Verizon announces pricing terms of its private exchange offers for 18 series of notes and related tender offers open to certain investors

PR Newswire

NEW YORK, Jan. 31, 2017

NEW YORK, Jan. 31, 2017 /PRNewswire/ -- Verizon Communications Inc. ("Verizon") (NYSE, NASDAQ: VZ) today announced the pricing terms of its two previously announced related transactions to repurchase 18 series of its outstanding notes.

Exchange Offers

The first transaction consists of 18 separate private offers to exchange (the "Exchange Offers") any and all of the outstanding series of notes listed below under the heading Exchange Offers (collectively, the "Old Notes") in exchange for a combination of newly issued debt securities of Verizon (the "New Notes") and, for certain specified series, cash, on the terms and subject to the conditions set forth in the Offering Memorandum dated January 25, 2017 (the "Offering Memorandum" and, together with the accompanying exchange offer notice of guaranteed delivery, the "Exchange Offer Documents"). Only holders who have duly completed and returned an Eligibility Letter certifying that they are either (1) "qualified institutional buyers" ("QIBs") as defined in Rule 144A under the Securities Act of 1933, as amended (the "Securities Act") ("QIBs") or (2) non-"U.S. persons" (as defined in Rule 902 under the Securities Act) located outside of the United States are authorized to receive the Offering Memorandum and to participate in the Exchange Offers ("Exchange Offer Eligible Holder").

The Exchange Offers will expire at 5:00 p.m. (Eastern time) today, January 31, 2017 (such date and time with respect to an Exchange Offer, as the same may be extended with respect to such Exchange Offer, the "Exchange Offer Expiration Date"). Old Notes tendered may be validly withdrawn at any time at or prior to 5:00 p.m. (Eastern time) today, January 31, 2017 (such date and time with respect to an Exchange Offer, as the same may be extended with respect to such Exchange Offer, the "Exchange Offer Withdrawal Date"), but not thereafter, unless extended by Verizon. The "Exchange Offer Settlement Date" with respect to an Exchange Offer will be promptly following the Exchange Offer Expiration Date and is expected to be February 3, 2017.

On the terms and subject to the conditions set forth in the Offering Memorandum, set forth below are the applicable Exchange Offer Yield, Total Exchange Price and Cash Amount (each as defined in the Offering Memorandum) for each series of Old Notes, as calculated at 11:00 a.m. (Eastern time) today, January 31, 2017 (the "Exchange Offer Price Determination Date"), in connection with Verizon's offers to:

(i) exchange (the "2022 Exchange Offers") any and all of its outstanding notes listed below for New Notes due 2022 of Verizon (the "New Notes due 2022") and, if applicable, cash:

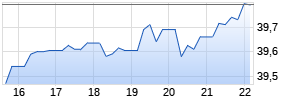

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Verizon Communications Inc | ||

|

VM8HBE

| Ask: 0,35 | Hebel: 19,12 |

| mit starkem Hebel |

Zum Produkt

| |

|

VM4UXA

| Ask: 0,50 | Hebel: 6,71 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

| CUSIP | Title of Security | Reference U.S. | Reference Yield | Fixed | Exchange |

Total | Composition of Total | |

| Cash | New Notes | |||||||

| 92343VAL8 | 5.500% notes due 2018 | 1.000% due 2/15/18 | 0.886% | +30 | 1.186% | $1,044.17 | $0.00 | $1,044.17 |

| 92343VAM6 | 6.100% notes due 2018 | 0.750% due 4/15/18 | 0.937% | +40 | 1.337% | $1,056.49 | $0.00 | $1,056.49 |

| 92343VBP8 | 3.650% notes due 2018 | 1.000% due 9/15/18 | 1.078% | +35 | 1.428% | $1,035.31 | $0.00 | $1,035.31 |

| 92343VCB8 | 2.550% notes due 2019 | 1.250% due 12/31/18 | 1.181% | +40 | 1.581% | $1,022.46 | $0.00 | $1,022.46 |

| 92343VDF8 | 1.375% notes due 2019 | 1.250% due 12/31/18 | 1.181% | +40 | 1.581% | $994.90 | $0.00 | $994.90 |

| 92343VCH5 | 2.625% notes due 2020 | 1.375% due 1/15/20 | 1.443% | +40 | 1.843% | $1,023.08 | $0.00 | $1,023.08 |

(ii) exchange (the "2039 Exchange Offers") any and all of its outstanding notes listed below for New Notes due 2039 of Verizon (the "New Notes due 2039") and, if applicable, cash:

| CUSIP | Title of Security | Reference U.S. | Reference Yield of | Fixed | Exchange |

Total | Composition of Total | |

| Cash | New Notes | |||||||

| 92343VBR4 | 5.150% notes due 2023 | 2.000% due 12/31/21 | 1.896% | +125 | 3.146% | $1,118.83 | $0.00 | $1,118.83 |

| 92344GAM8/92344GAC0 | 7.750% notes due 2030(4) Werbung Mehr Nachrichten zur Verizon Communications Inc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||