectiveness of our strategic focus on expanding our customer base and gaining additional market share in China's fragmented discount retail market. Specifically, we are delighted to witness that our total active customers for the trailing twelve months ended March 31, 2017 increased by 38% to over 55.5 million. In the past quarter, we made a number of strides in improving the end-to-end user experience across our platform, including our strengthened merchandising capability with various new international brands and the further expansion in the variety and selection of our product offerings, as well as the continued enhancement of the customization across the Vipshop platform. Our achievements were further recognized by independent third parties such as BrandZ, which served as endorsements of the value of our brand and the increasing influence of our platform."

Mr. Donghao Yang, chief financial officer of Vipshop, further commented, "We are delighted to have delivered another quarter of strong topline growth with steady margins in addition to improved free cash flow in the first quarter of 2017. Importantly, we are pleased to announce that our Board of Directors authorized the Company to explore a proposed spin-off of our Internet finance business, which could significantly strengthen the Company's cash flow, positively impact our earnings, and enable us to further invest in our core e-commerce business. Looking ahead, we are confident that we will continue to gain market share in our core categories while maintaining our stable and sustainable profitability as China's leading discount retailer."

Recent Business Highlights

- On May 11, 2017, Vipshop's Board of Directors authorized the Company to explore a proposed spin-off of its Internet finance business into a dedicated entity. The objective of the proposed spin-off is to alleviate the Internet finance business' financial impact on the Company's core e-commerce business and shift any associated incentives and risks to this dedicated entity. Additionally, it may enable the Internet finance business to accelerate its growth as an independent entity going forward. It has been proposed that Vipshop will inject all of its Internet finance business and related assets into the dedicated entity and restructure the existing variable interest entity arrangement with that dedicated entity. Certain key management personnel of the Internet finance business may acquire minority equity interests in the dedicated entity. Vipshop's Board of Directors has authorized the directors and officers of the Company to further explore, negotiate and finalize the terms and arrangements of the proposed spin-off for its final approval.

- On May 11, 2017, Vipshop's Board of Directors authorized the formation of a new entity dedicated to the Company's logistics business, aiming to open up Vipshop's logistics services to a broader market to lower costs for both Vipshop and its business partners, to explore a new initiative of online and offline retail integration, as well as to provide consistent delivery services with its more comprehensive nationwide network coverage.

- During the first quarter of 2017, the Company duly notified all holders of its 1.50% convertible senior notes due 2019 (of which US$632.5 million aggregate principal amount was outstanding at the time of such notification) of their one-time put right under the terms of the indenture for the notes. Approximately US$3.1 million aggregate principal amount of the notes were validly and timely surrendered and not withdrawn and the Company accepted all of these notes for repurchase. The Company believes the result of the put right exercise of its notes, together with its BBB+ rating by Fitch, Baa1 rating by Moody's, and BBB rating by Standard & Poor's, reflected Vipshop's financial strength and high credit quality. Further, the Company believes it is also a vote of confidence from the capital markets for its future growth prospects and market potential.

- In the first quarter of 2017, the Company's CRM team began to experiment with a new Super VIP paid membership program, which offers many features including early and exclusive access to selective sales events, privileged discounts, and free shipping and returns. Trial program members who enrolled as Super VIPs showed significant improvements in average order frequency and average revenue per user.

- Vipshop is in the process of developing a new generation of intelligent customer service chatbots that provide shopping guides prior to purchases and after-sales services. Through this initiative, the Company will be able to substantially enhance user experience, improve administrative efficiency, and reduce costs.

- In the first quarter of 2017, Vipshop added approximately 160,000 square meters of warehouse space in Jianyang, China and currently has approximately 2.1 million square meters of warehouse capacity nationwide. In order to be closer to its customers, shorten delivery time, and improve the efficiency of its distribution, in addition to its five regional and centralized warehouses, the Company added two local warehouses in Guiyang, China and Kunming, China during the quarter, increasing the total number of local warehouses to seven as of March 31, 2017.

- Vipshop scaled up the application of intelligent transportation robot system in its southern warehouse and rolled out its proprietary Warehouse Control System (WCS) in its southern and central warehouses. The Company also introduced automated systems in its central and southern warehouse facilities during the first quarter, which include conveyor belts and automatic systems for product sorting and storage, aiming to ultimately improve the Company's logistics efficiency and reduce costs.

- The Company added approximately 3,000 last mile delivery staff in the first quarter of 2017 and now has a total of more than 23,000 last mile delivery staff nationwide. It now has approximately 2,800 self-operated delivery stations and is able to deliver 93% of its orders through its last mile network as compared with 83% in the same period last year, covering all provinces in China. In addition, Vipshop further strengthened its logistics services by having its own delivery staff collect returns from customers directly, which currently covers 67% of the Company's total returns, up from 30% from the same period in the prior year.

- In the first quarter of 2017, Vipshop added a number of popular international brands and now works directly with Giorgio Armani, Guess, Versace, and many others.

- At the February 28 Beauty and Cosmetics Festival, Vipshop collaborated with over 300 international and domestic beauty brands. Orders for the event exceeded one million in just 1.5 hours. At the same time, Vipshop executed joint marketing with 70 major beauty and cosmetics brands on social media. At the March 8 Spring New Collection Event, Vipshop partnered with eight major apparel brands and published eight fashionable trends for 2017 spring and summer collections.

- In the first quarter of 2017, BrandZ ranked Vipshop as number 40 on the list of "Top 100 Most Valuable Chinese Brands 2017." In addition, the Company was ranked number 15 on the list of "Top 50 Chinese Listed Private Companies by Brand Value 2017," jointly published by Tsinghua University's China Enterprise Research Center and the Daily Economic News. These third party endorsements demonstrate the influence of Vipshop's growing brand and the power of the Vipshop platform.

First Quarter 2017 Financial Results

REVENUE

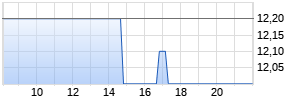

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Vipshop Holdings Ltd. ADR | ||

|

ME7YY9

| Ask: 0,52 | Hebel: 4,76 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Total net revenue for the first quarter of 2017 increased by 31.1% to RMB15.95 billion (US$2.32 billion) from RMB12.17 billion in the prior year period, primarily driven by the growth in the numbers of total active customers, repeat customers, and total orders.

The number of active customers for the first quarter of 2017 increased by 32% to 26.0 million from 19.7 million in the prior year period. The number of total orders for the first quarter of 2017 increased by 23% to 72.1 million from 58.7 million in the prior year period.

GROSS PROFIT

Gross profit for the first quarter of 2017 increased by 25.0% to RMB3.69 billion (US$536.7 million) from RMB2.96 billion in the prior year period. Gross margin was 23.2% as compared with 24.3% in the prior year period. The Company expects its gross margin to remain stable in the short term as it balances its promotional activities and sales with its marketing expenses.

OPERATING INCOME AND EXPENSES

Total operating expenses for the first quarter of 2017 were RMB3.13 billion (US$454.4 million), as compared with RMB2.39 billion in the prior year period. As a percentage of total net revenue, total operating expenses decreased to 19.6% from 19.7% in the prior year period.

- Fulfillment expenses for the first quarter of 2017 were RMB1.44 billion (US$208.7 million), as compared with RMB1.08 billion in the prior year period, primarily reflecting an increase in sales volume and number of orders fulfilled. As a percentage of total net revenue, fulfillment expenses were 9.0% as compared with 8.9% in the prior year period, primarily attributable to the Company's expansion to support an increase in the last mile business outside of the Vipshop platform.

- Marketing expenses for the first quarter of 2017 were RMB729.5 million (US$106.0 million), as compared with RMB603.8 million in the prior year period, reflecting the Company's strategy to drive long-term growth through sustainable investments to strengthen its brand awareness, attract new users and expand market share. As a percentage of total net revenue, marketing expenses decreased to 4.6% from 5.0% in the prior year period, primarily attributable to the Company's strategic balance between promotional activities and sales with its broader marketing efforts.

- Technology and content expenses for the first quarter of 2017 were RMB419.5 million (US$61.0 million), as compared with RMB326.7 million in the prior year period, reflecting the Company's continuing efforts to invest in human capital, advanced technologies such as data analytics as well as new business opportunities including the Internet finance business. As a percentage of total net revenue, technology and content expenses decreased to 2.6% from 2.7% in the prior year period.

- General and administrative expenses for the first quarter of 2017 were RMB542.2 million (US$78.8 million), as compared with RMB382.3 million in the prior year period. As a percentage of total net revenue, general and administrative expenses were 3.4% as compared with 3.1% in the prior year period, primarily attributable to an increase in share based compensation as well as the impact from building out the Internet finance business.

Income from operations for the first quarter of 2017 increased by 23.6% to RMB736.6 million (US$107.0 million) from RMB596.1 million in the prior year period. Operating margin was 4.6% as compared with 4.9% in the prior year period.

Non-GAAP income from operations[4], which excludes share-based compensation expenses and amortization of intangible assets resulting from business acquisitions, increased by 31.2% to RMB1.00 billion (US$145.9 million) from RMB765.2 million in the prior year period. Non-GAAP operating income margin[5] remained stable at 6.3% year over year.

NET INCOME

Net income attributable to Vipshop's shareholders increased by 16.3% to RMB551.9 million (US$80.2 million) from RMB474.6 million in the prior year period. Net margin attributable to Vipshop's shareholders was 3.5% as compared with 3.9% in the prior year period. Net income attributable to Vipshop's shareholders per diluted ADS[6] increased to RMB0.92 (US$0.13) from RMB0.80 in the prior year period.

Non-GAAP net income attributable to Vipshop's shareholders, which excludes share-based compensation expenses, impairment loss of investments, and amortization of intangible assets resulting from business acquisitions and equity method investments, increased by 28.2% to RMB799.4 million (US$116.1 million) from RMB623.4 million in the prior year period. Non-GAAP net margin attributable to Vipshop's shareholders[7] was 5.0% as compared with 5.1% in the prior year period. Non-GAAP net income attributable to Vipshop's shareholders per diluted ADS[8] increased to RMB1.31 (US$0.19) from RMB1.04 in the prior year period.

For the quarter ended March 31, 2017, the Company's weighted average number of ADSs used in computing diluted income per ADS was 625,339,078.

BALANCE SHEET AND CASH FLOW

As of March 31, 2017, the Company had cash and cash equivalents of RMB4.43 billion (US$644.3 million) and held-to-maturity securities of RMB746.2 million (US$108.4 million).

For the quarter ended March 31, 2017, operating cash was RMB0.74 billion, and free cash flow[9], a non-GAAP measurement of liquidity, was as follows:

| For the three months ended | ||||

| | Mar 31, 2016

RMB'000 | Mar 31, 2017

RMB'000 | Mar 31, 2017

US$'000 | |

| Net cash from operating activities | 153,211 | 736,744 | 107,035 | |

| Add: Impact from Internet financing activities[9] | 309,209 | 277,524 | 40,319 | |

| Less: Capital expenditures | (660,594) | (585,462) | (85,057) | |

| Free cash flow (out) in | (198,174) | 428,806 | 62,297 | |

| | | | | |

| Free cash flow trailing twelve months ended | ||||

| | ||||

| | Mar 31, 2016

RMB'000 | Mar 31, 2017

RMB'000 | Mar 31, 2017

US$'000 | |

| Net cash from operating activities | 1,575,008 | 3,414,946 | 496,128 | |

| Add: Impact from Internet financing activities[9] | 881,925 | 2,557,169 | 371,509 | |

| Less: Capital expenditures | (4,388,147) | (2,715,495) | (394,510) | |

| Free cash flow (out) in | (1,931,214) | 3,256,620 | 473,127 | |

Business Outlook

For the second quarter of 2017, the Company expects its total net revenue to be between RMB17.0 billion and RMB17.5 billion, representing a year-over-year growth rate of approximately 26% to 30%. These forecasts reflect the Company's current and preliminary view on the market and operational conditions, which is subject to change.

Exchange Rate

This announcement contains currency conversions of certain Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from Renminbi to U.S. dollars are made at a rate of RMB6.8832 to US$1.00, the effective noon buying rate for March 31, 2017 as set forth in the H.10 statistical release of the Federal Reserve Board.

Conference Call Information

The Company will hold a conference call on Tuesday, May 16, 2017 at 8:00 am Eastern Time or 8:00 pm Beijing Time to discuss its financial results and operating performance for the first quarter of 2017.

United States: +1-845-675-0438

International Toll Free: +1-855-500-8701

China Domestic: 400-1200-654

Hong Kong: +852-3018-6776

Conference ID: #17647828

The replay will be accessible through May 24, 2017 by dialing the following numbers:

United States Toll Free: +1-855-452-5696

International: +61-2-9003-4211

Conference ID: #17647828

A live and archived webcast of the conference call will also be available at the Company's investor relations website at http://ir.vip.com.

About Vipshop Holdings Limited

Vipshop Holdings Limited is a leading online discount retailer for brands in China. Vipshop offers high quality and popular branded products to consumers throughout China at a significant discount to retail prices. Since it was founded in August 2008, the Company has rapidly built a sizeable and growing base of customers and brand partners. For more information, please visit www.vip.com.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Vipshop's strategic and operational plans, contain forward-looking statements. Vipshop may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the "SEC"), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Vipshop's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Vipshop's goals and strategies; Vipshop's future business development, results of operations and financial condition; the expected growth of the online discount retail market in China; Vipshop's ability to attract customers and brand partners and further enhance its brand recognition; Vipshop's expectations regarding demand for and market acceptance of flash sales products and services; competition in the discount retail industry; fluctuations in general economic and business conditions in China and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Vipshop's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Vipshop does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Use of Non-GAAP Financial Measures

The unaudited condensed consolidated financial information is prepared in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP"), except that the consolidated statement of shareholders' equity, consolidated statements of cash flows, and the detailed notes required by Accounting Standards Codification 270 Interim Reporting ("ASC270"), have not been presented. Vipshop uses non-GAAP net income attributable to Vipshop's shareholders, non-GAAP net income attributable to Vipshop's shareholders per diluted ADS, non-GAAP income from operations, non-GAAP operating income margin, non-GAAP net margin attributable to Vipshop's shareholders, and free cash flow, each of which is a non-GAAP financial measure. Non-GAAP net income attributable to Vipshop's shareholders is net income attributable to Vipshop's shareholders excluding share-based compensation expenses, impairment loss of investments, and amortization of intangible assets resulting from business acquisitions and equity method investments. Non-GAAP net income attributable to Vipshop's shareholders per diluted ADS is computed using non-GAAP net income attributable to Vipshop's shareholders divided by weighted average number of diluted ADS outstanding for computing diluted earnings per ADS. Non-GAAP income from operations is income from operations excluding share-based compensation expenses and amortization of intangible assets resulting from business acquisitions. Non-GAAP operating income margin is non-GAAP income from operations as a percentage of total net revenue. Non-GAAP net margin attributable to Vipshop's shareholders is non-GAAP net income attributable to Vipshop's shareholders as a percentage of total net revenue. Free cash flow is the operating cash flow adding back the impact from Internet financing activities and less capital expenditures, which include purchase of property and equipment, purchase and deposits of land use rights, and purchase of other assets. The Company believes that separate analysis and exclusion of the non-cash impact of share-based compensation, impairment loss of investments and amortization of intangible assets adds clarity to the constituent parts of its performance. The Company reviews these non-GAAP financial measures together with GAAP financial measures to obtain a better understanding of its operating performance. It uses these non-GAAP financial measures for planning, forecasting and measuring results against the forecast. The Company believes that non-GAAP financial measures are useful supplemental information for investors and analysts to assess its operating performance without the effect of non-cash share-based compensation expenses, impairment loss of investments, and amortization of intangible assets. Free cash flow enables the Company to assess liquidity and cash flow, taking into account the impact from Internet financing activities and the financial resources needed for the expansion of fulfillment infrastructure and technology platform. Share-based compensation expenses and amortization of intangible assets have been and will continue to be significant recurring expenses in its business. However, the use of non-GAAP financial measures has material limitations as an analytical tool. One of the limitations of using non-GAAP financial measures is that they do not include all items that impact the Company's net income for the period. In addition, because non-GAAP financial measures are not measured in the same manner by all companies, they may not be comparable to other similar titled measures used by other companies. One of the key limitations of free cash flow is that it does not represent the residual cash flow available for discretionary expenditures. In light of the foregoing limitations, you should not consider non-GAAP financial measure in isolation from or as an alternative to the financial measure prepared in accordance with U.S. GAAP.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, or as a substitute for, the financial information prepared and presented in accordance with U.S. GAAP. For more information on these non-GAAP financial measures, please see the table captioned "Vipshop Holdings Limited Reconciliations of GAAP and Non-GAAP Results" at the end of this release.

Investor Relations Contact

Vipshop Holdings Limited

Millicent Tu

Tel: +86 (20) 2233-0732

Email: IR@vipshop.com

ICR, Inc.

Jeremy Peruski

Tel: +1 (646) 405-4866

Email: IR@vipshop.com

| [1] "Active customers" are defined as registered members who have purchased from the Company or the Company's online marketplace platforms at least once during the relevant period. |

| [2] "Total orders" are defined as the total number of orders placed during the relevant period, including the orders for products and services sold in the Company's online sales business and on the Company's online marketplace platforms, net of orders returned. |

| [3] Non-GAAP net income attributable to Vipshop's shareholders is a non-GAAP financial measure, which is defined as net income attributable to Vipshop's shareholders excluding share-based compensation expenses, impairment loss of investments, and amortization of intangible assets resulting from business acquisitions and equity method investments. Werbung Mehr Nachrichten zur Vipshop Holdings Ltd. ADR Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |